Salesforce’s second quarter outlook missed expectations, but the company said it is still early innings for generative AI demand. Nevertheless, Salesforce is projecting single-digit growth for the quarter ahead.

The company projected second quarter revenue of $9.2 billion to $9.25 billion, up 7% to 8%, with non-GAAP earnings of $2.34 a share to $2.36 a share. Wall Street was expecting earnings of $2.40 a share on revenue of $9.35 billion.

For fiscal 2025, Salesforce said sales will be between $37.7 billion and $38 billion, lower than the $38.05 billion estimate. The company said non-GAAP earnings for the year will be $9.86 a share to $9.94 a share, above the $9.80 s share.

Salesforce launches Einstein 1 Studio, Data Cloud enhancements | Salesforce Reinvents Itself Again With Einstein 1

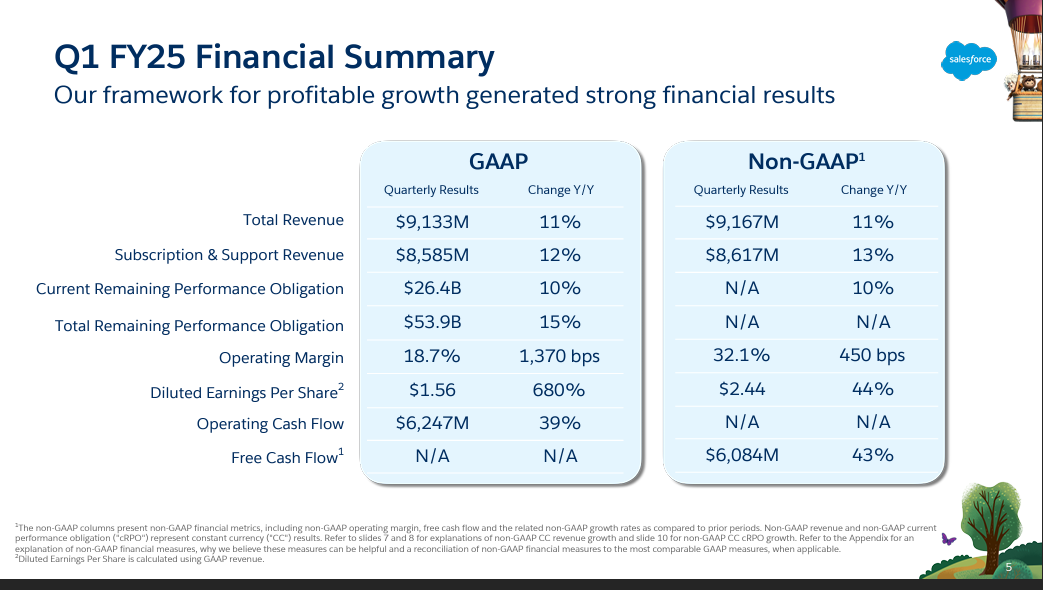

That outlook followed a mixed first quarter. Salesforce reported non-GAAP earnings of $2.44 a share on revenue of $9.13 billion. GAAP earnings in the first quarter were $1.56 a share. Wall Street was expecting Salesforce to report first quarter earnings of $2.37 a share on revenue of $9.15 billion.

CEO Marc Benioff said the company is “at the beginning of a massive opportunity for our customers to connect with their customers in a whole new way with AI.” The company’s remaining performance obligations in the first quarter were $52.9 billion, up 15% from a year ago.

Amy Weaver, CFO of Salesforce, said the company was disciplined with expenses and its capital return program.

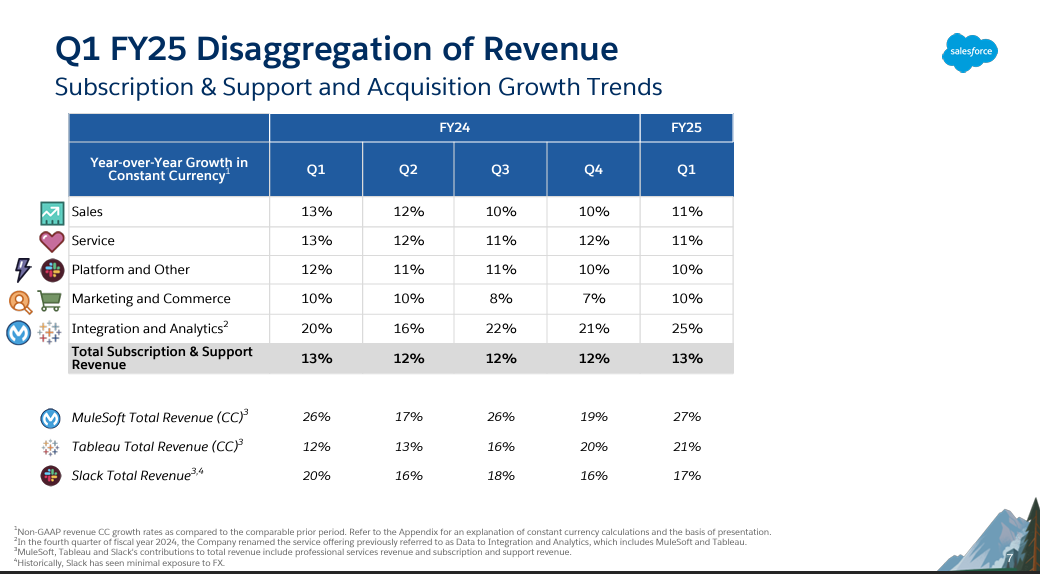

By cloud, Salesforce’s Sales Cloud revenue was up 11% in the first quarter as was Service Cloud. Platform and other and Market and Commerce had revenue growth of 10% each. Integration and Analytics (Tableau and Mulesoft) saw revenue growth of 25%.

On a conference call with analysts, Benioff put a positive spin on the outlook and first quarter results. He said large language models (LLM) are becoming a commodity and the enterprise value will be customer data and metadata. He noted that Salesforce manages more than 250PB of customer data.

Benioff said:

"Every company in the world across every industry is being transformed by AI in the next few years. And when you look at the power of AI, you realize the models and UI are not the critical success factors. There are 1,000s of these models, some open source and some closed source models. Most of these will not survive. They're just commodities now. They don't know anything about a company's customer relationships. Each day hundreds of petabytes of data are created that AI models can use for training and generating output. But the one thing that every enterprise needs to make AI work is their customer data, as well as the metadata that describes the data. Customer data and metadata are the new gold for these enterprises."

The Salesforce CEO, who seemed a bit wound up by the aftermarket reaction to the results, touted Data Cloud, the uptake of multiple clouds by customers and partnerships with Amazon, Databricks, Snowflake and other players. "Customers can access this live data from anywhere in data cloud without copying or moving it. It's the engine of our future growth and this is the engine of our future artificial intelligence growth as well," said Benioff.

Brian Millham, Salesforce's operating chief, said the company did see longer sales cycles. He said:

"We continue to see the measured buying behaviors similar to what we experienced over the past two years and with the exception of q4, where we saw stronger bookings, the momentum we thought q4 moderated in q1 and we saw elongated deal cycles do compression and high levels of budget scrutiny. In Q1 as part of our ongoing transformation, we made some intentional changes in our go to market organization to drive long term productivity and create better customer experiences."

Executives asked about whether genAI was taking budget from other software platforms. Benioff said genAI will drive software growth in the future, but many customers were focusing on data. Millham followed up:

"GenAI benefit will come from the front office and we're really feeling that right now. I do think customers are getting their data estate in order as a precursor to leveraging AI capabilities. We're seeing that with the growth of Data Cloud right now. I think it's actually a step process for many of our customers."

Benioff was also asked about acquisitions amid the Informatica rumors. He said:

"We will continue to look at products inorganically. But as we've committed to you, if we're looking at a large scale acquisition, we're going to make sure that it is not dilutive and has the right metrics. And we're also going to be quick to walk away from things that we are not totally confident in."

But yes, Salesforce will go shopping if it fits into its framework.