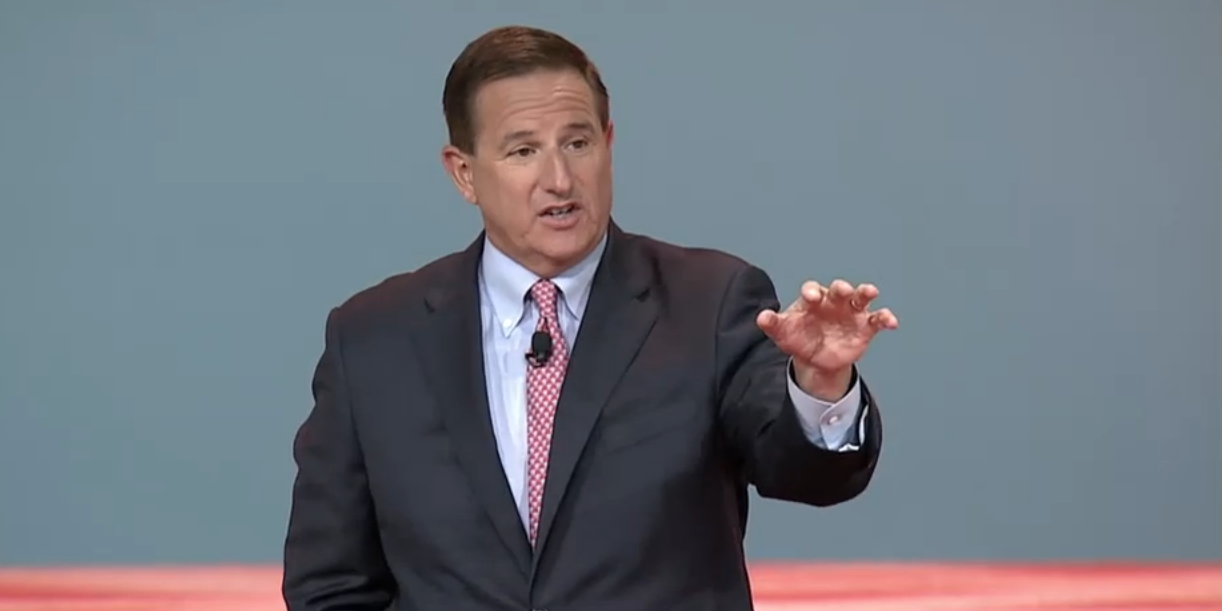

Oracle CEO Mark Hurd’s OpenWorld keynote on Monday featured the expected heavy sales pitches and claims of Oracle’s leadership in the cloud, but also provided some bold predictions and interesting perspectives from large customers. Here’s a look at some of the highlights.

The 2025 Vision

Hurd listed five things Oracle believes will be true by 2025:

1. Eighty percent of production apps will be in deployed in the cloud.

2. Two suite providers will own 80 percent of the SaaS market. Only 20 percent of the SaaS market will be held by point providers.

3. All new testing and development will be done in the cloud. Today, 30 to 40 percent of IT spending is on these areas, making them attractive cloud targets thanks to cost savings, according to Hurd.

4. By 2025, virtually all enterprise data will be stored in clouds. The rationales: Better economics, easier access and real-time availability, Hurd said.

5. To that end, enterprise clouds will be the most secure environments in the world. Oracle’s is more secure than anyone, he claimed.

POV: Hurd’s prediction regarding dev and test is the easiest one to agree with, since that segment is fairly mature already with options from many vendors, large and small.

As for a SaaS market dominated by two suite companies, such a scenario probably depends on a lot of consolidation between now and 2025. One key factor for customers would be how well each vendor integrates and harmonizes the pieces into their suites.

Finally, Hurd didn’t spend a lot of time on the data and security predictions, but both topics will be up for deeper discussion on Tuesday during CTO Larry Ellison’s second OpenWorld keynote.

General Electric's Journey to the Cloud

Hurd’s keynote featured discussions with high-profile customers, including General Electric CIO Jim Fowler. GE is undergoing a far-reaching move to the cloud as part of a transition into digital lines of business.

Fowler provided a succinct and telling example of the cloud’s multiple benefits. One GE division moved a configurator application off-premises to the cloud and in doing so, the cost to run it went from $65,000 to $6,000. But the real benefits were global scale and the resulting ability to push more orders and quotes through the system, he said.

GE is taking a deliberate approach to what it buys in the cloud, which includes Oracle’s Taleo recruitment software, according to Fowler. “I want to buy things that don’t differentiate me in the market,” he says. It makes more sense to buy those products from specialists like Oracle, and use in-house talent to build out unique IP, Fowler said.

POV: Just a few weeks ago, Fowler appeared at Amazon Web Services’ re:Invent conference and declared the company “all in” with AWS as part of a far-reaching digital transformation.

GE is planning to move 9,000 application workloads to AWS over the next few years, reducing its data center footprint from 34 to four.

This subject unsurprisingly didn’t come up during Hurd’s discussion with Fowler. Oracle is touting its ability to offer customers the cloud at all three levels—IaaS, PaaS and SaaS—but it’s got some catching up to do, particularly in the first category. The good news for customers considering both options is that Ellison has publicly stated Oracle will compete aggressively with Amazon on IaaS pricing.

CONSTELLATION INSIGHTS

Constellation Insights provides members with daily analysis of breaking news across the enterprise. Insights will be available in November 2015. Learn more about Constellation Insights.