ServiceNow reported better-than-expected fourth quarter results, delivered revenue growth of 26% and said it landed more than 168 deals with annual contract value topping $1 million.

The company reported fourth-quarter net income of $295 million, or $1.43 a share, on revenue of $2.44 billion, up 26% from a year ago. Non-GAAP fourth quarter earnings were $3.11 a share.

Wall Street was expecting ServiceNow to report earnings of $2.78 a share on revenue of $2.4 billion.

For 2023, ServiceNow reported net income of $1.73 billion, or $8.42 a share, on revenue of $8.97 billion, up 24% from a year ago.

- ServiceNow CEO McDermott talks business transformation, generative AI, processes

- AWS, ServiceNow ink 5-year collaboration pact

- ServiceNow acquires UltimateSuite, adds task mining

- ServiceNow's latest Now Assist generative AI features highlight its strategy

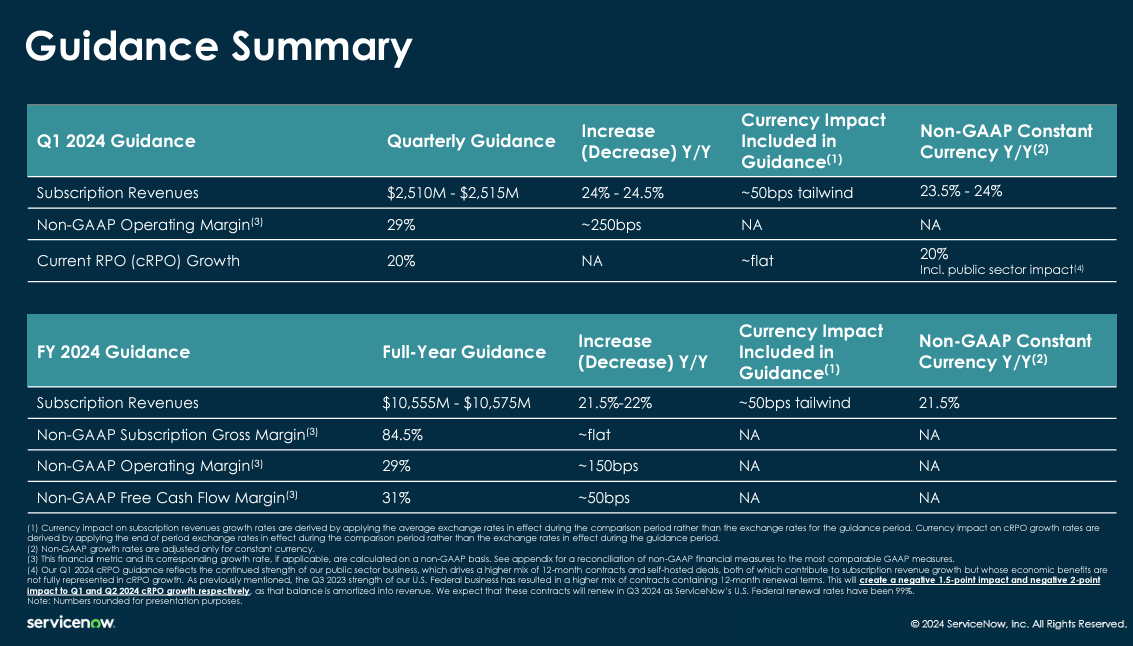

As for the outlook, ServiceNow projected first quarter subscription revenue growth of 24% to 24.5% with non-GAAP margins of 29%. Here's the full outlook.

Separately, ServiceNow said it inked a five-year strategic alliance with Visa. The two companies will launch ServiceNow Disputes Management, Built with Visa. The two companies aim to streamline the disputes management process for issues with AI. ServiceNow also expanded a partnership with EY to offer generative AI compliance, governance and risk management tools.

CEO Bill McDermott said generative AI is "injecting new fuel into our already high-performing engine." ServiceNow CFO Gina Mastantuono said the company saw 99% renewal rates in the fourth quarter.

On a conference call, McDermott said:

"We see AI as a 360 degree strategic imperative. I've told the ServiceNow team worldwide that the company is now moving into Phase Five, the culmination of our long term goal of surpassing $10 billion in ACV, which incidentally only a handful of software companies have ever achieved. We have so much runway ahead for the long term growth of this company. There are two key elements of our strategy, execution and scale. Execution is an art form and scale is all about capitalizing on new opportunities as a truly global platform company."

By the numbers:

- Current remaining performance obligations to be recognized as revenue over the next 12 months was $8.6 billion, up 24% from a year ago.

- The company has 1,897 customers with more than $1 million in annual contract value.

- ServiceNow spent $2.12 billion on R&D in 2024.

- 63% of ServiceNow's revenue is from North America.