Nutanix is winning larger enterprise deals and looking to ride hyperconverged infrastructure partnerships with Cisco and Dell as it plays the long game against Broadcom's VMware.

It's difficult to break out Nutanix's direct revenue due to Broadcom's VMware purchase, but it's safe to say the acquisition helped the company land high-level conversations. Nutanix results landed a day after Broadcom CEO Hock Tan made his pitch for VMware Cloud Foundation in Las Vegas.

- Nutanix product additions, partnerships designed to capitalize on VMware customer angst

- Nutanix winning deals vs. VMware, but Broadcom punching back with pricing

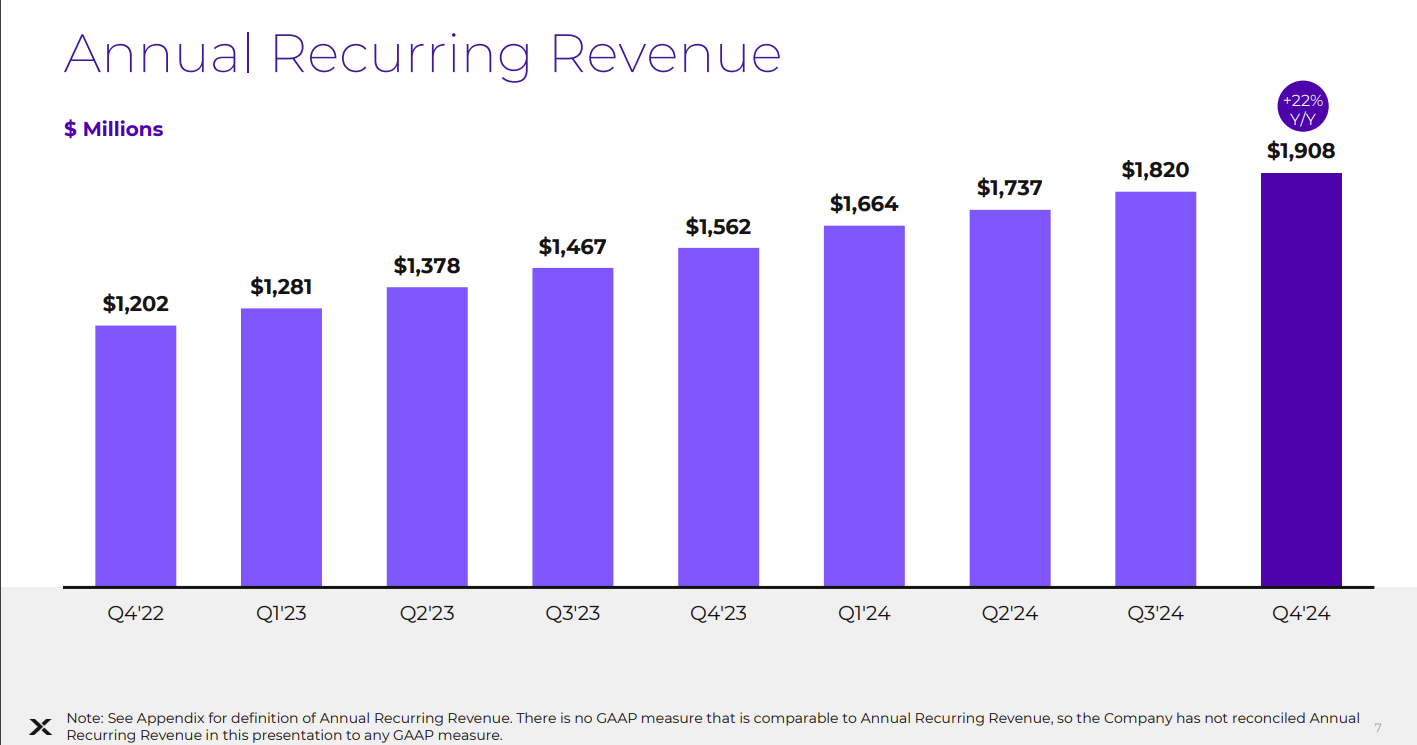

Nutanix is growing its pipeline with large enterprises, but these deals take longer to play out. For now, Nutanix beats expectations on a quarterly basis with the exception of lumpiness of deals closing. The company reported non-GAAP fourth quarter earnings of 27 cents a share on revenue of $548 million, up 11% from a year ago. Wall Street had expected non-GAAP earnings of 20 cents a share on revenue of $537.3 million. Net loss in the fourth quarter was 51 cents a share.

The outlook for Nutanix was solid and ahead of estimates. For the first quarter, Nutanix projected revenue of $565 million to $575 million and fiscal 2025 revenue of $2.435 billion to $2.465 billion.

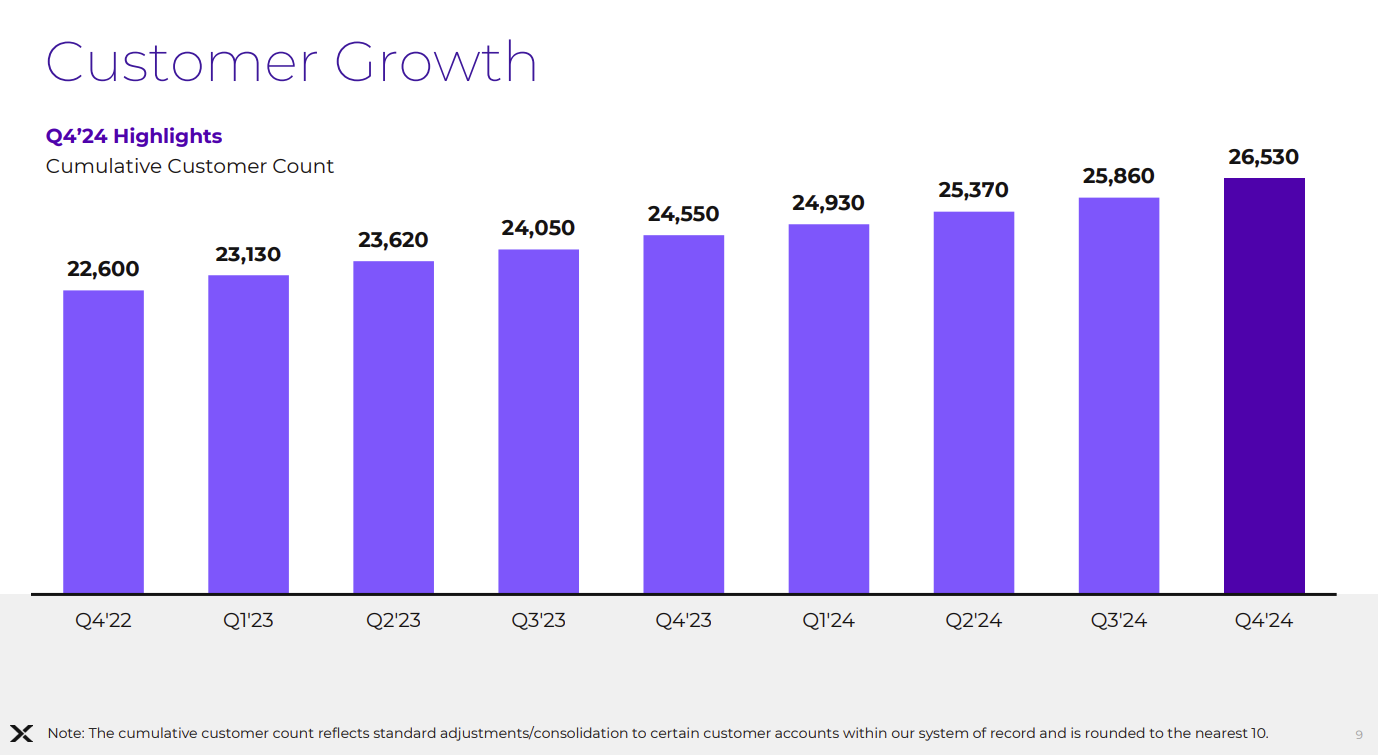

Rajiv Ramaswami, CEO of Nutanix, said the company's products and appeal are landing with large enterprises. "We saw good growth in our pipeline of larger deals as we shifted our focus up-market and saw increased engagement from prospects, looking for alternatives to their existing infrastructure solutions," he said.

However, Ramaswami noted that its "land and expand" business fell short of internal projections.

Nutanix is also betting that partnerships Cisco, Dell and Nvidia will expand its market. Dell XC Plus, a turnkey hyperconverged Nutanix offering, is generally available. Nutanix's GPT in-a-box is also gaining traction. "Our most significant wins in the quarter demonstrated the appeal of Nutanix cloud platform to organizations that are looking to modernize their IT footprints and adopt hybrid cloud operating models, as well as those looking for alternatives in the wake of recent industry M&A," said Ramaswami.

Moving up to large enterprises, however, takes time. Nutanix's largest fourth quarter deal was a multimillion-dollar deal that followed a 1.5-year engagement.

In other words, Nutanix is playing the long game vs. VMware as it expands its addressable market.

Ramaswami said:

"We are seeing some of these larger opportunities close. I do expect that we'll continue to see more of these over time. Now in the midsize and smaller customer segments, we're seeing significant increased engagement and opportunity as many of these smaller companies look for alternatives.

Along with our increased leverage from our go-to-market partnerships that we've talked about as well as our programs and incentives that we have in place, this dynamic has also been one of our drivers for our larger -- our stronger new logo performance."