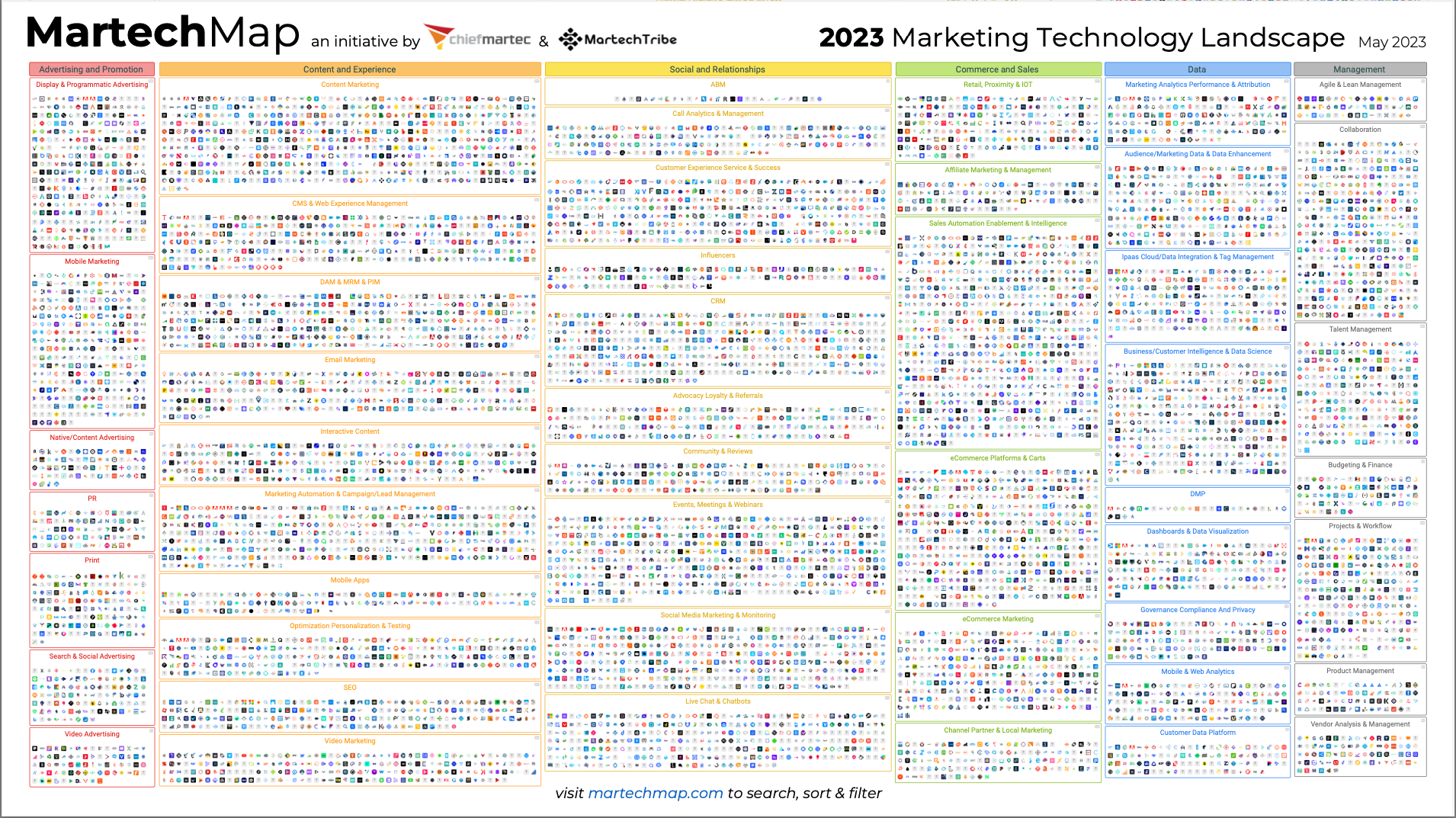

Every year, ChiefMarTech…helmed by the ever-brilliant Scott Brinker…puts on the magnifying glasses, throws on the digital muck boots and wades through the swamp of Marketing Technology to compile the annual extravaganza called the MarTech Landscape Supergraphic. You can check it out as an interactive experience at Martechmap.com thanks to the teams at ChiefMartech and the Martech Tribe.

In April 2020, when I was still a “rookie” here at Constellation Research, I wrote in wonder and exhaustion that the landscape had ballooned to include 8,000-plus solutions. At that time, I called the graphic a representation of a beast chasing down marketers…a manifestation of the Frankenstack that was lumbering about promising engagement while delivering confusion and complexity. I called it a Clash of Clans map where you could imagine the rebel land of CDP was poised to devour the kingdom of DMP.

In April 2020, when I was still a “rookie” here at Constellation Research, I wrote in wonder and exhaustion that the landscape had ballooned to include 8,000-plus solutions. At that time, I called the graphic a representation of a beast chasing down marketers…a manifestation of the Frankenstack that was lumbering about promising engagement while delivering confusion and complexity. I called it a Clash of Clans map where you could imagine the rebel land of CDP was poised to devour the kingdom of DMP.

Had you told me that 3 years and 1 pandemic later I would be talking about 11,000+ solutions arranged into something that looked like a DNA sequencing map, I would have laughed. I would have also hoped it was a lie. But here we are. 11,038 solutions categorized, organized and searchable depicting the chaos known as the marketing stack.

Let’s dig in with a couple highlights:

- The landscape is split into 6 primary categories across 49 individual segments but take a closer look…the column that once dominated the marketing landscape, namely advertising and promotion, has shrunk, much like the DMP section within the Data column. The reality here is that many of those DMP players have escaped, some seeking asylum within the Audience Data category, others masquerading as CDPs.

- 689 companies were removed from the landscape between 2022 and 2023 (7% churn), some thanks to acquisition, but others because of business closure.

- The growth rate of the space has slowed to 10% year over year. By comparison, in 2020, the growth rate for new market entries was 24.5% with a churn rate of 8.7%. While the slowdown has provided a bit of respite for weary marketers exhausted by the endless sales pitches, don’t expect the slowdown to remain. Afterall, AI hasn’t earned its own segment yet.

11,038 products are included but there are a couple omissions which is bound to happen. For example, Oracle Unity is a CDP not included in the category. Salesforce CDP or even mention of Genie or Data Cloud is missing. Brightspot is listed as a DAM, but not a CMS. HCL has a DAM offering that is included with their DX solution…should it be listed, or not because it isn’t sold as a standalone? On and on it goes. I mean Constellation Research isn’t included in the Vendor Analysis & Management section…not that I’m feeling left out or anything. Let’s just agree the actual number of solutions is actually higher 11,038.

While a by-the-numbers view of the sprawling landscape can feel overwhelming, the continued growth is also totally understandable. Customer engagement and more specifically the ways our most profitable customers want to engage with brands has become increasingly complex. While we need the data to power ambient experiences, we also need the traditional investments in events and moments that are indelibly etched into a customer’s lifetime of experiences.

We need to accept that any collapse or consolidation of the market will happen in small corners…like adtech or DMPs…for now. The moral of this year’s landscape is that this is not getting easier. We haven’t hit a point of mandatory and potentially cataclysmic consolidation. For every logo that disappears, 8 more emerge like an angry Gremlin confronted with water.

There is still the AI factor that could shift this landscape in any number of ways. Instead of disconnected point tools, AI could be the great consolidator, pulling data across these segmented systems and driving new efficiency in intelligence operations in new ways. The connection between AI’s capacity to analyze data at machine scale and empower work at human scale is undeniable. Joining AI’s intelligence output with automated workflows promises to herald in a new age of near real time customer journey optimization. Instead of collaboration tools to connect people around conversations, expect to see AI empowered work and collaboration tools that start to manage how humans collaborate with AI and, eventually, how machines collaborate with other AI managed machines.

Perhaps the very section I lament not being included in is the very section that could save us. I’m not suggesting that we analysts will save the stack…rather that 2023 might be the year of the vendor catalogs and technology management tools. We have officially hit the phase of operations where we must step back and admit that we can’t know what we don’t know.

So, use the stack builder page on the MarTechMap site. I myself have the urge to build out a stack using nothing but icons in the form of animals. Take the time to build a bill of materials for experience on a solution like CabinetM…start with MarTech but expand out beyond marketing’s walls to include any and all solutions that touch the customer or deliver experiences. Even if you think you took a single vendor approach…I guarantee you have a rogue implementation of something hiding in a corner.

If there is a single call to action I land upon after analyzing this landscape it is this: get on those muck boots and wade through the known and unknown of all the engagement stacks out there. Drag it all out into the light. Get your CIO colleagues involved. Let it be a bonding exercise in radical tech and data transparency. But do it now. Choice drives innovation and transformation. It also sows chaos. Time to go tame the chaos.