Supply chain and customer experience are typically viewed as two different disciplines, but Walmart and Target are illustrating how they're blending together.

Walmart has been talking about omnichannel retail for years and its tech team has consolidated apps, installed a multi-cloud approach and invested heavily in supply chain automation and logistics. The upshot is that Walmart's stores, apps and commerce engine are unified. Today, those investments are paying off because Walmart tends to benefit during economic uncertainty.

Doug McMillon, Walmart CEO, said on the company's first quarter earnings conference call:

"The omnichannel model we're building continues to resonate with customers and members. As expected, a higher mix of sales in the food and consumables categories negatively affected gross profit, but strong expense management and progress with our newer mutually reinforcing businesses helped us grow profit ahead of sales at 17.3%."

McMillon added that customers are buying private brands, trading down and cutting discretionary spending. As a result, Walmart is managing inventory tightly as well as expense management. It is also boosting productivity and operating margins via automation.

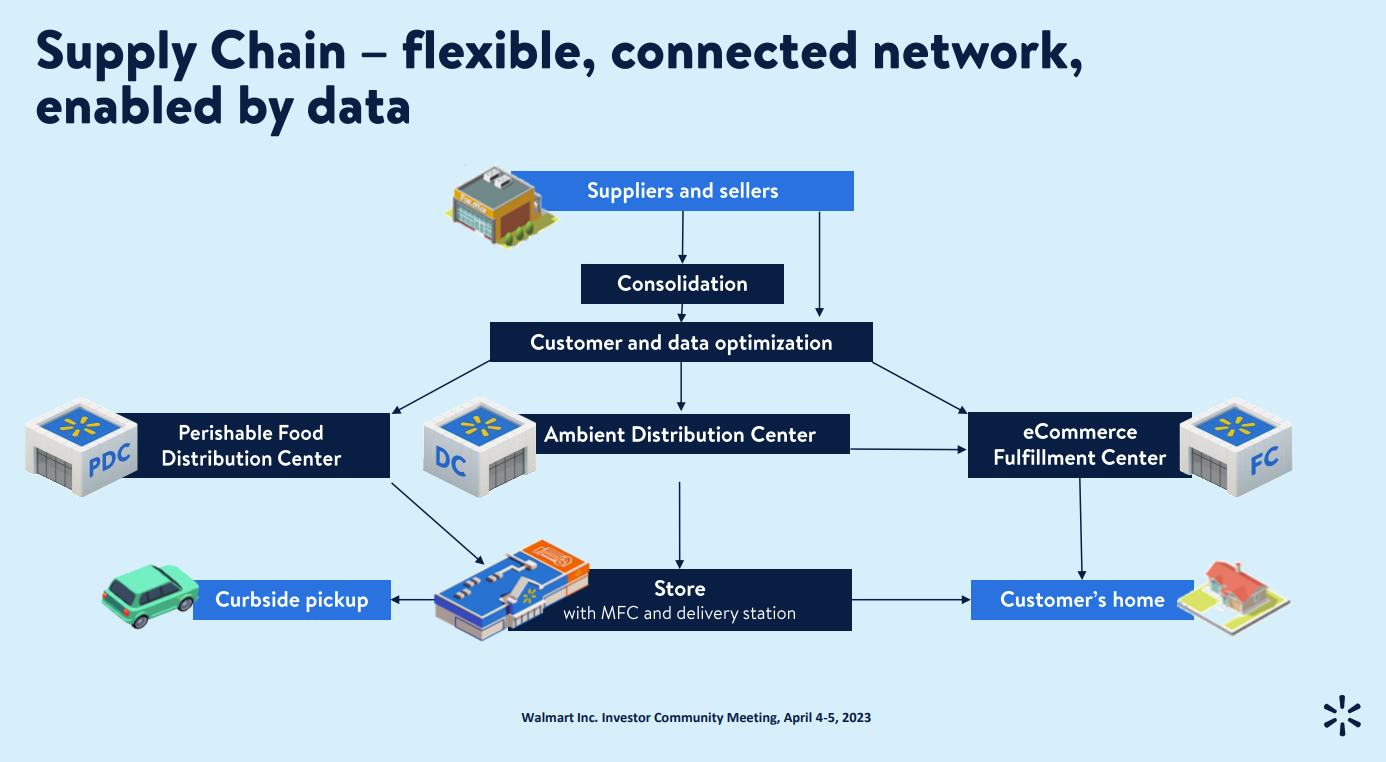

At its investor meeting in April, Walmart walked analysts through its ambient distribution center and market fulfillment centers, which use automated storage and retrieval systems. "It's about creating a supply chain that's better, not just bigger," said McMillon. "We're excited about how our new capabilities will help our associates by making some of our more physically demanding jobs into more rewarding, higher skilled career paths."

Walmart is realizing that its supply chain game directly impacts the customer experience--especially for digital business. Walmart's e-commerce comparable sales were 27% higher in the first quarter compared to a year ago.

And the big benefit is that the more Walmart optimizes its supply chain the more it increases margins. And customers get goods fresh and fast since Walmart is increasingly about grocery. Walmart CFO John David Rainey said, "we want our ROI to go up every year."

At Walmart's April investor meeting, Rainey said the company's investment in automation, robotics and software are exceeding productivity targets by as much as 30%. Walmart said by the end of the year, 65% of its stores will be serviced by automation and 55% of its fulfillment center volume will be automated.

Target is also connecting the dots between supply chain, automation and customer experience. Target Chief Operating Officer John Mulligan said on the retailer's first quarter earnings call that his company is also investing in automation. He said:

"With this modernization effort, our primary goal is to reduce those labor demands on our stores. We achieved that result by moving work upstream to a distribution center where we can apply the appropriate processes, technology, tools and automation to accomplish the work at scale. This results in higher labor efficiency for the company overall, while allowing our store team members to spend more time in the front of our stores with our guests. In the upstream distribution centers, we've opened over the last two years, we've implemented technology and capabilities that improve how product is sorted and loaded onto trailers headed for our stores. These improvements reduce the necessary time for the store team to unload the trailer and for them to move the inventory to where it's needed in the store."

Target is also deploying automation for the shipment of quantities smaller than a full case. The automated system makes the shipment easier to unload. Target is also upgrading legacy distribution centers and deploying tools for faster store replenishment, said Mulligan.

While sortation centers are not highly automated, Target is using "sophisticated process logic" to sort packages and provide better experiences. Last mile delivery is also a focus for Target, which owns Shipt. Target is using larger trucks for last mile deliveries as well as a standardized way to load them.

Mulligan said:

"While there are many different ways our team is working to gain efficiencies and deliver value to the business, all of our projects have some things in common. First and foremost, they're all designed and implemented with a focus on our guest and continuing to build their engagement with Target. In keeping with that guest focus, we design processes and deploy technology and automation as a way to highlight the human element in our business rather than minimizing it."

Ultimately efficiency and experience are blending together for retailers. Walmart CFO Rainey said:

"Retail has changed a lot in the last 5 to 10 years, and the change over the next 5 to 10 years is likely to be just as significant. Customers are demonstrating preference for multichannel offerings, convenience, value and selection, and up to this point, for most, it's proving challenging to provide all of these things at attractive economics. What's important to understand is this, the investments we've made in people, price, e-commerce, and the high value technology capabilities are why we are at an inflection point today. The benefit of any technology platform is being able to scale it at a lower marginal cost."

How 4 CEOs are approaching generative AI use cases in their companies

Starbucks’ new CEO: ‘We can enhance our tech stack to lower costs and reinvest’

Here Comes the Virtual Experience Lab: A Secret Weapon for Improving Sales and Customer Loyalty

Constellation ShortList™ Customer Experience (CX) Operations Services: Global