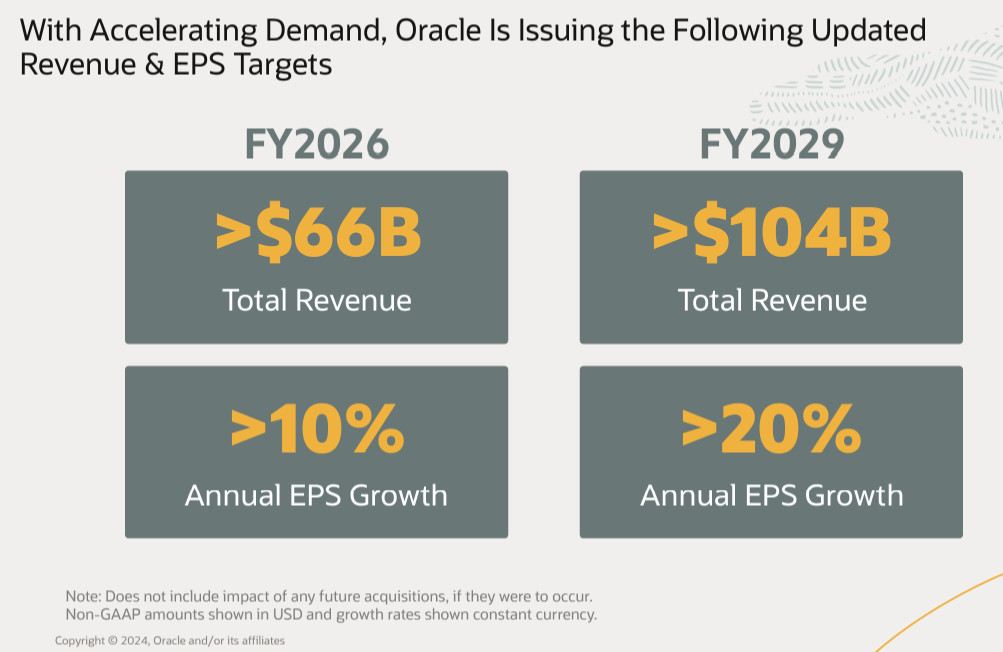

Should Oracle's march toward fiscal 2029 revenue of $104 billion succeed it'll largely because it has managed multi-cloud deployments, co-opetition and triple wins for itself, partners and enterprises.

Oracle's CloudWorld news, led by a key partnership with Amazon Web Services (AWS) laid out a path that gives the database giant a path to expand its total market. Oracle and AWS--for all the cloud trash talk over the years--have multiple joint customers. Those customers really wanted the ability to use their AWS infrastructure and Oracle.

- Oracle CTO Ellison talks AWS partnership with Garman, the need for autonomous security

- Oracle CloudWorld 2024: Oracle HeatWave Lakehouse, GenAI agents, Zettascale supercluster, Intelligent Data Lake

- Oracle databases everywhere with AWS partnership, strong Q1 results

According to the Harvard Business Review, co-opetition arrangements usually start with a simple question: What happens if you don't pursue a cooperative opportunity? HBR: "If a cooperative opportunity is on the table, start by imagining what each party will do if it’s not taken. What alternative agreements might the other side make, and what alternatives might you pursue? If you don’t agree to the deal, will someone else take your place in it? In particular, will the status quo still be an option?"

Looking at AWS and Oracle through that lens makes the partnership a little less shocking. Oracle had already forged Oracle Database deals with Microsoft Azure and Google Cloud. That reality made a co-opetition arrangement between AWS and Oracle more likely. In addition, Oracle could theoretically lose a few cloud deals to AWS, but Oracle Cloud Infrastructure (OCI) is much smaller. If anything, AWS customers may try OCI due to the partnership. Meanwhile, Oracle sees its database business as its identity and a huge revenue stream.

Oracle CTO Larry Ellison explained during a Q&A on the company's Investor Day.

"I think the AWS deal increases the size of the market for us dramatically. I think it's interesting because we debated this a lot internally. What's going to happen when we partner with Microsoft, AWS and Google? Is this going to hurt our business and OCI? I think it's about the customer. Customers are using AWS and also like to use OCI. I'm going to have two cloud providers and one's going to be AWS and the other OCI. I think our OCI business has actually been strengthened. The goal is for us to be a leader in AI, if they can help us be a leader in AI, let's go work with them."

Clay Magouyrk, Executive Vice President, Oracle Cloud Infrastructure, noted: "I have conversations with customers now and they are incredibly encouraged by the fact that it doesn't matter which Cloud they choose. They can maintain their investment in the Oracle database. They can move that into the cloud and still get all of our best and greatest services. Everything that we have available inside OCI is now going to be available in our partner clouds."

Because Oracle missed the first cloud wave, it had to think differently for its database and applications. It focused on networking, file storage and autonomous databases. As a result, OCI turned out to be a handy platform for generative AI training. "It's nice having that late mover advantage sometimes," said Magouyrk.

Ellison also said Oracle had a little bit of luck in that it focused on database automation and innovation as competitors pulled back to chase cloud. Ellison said:

"We had made our name on the technology that we had pioneered relational database technology. I think most people thought we were going to lose that franchise because we only had it at OCI. We had a huge amount on-premises. There was a lot of skepticism whether all information would move to the cloud. In fact, no one else invested in the database during that period of time. Unless you have your data properly organized you can't use AI."

"There's no alternative to the original database. Microsoft SQL isn't a bad product and probably the second-best relational database out there. AWS is an incredible company, but they took open-source databases and moved them to their cloud. Google Cloud has BigQuery but it's not really a database."

Now that database business can play into gaining more OCI workloads, said Ellison.

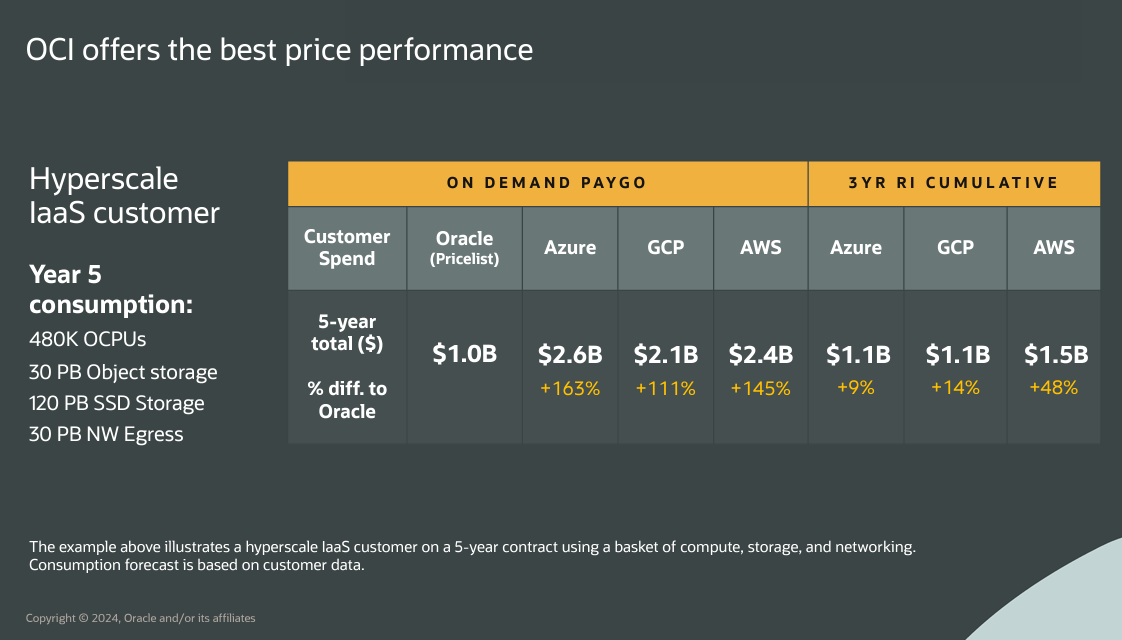

Indeed, OCI is outlining illustrations that show better price performance vs. its partners, but as long as the AI workload pie is big enough the co-opetition arrangement is just swell. Co-opetition works great...until it doesn't.

Constellation Research analyst Holger Mueller said Oracle's success was built on a series of smart strategic moves.

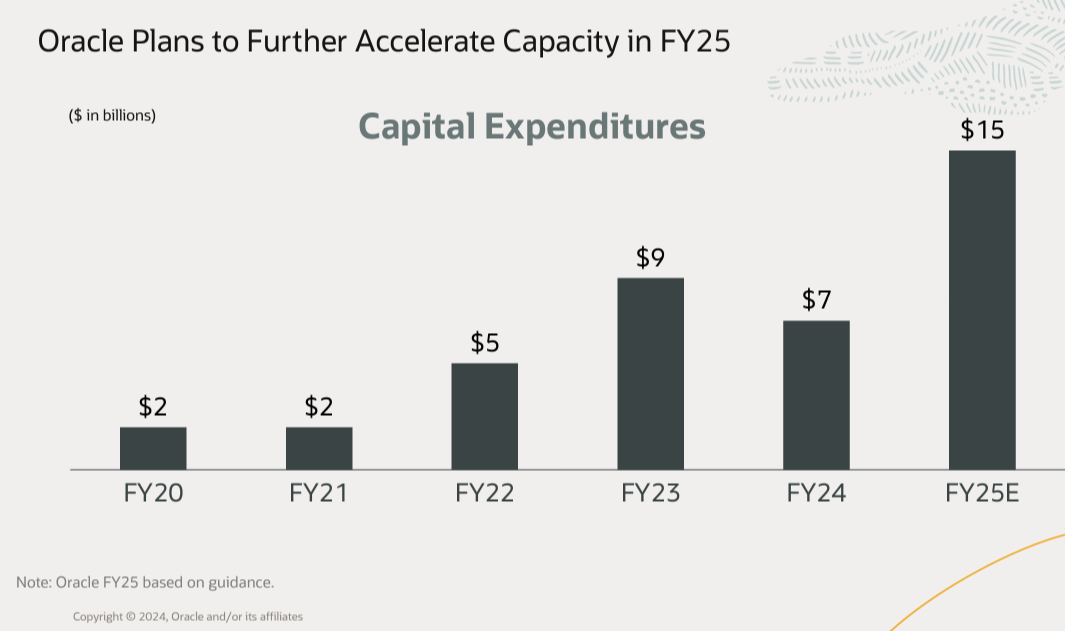

"What really delivered for Oracle was to build a cloud infrastructure for its database. It already had the hardware platform with Exadata - and now needed a flexible pod size that could scale to large data centers and the small government data center of a sovereign state of the size of San Marino. At CloudWorld, Oracle showed that the whole stack can run on three 'fridges' which is the smallest footprint of all cloud vendors. Next was to manage all these clouds--even at customer facilities the same way as Oracle Datacenters. That approach reduces Opex and gives CxOs peace of mind of a fully managed cloud stack on premises. Next the design point of a cloud for databases is very similar for a cloud for AI. And Oracle needs to be good at AI or the data from its RDBMS will flow into lakehouses and Oracle could be commoditized. Lastly, Ellison and Catz have spent on CAPEX like never before in Oracle history. And the small footprint works great to move the database to other clouds."

Larry Ellison is quite quotable

There were a bevy of quotes worth highlighting that didn't make the story. Here's a bit of Larry being Larry.

- "I was just discussing with Safra (Catz) and every 10th sentence I say I feel like we're living in a science fiction movie. Then we get over it and go back and talk a little more about business."

- "We'll be training robots to be nurses to do a variety of things in the hospital and at home."

- "We're very involved with automating hospitals. We're connecting robotics in hospitals and connecting all of that data and machines on our IoT framework. We're good at IoT because we build applications."

- "I went out to dinner with Jensen (Huang) and Elon (Musk) at Nobu in Palo Alto. I would describe the dinner as begging Jensen for GPUs. Please take our money. In fact, take more of it. You're not taking enough of it. It went well. The demand for GPUs and the desire to be first is a big deal."

- "Another differentiator between us and the competition is that we do applications and infrastructure."

- "Cerner will be another pillar for growth. You just haven't seen it yet. Healthcare is a multi-trillion-dollar industry and there are two giants: Epic and Cerner. We're used to competing with Microsoft, Amazon and Google. we're trying to automate the entire medical ecosystem with Cerner. If we can do it, we must do it. We have a moral obligation to do it. I can't believe that this industry that is so important and touches all of us doesn't have the very best technology."

- "We could charge for a new AI module, but I think it misses the point. We're not trying to raise prices. We're trying to increase the volume of sales.