So, take a look at my musings on the event here: (if the video doesn’t show up, check here)

No time to watch – here is the 1-2 slide condensation (if the slide doesn’t show up, check here):

Want to read on?

Here you go: Always tough to pick the takeaways – but here are my Top 3:

Partnership with AWS. The big news of Day #2 was the Red Hat partnership with AWS, freshly put into action, so details were a little sparse. But effectively, Red Hat is looking to give its customers more software capabilities through making it easier to them to administer, launch and use 3rd party software capabilities, in this case AWS. It all happens through Red Hat OpenShift Container Platform, its PaaS platform. In the Day #2 keynote we saw a joint demo in which an OpenShift based JBoss server got access to an AWS RDS database, all provisioned from Red Hat OpenShift. Red Hat customers will not only be able to configure and deploy AWS services from the OpenShift version running on AWS, but also from an OpenShift deployment that runs on premises, on their very own servers. The targeted AWS products are Amazon Aurora, Amazon Redshift, Amazon EMR, Amazon Athena, Amazon CloudFront, Amazon Route 53, and Elastic Load Balancing. No surprise – a data base centric range. What Red Hat customers gain from this partnership will be the access to new capabilities that they could only deploy with substantial cost inside of OpenShift (especially on premises), take e.g. Hadoop / BigData use cases enabled now by Amazon AMR. Effectively Red Hat protects software assets that customers have created inside of OpenShift and gives them a future with adding / expanding use cases. And AWS gets access to enterprise load, while extending the reach of AWS products to …. On premises deployments and load. Something that could not have been done so far, as it was always ‘all in’ and building on AWS or migrating to AWS. Lastly on the Linux side, Red Hat and AWS will work together to expose more AWS services directly to RHEL, this will help customers who want to bring RHEL based applications to AWS, staying on Linux. And on the JBoss side both vendors will work together to provide JBoss as a containerized application on AWS. It all is planned to go live in fall of 2017. ReInvent timeframe maybe?

Red Hat OpenShift.io unveiled – The years are over when new IDEs are unveiled, but every now and then a new effort is announced, here it was OpenShift.io. IDEs are important for developer productivity, and quickly become the ‘living room’ of a developer, as such they have tremendous ‘stickiness’. Red Hat felt compelled to provide a modern, container (of course Kubernetes based) new IDE. Of course, it leverages Open Source IDE ingredients, such as Jenkins, fabric8 and Eclipse Che. More tooling is available for Workspace Management (shown in demos), better (of course agile) planning, team collaboration, coding and testing and of course CI / CD. I was impressed by the real-time Stack Analysis capabilities and plans – but that was to be expected from a multiple ISO layer owning technology stack vendor like Red Hat. And unsurprisingly it is ‘free’ in the sense of being part of the Developer Program and now in developer preview, developers can find it at https://openshift.io.

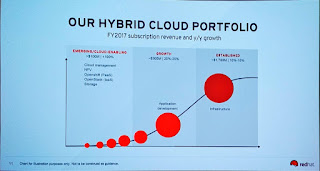

The New Kids on the Block are doing well. Red Hat is the largest Linux and Open Source company with revenues north of 2B US$. But with the threat of public cloud lingering over all on premises deployments, it is questionable how long Red Hat can derive revenues from Red Hat Enterprise Linux (RHEL). It’s remarkable the vendor is still growing this revenue segment with 10-20% growth, nonetheless it will slow down, maybe even come to a screeching halt. Red Hat knows this and has another revenue stream around JBoss, but that is equally heavily on premises centric, but growing relatively faster. So, longer term revenue growth and customer appeal for Red Hat must come from the newer products, the new kids on the block: OpenShift, OpenStack related services. Encouragingly these are growing at 100% now, but the small scale of a combined 100M US$ is still way too small to carry Red Hat as the 10k+ employee software vendor that it is right now. Speed of product development, acceptance by customers and loyalty of customers will be key. On the new capabilities, Red Hat has done well, it now needs to get customers to adopt the solution. It needs to change the conversation from administrators of server and services to the CxOs who make platform decisions. Not an easy task. But you need to have the products first.

On the concern side, Red Hat maybe running out of runway. The fact that all Innovation Award winners were not US based is a surprise for a US based event (yes Rackspace as a partner announcement is a US based vendors, but partner awards are always …. somewhat political). Compare that to the 2015 innovation award – where all winners were US based, except for one, Avianca. Public cloud adoption outside of the US is lagging, amongst many reasons largely because of the absence of public cloud vendor data centers. Consequently, enterprises hold on to older, proven best practices to run their enterprise loads. Likewise, an exposure to government customers (State of Jalisco, British Columbia, Singapore Govtech) gives room to highly beneficial use cases, but governments are in general not aggressive technology adopters. A trend to watch, possibly a fluke, maybe not.

But for now, Red Hat is doing well, passionate customers and employees were all in the direction of the conference, which was about the individual making the different. But in developer terms, the individual needs the right tools (Red Hat provides Openshift.io), and platforms that provide portability in times of uncertainty (Red Hat offers OpenShift Container Platform) and offer attractive functionalities (the partnership with AWS comes to mind). So, good progress by Red Hat in the age of (public) cloud transformation of enterprise workloads. Stay tuned.

Want to learn more? Checkout the Storify of Day #1 collection below (if it doesn’t show up – check here). And checkout the Analyst Day Storify here. And Day #2 here. And I had 10 Questions for Red Hat - see here.

Partnership with AWS. The big news of Day #2 was the Red Hat partnership with AWS, freshly put into action, so details were a little sparse. But effectively, Red Hat is looking to give its customers more software capabilities through making it easier to them to administer, launch and use 3rd party software capabilities, in this case AWS. It all happens through Red Hat OpenShift Container Platform, its PaaS platform. In the Day #2 keynote we saw a joint demo in which an OpenShift based JBoss server got access to an AWS RDS database, all provisioned from Red Hat OpenShift. Red Hat customers will not only be able to configure and deploy AWS services from the OpenShift version running on AWS, but also from an OpenShift deployment that runs on premises, on their very own servers. The targeted AWS products are Amazon Aurora, Amazon Redshift, Amazon EMR, Amazon Athena, Amazon CloudFront, Amazon Route 53, and Elastic Load Balancing. No surprise – a data base centric range. What Red Hat customers gain from this partnership will be the access to new capabilities that they could only deploy with substantial cost inside of OpenShift (especially on premises), take e.g. Hadoop / BigData use cases enabled now by Amazon AMR. Effectively Red Hat protects software assets that customers have created inside of OpenShift and gives them a future with adding / expanding use cases. And AWS gets access to enterprise load, while extending the reach of AWS products to …. On premises deployments and load. Something that could not have been done so far, as it was always ‘all in’ and building on AWS or migrating to AWS. Lastly on the Linux side, Red Hat and AWS will work together to expose more AWS services directly to RHEL, this will help customers who want to bring RHEL based applications to AWS, staying on Linux. And on the JBoss side both vendors will work together to provide JBoss as a containerized application on AWS. It all is planned to go live in fall of 2017. ReInvent timeframe maybe?

| Whitehurst on the opportunity ahead for Red Hat |

Red Hat OpenShift.io unveiled – The years are over when new IDEs are unveiled, but every now and then a new effort is announced, here it was OpenShift.io. IDEs are important for developer productivity, and quickly become the ‘living room’ of a developer, as such they have tremendous ‘stickiness’. Red Hat felt compelled to provide a modern, container (of course Kubernetes based) new IDE. Of course, it leverages Open Source IDE ingredients, such as Jenkins, fabric8 and Eclipse Che. More tooling is available for Workspace Management (shown in demos), better (of course agile) planning, team collaboration, coding and testing and of course CI / CD. I was impressed by the real-time Stack Analysis capabilities and plans – but that was to be expected from a multiple ISO layer owning technology stack vendor like Red Hat. And unsurprisingly it is ‘free’ in the sense of being part of the Developer Program and now in developer preview, developers can find it at https://openshift.io.

| Cormier on the Red Hat Model |

The New Kids on the Block are doing well. Red Hat is the largest Linux and Open Source company with revenues north of 2B US$. But with the threat of public cloud lingering over all on premises deployments, it is questionable how long Red Hat can derive revenues from Red Hat Enterprise Linux (RHEL). It’s remarkable the vendor is still growing this revenue segment with 10-20% growth, nonetheless it will slow down, maybe even come to a screeching halt. Red Hat knows this and has another revenue stream around JBoss, but that is equally heavily on premises centric, but growing relatively faster. So, longer term revenue growth and customer appeal for Red Hat must come from the newer products, the new kids on the block: OpenShift, OpenStack related services. Encouragingly these are growing at 100% now, but the small scale of a combined 100M US$ is still way too small to carry Red Hat as the 10k+ employee software vendor that it is right now. Speed of product development, acceptance by customers and loyalty of customers will be key. On the new capabilities, Red Hat has done well, it now needs to get customers to adopt the solution. It needs to change the conversation from administrators of server and services to the CxOs who make platform decisions. Not an easy task. But you need to have the products first.

|

| The Red Hat Product Portfolio |

MyPOV

A good event for Red Hat customers. An interesting selection of topics for the keynotes – it was not yet about the new offerings, at the same time the largest Linux vendor did not show a roadmap / planned capabilities for RHEL, a surprise. We heard ‘Containers are Linux’ a lot of times, but in the public cloud it doesn’t matter what they run on. Customers care for SLAs, not for operating systems. And we heard a lot of pledges to Open Source – but everybody is using Open Source these days, Open Source has won, they question what Red Hat does better and different than the other players would be interesting to hear. The direction of multi-cloud is the right one, as we have seen from the success of other multi-cloud offerings, most prominently CloudFoundry. The question will be how much net new load Red Hat can attract for next generation application use cases – running in the (public) cloud, vs. existing RHEL and JBoss based load ‘just’ migrating to the cloud.On the concern side, Red Hat maybe running out of runway. The fact that all Innovation Award winners were not US based is a surprise for a US based event (yes Rackspace as a partner announcement is a US based vendors, but partner awards are always …. somewhat political). Compare that to the 2015 innovation award – where all winners were US based, except for one, Avianca. Public cloud adoption outside of the US is lagging, amongst many reasons largely because of the absence of public cloud vendor data centers. Consequently, enterprises hold on to older, proven best practices to run their enterprise loads. Likewise, an exposure to government customers (State of Jalisco, British Columbia, Singapore Govtech) gives room to highly beneficial use cases, but governments are in general not aggressive technology adopters. A trend to watch, possibly a fluke, maybe not.

But for now, Red Hat is doing well, passionate customers and employees were all in the direction of the conference, which was about the individual making the different. But in developer terms, the individual needs the right tools (Red Hat provides Openshift.io), and platforms that provide portability in times of uncertainty (Red Hat offers OpenShift Container Platform) and offer attractive functionalities (the partnership with AWS comes to mind). So, good progress by Red Hat in the age of (public) cloud transformation of enterprise workloads. Stay tuned.

Want to learn more? Checkout the Storify of Day #1 collection below (if it doesn’t show up – check here). And checkout the Analyst Day Storify here. And Day #2 here. And I had 10 Questions for Red Hat - see here.