AWS re:Invent is an overwhelming barrage of features, services and launches that fly by so fast you can miss a lot of things that could drive real business value.

To that end, here are a some of the announcements that team Constellation Research thought were interesting even if they didn't get all the attention that Amazon Q, SageMaker, Graviton, Trainium and Inferentia get. These items were dropped by AWS CEO Adam Selipsky in passing while others hit the wires ahead of the lead keynote.

Data sovereignty requirements. Before AWS re:Invent kicked off at scale, AWS outlined AWS Control Tower, a set of 65 controls to meet data sovereignty requirements, which requires enterprises to control where data resides and flows. AWS Control Tower offers a consolidated view of the controls enabled, your cmpliance status, and controls evidence across your multiple accounts.

Constellation Research analyst Dion Hinchcliffe said:

"This announcement is very significant for large enterprises operating across different countries. Cloud is a real challenge for large multinational organizations. These new controls are vital for them to stay in compliance with data residency and other requirements. The support for multi-account controls is particularly noteworthy."

More from re:Invent:

- AWS launches Amazon Q, makes its case to be your generative AI stack

- AWS Expands Zero-ETL Options, Adds AI Recommendations for DataZone

- AWS presses custom silicon edge with Graviton4, Trainium2 and Inferentia2

- AWS bets palm reading will come to an enterprise near you

- AWS Introduces Two Important Database Upgrades at Re:Invent 2023

- AWS launches Braket Direct with dedicated quantum computing instances, access to experts

- AWS re:Invent 2023: Perspectives for the CIO | Live Blog

- AWS, Salesforce expand partnership with Amazon Bedrock, Salesforce Data Cloud, AWS Marketplace integrations

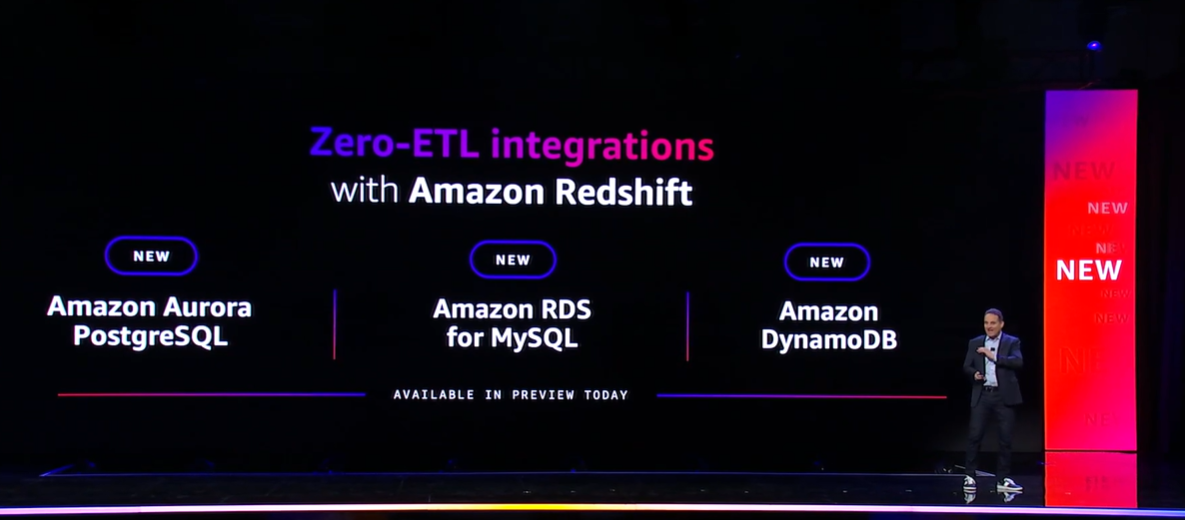

Zero-ETL integrations. Selipsky quipped that the audience winced in unison when he said ETL (extract, transform and load), but in the future zero-ETL will be a reality. ETL is a major enterprise pain point and while zero-ETL integrations will garner yawns over headlines what AWS announced could be promising for enterprises. I'm betting that there enough enterprise buyers that'll care about zero ETL to throw you a few links about integrations across AWS data stores.

Constellation Research analyst Doug Henschen knows the ETL pain. He said:

"The idea of Zero-ETL is compelling because it promises considerable savings in time, effort and administrative headaches over ETL development work. It promotes low-latency insight while also reducing ETL processing and development costs. The Zero-ETL service will clearly introduce its own costs, but the time and labor savings are compelling. As for the DynamoDB to OpenSearch integration, this will enable data from massive, customer-facing DynamoDB-based transactional deployments to be quickly available to OpenSearch full-text search, fuzzy search, auto-complete, and vector search for machine learning (ML) capabilities. Talking to AWS executives it’s pretty clear a future step might be using the Zero-ETL capability to do reverse ETL from Redshift back into operational databases such as the various flavors of Aurora, RDS and DynamoDB."

Amazon DataZone. Like ETL, data cataloging isn't a lot of fun either. Anyone in the data trenches knows that it's difficult to provide context around organizational data. The process of data cataloguing matters and anything that cuts down on the labor will be welcomed by enterprises.

Henschen, who penned a report on the importance of data cataloging, added:

"The use of ML/AI for augmented cataloging is pervasive among metadata management, cataloging and governance platforms, with examples including Alation, Collibra, Microsoft Purview and Google Dataplex. What's novel here is application of GenAI, which is an obvious next step that multiple vendors are either previewing or adding to their roadmaps. Given that everything is in preview, it's hard to say whether anybody has an edge in using GenAI at this point. DataZone is in the early days of its adoption by AWS customers, so anything it can do to remove friction from using the service will help to promote wider adoption."

Amazon Q Code Transformation. This announcement was dropped during the keynote but may have been lost. Amazon Q, a generative AI assistant that runs horizontally across AWS' portfolio, can be used to upgrade Java applications quickly. Amazon Q Code Transformation will analyze existing code, generate a transformation plan and complete tasks. Given how much enterprises need to update and transform code, Amazon Q Code Transformation is worth a look. In a blog post, AWS said:

"Previously, developers could spend two to three days upgrading each application. Our internal testing shows that the transformation capability can upgrade an application in minutes compared to the days or weeks typically required for manual upgrades, freeing up time to focus on new business requirements. For example, an internal Amazon team of five people successfully upgraded one thousand production applications from Java 8 to 17 in 2 days. It took, on average, 10 minutes to upgrade applications, and the longest one took less than an hour."

Amazon launches WorkSpaces Thin Client. This announcement received some press play but felt very retro. Thin clients?!? The economics of thin clients have made sense for a while. Adoption has been another story. WorkSpaces Thin Client will cost $195, be centrally managed and give access to Amazon WorkSpaces, WorkSpaces Web or Amazon AppStream 2.0, which provides wider access to applications. Thin clients solve a pain point and it'll be interesting to see if AWS gets traction.

Amazon EC2 high memory U7i instances for in-memory databases. These instances are in preview and designed to support large, in-memory databases including SAP HANA, Oracle, and SQL Server. Given that many enterprises are moving to SAP HANA, these instances are worth a look.