Google Cloud revenue in the fourth quarter were $12 billion, up 30% from a year ago, amid mixed results from parent Alphabet, which said it will spend $75 billion in capital expenditures in 2025. The company also said its Google Cloud business was capacity constrained.

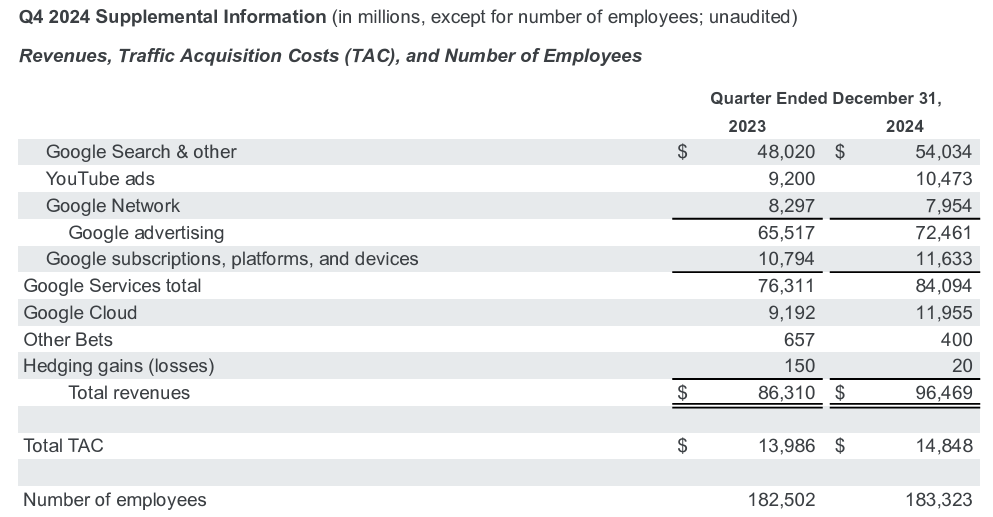

The company reported net income of $26.54 billion, or $2.15 a share, on revenue of $96.47 billion, up 12%. Wall Street was expecting Alphabet to report fourth quarter earnings of $2.13 a share on revenue of $96.67 billion.

For 2025, Alphabet reported earnings of $100.1 billion, or $8.04 a share, on revenue of $350.02 billion, up 14%.

- Google Cloud launches Agentspace to create, deploy agents

- Oracle scales Oracle Database@Google Cloud

-

Google Workspace drops Gemini add-on charge, raises business, enterprise plan prices

Sundar Pichai, CEO of Alphabet, said:

"We are building, testing, and launching products and models faster than ever, and making significant progress in compute and driving efficiencies. In Search, advances like AI Overviews and Circle to Search are increasing user engagement. Our AI-powered Google Cloud portfolio is seeing stronger customer demand."

By the numbers:

- Google Cloud revenue in the fourth quarter was $11.95 billion, up 30% from $9.19 billion a year ago. Microsoft Azure put up quarterly revenue growth of 31%. Operating income for Google Cloud was $2.09 billion, up from $864 million in the fourth quarter a year ago.

- Google search revenue in the fourth quarter were $54.03 billion.

- Google advertising revenue was $72.46 billion.

- Google services operating income was $32.84 billion and that unit includes the Gemini team.

- Alphabet ended the quarter with 183,323 employees.

Anat Ashkenazi, Alphabet CFO, said:

"We do see and have been seeing very strong demand for AI products in the fourth quarter in 2024. We exited the year with more demand than we had available capacity. So we are in a tight supply demand situation, working very hard to bring more capacity online. As I mentioned, we've increased investment in CapEx in 2024, continue to increase in 2025, and will bring more capacity throughout the year."

Pichai said the following on the company's earnings call:

- "Cloud customers consume more than eight times the compute capacity for training and inferencing compared to 18 months ago."

- "We are working on even better thinking models and look forward to sharing those with the developer community soon. We're also excited by the progress of our video and image generation models."

- 4.4 million developers are using Gemini models, double from six months ago.

- AI overviews are now available in more than 100 countries. Circle to Search is now available on over 200 million Android devices in cloud and YouTube.

- "Those who have tried Circle to Search before now use it to start more than 10% of their searches."

- The number of first-time commitments to Google Cloud doubled in 2024 and the company is closing more strategic deals over $1 billion and doubled the number of $250 million deals.

- Vertex AI saw a 5x increase in customers in the fourth quarter compared to a year ago.

- Waymo is averaging more than 150,000 trips each week.

Anat Ashkenazi, Alphabet CFO, said:

"We do see and have been seeing very strong demand for AI products in the fourth quarter in 2024. We exited the year with more demand than we had available capacity. So we are in a tight supply demand situation, working very hard to bring more capacity online. As I mentioned, we've increased investment in CapEx in 2024, continue to increase in 2025, and will bring more capacity throughout the year."

Constellation Research's take

Constellation Research analyst Holger Mueller said:

"Alphabet narrowly missed revenue targets. The surprise though is that the contribution of the advertisement business did better than the its cloud business, not the expectation investors had for 2024 results. The good news is that the Alphabet core business is proving itself in the AI era – even before Google has started to infuse advertisement into its Gemini offering.

The argument can be made that the hopes of its advertisement / search business competitors (Microsoft) are not materializing, which is good for Alphabet. Sundar Pichai and team know this and are doubling down on investment – with $75 billion committed to capital expenditures in 2025, a record commitment. And despite all the investment and raising EPS earnings by almost 40%, the question for Q1 will be: How can Thomas Kurian and team get the Google Cloud growth back to expectations? Google Cloud capacity limitations were cited as core reason for the slowdown. The first half will be critical to see how well Google Cloud can help carry Alphabet into high teens / maybe even low twenties revenue growth."