Qlik’s acquisition by private equity firm Thoma Bravo is expected to bring disciplined growth as the company moves into cloud business intelligence and analytics.

It came as no shock in early June when business intelligence and analytics vendor Qlik announced an agreement to be purchased by private equity firm Thoma Bravo. The all-cash, $3.0 billion deal to take the company private came just a few months after hedge fund Elliott Management Corp. took an 8.8% stake in Qlik and declared the $700-million-annual revenue firm was ripe for acquisition.

Being private can be a welcome respite from the harsh scrutiny of Wall Street – something Qlik rival Tableau Software has been subjected to in recent quarters. On the other hand, the standard Constellation Research advice to technology buyers is to beware of private equity firms that seek to wring too much “value” out of an acquired company. Optimizing profitability is one thing, but will they invest too little in the product, innovation, customer service and the future of the company?

A new Qlik board member from Thoma Bravo, Chip Virnig, says the private equity

firm leaves it to existing management teams to run its many investments.

Against this backdrop, job number one for Qlik at its October 17-19 Qlik UnSummit in Miami Beach, Fla., was to reassure the more than 20 analysts and customers attending that Thoma Bravo is interested in growing Qlik and bringing it to the next level, not wringing it dry. Qlik also used the event to update influencers on its strategy and its progress toward cloud. That move is ushering in changes in architecture, partner strategy and more.

Thoma Bravo Stays Qlik’s Course

If you can know a company by its actions, it wasn’t encouraging for some to learn that Qlik’s first big move following approval of the Thoma Bravo acquisition in August was an 8% staff reduction carried out in October. But at Qlik’s event we met Thoma Bravo principal Chip Virnig, who was there to paint the big picture. A former Merrill Lynch analyst and 2006 graduate of Brown University, Virnig disarmed with his Ben Affleck good looks and straightforward way of explaining the company’s strategy.

“We don’t make $3 billion investments only to have the company look pretty much the same in five years,” Virnig insisted. “Qlik has to continue to grow and innovate.”

Thoma Bravo invests exclusively in enterprise tech, and it only invests in companies with solid management teams that it can entrust to keep acquired businesses growing, Virnig explained. The company tends to hold the companies it buys for three to five years before selling them or returning them to the public market. Along the way, existing management teams usually retain an ownership stake and they co-invest alongside Thoma Bravo, he added.

“We’ve been better than any of our peers at keeping existing management teams in place,” Virnig explained. “You lose at least a year if you have management turnover, and that’s too risky to our model.”

On that note, Qlik’s top management team, including CEO Lars Bjork, CTO Anthony Deighton, and CMO Rick Jackson, all retained their positions and led the UnSummit. One notable departure was Donald Farmer, the Microsoft veteran who served as vice president of innovation and design. He announced his resignation in September.

As for the staff reduction, Virnig called it a “one-time” optimization, necessary to ensure that Thoma Bravo investors, such as big pension funds, get a share of profits along the way to an eventual liquidity event. Such moves are typical within the first month of any Thoma Bravo acquisition, he said.

Qlik executives I spoke to at the event said that the closer an employee was to the product – to developing it, managing it, supporting it, marketing it or selling it — the more likely it is that they’re still at the company. And in a sign of Thoma Bravo’s focus, Qlik has also hired more sales and research and development staff, they said, although the headcount is still below the pre-acquisition level.

MyPOV on Qlik’s Thoma Bravo Era. My conversations with Virnig and Qlik management lead me to believe that Qlik is going to be leaner and more competitive. Management is unburdened by the distractions of Wall Street, but it has to meet clear-cut and agreed-upon performance and profitability measures. Thoma Bravo is counting on Qlik to grow and to continue to innovate, but to do so efficiently and, from the sound of it, through organic development work. “It’s not just what you spend [to invest in a company], it’s the people and the turnover,” Virnig commented. “Qlik is stable and doesn’t have turnover every six months like some of the Silicon Valley firms.”

Qlik has matured and it’s not growing at the torrid pace of a SaaS startup. But if it can continue to grow at its current pace – 24 percent revenue growth in its last quarter as a public company – Qlik will undoubtedly live up to Thoma Bravo’s strategy and be a more prominent BI vendor and corporate asset three to five years down the road. The question is whether the changing and increasingly cloud-centric market will disrupt Qlik’s growth trajectory.

Qlik’s Cloud Strategy

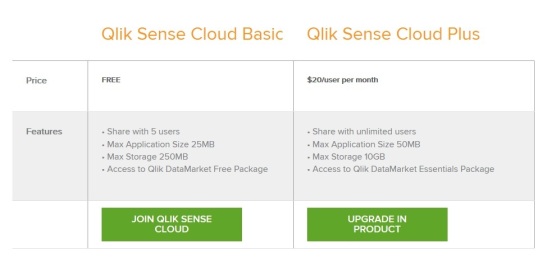

As I documented at last year’s UnSummit and this year’s Qonnections customer event, Qlik is a late entrant to cloud-based BI and analytics compared to many of its competitors. The company introduced its freemium-level Qlik Sense Cloud service in 2015. The service lets you load up to 250 MB of data and share Qlik Sense analytic apps with up to five other users. By year-end 2015 the service had 26,000 registered users.

In early 2016 Qlik introduced Qlik Sense Cloud Plus, which, at $20 per user, per month, lets you load up to 10 GB of data and sharing Qlik Sense analyses with unlimited numbers of users. Today the company has more than 80,000 registered cloud users, but Qlik didn’t divulge how many are paid or active users, as opposed to one-time or occasional tire kickers.

Qlik Sense Cloud will soon gain a Business service offering scheduled data refreshes,

cloud app and API connectivity, and user and group access controls.

Qlik’s next cloud step up, due within weeks, is Qlik Sense Cloud Business, which will support data integration from SaaS apps, such as Salesforce, and REST-based interfaces. It also lets you push data from on-premises databases and sources and schedule refreshes so you always have the latest data. The Business service will also provide governance in the form of user and group access controls and it will open up access to data in the Qlik DataMarket. Free DataMarket Essentials includes population (census), currency, weather, and socioeconomic data sets. Industry specific data, such as a Financial data from global stock markets, entails extra fees.

Qlik plans to deliver a full-on, multitenant cloud-based version of Qlik Sense Enterprise, its flagship product, sometime next year. But at UnSummit, Qlik mainly talked about the hybrid cloud deployment scenarios it sees ahead. In short, you’ll be able to run Qlik on premises, in private clouds, on public cloud infrastructure or on the Qlik Cloud, but the company is betting that the majority of companies will retain on-premises or private-cloud deployments over the next three to five years even as they add public cloud and/or Qlik Cloud components.

In particular, Qlik expects to see two popular deployment scenarios in the short term. In the first, companies will continue to index their various data sources in Qlik instances on-premises or in private-cloud deployments, but they’ll push Qlik Sense analyses into the Qlik cloud, where they can be broadly shared and where processing capacity can be elastically scaled to handle highly variable (Saturday night versus Monday morning) workloads.

In the second scenario, companies will use Qlik instances on Public Cloud infrastructure or in the Qlik Cloud to analyze cloud-centric combinations of sources, including data from SaaS apps, social networks, mobile apps and so on. That’s not to say that cloud instances will be used for cloud data and on-premises instances will handle the on-premises data, necessarily. There will be a mix in either case, but you’ll likely gradually move the analysis to where the majority of the data lives.

MyPOV on Qlik Cloud Plans. Qlik is sticking with what I see as a conservative path to the cloud. Qlik is well along on building out a microservices architecture that is already running Qlik Cloud, but the technology has yet to be introduced to shipping software. On some fronts, Qlik seems to be catching up to customer and partner cloud demand. For example, Qlik only recently started to craft formal programs to support managed-services providers and cloud-deployment partners that have introduced cloud deployment options for Qlik on their own. The company is also soon to announce ready-to-run, bring-your-own license deployment options on the AWS and Azure marketplaces. But that’s something that many rivals have offered for years.

In my view, Qlik needs to embrace powerful capabilities that are coming to public clouds, such as machine learning, natural language processing and other capabilities that will harness cloud scalability and processing power. Qlik executives were quick to point out that the company does take advantage of machine learning for data prep and various analyses. But they tended to dismiss “AI” and “cognitive” services as attempts to remove humans from decision-making. Meanwhile we saw a video at the event in which a customer was experimenting with Microsoft Cortana voice-to-text capabilities to create a natural language querying interface for Qlik.

I believe that customers running Qlik on AWS or Azure will want to mix and match capabilities. What’s more, the Qlik Cloud runs on AWS, so why not open it up to AWS services that Qlik won’t replicate, such as Kinesis stream processing and Alexa natural language processing? Qlik hasn’t said that it won’t take such an open approach, so I’m hoping it will embrace and make it easier for customers to benefit from what AWS, Azure and Google can offer. Cloud computing is already disrupting the BI and analytics market as we know it, so vendors must differentiate by embracing available services and extending what customers can do.

Related Reading:

Oracle Vs. Salesforce on AI: What to Expect When

Qlik Extends Its Platform As Cloud Disruption Looms

Qlik Unveils QlikView 12, Qlik Sense Cloud Roadmap

![]()