Shopify is getting enough traction as an enterprise commerce platform that can deliver a real-time customer case study in two conference calls.

Speaking on Shopify's third quarter earnings call, Shopify President Harley Finkelstein cited On Running as a company that is betting on the company's platform. He said:

"Our platform's composability gives large brands the flexibility to choose modular components like On Running, who recently adopted our checkout commerce component. One of the best things about modular components is that integration can happen fast."

At roughly the same time, On Holding AG was reporting strong direct-to-consumer channel growth of 49.8% in the third quarter from a year ago.

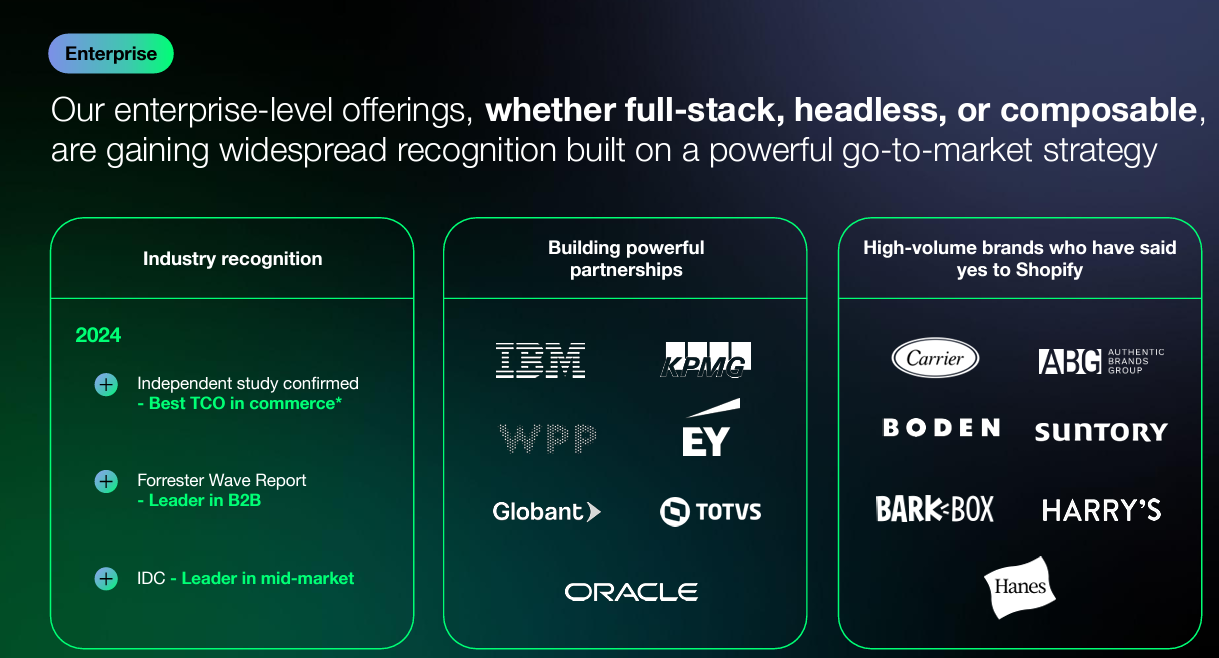

As noted earlier in the year, Shopify was betting that it could expand its business into B2B commerce and larger retailers. So far, so good. The company reported third quarter net income of $344 million excluding the impact of equity investments on revenue of $2.16 billion, up 26% from a year ago. For the fourth quarter, Shopify is projecting revenue growth in the mid-to-high 20 percent range.

Shopify unveils Target partnership, new AI features

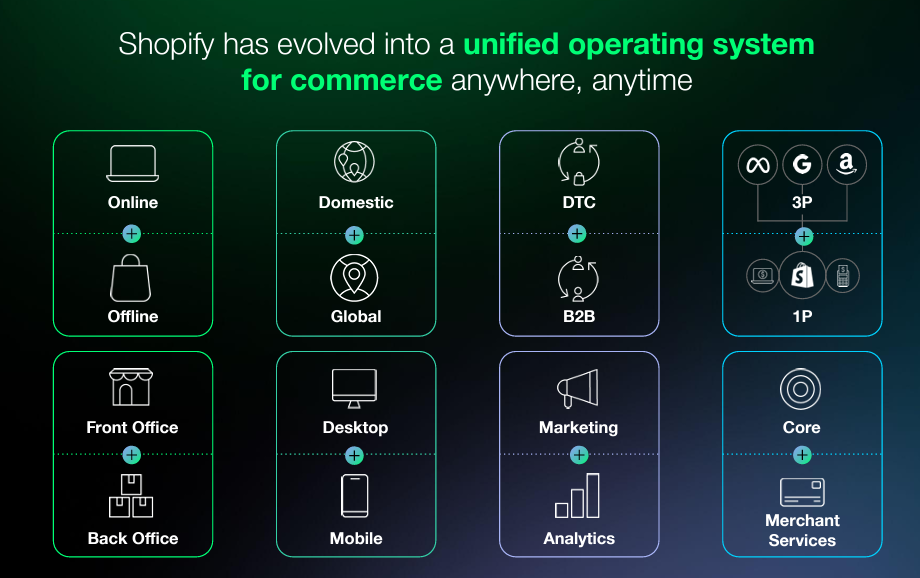

Finkelstein said larger brands and retailers are looking for a unified commerce system but are currently stuck with standalone single channel products. "This idea of having a modern future-proofed retail operating system that is unified across every channel like Shopify is very compelling," he said. Finkelstein added that Shopify's Commerce Components is enabling brands to expand on the company's platform. Sometimes it's the backend then checkout and other times its vice versa. With larger brands, enterprises are looking to consolidate checkout options.

"This idea that some of these large brands that are very sophisticated still don't have an optimized checkout like they would have on Shopify is becoming a competitive liability. And so, that's also driving things quite a bit," said Finkelstein.

Shopify is also pushing total cost of ownership and transparent pricing, which is often hard to find with large enterprise vendors. It's not clear what enterprises are replacing with Shopify, but you can check out our all-in-one commerce cloud Shortlist and figure it out.

Finkelstein said that brands, including B2B, are focusing more on direct-to-consumer sales.

He said:

"Once you're in the ecosystem, you begin to make that your retail operating system. Those gaps are getting closed pretty quickly. And we just think B2B, it is a huge -- I think there's like a $14 billion TAM. We're already seeing our B2B GMV doubled since last year. We think that's a great opportunity and we're able to close these future gaps quite quickly."

The game plan from here is for Shopify to replace commerce systems and shift "this narrative that Shopify is no longer just for small businesses," said Finkelstein. Shopify is adding data migration tools and working with systems integrators to expand its reach. "We're displacing the largest enterprise commerce companies in the planet, and that momentum is continuing. And the best part is we're winning these deals," he said.

And Shopify has plenty of runway. The company's US e-commerce market share is just above 10%.