Snowflake and Microsoft have expanded their partnership in a move that puts OpenAI and Anthropic models in Snowflake's Cortex AI natively.

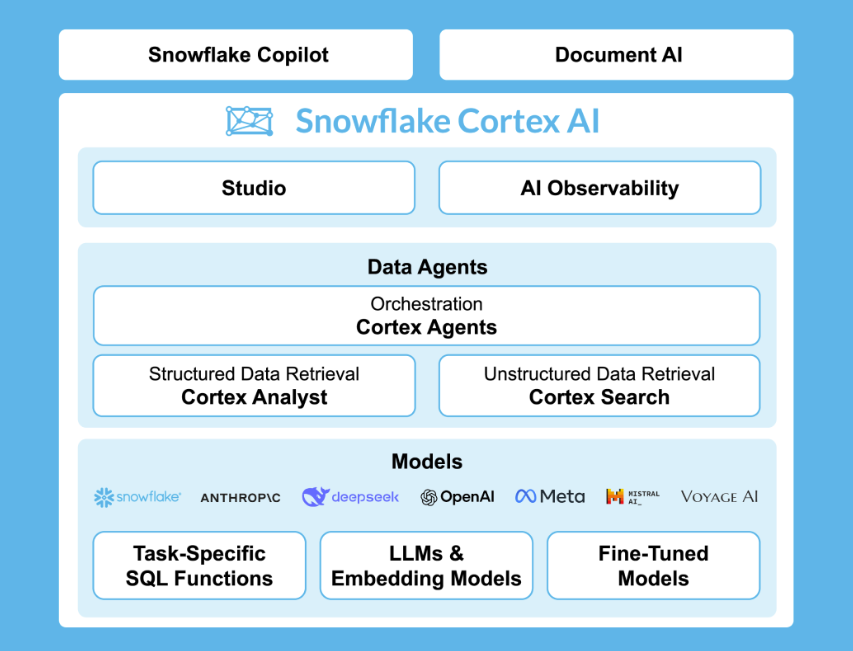

Cortex AI is Snowflake's fully managed AI service. According to the companies, Snowflake Cortex AI will integrate Microsoft Azure OpenAI Service in Azure AI Foundry. That move will put OpenAI's models Snowflake and make them available as data agents in Snowflake's AI Data Cloud.

The data platform space has seen a flurry of deals and partnerships. For instance, SAP and Databricks paired up on SAP Business Cloud. IBM acquired DataStax to add to its watsonx platform. Salesforce and Google Cloud also expanded a partnership that includes Data Cloud.

- Constellation ShortList™ Automated Cloud Data Warehouse Services

- Constellation ShortList™ Customer Data Platform (CDP)

For Snowflake, adding OpenAI to Cortex AI gives it some differentiation for its data platform. Snowflake is looking to stand out for AI inference workloads across multiple cloud regions.

Snowflake's partnership with Microsoft includes the following:

- Snowflake customers will be able to leverage OpenAI models within Snowflake Cortex AI on Microsoft Azure and run them with Snowflake Horizon Catalog and compliance and security settings.

- Enterprises will be able to create data agents powered by OpenAI within Snowflake's AI Data Cloud.

- Snowflake becomes a platform that hosts both Anthropic and OpenAI models on its platform.

- The companies also announced a native integration to make Snowflake Cortex Agents available in Microsoft 365 Copilot and Microsoft Teams. Microsoft users will be able to interact with unstructured and structured Snowflake data from their daily apps. Availability for this integration is expected in June.

Also see:

- Snowflake bolsters Cortex, launches AI and ML Studio, Snowflake Trail

- Snowflake to support Polaris Catalog for Apache Iceberg

- Microsoft Build 2024: Microsoft Fabric opens up, adds real-time intelligence, Snowflake, Databricks connections

- Databricks annual revenue run rate hits $3 billion, compared to Snowflake’s $3.77 billion

Snowflake posts strong Q4 growth

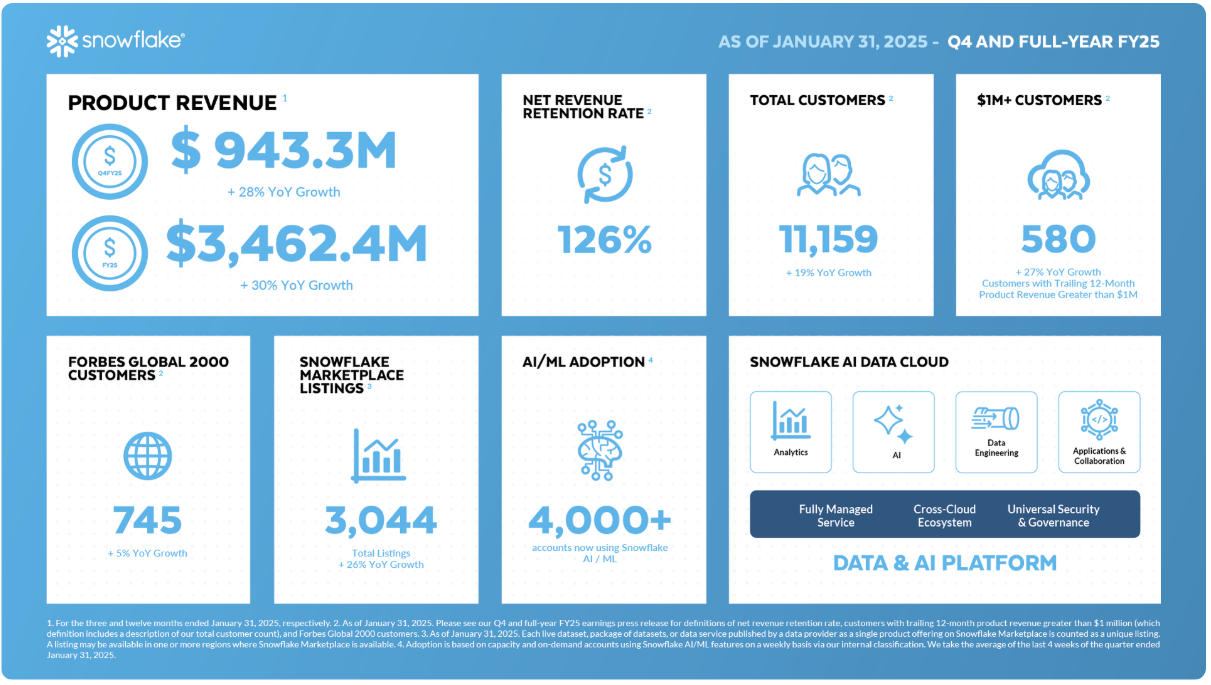

Separately, Snowflake reported strong fourth quarter results with revenue growth of 28% from a year ago. Snowflake reported a fourth quarter net loss of $327.47 million, or 99 cents a share, on revenue of $986.77 million. Non-GAAP earnings in the fourth quarter were 30 cents a share.

For fiscal 2025, Snowflake reported revenue of $3.63 billion, up 29% from a year ago. Snowflake's net loss for fiscal 2025 was $1.29 billion, or $3.86 a share. Non-GAAP earnings were 83 cents a share.

Sridhar Ramaswamy, CEO of Snowflake, said the company has become one of "the most consequential data and AI company in the world." Snowflake has more than 11,000 customers.

As for the outlook, Snowflake projected first quarter product revenue between $955 million to $960 million. For fiscal 2026, Snowflake projected product revenue of $4.28 billion, up 24% from a year ago.

Constellation Research analyst Holger Mueller said:

"Snowflake had a good growth quarter, but growth came at a cost, as it practically doubled its EPS loss year over year. Sridhar Ramaswamy and team now need to show that they cannot only grow, but they can also grow with profitability in mind, as the quarterly trend is not encouraging. When a single billion revenue tech vendor racks up an over $1 billion net loss, while growing almost 30% - the alarm bells go off. Running an AI company isn’t cheap – as cost of revenue is up 30+% YoY, and as operating expenses are up 25% the warning bells are being tested. We will see if Q1 bides better, the critical aspect being that Snowflake was not doing anything spectacular in regards of one time investments. With guidance for product revenue pulling back into the low 20ies there is further data for concern."

Speaking on an earnings conference call, Ramaswamy said:

- "Our core business is very strong. Our product delivery is in overdrive and our go-to-market engine is humming. We are innovating better than ever and firing on all cylinders and we have an enormous opportunity ahead of us."

- "As our competitors continue to require expensive engineering resources to maintain and scale, more and more customers are seeing real bottom-line impact by turning to Snowflake. We have seen more and more Snowflake customers save over 50% by migrating to us from other providers."

- "Customers should have a right to decide where it is that their data should be. And as far as we are concerned, I think we are very uniquely positioned as a central and very efficient repository of data for most companies."