Palo Alto Networks reported better-than-expected third quarter results as the company said customers had an "enthusiastic response to platformization."

The cybersecurity company reported third quarter earnings of $278.8 million, or 79 cents a share, on revenue of $2 billion, up 155 from a year ago. Non-GAAP earnings were $1.32 a share.

Analysts expected Palo Alto Networks to report fiscal third quarter earnings of $1.25 a share on revenue of $1.97 billion.

Palo Alto Networks' third quarter landed three months after the company outlined a new go-to-market plan and said customers were more discerning with their budgets. Palo Alto Networks recently forged a partnership with IBM Consulting and agreed to purchase QRadar's SaaS assets from Big Blue. As security vendors race to consolidate platforms and customer wallet share, IBM and Palo Alto Networks moved to forge an alliance that on paper looks like a win-win.

Nikesh Arora, CEO of Palo Alto Networks, said: "We are pleased with the enthusiastic response to platformization from our customers in Q3. Platformization is a long-term strategy that addresses the increasing sophistication and volume of threats, and the need for AI-infused security outcomes."

With IBM as a partner, Palo Alto Networks is looking to fend off multiple players including CrowdStrike. IBM can focus on its core strengths and leverage security services and AI models. CrowdStrike recently expanded its partnership with AWS.

Constellation Research analyst Chirag Mehta said:

“While platformization helps vendors consolidate data on a single platform to deliver integrated experience, it limits choices for customers. Cybersecurity is a team sport; increased telemetry from other systems lead to better security posture. In the age of automation and AI, access to higher quality diverse signals lead to better outcomes. Best of suites approach works well when business processes are well-defined and the domain is mature. That might be the case for ERP, but most certainly not for cybersecurity.”

Mehta, when interviewed by the Wall Street Journal for a story on Palo Alto Network’s recent acquisition of QRadar, cautioned on a vendor lock-in. “As you go down that path and invest further, it gets harder and harder to get out. Vendors can essentially increase their prices without customers having a choice, because the switching cost is very high," he said.

Chirag Mehta on the intersection of cybersecurity, design thinking and AI

For the fourth quarter, Palo Alto Networks projected revenue between $2.15 billion to $2.17 billion, up 10% to 11%, with non-GAAP earnings of $1.40 a share to $1.42 a share. For fiscal 2024, Palo Alto Networks projected revenue of $7.99 billion to $8.01 billion, up 16%, with non-GAAP $5.56 a share to $5.58 a share.

Speaking on an earnings conference call, Arora said:

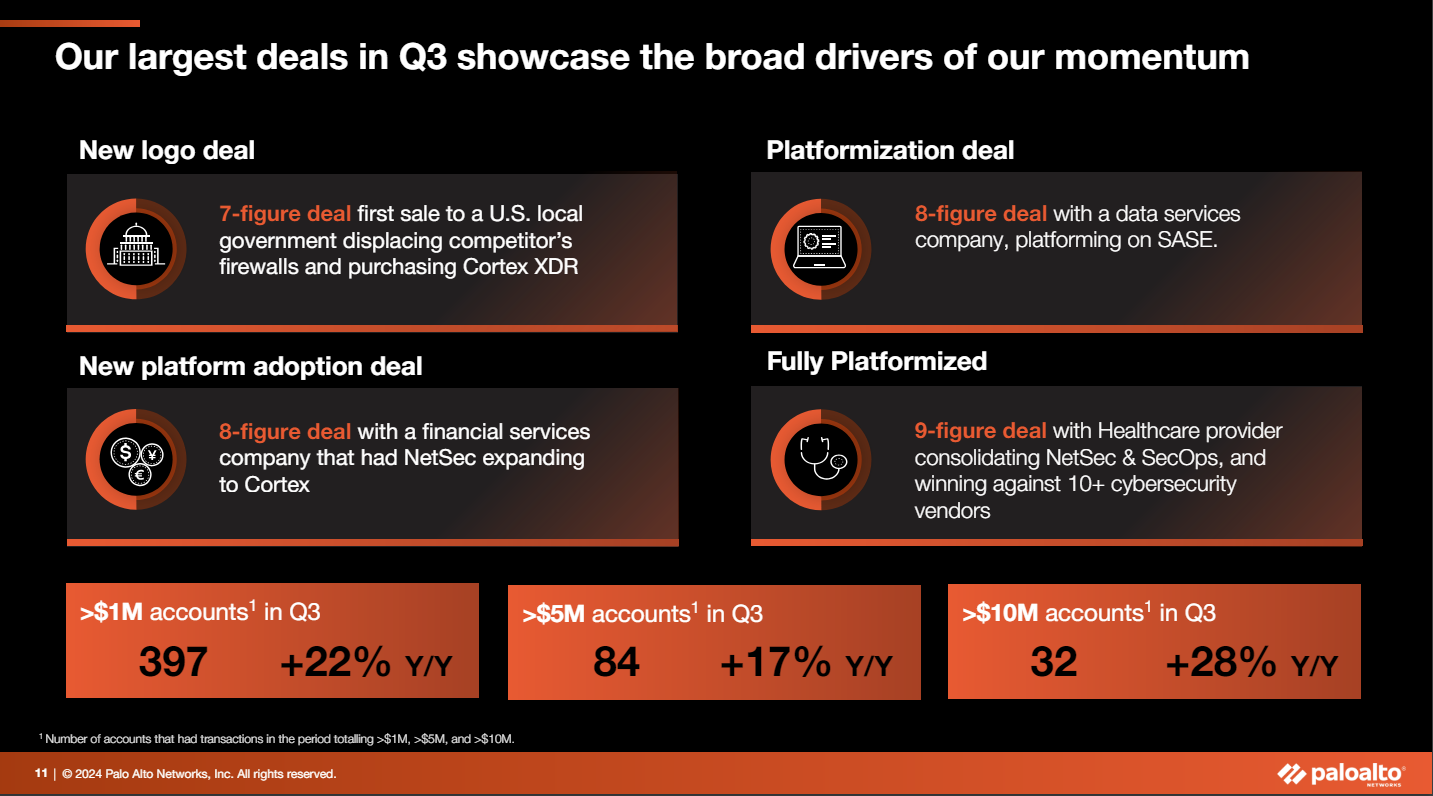

"Despite the concerns around our platformization approach after our last quarter, the customer feedback has been nothing but encouraging. We have initiated way more conversations about platformization than we expected. If meetings were a measure of outcome, they've gone up 30%. And a majority of them have been centered on platform opportunities. In short, demand is robust. And my expectation is that we will continue to see it be that way for the next many quarters."

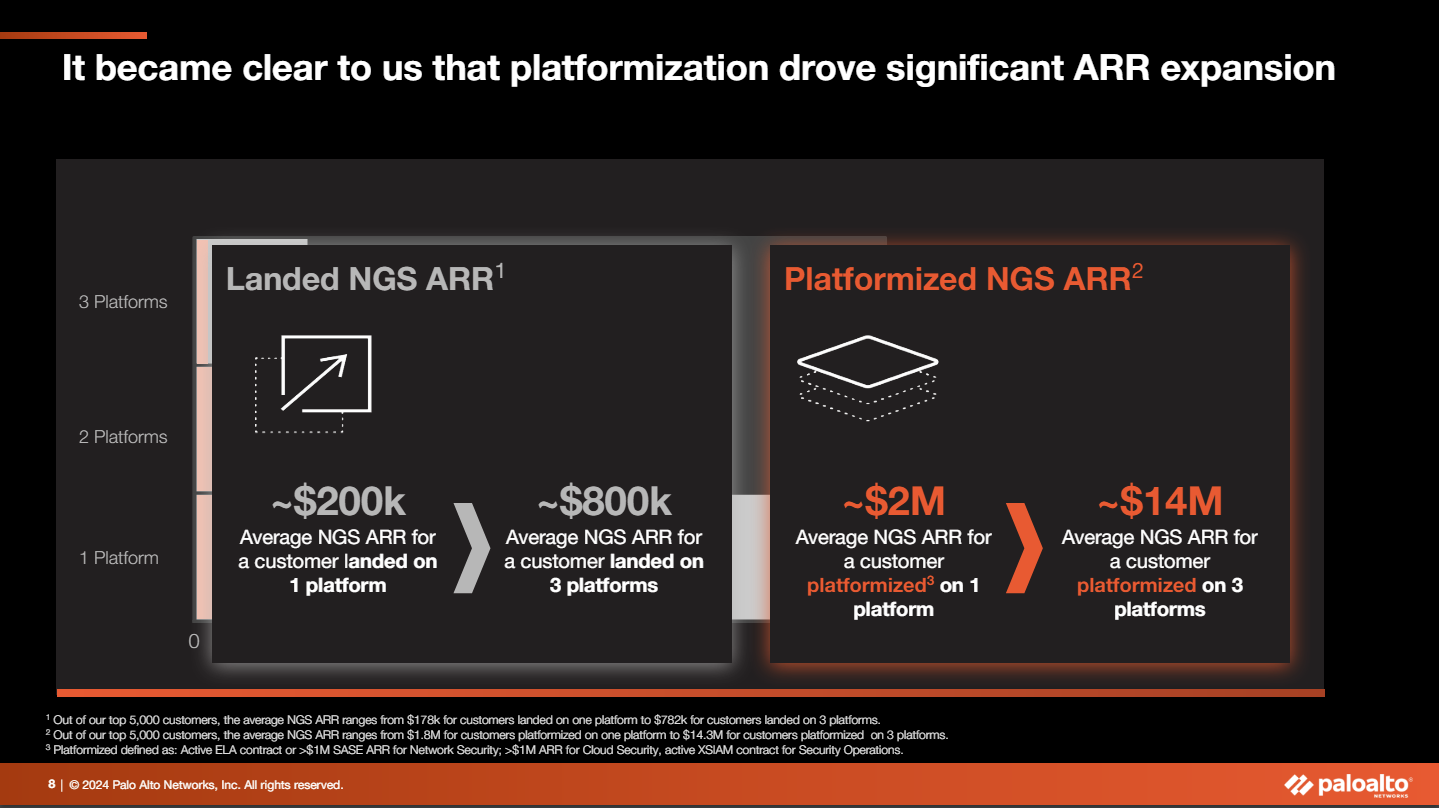

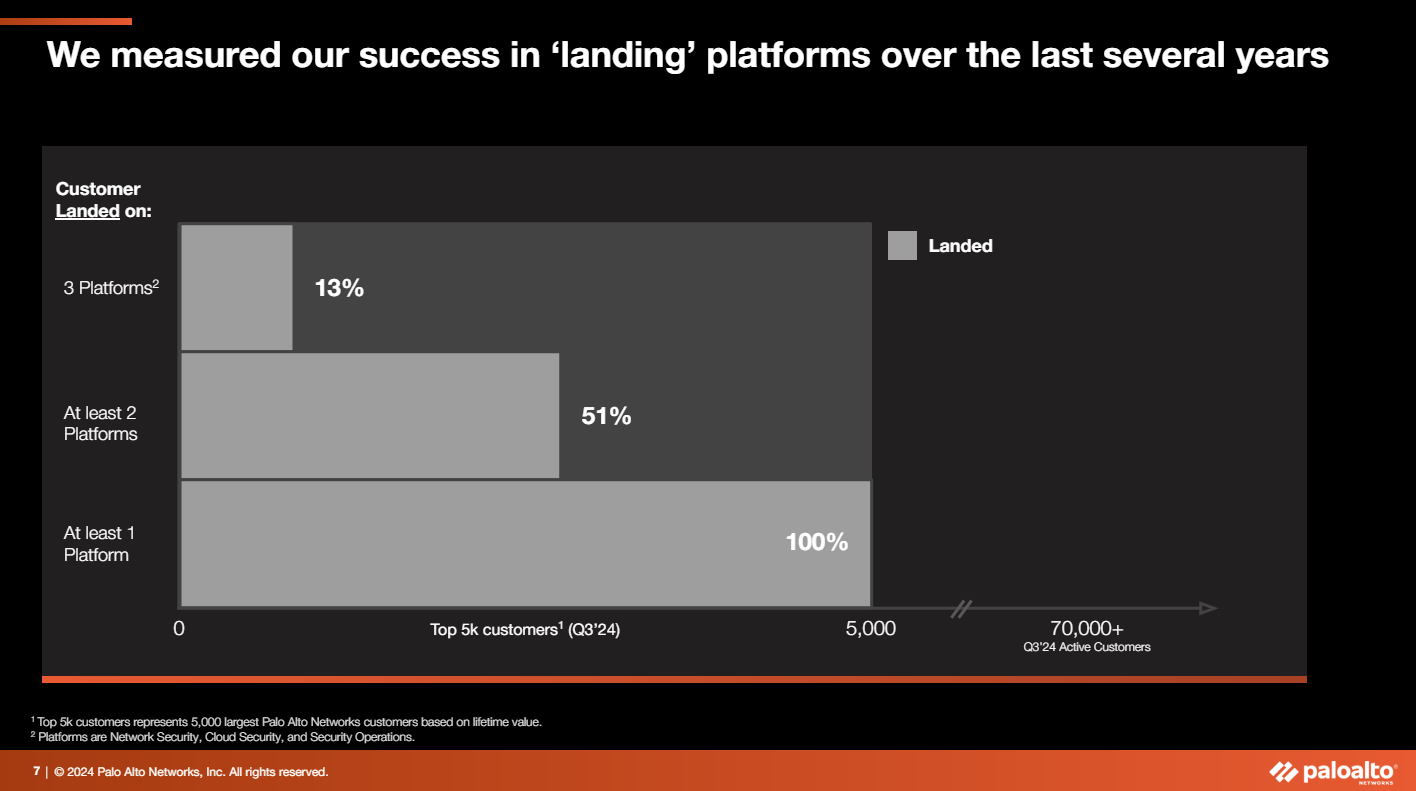

Arora also outlined a framework for platformization and the business model. He explained that Palo Alto Networks had an approach that revolved around landing new customers, but cross-platform adoption went slowly. "We realized that for fully platformed customers while they saw better security outcomes, our ARR profile is also very different," said Arora. "While our average next generation security ARR for landing customers ranges from $200,000 to $800,000 for land strategy, we discovered that our ARR for fully PRISMA customers ranges from $2 million to $14 million, depending on how many platforms the customers are using."

Arora added:

"Our rollout of platformization has spurred a long standing debate within the cybersecurity industry about whether customers desire a platform or best of breed cybersecurity. We've proven it is possible to deliver best of breed on a platform. This is why we have invested in building leading products, while also delivering the benefits of integration across multiple platforms."