Google Cloud launched Agentspace, Salesforce is prepping Agentforce 2.0 and Amazon Web Services wants Amazon Bedrock to be your agentic AI orchestration engine. And that's just two weeks of news.

Simply put, the agentic AI platforms are launching at a rapid clip. AI agents will be a big theme for 2025, but open questions abound.

Sign up for the Constellation Insights newsletter

Here are three things to watch in agentic AI. Like generative AI, CxOs are going to have to weigh vendor pitches against lock-in and architectural decisions to regret.

Horizontal approaches vs. platform specific

Agentic AI launches have been proliferating in recent weeks ever since Salesforce's Agentforce launch at Dreamforce. ServiceNow is deploying agents across its Now Platform. And every vendor from SAP to Microsoft is talking agents across their platforms.

Naturally, many of these agentic AI visions resemble decks that place the vendor at the center of the universe and a bunch of connectors to other platforms.

For customers, however, the incoming AI agent sprawl is going to be an issue. Will enterprises simply wind up managing different buckets of AI agents? SAP Joule agents are over here. Salesforce Agentforce actions there. Google Cloud agents operating over the top. You get the idea.

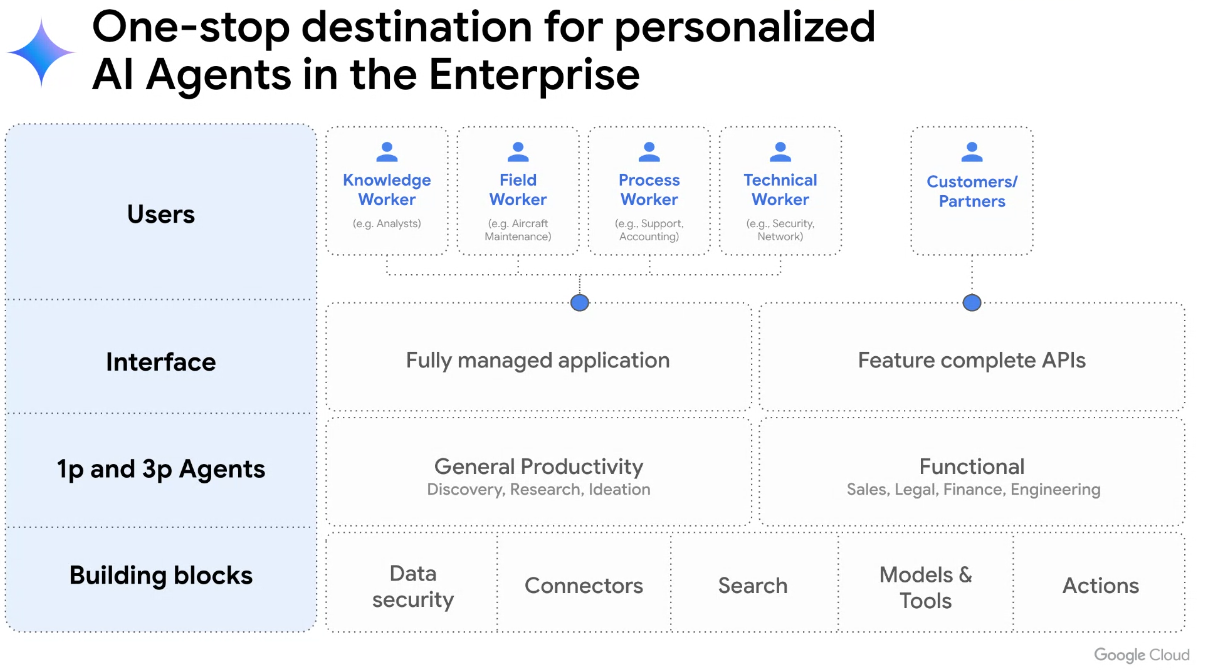

The big question for 2025 is whether enterprises will choose to go horizontal with AI agent orchestration and management. Hyperscalers may be in the best position here. Amazon Bedrock will have agent orchestration. Amazon Q will operate across applications and data silos. Google Cloud Agentspace will take a similar approach. Microsoft Azure will also orchestrate your agents, but it's unclear whether tech buyers will see the cloud giant as more about its own platform or a horizontal play.

- Agentic AI without process optimization, orchestration will flop

- Enterprises leading with AI plan next genAI, agentic AI phases

- With Salesforce push, AI Agents, agentic AI overload looms

- GenAI's 2025 disconnect: The buildout, business value, user adoption and CxOs

UiPath is a player that is betting on a Switzerland approach. CEO Daniel Dines explained where the company stands on UiPath's third quarter earnings call. UiPath launched Agent Builder as it makes agents a first class citizen along with its robotic process automation. Dines explained the difference between horizontal plays and application specific offerings.

He said:

"Our agents and robots work across all applications, both new and legacy, eliminating vendor lock-in for our customers. Business processes today don't run on a single system. We will continue to be the Switzerland of business applications and agents, providing equal access to third-party systems. Agentic orchestration will be the governor across agents, robots, people, and models. We will democratize access to agents by leveraging our low-code platform that is already known to automation developers."

Raj Pai, Vice President, Product Management at Google Cloud AI, had a similar take.

"We see agents--software systems that use AI to complete tasks--as the biggest opportunity to meet this unmet promise of genAI and really drive employee productivity and ingenuity," said Pai. "AI agents across all enterprise data sources can complete tasks that require planning, research, content generation and actions."

In other words, this pole position in agentic AI is going to require a horizontal approach--and hundreds if not thousands of connectors.

ServiceNow CFO Gina Mastantuono, speaking at a Barclays investment conference, said the horizontal approach and ability to be neutral is critical to playing in the agentic AI and genAI space. "We can sit on top of the application sprawl or data sprawl and really drive productivity. And the differentiation that we have in that it's one platform across the enterprise, whether you're working in HR, IT, customer service, legal, finance," she said.

AWS CTO Werner Vogels said in a re:Invent keynote that agents will manage more narrow-focused agents to automate workflows. Vogels gave an example of how AWS is resolving tickets with agents. "The goal of the agent is to efficiently resolve support tickets, and the process then becomes, read the ticket, use the tools iterate. It categorizes, prioritizes the tickets based on analysis, and it determines the action. It could be to resolve automatically, or it could be to escalate for human review," said Vogels.

- AWS unveils next-gen Amazon SageMaker in bid to unify data, analytics, AI

- AWS aims to make Amazon Bedrock your agentic AI point guard

Wild cards include:

- Will a vendor like Boomi make headway with a registry to manage AI agents?

- Are hyperscalers the de facto favorite to manage agentic AI?

- Can platform-specific vendors such as Salesforce with MuleSoft and ServiceNow leverage their breadth of connectors to become horizontal plays?

Pricing for agentic AI

Box CEO Aaron Levie on LinkedIn noted the great AI agent debate. He said that one approach is to price AI agents like traditional work at a steep discount. You'd pay for amount of time or units to do the work. Another approach is pricing agents on a per-outcome basis. This per outcome basis rhymes with a consumption model, say $2 per resolved conversation.

Levie added that pricing agents as close to the AI costs as possible could be great for customers, but doing shareholder returns. And finally, vendors could stick to a SaaS seat subscription model and offer agents to users that do unlimited work.

"Lots of different approaches - and probably many more than the above - but fairly exciting times to watch new business models in software emerge after a decade plus of limited changed," said Levie.

Indeed, Levie's post generated more than 120 comments with some noting outcome-based pricing will result in complicated contracts and too much cost variability. Others seemed to think agents will be free.

In this pricing debate, hyperscale cloud providers may have the edge because customers are used to consumption-based models. For instance, Google Cloud is pricing Agentspace on a per-user basis. Agentspace Enterprise Plus includes the ability to ask agents follow-up questions, carry out actions, create agents and use the research agent. AWS pricing for agent orchestration will ride along with Amazon Bedrock. Keep in mind that AWS will profit from storage, data and compute consumption.

Outcome-based pricing is going to be a tough sell since most CxOs don't want to share a cut of value created. After all, vendors don't give you back dough when value is destroyed.

Salesforce CEO Marc Benioff said consumption-based pricing will likely win out. Speaking about Agentforce, he said "this is a consumption product. We have per-user products, which are for humans. We have consumption products for agents and robots and that's how I think we should look at it, which is the comparative costs is there's just no comparison."

Brian Millham, Salesforce's Chief Operating Officer, said customers understand the cost of labor and when they can deploy agents to manage interactions with customers. Salesforce’s $2 per conversation approach makes sense. When Salesforce launches Agentforce 2.0 we may get more clarity on pricing as well as whether the company aims to be an agent orchestrator across all enterprise applications.

How ServiceNow is thinking about pricing and why hybrid approaches are likely

Pricing is a critical topic in enterprise software--especially with genAI and now agentic AI. ServiceNow's Mastantuono was asked about the company's approach to pricing. She spoke about this pricing strategy before, but it has evolved with genAI.

ServiceNow has launched its Pro Plus SKUs and Now Assist is the genAI flavor. Mastantuono said she thinks there's a hybrid pricing model that's going to play out with AI agents that includes seats and then consumption. Outcome-based pricing is possible too over time.

She said: "We have a hybrid model. It's seat based and you get a certain number of tokens. And then, if you're over-consuming, you need to buy more tokens. This is the way that we have initially thought about monetization."

Mastantuono added that customers like the switch to consumption based because they can more easily forecast (and so can ServiceNow).

With outcome-based pricing, Mastantuono said the conversation appears every few years in enterprise software, but the issue is providing customers with cost predictability. ServiceNow's approach has been to add a pricing uplift of 30% as innovation and value is added. She said: "It's all about value. We're a value seller play and the conversations with customers have gone really well when we can say the lion's share of the value is going to you and we're taking a slice of it because we're investing in all the innovation that's allowing that value."

Wild cards for pricing include:

- Are enterprises really going to accept more operating expense volatility with AI agent consumption based models?

- Will the labor for AI agent argument hold?

- Can a model like value-based contracts work when AWS Marketplace is standardizing contracts instead of making them more complicated?

Are all these agents going to communicate and negotiate?

There is nothing that puts me to sleep faster than talking about technology standards and the committees and meetings that go with them. Standards are necessary, but the topic is a yawner.

However, if we really want this agentic AI dream to play out we're going to need some standards so these agents can communicate and negotiate to get things done.

What happens when an SAP Joule AI agent runs into an Agentforce agent and has to negotiate with a Google Cloud Agentspace creation? Sure, they can connect, but the future will require real communication--like those good ol' humans do.

Today, there isn't one universally adopted standard for agentic AI communications across platforms. IEEE has a few working groups and there are other standards orgs on the case. It’s likely that agentic AI standards will emerge in the years ahead. Challenges include:

- Agent architecture. Agents will be built on multiple platforms and languages.

- Security. How will secure communication channels be managed.

- Performance. Agents will be communicating at scale with multiple agents.

- Industry-specific standards.

Wild cards include:

- Standards move at a glacial pace--unlike AI.

- Multi-cloud is still a work in progress so it's unclear whether vendors will cooperate.