Adobe reported better than expected third quarter earnings as its primary segments delivered double-digit growth from a year ago. However, the fourth quarter outlook was lower than expected.

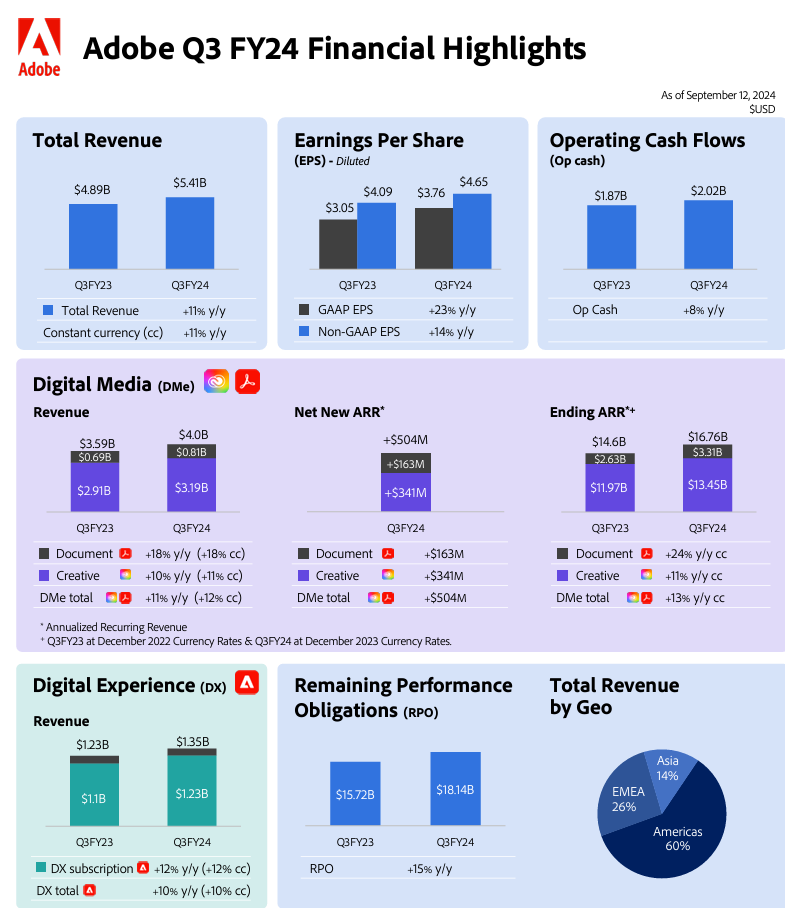

The company reported third quarter earnings of $3.76 a share on revenue of $5.41 billion, up 11% from a year ago. Non-GAAP earnings were $4.65 a share.

Wall Street was looking for Adobe to report third quarter earnings of $4.54 a share on revenue of $5.37 billion.

As for the outlook, Adobe projected non-GAAP fourth quarter earnings of $4.63 a share to $4.68 a share on revenue of $5.5 billion to $5.55 billion. For the fourth quarter, Wall Street was looking for earnings of $4.67 per share on revenue of $5.6 billion.

In prepared remarks, Adobe CEO Shantanu Narayen said the product advanced launched in the last 18 months "are delighting a huge and growing universe of users and enterprises."

"Our vision revolves around Adobe's deep technology platforms across Creative Cloud, Document Cloud and Experience Cloud which, when integrated, provide significant differentiation and value," said Narayen, who said adoption of Adobe AI features such as Firefly and Acrobat AI Assistant are driving demand. Adobe has surpassed 12 billion Firefly-powered generations across the company's platform.

Speaking on a conference call, Narayen said the fourth quarter is shaping up to be strong. "We saw the typical strength that we would see going into Q4. You're looking at the sequential guide. We're looking at it and saying it's the strongest ever Q4 target that we have put out there for Q4. I think we just continue to focus," said Narayen.

David Wadhwani, President, Digital Media Business at Adobe, added:

"Q3 was a little stronger than you expected, and for a good reason given seasonality. I think a lot of that can be explained by a few deals that would have historically just closed in Q4, closing earlier than expected in Q3, and that changed the dynamic in terms of the linearity that you would typically see between Q3 and Q4."

Wadhwani said Creative Cloud is seeing revenue gains from AI. "We have higher-value, higher-priced offers, thanks to AI innovation that's happening in the base plans that are impacting how the Creative Cloud business is doing," he said. "We also have a broader set of offerings than we've ever had now with web and mobile, including Premium and lower-priced offerings that are driving more proliferation."

By the numbers:

- Digital Media revenue in the third quarter was $4 billion, up 11% from a year ago. Within that segment, Document Cloud revenue was $807 million, up 18% from a year ago and Creative revenue was $3.19 billion, up 10%.

- Digital Experience revenue was $1.35 billion, up 10% from a year ago. Digital Experience subscription revenue as $1.23 billion, up 12%.

- AI interactions within Adobe Acrobat was up 70% in the third quarter compared to the second quarter.