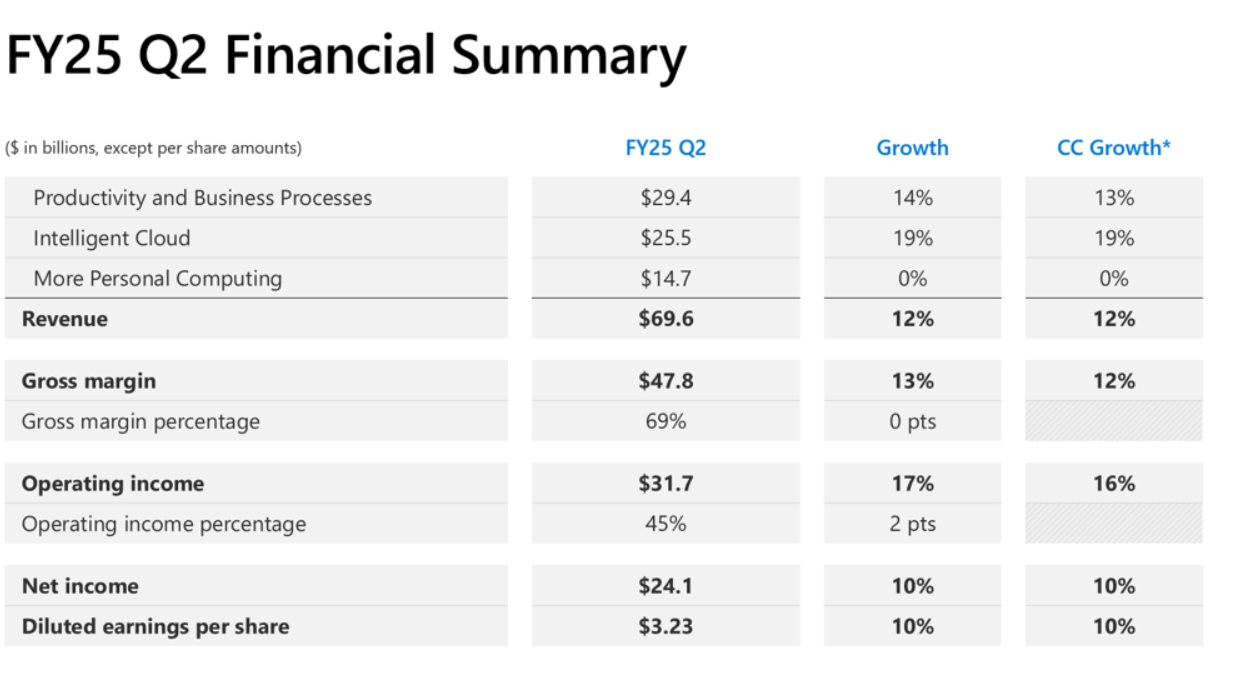

Microsoft reported strong second quarter results with revenue growth of 12%, Azure revenue growth of 31% and an AI business annual revenue run rate of $13 billion.

The company reported fiscal second quarter earnings of $24.1 billion, or $3.23 a share, on revenue of $69.6 billion. Wall Street was looking for earnings of $3.11 a share on revenue of $68.78 billion.

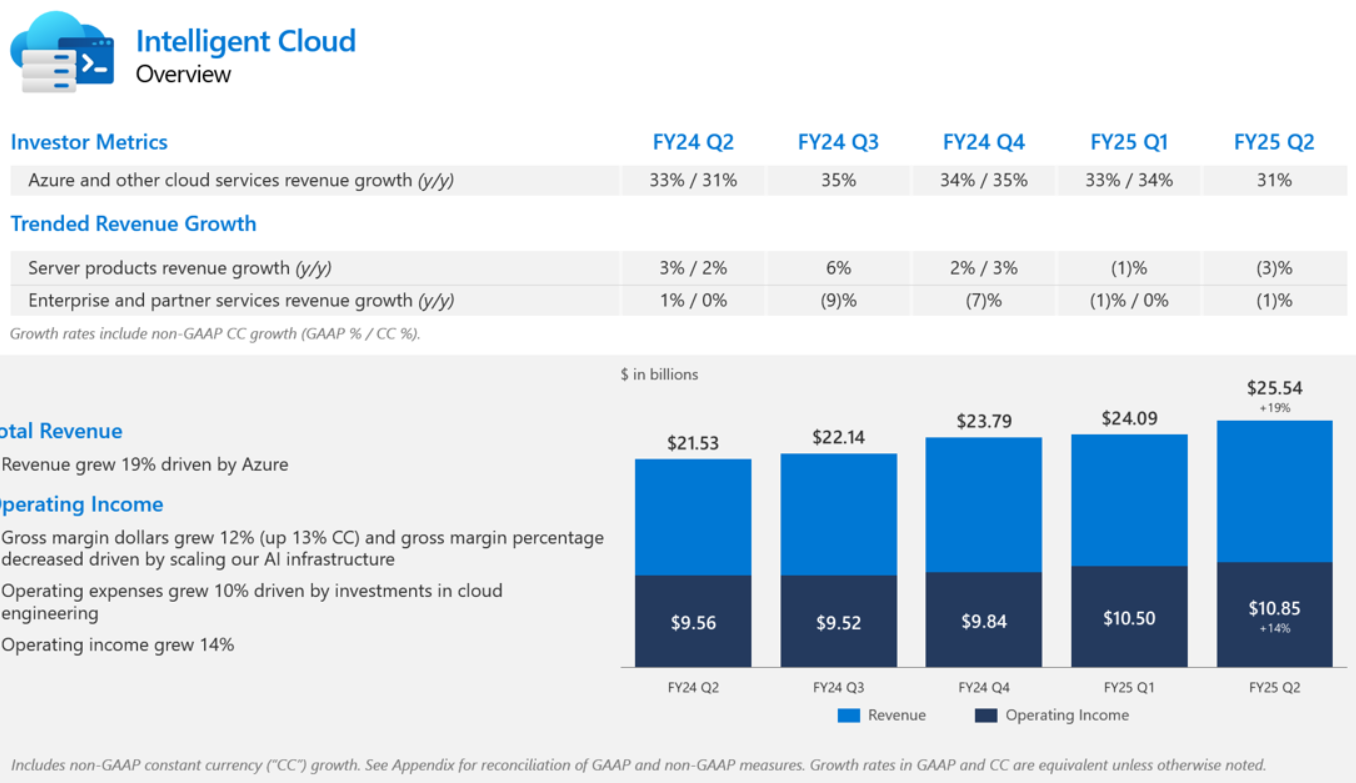

Intelligent cloud second quarter revenue was $25.5 billion, up 19% from a year ago. Productivity and business process revenue was $39.4 billion, up 14% from a year ago. Microsoft Cloud revenue was $40.9 billion, up 21% from a year ago.

In a statement, Microsoft CEO Satya Nadella said "we are innovating across our tech stack and helping customers unlock the full ROI of AI."

Nadella addressed multiple topics on the earnings call. Here's a look:

- He said Microsoft is allocating capital to AI compute as it is seeing "significant efficiency gains in both training and inference for years now." Nadella said: "On inference, we have typically seen more than 2x price performance gain for every hardware generation and more than 10x for every model generation due to software optimization."

- These efficiency gains for AI workloads will leave to more demand.

- "We have more than doubled our overall data center capacity in the last three years, and we have added more capacity last year than any other year in our history. Our data centers, networks, racks and silicon are all coming together as a complete system to drive new efficiencies to power both the cloud workloads of today and the next generation AI workloads."

- Fabric is Microsoft fastest growing analytics product in the company's history and PowerBI has more than 30 million monthly active users, up 40% from a year ago.

- "We are seeing accelerated customer adoption across all deal sizes as we win new Microsoft 365 Copilot customers, and see the majority of existing enterprise customers come back to purchase more seats. When you look at customers who purchase copilot during the first quarter of availability, they have expanded their seat collectively by more than 10x over the past 18 months."

- 160,000 organizations have used Copilot Studio to collectively create more than 400,000 custom agents in 3 months.

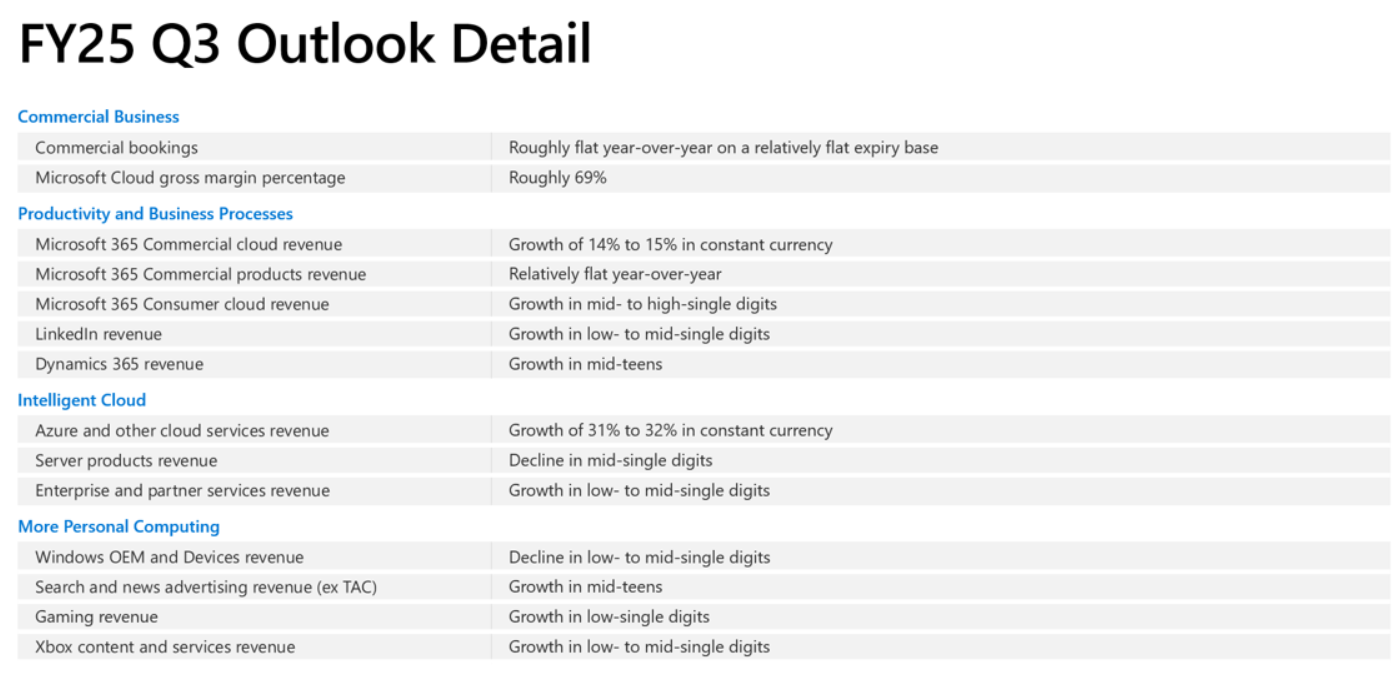

Amy Hood, CFO of Microsoft, added that the company will continue to balance operational discipline with investments in AI and cloud. As for the outlook, Hood projected the following for the third quarter.

Hood said a stronger US dollar will hit revenue growth by 2%, but still be in double digits. She said demand for cloud AI offerings should remain strong. Intelligent Cloud revenue should grow between 19% to 20% with Azure delivering growth of 31% to 32%.

She added that by the end of the year Azure capacity should be in line with near-term demand. Here's the outlook.

- GenAI prices to tank: Here’s why

- Agentic AI: Three themes to watch for 2025

- Enterprise software 2025: Three big shifts to watch

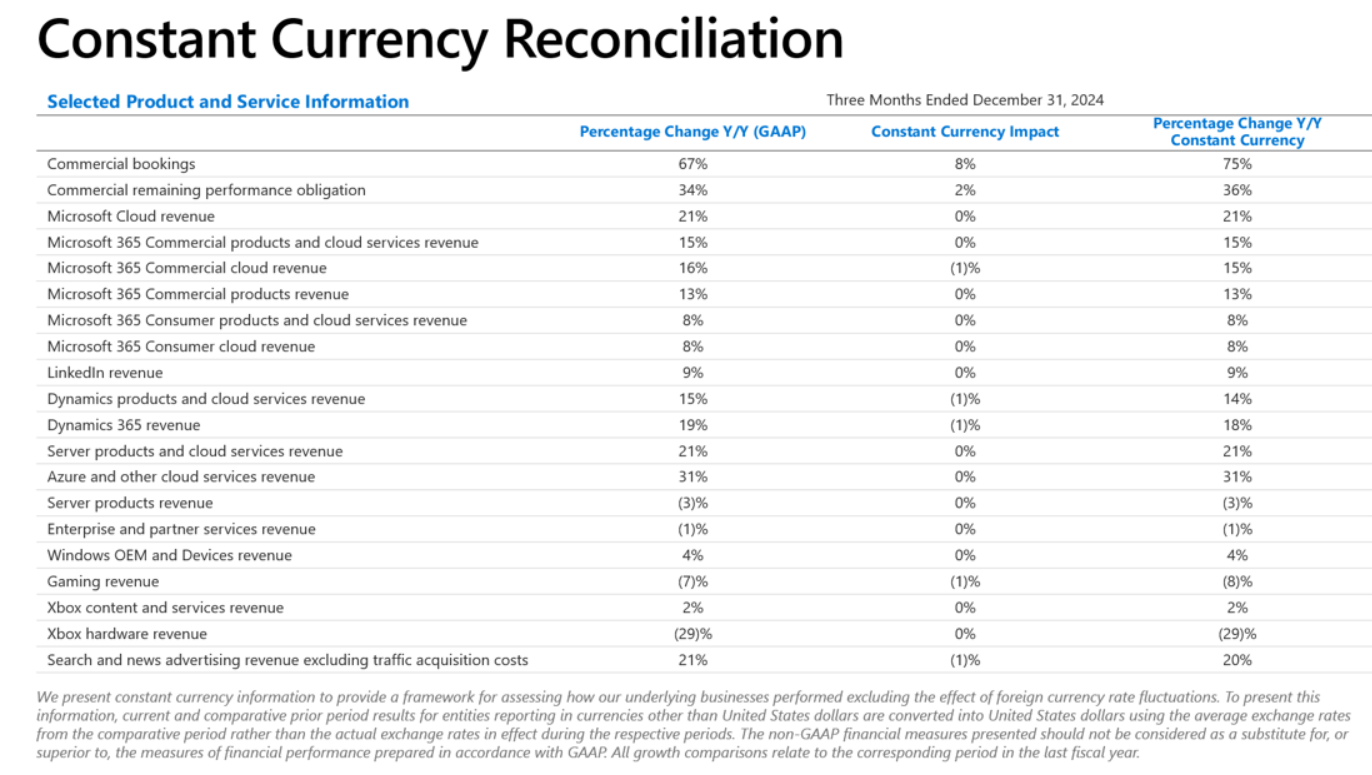

By the numbers for the second quarter:

- Microsoft 365 Commercial cloud revenue growth was up 16% from a year ago.

- LinkedIn revenue was up 9%.

- Dynamics 365 revenue was up 19%.

- Microsoft 365 had 86.3 million consumer subscribers.

Constellation Research analyst Holger Mueller said:

"Microsoft is in full transfer of product to services revenue, with product revenue down $2.5 billion year over year, but services (and other) revenue up by more than $10 billion. Services come with a higher cost and cost or revenue is up by more than $2 billion. The result is 30c ents higher EPS. The question is how many quarters can Microsoft repeat the feat – especially as Satya Nadella and Amy Hood for the first time acknowledged capacity challenges for Azure. The next quarter will tell."

Here's the breakdown of Microsoft by product line.