Palo Alto Networks reported better-than-expected fourth quarter results and raised its outlook for the first quarter.

For the fourth quarter, Palo Alto Networks reported net income of $357.7 million, or $1.01 a share, on revenue of $2.2 billion, up 12% from a year ago. Non-GAAP earnings for the fourth quarter were $1.51 a share.

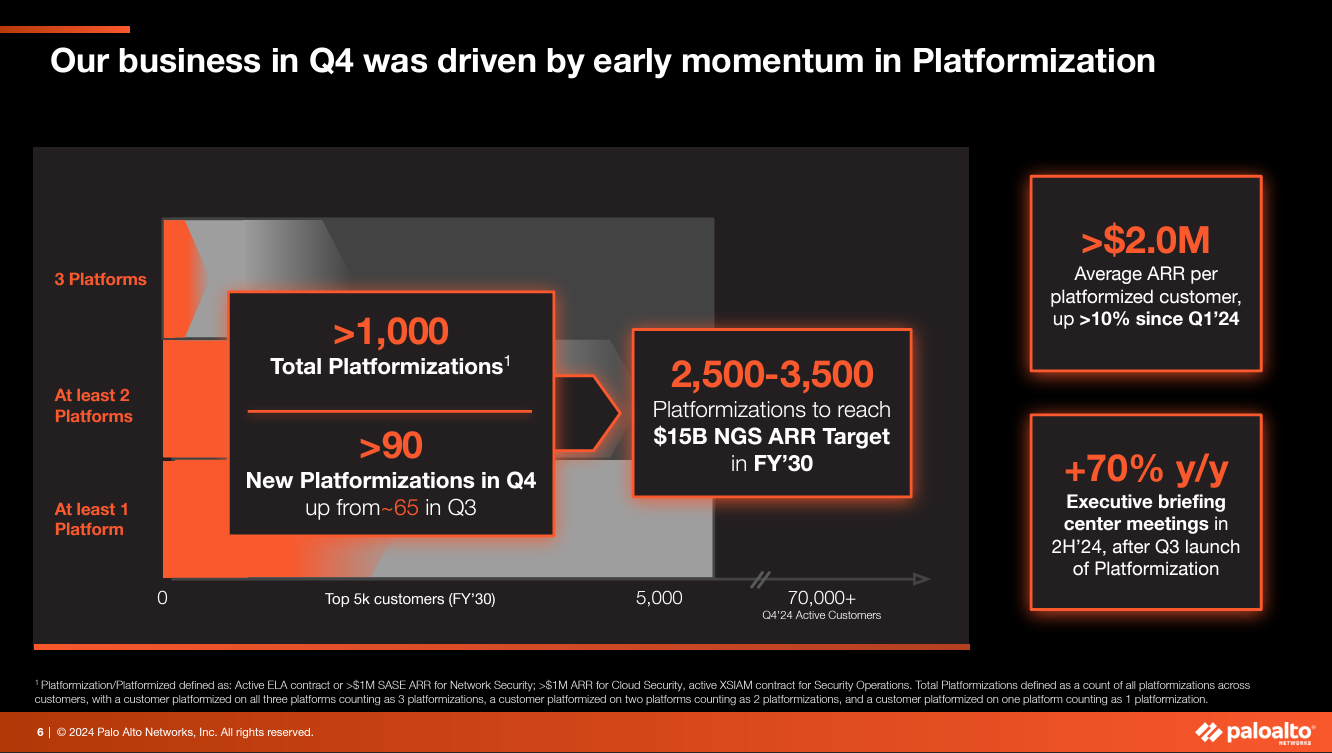

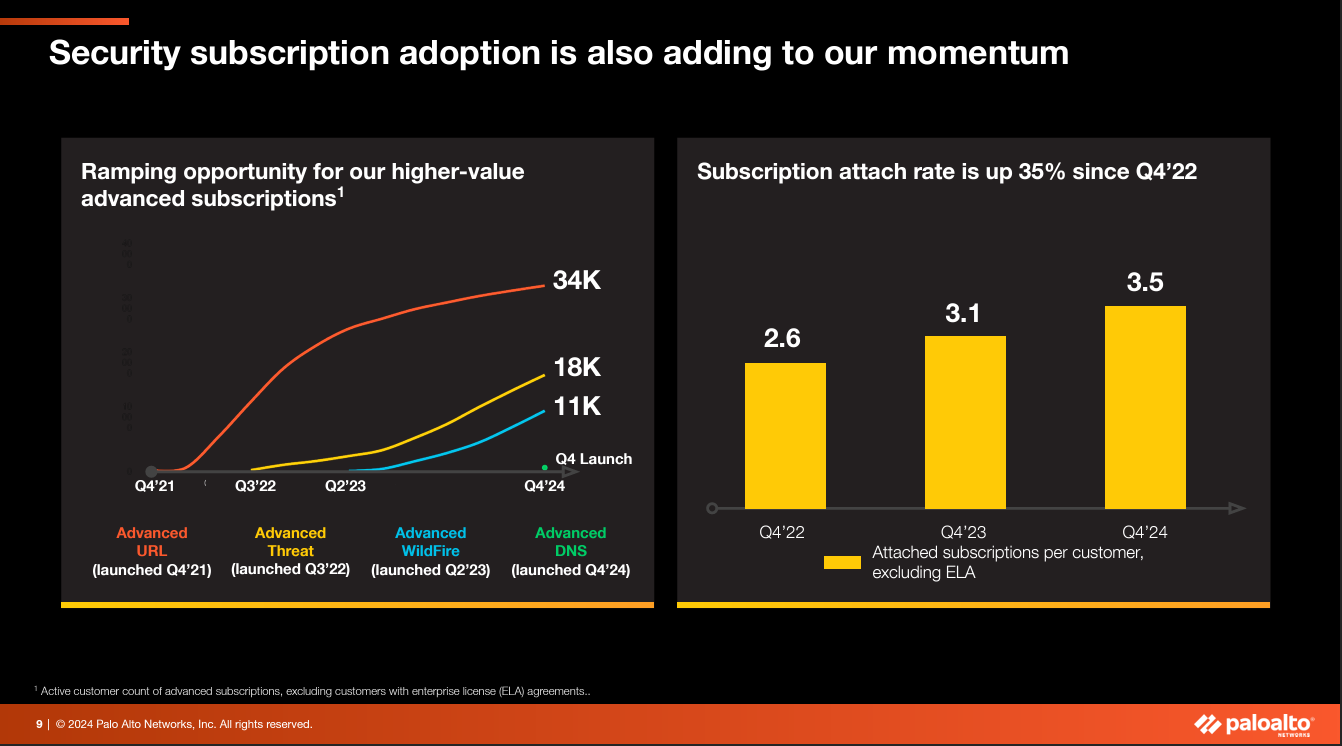

Wall Street was looking for fourth quarter earnings of $1.41 a share on revenue of $2.16 billion. CEO Nikesh Arora said the company is focused on building its Next-Generation Security business. On a conference call, Arora said Palo Alto Networks' platformization strategy is paying off.

"I know there was significant consternation around our platformization guarantee six months ago," said Arora. "All I want to say is, I wish it started down that path sooner. The amount of interest and activity around it has certainly been hardening and shows promise. As we convert our customers to platform customers and single platform customers to multi-platform customers, we see an uplift in ARR."

The company said its next-generation security ARR was up 43% to $4.2 billion.

Platformization has been a key topic in cybersecurity and even more so following the CrowdStrike and Microsoft outage.

- From Blue Screen to Blackout: Unpacking the CrowdStrike Catastrophe and Industry Implications

- CrowdStrike outage likely to hit cybersecurity's platformization pitch

- Cybersecurity platformization: What you need to know

As for the outlook, Palo Alto Networks said it will deliver first quarter revenue between $2.1 billion to $2.13 billion, up 12% to 13%. Non-GAAP earnings will be between $1.47 a share to $1.49 a share. Wall Street was looking for first quarter earnings of $1.43 a share on revenue of $2.11 billion.

For fiscal 2025, Palo Alto Networks is projecting revenue between $9.10 billion to $9.15 billion with non-GAAP earnings of $6.18 a share to $6.31 a share. Palo Alto Networks said it will authorize another $500 million for share repurchases.

Platformization momentum

Arora pointed out new customers betting on the Palo Alto Networks platform strategy and noted that it had more than 90 new platformization deals in the fourth quarter, up from 65 in the third quarter. The average ARR for a platformed customer is more than $2 million.

Among the key items from the fourth quarter:

- High-level executive meetings were up more than 70% in the third quarter.

- Arora said AI offerings will drive growth going forward.

- AI ARR is more than $200 million with growth expected into fiscal 2025.

- The acquisition of IBM's security SaaS business is on track to close by the end of September, which is a key part of Palo Alto Networks' partnership with IBM.

"We continue to believe in the opportunity around AI. We think we are in the very early innings, and AI will be a big opportunity," said Arora.

The CrowdStrike outage was also an elephant in the conference call. Analysts asked about Palo Alto Networks’ approach to updates and whether it gained business.

CrowdStrike to Delta: Don't blame us for your IT outage response

Here’s what Arora had to say:

“That was a tough event that simultaneously impacted 10s of millions of users, which is unfortunate. I appreciate the way CrowdStrike handled but at the same time, it caused two things to happen. One, customers are asking us ‘if you have the same product how do you deploy?’ We have a fundamentally different way with updates. We were able to articulate that and even though some customers were busy remediating that issue we got our deals done with them. It's kind of interesting. The other thing the outage did was cause customers to step back and say, ‘wait a minute. I need to make sure that I'm evaluating all the XDR opportunities in the market. It's exciting because customers are willing to give us consideration on the XDR space.”