IBM delivered better-than-expected fourth quarter results and said its generative AI business including consulting and software is now a $5 billion business, up from $3 billion in the third quarter.

The company reported fourth quarter earnings of $2.98 billion, or $3.11 a share, on revenue of $17.6 billion, up 1% from a year ago. Non-GAAP earnings were $3.92 a share, 15 cents better than Wall Street estimates.

IBM CEO Arvind Krishna said the company is "well-positioned for 2025 and beyond" with annual revenue growth of at least 5%.

For 2024, IBM reported net income of $6 billion, or $6.42 a share, on revenue of $62.8 billion.

By the numbers for the fourth quarter:

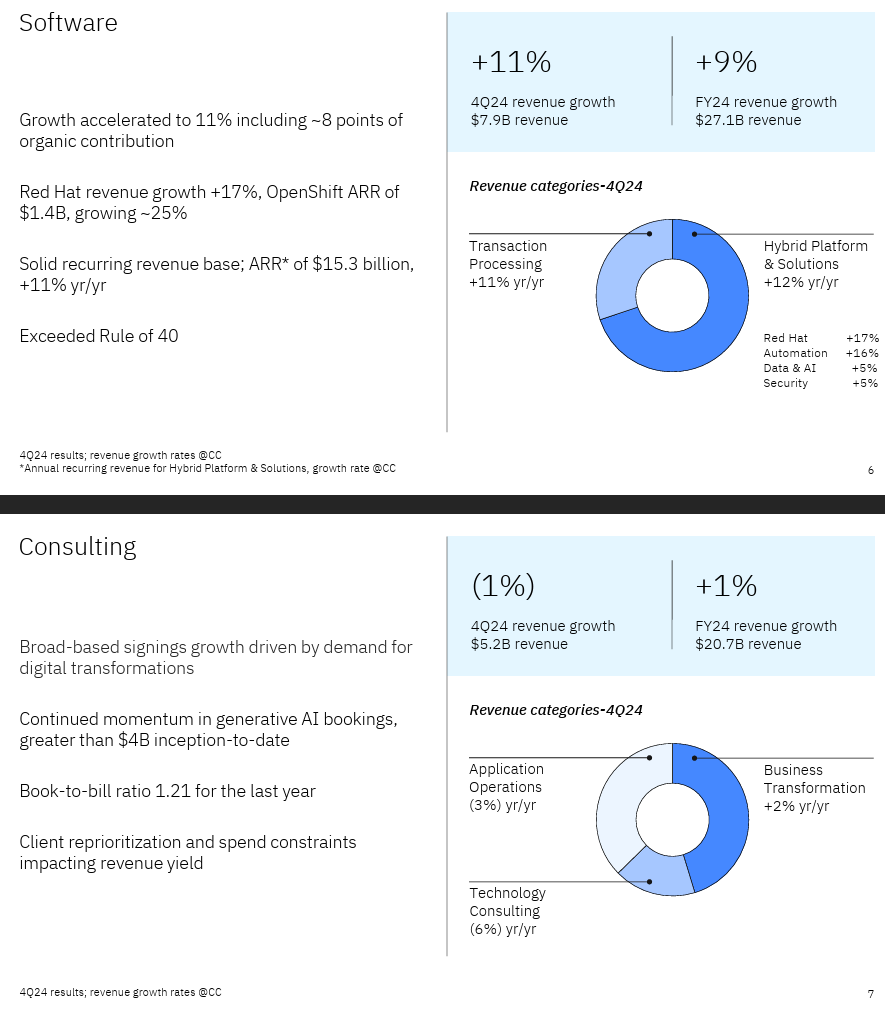

- IBM software revenue of $7.9 billion was up 10% from a year ago with Red Hat revenue up 16%. IBM said that automation revenue was up 15% and data and AI up 4%.

- Consulting revenue was down 2% to $5.2 billion with the business transformation unit faring the best, but still down 1% in the fourth quarter. Technology consulting revenue was down 7%.

- Infrastructure revenue was down 7.6% to $4.3 billion.

Krishna made the following points on an earnings conference call:

- "Our AI portfolio is tailored to meet the diverse needs of enterprise clients, enabling them to leverage a mix of models, IBMs, their own, open models from Hugging Face, Meta and Mistral. IBM's Granite models designed for specific purposes are 90% more cost-efficient than larger alternatives."

- "We are looking forward to a regulatory environment that is a bit more rational and a bit more pro-competition. So I think what that implies for us is that we think reasonable deals have a very good chance of getting through in a reasonable amount of time and not being held up for years. With that context, we are going to lean in more."

- "DeepSeek was a point of validation. We have been very vocal for about a year that smaller models and more reasonable training times are going to be essential for enterprise deployment of large language models. We have been down that journey ourselves for more than a year. We see as much as 30 times reduction in inference costs using these approaches. As other people begin to follow that route, we think that this is incredibly good for our enterprise clients." DeepSeek: What CxOs and enterprises need to know