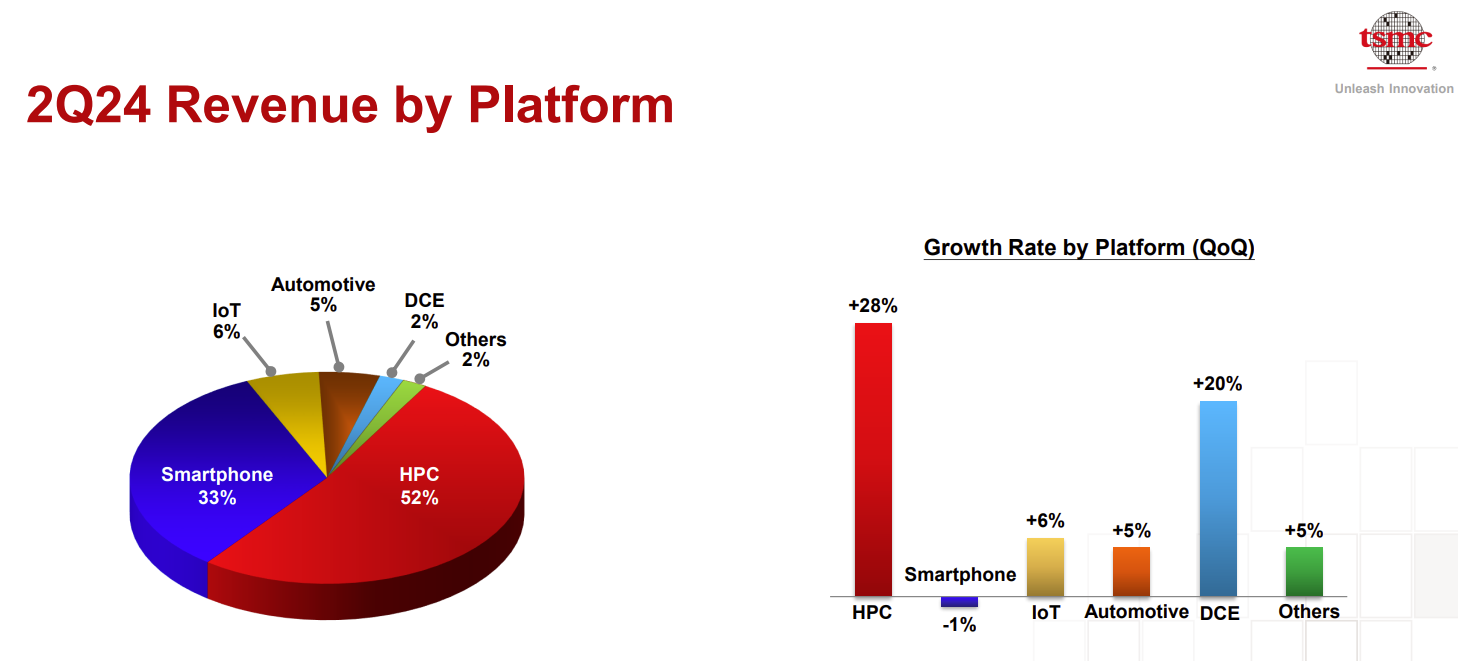

TSMC’s second quarter earnings were better-than-expected and the chip manufacturer is becoming a barometer for generative AI infrastructure demand. High-performance computing (HPC) is now more than half of TSMC's revenue.

In addition, TSMC’s ability to be bleeding edge has made it the go-to partner for every generative AI infrastructure player including Nvidia and AMD, two companies moving toward an annual GPU cadence.

TSMC's second quarter revenue was $20.92 billion, up 32.8% from a year ago, with earnings of $1.48 per American Depository Receipt unit. TSMC is projecting third quarter revenue to be between $22.4 billion and $23.2 billion.

Here are the takeaways from TSMC's second quarter earnings call.

Demand for AI processors is still well ahead of supply. TSMC CEO C.C. Wei said the company is working hard to meet customer demand, but supplies of AI chips will remain tight. "We are working very hard to get enough capacity to support customers from now to next year and 2026," said Wei. "The supply continues to be very tight, all the way through probably 2025 and I hope it can be eased in 2026. That's today's situation."

TSMC is disciplined about adding capacity. "Our capital investment decisions are based on four disciplines, that is, technology leadership, flexible and responsive manufacturing, retaining customers' trust, and earning a sustainable and healthy return. To ensure a proper return from our investment, both pricing and cost are important. TSMC's pricing strategy is strategic, not opportunistic to reflect the value that we provide," said Wei.

Wei said TSMC won't repeat the same mistakes made in 2021 and 2022 where demand was driven by pandemic and shortages and not sustainable.

AI demand is more durable than previous boom-bust cycles. "AI demand is more real than two or three years ago," said Wei. "AI will be a very useful tool for human to improve productivity. Everything will need AI."

Wei noted that TSMC is also in line to buy its customers' products because it is leveraging AI to be more productive. Nevertheless, TSMC wants to make sure customers are realistic about future demand for AI chips. "We have a top-down bottom-up approach and discuss with our customers and ask them to be more realistic. I don't want to repeat the same kind of mistake two or three years ago, and that's what we are doing right now," said Wei.

AI will drive PC and smartphone processor demand. Wei noted that customers are all looking to put AI functionality into edge devices, but don't have a handle on demand and replacement cycles yet. He said that AI is likely to drive edge processor demand in about two years.

TSMC will raise prices, but each customer and category are different. Wei noted that doubling capacity isn't cheap--$30 billion to $32 billion in capex for 2024--and TSMC hasn't been able to meaningfully boost the gross margins. TSMC executives repeatedly said the company will "sell the value" so that customer wins also filter down to it.

Wei said: "This is an ongoing and continuous process, and we are continuing to sell our value. And by the way, my customers are doing very well also. You knew that. So, we should do well also."

"When TSMC wants to expand the capacity, we need the land, we need the electricity and we need the talented people," said Wei. "All of my customers are looking for leading-edge capacity for the next few years and we are working with them to support them, both in pricing and in capacity."

The company is ready for an annual GPU product cadence. Wei said typically every processor takes 1.5 years to 2 years to move from design to production. Nvidia gave TSMC the heads up a while ago. "We have been prepared. And not just from June when they announced it, but much earlier," said Wei.