Verint said it expanded its analytics suite for contact centers as it launched a series of bots designed to automate customer experience.

At its Engage conference this week, Verint, which bills itself a CX Automation Company, launched the following:

- The expansion of Verint Data Hub, which unifies behavioral data across customer touchpoints, to include the new Verint Genie Bot in the company's speech analytics platform as well as the Verint Data Insight Bot. The idea is to enable analysts to deliver CX insights faster by having a natural language conversation with the Verint analytics platform.

- Verint Knowledge Automation Bot, which joins the company's portfolio of Agent Copilot Bots. The Verint Knowledge Automation Bot searches across enterprise content and uses generative AI to summarize results for human agents.

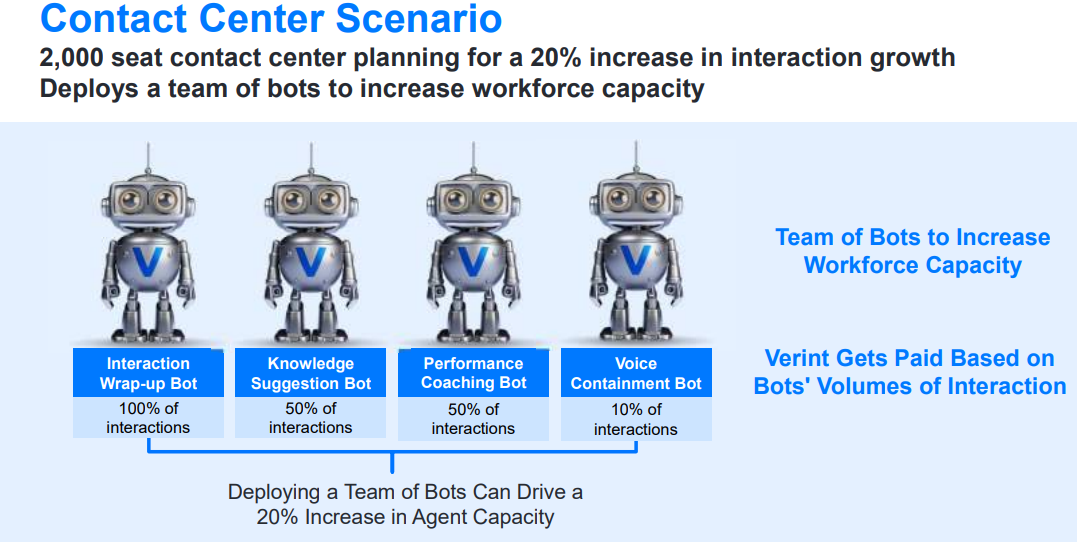

During Verint's recent second quarter earnings call, CEO Dan Bodner said contact centers are in the early stages of adopting AI. "We believe the AI opportunity in the contact center market is very large. The CX industry is spending about $2 trillion annually on labor costs and brands are seeking AI-powered bots that can deliver tangible business outcomes," he said. "AI adoption in our market is currently in its early stages."

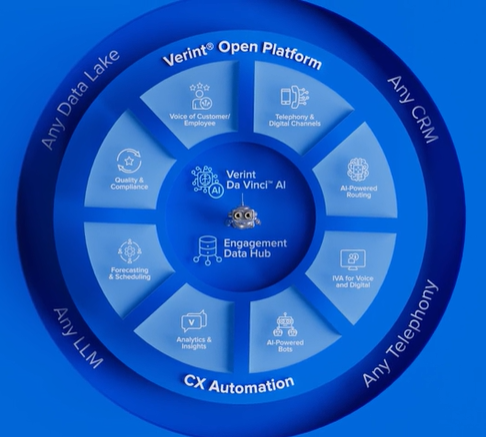

Verint's stack includes the Verint Open Platform, Verint Da Vinci, a factory for specialized bots and then ongoing training, and the Data Hub. Verint launched its Open Platform a year ago with 40 AI bots. Bodner added that customers are typically buying a few bots and then scaling with returns.

- Constellation ShortList™ Contact Center as a Service (CCaaS)

- Constellation ShortList™ Conversational AI

- Constellation ShortList™ Digital Customer Service and Support

- Constellation ShortList™ Contact Center Workforce Engagement Management (WEM)

This over-the-top hybrid strategy for Verint is working out since enterprises can get rolling in weeks instead of months. Verint said it is seeing bot consumption gains as enterprise realize they can deploy one for a use case and then scale without deciding on a complete platform overhaul.

Constellation Research analyst Liz Miller said:

"Verint's AI approach has been one that encourages customers to start their AI journey from right where they stand, selecting a singular challenge or need to address and deploying preconfigured Bots to address those very specific needs. One example of this is their newly revealed "Genie Bot" which will be released as a Beta for now.

This bot addresses the reality in the contact center that there is more business intelligence demands than resources as analytics and operations teams are often spread thin asked to dive deep into the data and answer big "why" questions around interactions and experiences. With the Bot, agents and supervisors will be able to interrogate data themselves to better understand where and how interactions can be improved, even identify trends in agent performance that can be proactively addressed with training or upskilling. This understanding can then be turned into data rich slides to share insights and intelligence with peers and leadership."

Bodner said:

"It's the very beginning of AI impacting the capacity. It's also interesting that from those customers that now have the capacity increased, they’re not just choosing to reduce agent count, some of them are choosing to dedicate agents to improve customer retention, and some of them are actually dedicating agents to increased sales. So, we see really an interesting trend. AI can turn the contact center from a service center to a revenue generating center."

What remains to be seen is how the CX AI agent/bot market develops. Verint is in a competitive market and giants like Google Cloud are getting into the contact center space. OpenAI and T-Mobile also announced a genAI CX partnership. Verint's Bodner argued that the company is in a good position because it is neutral and can put customers on an AI journey quickly and generate cost savings.

Verint said its fiscal year 2025 revenue will be $933 million with non-GAAP earnings of $2.90 a share. Verint's AI bookings in the second quarter increased more than 40%.

Bodner said:

"There are a lot of companies that are now attracted to the contact center market because obviously there’s a growing TAM and it looks like a great opportunity to for more automation based on Gen AI. But we see companies coming to the market with Gen AI and then IT is struggling to really take that Gen AI technology and create real business outcomes.

And that’s true for the hyperscalers, but also for smaller companies who just want to deliver Gen AI tools. And there’s a big difference between a generic Gen AI model and basically to train the model, to embed the model into existing workflow based on the contact center expertise that we have."