Hubris Drives Most Tech Firm Failures

After observing the technology industry for two decades, one can’t help but identify a recurring theme – the beginning of the end of a technology vendor. While most firms do not endure a mass failure and come back to life like Apple did with Steve Jobs or transform business models as IBM did under Lou Gerstner, Constellation often sees early signs when a technology vendor is in trouble. The factors that take shape often manifest for years but are apparent. While the tectonic shift of technology trends, business models, and non-traditional competitors play a key role, seven universal factors stem from hubris by management.

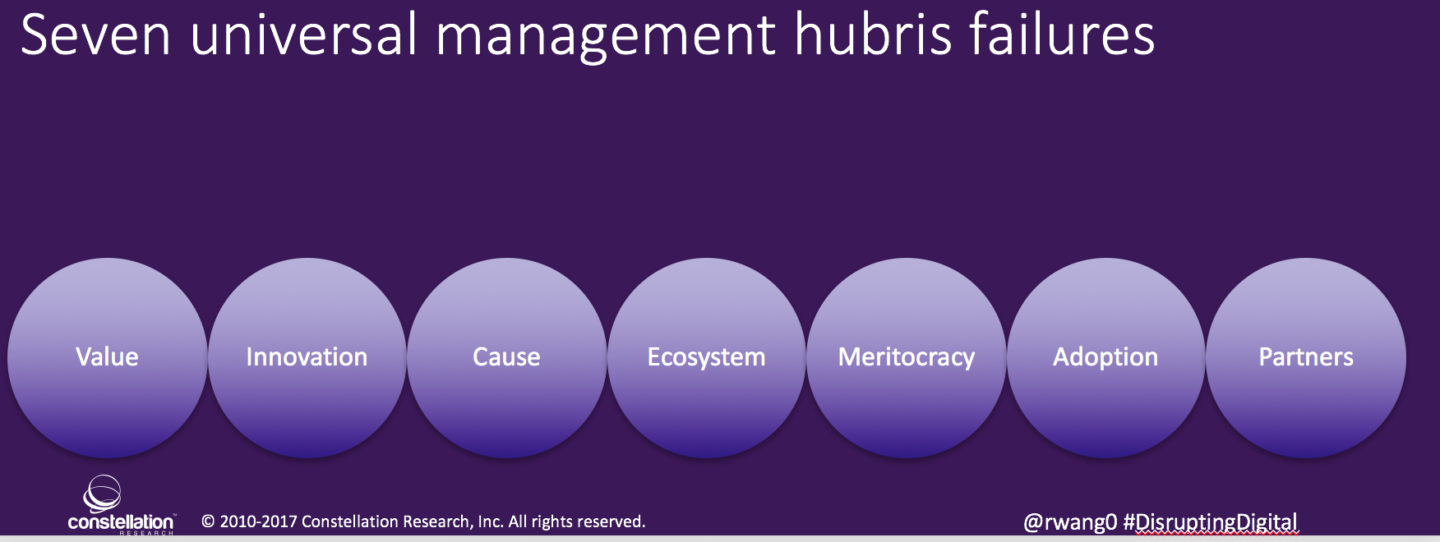

These seven universal VICEMAP failures include (see Figure 1):

- Value. Customers no longer perceive nor receive value for goods and services. ERP vendors in the late 1990’s and early 2000’s would buy each other up and hold customers hostage on maintenance without delivering new updates and key features. Reliance on marketing over product or service to cover up deficiencies is a common failure strategy.

- Innovation. Vendors who fail to move to new platforms, slow the pace and quality of innovation, or not adapt to new trends would fail to make the transition to the next era. In many cases, the pile of technical debt from failing to innovate holds back the vendor’s ability to innovate. Slashing of R&D and innovation budgets, departure of key founders and executives, and the failure to attract new talent signify impending failure.

- Cause. Forgetting the mission of the vendor can quickly impact brand value and future direction. Searching for the “why” and a constant change of tag lines and logos is a telltale sign.

- Ecosystem. Under developing a community of customers and partners hinders growth and success. The vendor should find ways to reduce the friction in working with partners and to empower customers to become advocates.

- Meritocracy. Talent requires recognition of accomplishment and reward for outcomes. An over correctional shift to hiring for political correctness over talent and the failure to promote internal talent starts the decline.

- Adoption. One of the most significant factors to customer success is adoption. Hard to use products, failure to accommodate customer requests often lead to declining adoption and usage.

- Profitability. The shift from market share to profitability per sale is a requirement for success. However, a decreasing profit per sale means that competitors have more money to invest and innovate.

Figure 1. Seven Universal Management Hubris Failures (VICEMAP)

The Bottom Line: Failure Is Preventable

As a client advocate, the role of an industry analyst requires a critical evaluation of a technology vendor’s viability. Viability rests on the management talent and life cycle of an organization. Early startups focus on attracting the right talent. Well funded startups focus on developing the right products. IPO’d companies focus on growing the customer market share. Legacy tech vendors focus on financial engineering. While each of these stages have different goals, the seven universal factors apply throughout the life cycle. In fact, failure in any two of these seven factors hint at decline. Failure in more than four factors highlight a severe risk. Failure in more than five hasten the decline to an irreversible recovery. This framework powers Constellation’s view on how well a vendor will succeed and align with a buy-side client’s overall technology and business strategy.

Your POV.

Got a few minutes? Take Constellation's 2017 Digital Transformation Survey and see how your organization stacks up against others pursuing digital transformation. Constellation will send you a copy of the results.