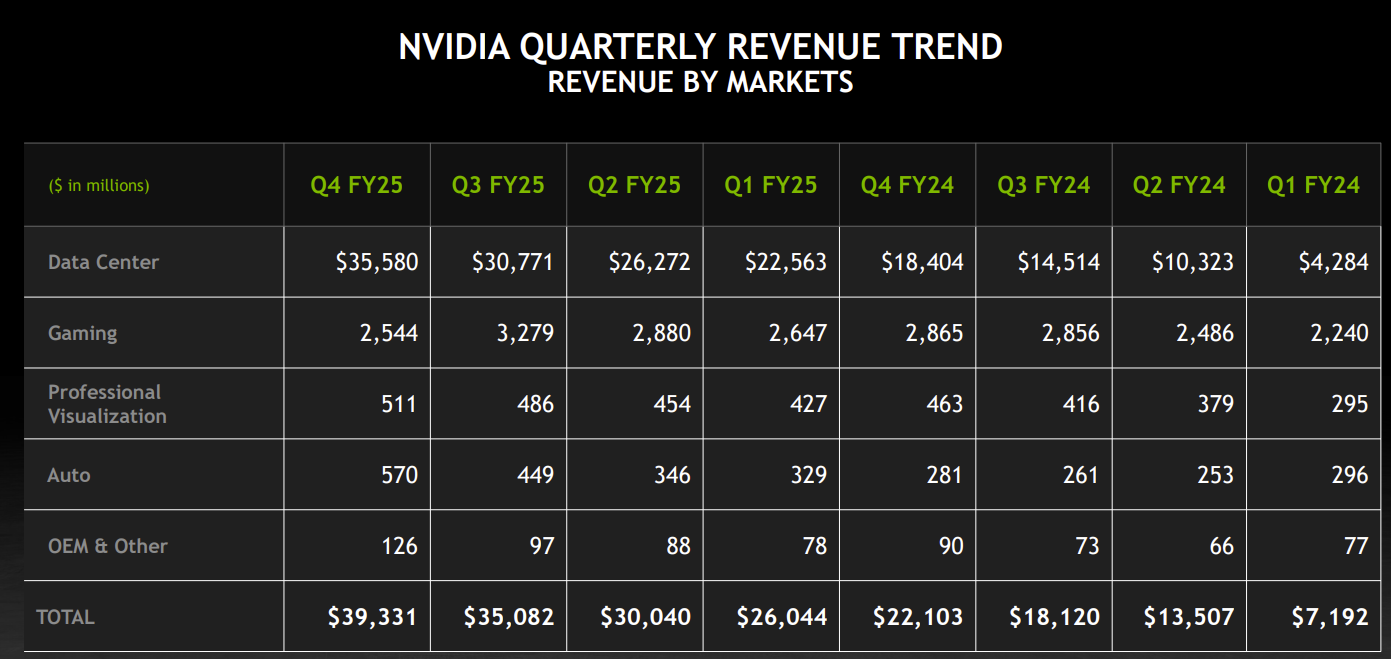

Nvidia delivered strong results in the fourth quarter as its data center business posted growth of 93% from a year ago.

The company reported fourth quarter earnings of 89 cents a share (GAAP and non-GAAP) on revenue of $39.3 billion, up 78% from a year ago.

Wall Street was expecting Nvidia to report fourth quarter non-GAAP earnings of 80 cents a share on revenue of $38.16 billion.

- Nvidia launches Project Digits, a desktop AI supercomputer

- Nvidia launches Cosmos models, aims to expand physical AI, industrial reach

- Nvidia moves to advance agentic AI use cases at CES 2025

- Here’s what Nvidia CEO Jensen Huang said about quantum computing, Project Digits and robotics

Going into the earnings, Nvidia investors had been skittish about AI infrastructure spending due to DeepSeek's emergence. With foundational models going commodity, the need to spend on AI infrastructure may be diminished.

- DeepSeek's real legacy: Shifting the AI conversation to returns, value, edge

- DeepSeek: What CxOs and enterprises need to know | GenAI prices to tank: Here’s why

The results appear to eased those AI infrastructure spending concerns for now. CEO Jensen Huang said: “We’ve successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter. AI is advancing at light speed as agentic AI and physical AI set the stage for the next wave of AI to revolutionize the largest industries.”

As for the outlook, Nvidia projected first quarter revenue of $43 billion, give or take 2%.

Wall Street was looking for Nvidia to report first quarter earnings of 91 cents a share on revenue of $42.05 billion, up 61% from a year ago. Analysts were expecting Nvidia to report fiscal 2026 revenue of $196 billion with non-GAAP earnings of $4.43 a share.

Key comments from CFO Colette Kress:

- "We delivered $11.0 billion of Blackwell architecture revenue in the fourth quarter of fiscal 2025, the fastest product ramp in our company’s history. Blackwell sales were led by large cloud service providers which represented approximately 50% of our Data Center revenue."

- "Automotive revenue for fiscal 2025 was up 55% from a year ago. Automotive revenue for the fourth quarter was up 103% from a year ago and up 27% sequentially. These increases were driven by sales of our self-driving platforms."

- "Networking revenue was $3.0 billion, down 9% from a year ago and down 3% sequentially. We are transitioning

- from small NVLink 8 with Infiniband to large NVLink 72 with Spectrum X. Networking experienced growth in Ethernet for AI, which includes Spectrum-X end-to-end ethernet platform, and NVLink products related to the ramp of our Grace Blackwell platform."

Ahead of the earnings, Nvidia and Cisco said they will create a unified architecture for networks optimized for AI workloads.

Nvidia will couple Cisco Silicon One with Nvidia SuperNICs as part of the Nvidia Spectrum-X Ethernet networking platform. Cisco becomes the only partner silicon in the networking system.

Cisco will build systems combining Nvidia Spectrum silicon with Cisco's operating system software. The companies will also co-sell the data center gear.

Huang commets

Speaking on an earnings conference call, Huang said the following:

- "The amount of computation you use for post training is actually higher than pretraining. And it's kind of sensible in the sense that you could, while you're using reinforcement learning, generate an enormous amount of synthetic data or synthetically generated tokens."

- "We have some 350 plants manufacturing the 1.5 million components that go into each one of the Blackwell racks, Grace Blackwell racks."

- "The next train is on an annual rhythm and Blackwell Ultra with new networking, new memories and of course, new processors, and all of that is coming online. We've have been working with all of our partners and customers, laying this out. They have all of the necessary information, and we'll work with everybody to do the proper transition. This time between Blackwell and Blackwell Ultra, the system architecture is exactly the same."

- "Using Agentic AI to revolutionize the way we work inside companies, that's just starting. This is now the beginning of the agent AI era, and you hear a lot of people talking about it and we got some really great things going on. And then there's the physical AI after that, and then there are robotic systems after that."

- "The more the model thinks the smarter the answer. Models like OpenAI, Grok-3, DeepSeek-R1 are reasoning models that apply inference time scaling. Reasoning models can consume 100x more compute. Future reasoning models can consume much more compute. DeepSeek-R1 has ignited global enthusiast -- it's an excellent innovation. But even more importantly, it has open source a world-class reasoning AI model. Nearly every AI developer is applying R1 or chain of thought and reinforcement learning techniques like R1 to scale their model's performance."

Constellation Research's take

Constellation Research analyst Holger Mueller said:

"Rumors of Nvidia’s demise courtesy of DeepSeek have not materialized, at least in this quarter. All YoY comparisons of Nvidia are out of this world – like revenue more than doubling, operating and net income up 140+%. The quarter over quarter comparisons are slower, and coming to a realistic pace for Nvidia. What is remarkable is that the team around Jensen Huang kept cost under control and Nvidia is more profitable now that a year ago. Nvidia shows thriftiness and frugality, never a bad trait in the volatile chip industry. It is remarkable that a tech vendor who had no substantial data center revenue, is now showing over 80% of revenue in data center, while being 10x larger. Truly remarkable. Let’s see how the party so far will switch to a happy growth mood in 2025 – or not. Q1 will tell."