Salesforce reported better-than-expected second quarter results and raised its outlook ahead of its August price increases.

The company reported second quarter earnings of $1.28 a share on revenue of $8.6 billion, up 11% from a year ago. Non-GAAP earnings in the quarter were $2.12 a share. Wall Street expected Salesforce to report non-GAAP earnings of $1.90 a share on revenue of $8.53 billion.

In July, Salesforce said it would raise list prices across its clouds by about 9%. Those price increases started in August and weren't captured for the second quarter, which ended July 31.

Salesforce CEO Marc Benioff said the company is seeing improving demand in the second half of the fiscal year and raised its fiscal 2024 outlook for operating margins and cash flow.

On a conference call with analysts, Benioff said the company is committed to improving margins while investing in the future. Naturally, Benioff talked about AI. “We are at the dawn of a new AI innovation cycle. Every company will undergo an AI transformation with the customer at the center,” said Benioff.

He added that Dreamforce in September will feature Data Cloud advances that make it easier to access data with one architecture. Benioff took aim at data warehouses and silos and said it’s hard for customers to integrate. “Our goal is to make it easy for every customer to turn (Data Cloud) on,” said Benioff. “Customers must get their data correct if they want to move forward with AI.”

Benioff added that Salesforce is using its own AI internally and “trying to augment ourselves using Einstein.”

- Salesforce rolls out Sales GPT, Service GPT

- What Movies Get Wrong…and Salesforce Gets Right…About AI

- Salesforce launches AI Cloud, aims to be abstraction layer between corporate data, generative AI models

- Salesforce launches Marketing GPT, Commerce GPT, aims to connect generative AI to ROI

- Salesforce Q1 better than expected, margins improve

The company projected third quarter revenue of $8.7 billion to $8.72 billion, up 11% from a year ago. Non-GAAP earnings for the third quarter will be $2.05 a share to $2.06 a share. For fiscal 2024, Salesforce said revenue will be $34.7 billion to $34.8 billion, up 11%, with non-GAAP earnings $8.04 a share to $8.06 a share.

When Benioff was asked about whether Salesforce could grow wallet share, he said growth will start with AI even as sales cycles are longer than usual. “I really think Dreamforce will be a catalyst for customers to grow with us as they reignite their IT budgets,” said Benioff. International expansion and industries are also key growth avenues.

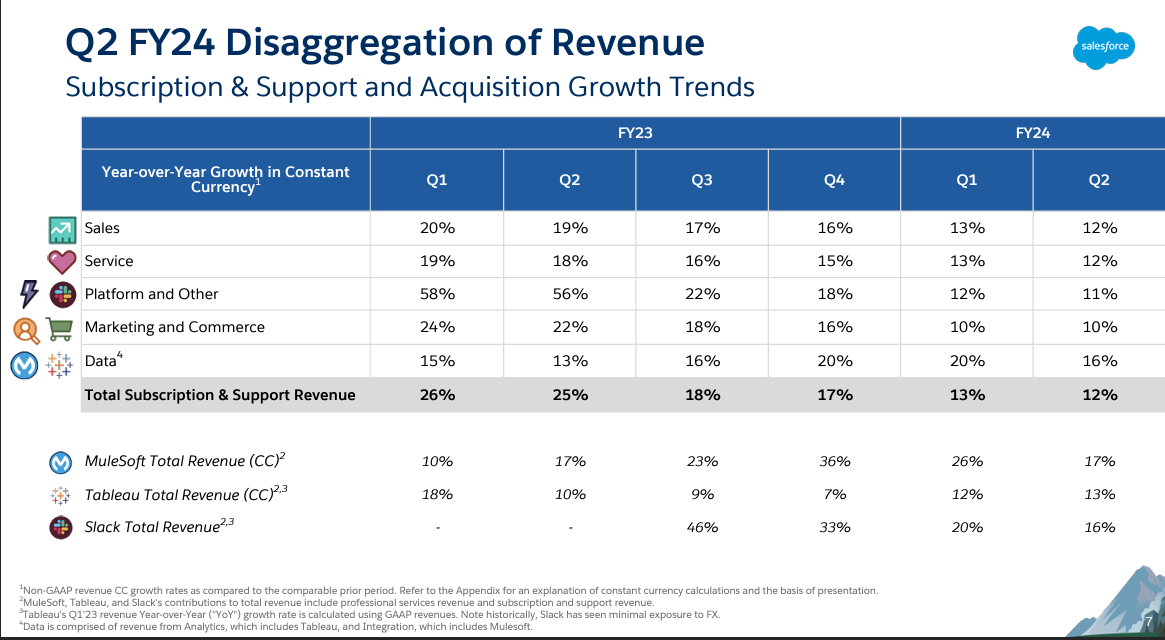

In the second quarter, Salesforce's revenue by cloud showed growth between 10% and 16%. Here's the breakdown.

- Sales cloud revenue was $1.89 billion, up from $1.69 billion a year ago.

- Service cloud sales were $2.05 billion, up from $1.83 billion a year ago.

- Platform and other revenue were $1.64 billion, up from $1.48 billion.

- Marketing and commerce cloud revenue was $1.24 billion, up from $1.21 billion a year ago.

- Data revenue was $1.19 billion, up from $1.02 billion. Data revenue includes Tableau and MuleSoft.

By geographic region, Asia Pacific had the fastest growing revenue growth at 24% from a smaller base with growth in Europe at 11% and Americas at 10%.