Expect Regulations For National Security, But Overall Lighter Regulatory Framework

For the most part, tech has done well regardless of presidential administrations due to the light regulation of the overall industry. This has allowed large digital giants to emerge and dominate global markets across a multitude of industries. Amidst a national security backdrop and increasing capital required in the tech arms race, government has been hesitant to over regulate.

We’ve seen renewed optimism in three areas since Donald J. Trump's election victory:

- Cryptocurrencies. Bitcoin – probably will blow past 100k.

- Big Tech. stocks are back for tech as M&A activity heats up.

- BFSI (Banking, Financial Services, and Insurance). Banks are gearing up for IPOs, M&A, and deals.

In the Biden administration the primary lever was an over zealous anti-trust regime intent on idealogically taming tech giants from becoming monopolies. This over reach of anti-trust doctrine which rested on ensuring the customer was not harmed resulted in more harm to the consumer and markets. Why? Innovative startups had no M&A opportunities, IPO market cratered, and consumers lost out on new innovations. In new markets such as cryptocurrencies, the lack of clear regulation led to an outflow of capital, talent, and innovation to the Middle East which quickly established clear ground rules and light regulation.

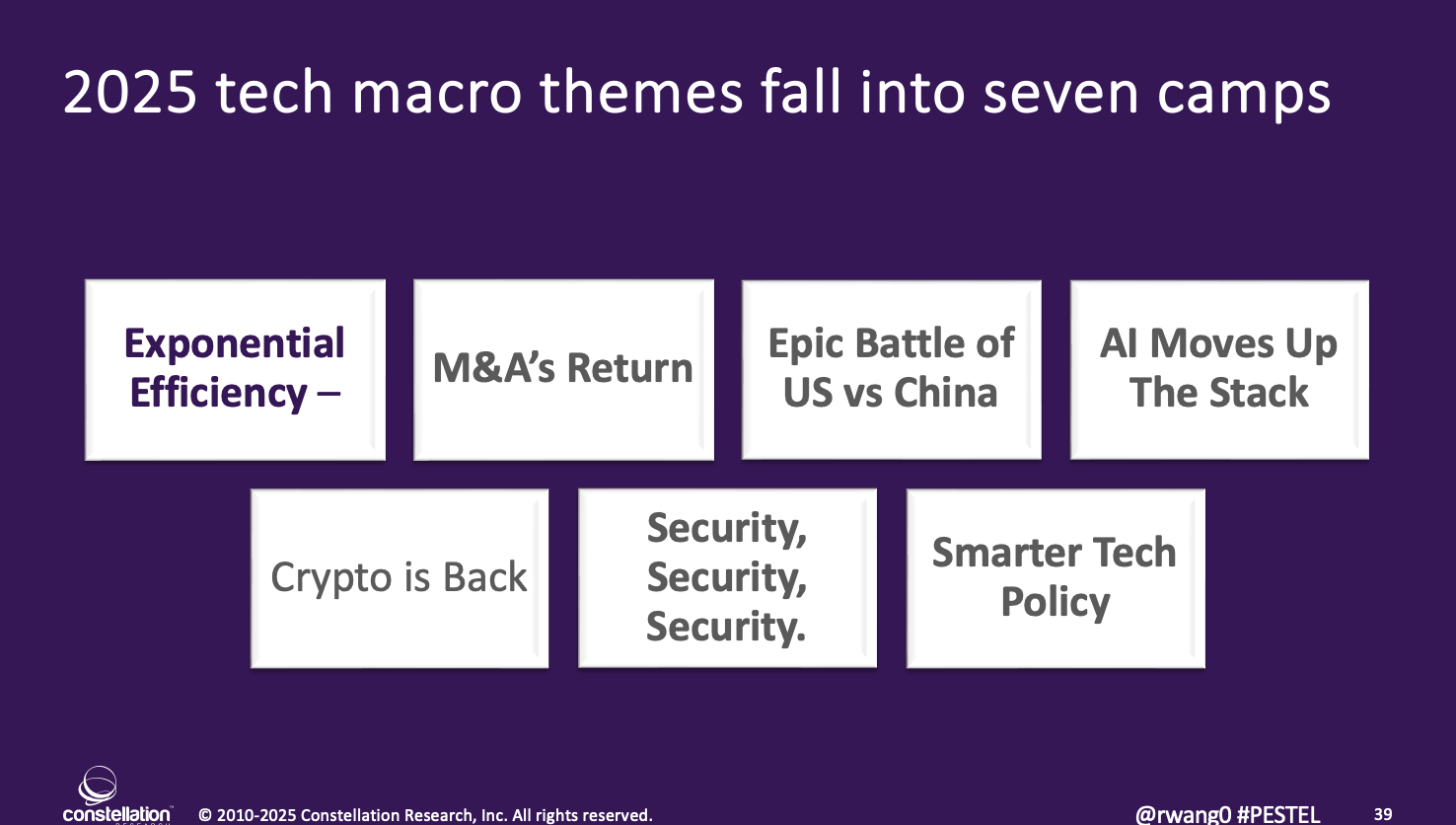

2025 Tech Macro Themes Fall Into Seven Camps

When forecasting, Constellation's base case is 3% inflation and 4% growth The stretch case is 4% inflation but 6-7% growth. These assumptions are a far cry from 8% inflation with 2% growth under Biden. Meanwhile, IPOs and M&A activity are gearing up. In fact, the bankers are telling us they are starting to ramp up the M&A teams they let go over the past four years. The good news - IPO’s are waiting for unicorns like Stripe, Databricks, OpenAI, SpaceX, Anduril, ByteDance, and CoreWeave.

Constellation Research expects the following seven macro themes for 2025:

- Exponential Efficiency. Tech buyers face massive budget constraints as AI investments increase and margin compression continues. Almost every tech buyer interviewed by Constellation Research seeks cost savings to fund innovation. Today's OpEx heavy budgets leave little room for innovation. Consequently, if a technology vendor's offerings are not 10x better or 1/10th the cost, buyers are ignoring those technology vendors. Expect the continued massive growth of Global Competency Centers where tech talent shifts outside of the US to lower cost delivery owned by enterprises seeking labor and AI arbitrage.

- M&A's Return. The regulatory overreach by Anti Trust and DOJ will be pushed back. Startups will have pipeline to exits for innovation. M&As will face easier hurdles for approvals, except national security concerns.

- Epic Battle of US vs China. The recent high-memory chip band is a continuation of other national security related actions. Expect an equally or more hawkish stance by the new administration.

- AI Moves Up The Stack. The first wave of AI growth came from Chips,. Clear winners include Nvidia, TSMC, SuperMIcro, ASML, and maybe AMD. The second wave comes from the HyperScalers. The next 24 months will come from software vendors who deliver real AI improvements. Currently, the market has seen meager offerings of lame Co-Pilots and weak agents that any university student could build in 30 days or less. When these enterprise vendors finally deliver real AI, there will be a boom. The fourth wave will come from enterprises who apply AI such as Walmart and Uber who have used this for dynamic pricing, optimization of operations, and improved consumer personalization. Consequently, expect a market rotation out of chips and a move to other waves.

- Crypto Is Back. With the crypto and tech bros whispering in POTUS' ear, expect clearer guidelines. Should the Crypto Act pass, expect capital, talent, and innovation to shift out of Middle East back to US

- Security. Security. Security. From cyber security, to deep technologies, to critical infrastructure, security is also paramount to the administration. This administration is expected to root out any espionage and take a harsher stance on cyber criminals.

- Smarter Tech Policy. Since President Obama, the link between Silicon Valley and DC has improved. Unfortunately, the past 8 years has seen a politicization of the tech industry. Expect a swing back to the middle as the Trump team balances out business interests with societal priorities. Constellation expects a deeper discussion on Section 230, Online Safety Act for Kids, overall privacy rights, and TikTok.

Figure 1. Seven Macro Themes for 2025

Source: Constellation Research ,Inc.

The Bottom Line: The Age Of AI Changes All The Rules

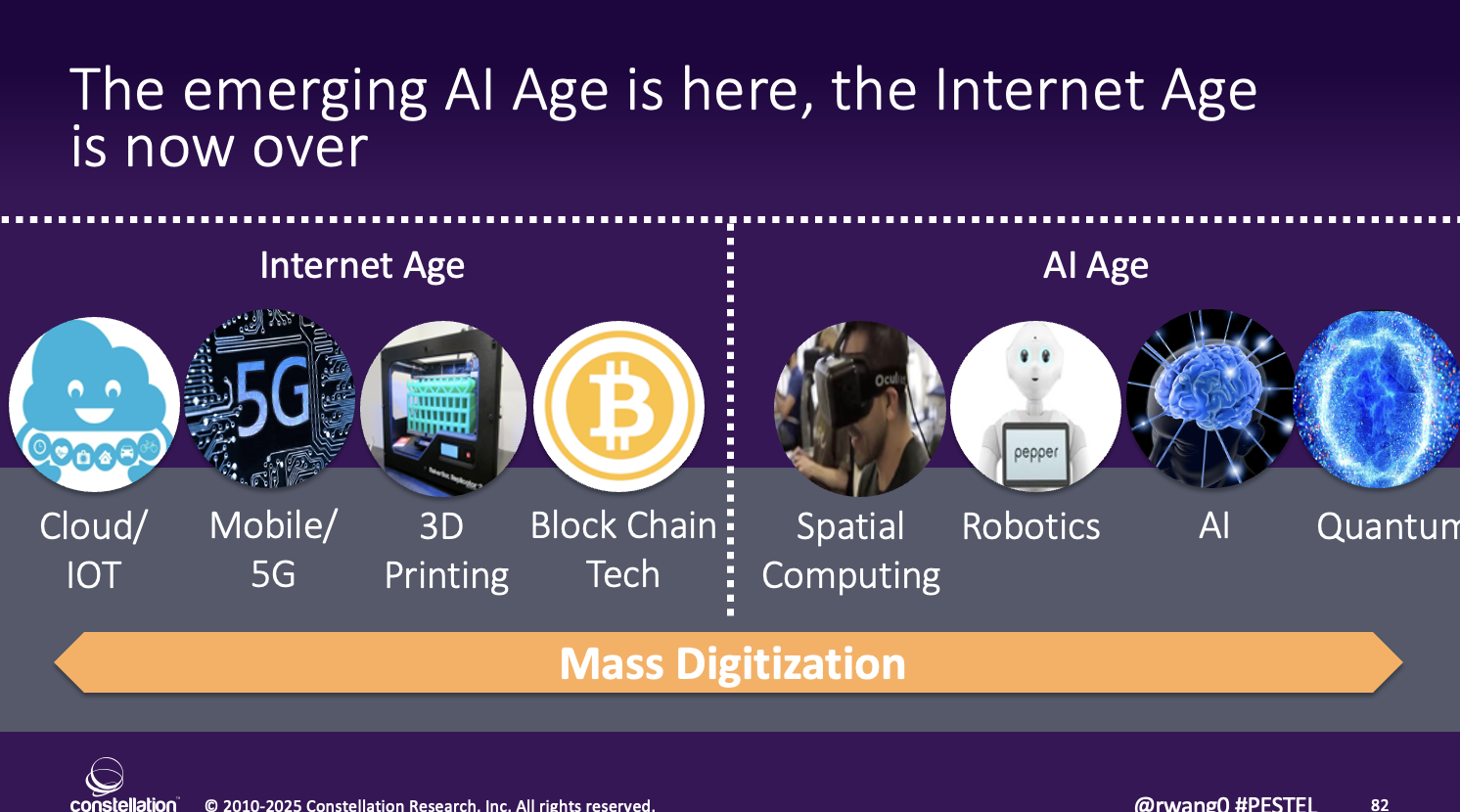

The clear demarcation between the Internet Age and the Age of AI provides technology buyers with an understanding of the digital impact across these ages. Keep in mind there was no Fourth Industrial revolution. Those technologies in that fourth industrial revolution were third order derivatives of the internet age (see Figure 2)

Figure 2. The Age of AI Is Here.

Source: Constellation Research ,Inc.

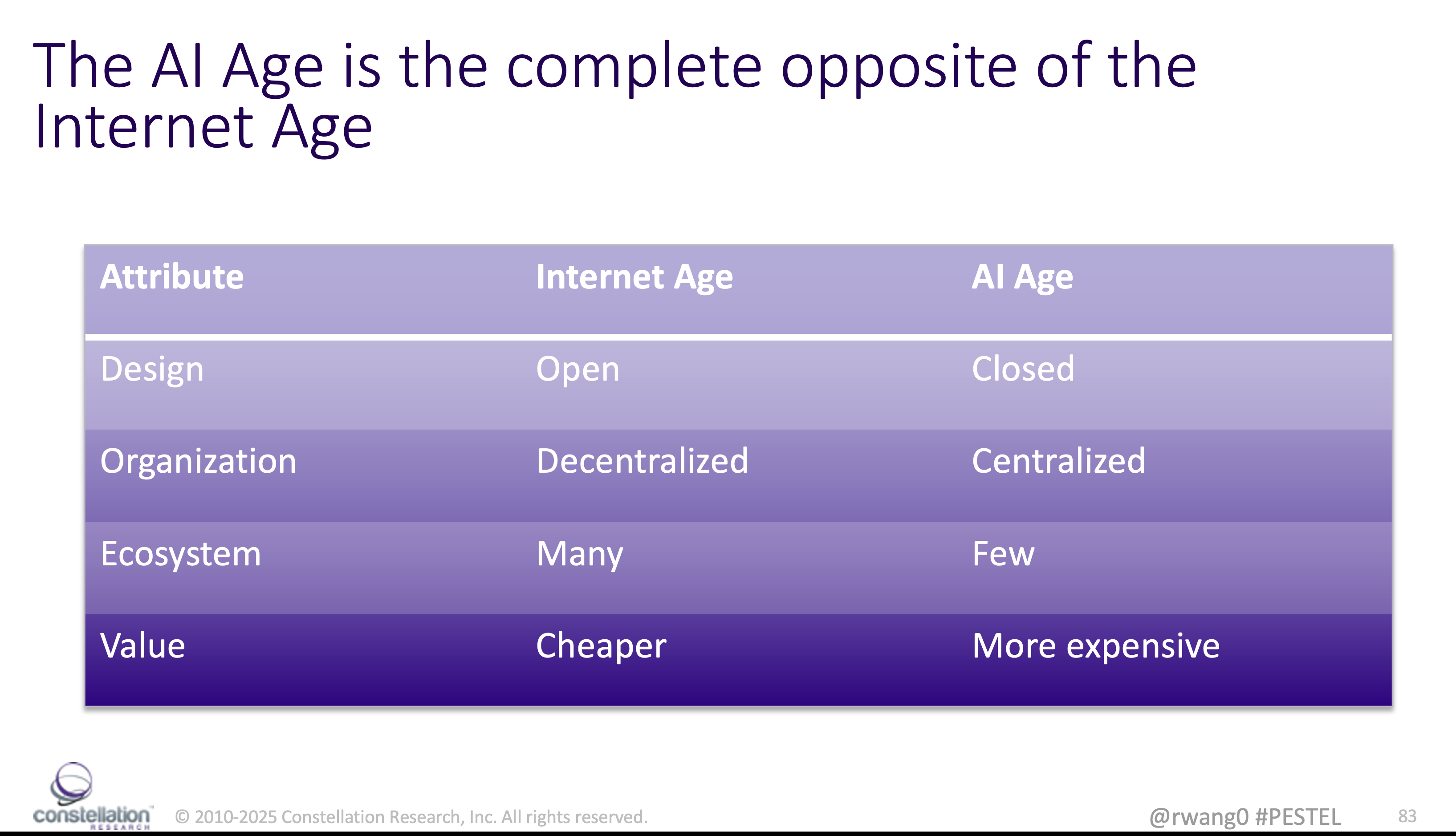

We have seen a sharp contrast with the Internet Age for AI Age and technology buyers have not seen the returns yet. AI has been more closed more centralized, with few winners, and more expensive costs. Technology vendors can not continue to hold their buyers hostage to preserve stock price without delivering on exponential efficiency. For example, India's peer to peer payments system operates at fractions of pennies per transaction versus today's SWIFT regime at $25 for a wire and $1.50 for an ACH transaction. Companies can acquire Zoho at 1/10th the cost of buying Microsoft, Google, Salesforce, Zoom, etc. The conditions are ripe for disruptive startups that will challenge these once innovative vendors who are now holding back progress.

Figure 3. Internet Age Vs AI Age (So Far)

Source: Constellation Research ,Inc.

Your POV

Ready for the Age of AI? Are you in the midst of margin compression? What are your plans for reducing OpEx to pay for innovation in 2025?

Add your comments to the blog or reach me via email: R (at) ConstellationR (dot) com or R (at) SoftwareInsider (dot) org. Please let us know if you need help with your strategy efforts. Here’s how we can assist:

- Developing your AI and digital business strategy

- Connecting with other pioneers

- Sharing best practices

- Vendor selection

- Implementation partner selection

- Providing contract negotiations and software licensing support

- Demystifying software licensing

Reprints can be purchased through Constellation Research, Inc. To request official reprints in PDF format, please contact Sales.

Disclosures

Although we work closely with many mega software vendors, we want you to trust us. For the full disclosure policy,stay tuned for the full client list on the Constellation Research website. * Not responsible for any factual errors or omissions. However, happy to correct any errors upon email receipt.

Constellation Research recommends that readers consult a stock professional for their investment guidance. Investors should understand the potential conflicts of interest analysts might face. Constellation does not underwrite or own the securities of the companies the analysts cover. Analysts themselves sometimes own stocks in the companies they cover—either directly or indirectly, such as through employee stock-purchase pools in which they and their colleagues participate. As a general matter, investors should not rely solely on an analyst’s recommendation when deciding whether to buy, hold, or sell a stock. Instead, they should also do their own research—such as reading the prospectus for new companies or for public companies, the quarterly and annual reports filed with the SEC—to confirm whether a particular investment is appropriate for them in light of their individual financial circumstances.

Copyright © 2001 – 2024 R Wang and Insider Associates, LLC All rights reserved.

Contact the Sales team to purchase this report on a a la carte basis or join the Constellation Executive Network