Salesforce posted a mixed third quarter and fourth quarter outlook as revenue was up 8% from a year ago. The company saw revenue growth decelerate sequentially across multiple categories, but executives were bullish on Agentforce prospects.

The company reported third quarter earnings of $1.58 a share on revenue of $9.44 billion. Non-GAAP earnings in the third quarter were $2.41 a share. Salesforce said it took a hit of 17 cents a share due to investment losses.

Wall Street was looking for third quarter non-GAAP earnings of $2.44 a share on revenue of $9.34 billion.

As for the outlook, Salesforce projected fourth quarter sales between $9.9 billion to $10.10 billion compared to estimates of $10.05 billion. Salesforce projected non-GAAP earnings of $2.57 a share to $2.62 a share compared to estimates of $2.65 a share.

For fiscal 2025, Salesforce projected revenue of $37.8 billion to $38 billion.

CEO Marc Benioff said the company is seeing strong interest in its Agentforce effort.

- Salesforce Dreamforce 2024: Takeaways on agentic AI, platform, end of copilot era

- Salesforce adds AI agents to Marketing, Commerce Clouds, Slack at Dreamforce 2024

- Salesforce's acquisition of Own highlights small ball approach to M&A

- Salesforce debuts Agentforce: Will enterprises pay $2 per AI agent conversation?

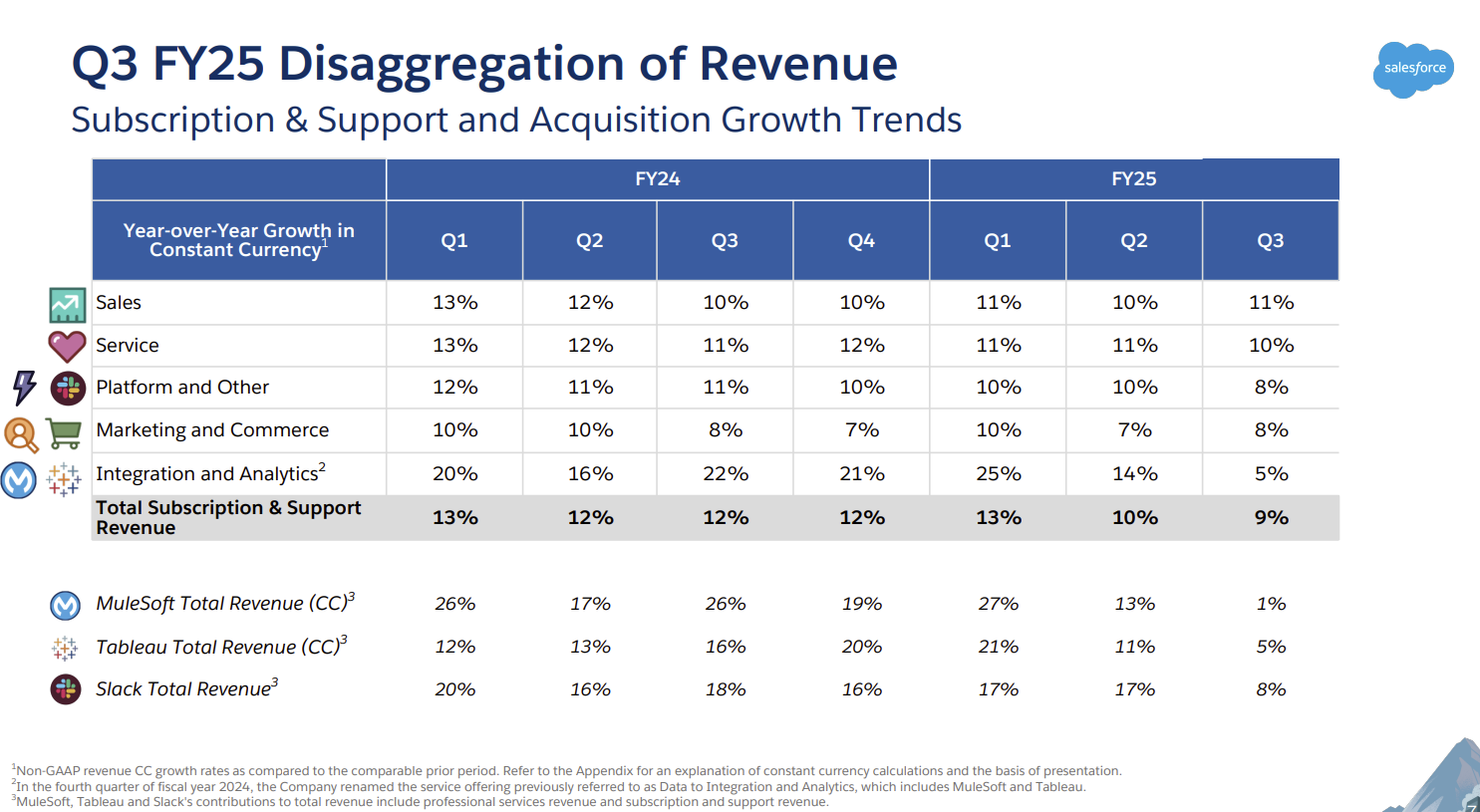

Salesforce saw sales growth deceleration in integration and analytics (MuleSoft and Tableau) with third quarter revenue growth of 5%. Platform and other (think Slack) saw third quarter revenue growth of 8%, down from 10% in the second quarter.

Here's a look.

Constellation Research analyst Holger Mueller said:

"Cost for subscription and support is down - $70 million or 4.8%. Not sure if Salesforce let go of support people here -- but it maybe an indicator that old on premise instances are more expensive as Salesforce customers have been moving to public cloud. But running all these agents should be a bump up in cost."

On the earnings conference call, Benioff outlined how Agentforce is being deployed within Salesforce. Although Agentforce isn't turning up in Salesforce's remaining performance obligations executives were bullish. Here's a look at some of the key comments:

- "We're seeing this demand for Agentforce, which just became available on October 24th, and we're already seeing this incredible velocity, more than 200 Agentforce deals just in Q3. It doesn't mean anything because the pipeline is in the thousands for potential transactions that are coming up in future quarters," said Benioff.

- The company has deployed Agentforce on help.salesforce.com so enterprises can see agents in action.

- Salesforce is trying to hire about 1,000 to 2,000 more salespeople.

- "We expect that our own transformation with Agentforce on help.salesforce.com and in many other areas of our company is going to deflect between a quarter and a half of our annual case volume and in optimistic cases, probably much, much more of that," said Benioff.

- Salesforce is customer zero for Agentforce. "We're deploying Agentforce to engage our prospects on Salesforce.com, answering their questions 24x7 as well as handing them off to our SDR team," said Brian Millham, President of Salesforce. "We'll use our new Agentforce SDR agent to further automate top-of-funnel activities from gathering leads, lead data for providing education and qualifying prospects and booking meetings.

- Agentforce deals are usually part of Service Cloud offerings. "Service Cloud is our largest cloud and our initial Agentforce opportunity is with our Service Cloud customers right now and we saw a ton of add-ons happening in our customer base with Service Cloud. But what our customers also recognize is that this is a platform," said Millham, who added Sales Cloud, Marketing Cloud and Data Cloud will also see Agentforce add-ons.