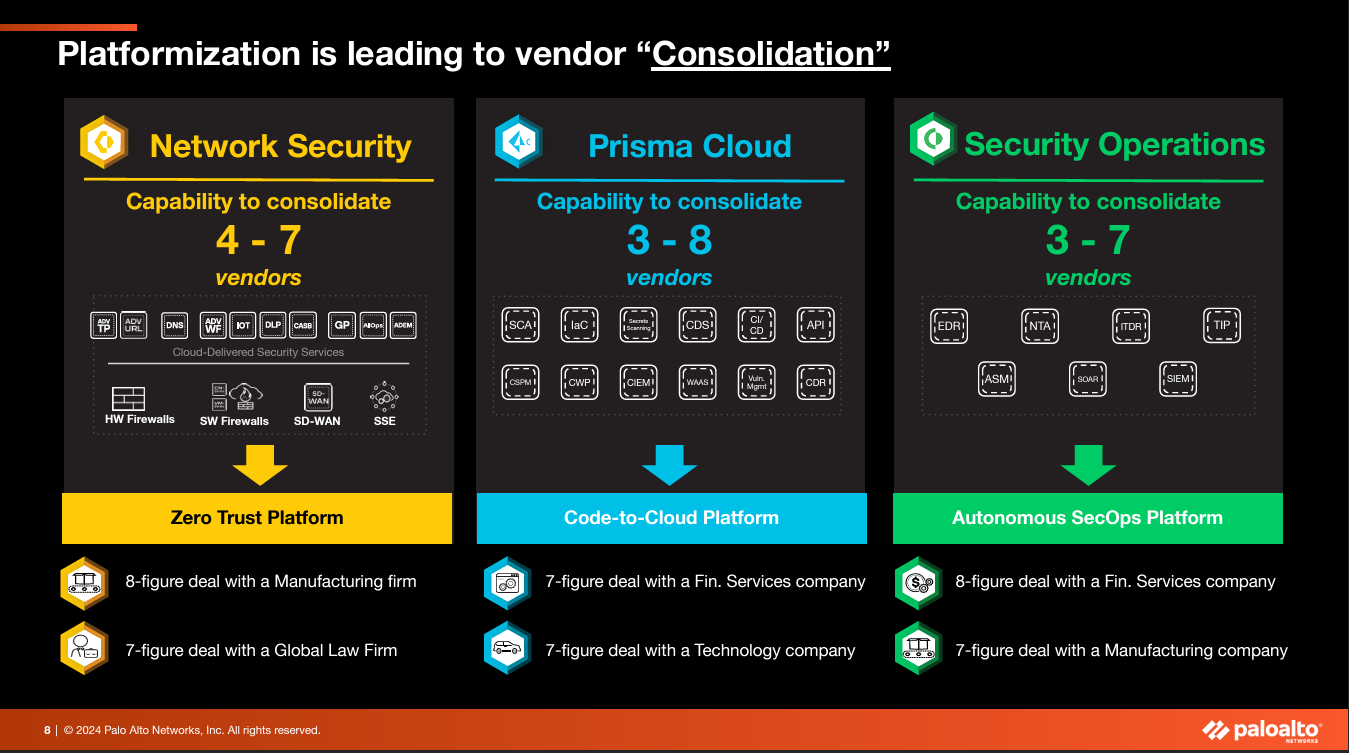

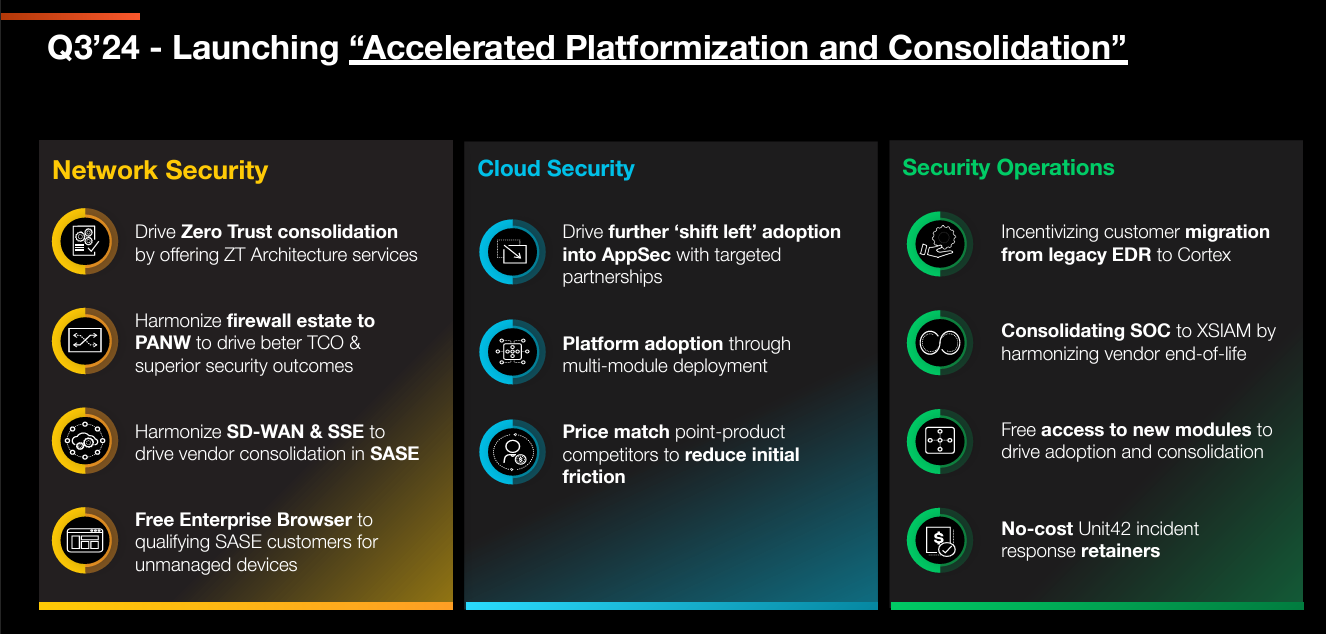

Palo Alto Networks is changing its strategy to entice enterprises to spend on its security platform as customers consolidate security vendors. Palo Alto Networks' bet is to accelerate security vendor consolidation by offering platform deals with introductory offers and deferred payments to grab share.

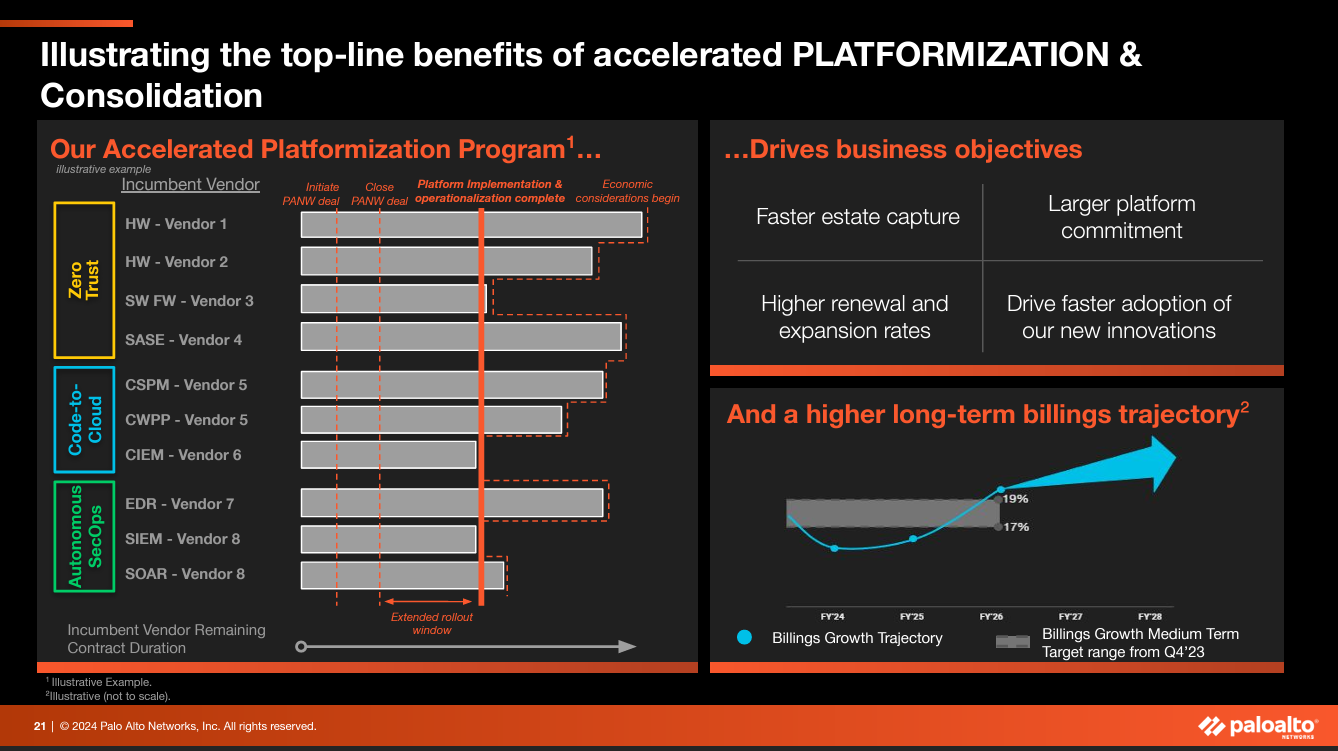

When Palo Alto Networks reported its second quarter earnings it handily topped expectations. The outlook, however, was light. Palo Alto Networks projected fiscal 2024 billings between $10.1 billion to $10.2 billion, down from the earlier range of $10.7 billion to $10.8 billion. Revenue for fiscal 2024 will be between $7.95 billion and $8 billion, down from $8.15 billion to $8.2 billion.

The efforts to gain share will impact revenue growth for about 12 months to 18 months, but Palo Alto Networks CFO Dipak Golechha said the security vendor has internal expense levers to preserve operating margins. Rest assured that other cybersecurity platforms—namely CrowdStrike and Zscaler will offer enterprise deals and incentives too.

CEO Nikesh Arora said customers are seeing spending fatigue and optimizing security budgets to see returns on investment.

Here's Arora's assessment of enterprise security spending on Palo Alto Networks' earnings call.

"Most of our customers have ended up spending more on cybersecurity than they wanted to. As a consequence, they're feeling like the budget for cybersecurity keeps going up in double digits every year and you see the number of breaches continue to rise. So, customers are sitting down and saying if I spend more money, then show me how I get a lower total cost of ownership across my enterprise. How do I spend less on the services that I have to deploy? How do I get better ROI? It's more about optimizing their current cybersecurity budgets. Demand continues to be very strong, but customers are demanding more for the money allocated to cybersecurity. That's where platform consolidation kicks in."

Palo Alto Networks said it will offer programs to trade in legacy vendors, no cost deals, introductory offers and product add-ons and incentives to convince enterprises to standardize on Palo Alto Networks.

Arora said the programs and offers are designed to address customers' economic concerns and Palo Alto Networks "must bear the cost of the transition to lower upfront financial outcomes."

As a result, customers entering a platform transaction won't pay Palo Alto Networks for a time period. Over time, customers will migrate to full billing and revenue contribution.

"We believe we can sustain high growth rates for longer aspire to by sticky and broad platform relationships and incremental customers, allowing us to aspire the goal of $15 billion in next generation security in 2030," said Arora.

He added that as Palo Alto Networks puts more customers on its platform it'll gain as AI gains as a use case for cybersecurity in the years ahead. said Golechha. "Once a customer deploys the platform, it's easier to continue to consolidate vendors and adopt new innovations. We expect this to drive a significant increase in our overall revenue mix that is occurring," said Golechha.

For the second quarter ending Jan. 31, Palo Alto Networks had non-GAAP earnings of $1.46 a share on revenue of $2 billion. Wall Street was looking for earnings of $1.30 a share on revenue of $1.97 billion.