For Micron Technology more memory due to data center demand and AI workloads is going to mean more money.

The company reported better-than-expected fourth quarter results due to a boom in data center demand. Like other vendors in the infrastructure space, Micron Technology is riding the AI wave. Micron Technology reported record data center revenue and saw strong demand for its data center DRAM and high bandwidth memory as well as data center SSD sales.

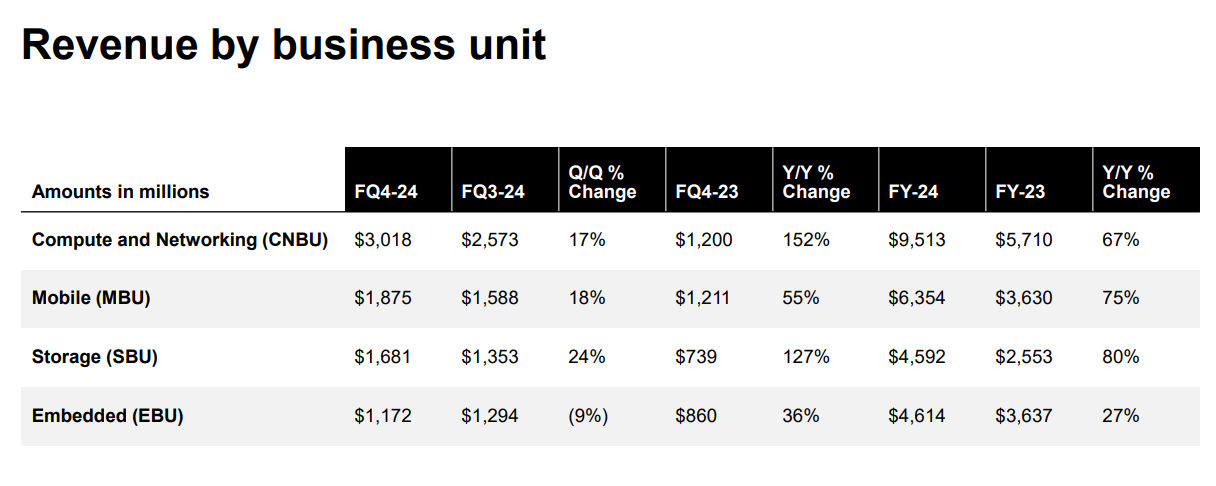

Micron Technology delivered fourth-quarter net income of $887 million, or 79 cents a share, on revenue of $7.75 billion, up 93% from $4 billion in the same quarter a year ago. Non-GAAP earnings were $1.18 a share. Wall Street was expecting non-GAAP fourth quarter earnings of $1.11 a share on revenue of $7.65 billion.

As for the outlook, Micron Technology said first quarter revenue will be about $8.7 billion, well ahead of Wall Street estimates of $8.21 billion. Non-GAAP earnings for the first quarter are expected to be $1.74 a share compared to estimates of $1.54 a share.

- Generative AI driving interest in nuclear power for data centers

- DigitalOcean highlights the rise of boutique AI cloud providers

- Equinix, Digital Realty: AI workloads to pick up cloud baton amid data center boom

- The generative AI buildout, overcapacity and what history tells us

- AI infrastructure is the new innovation hotbed with smartphone-like release cadence

In prepared remarks, CEO Sanjay Mehrotra said:

“Robust data center demand is exceeding our leading-edge node supply and driving overall healthy supply-demand dynamics. As we move through calendar 2025, we expect a broadening of demand drivers, complementing strong demand in the data center. We are making investments to support artificial intelligence (AI)-driven demand, and our manufacturing network is well positioned to execute on these opportunities. We look forward to delivering a substantial revenue record with significantly improved profitability in fiscal 2025, beginning with our guidance for record quarterly revenue in fiscal Q1."

Constellation Research analyst Holger Mueller said:

"Micron is on a roll, almost doubling its revenue – and showing a stark contrast to YoY performance – where the company had an operating loss of close to $1.5 billion – and now an operating profit of more than $1.5 billion - all a sign of high demand of course fueled by AI to its high performance memory chips. Kudos to Sanjay Mehrotra to have the intestinal fortitude to keep the cost base and investment base intact. Micron is riding the chip rollercoaster, which for Micron is on the way up."

Other key points from Micron Technology:

- Data center demand is being driven by AI servers, but there's a refresh cycle for traditional servers that's just starting.

- The high-bandwidth memory (HBM) total available market is expected to top $25 billion in 2025, up from about $4 billion in 2023.

- "Our HBM is sold out for calendar 2024 and 2025, with pricing already determined for this time frame," said Mehrotra. "In calendar 2025 and 2026, we will have a more diversified HBM revenue profile as we have won business across a broad range of HBM customers."

- Micron said data center SSDs topped $1 billion in sales in the fourth quarter.

- PC makers have built up inventory due to rising memory prices and AI PCs, but Micron expects a better inventory picture by spring of 2025.

- Micron expects to benefit as PC makers move to a minimum of 16GB of DRAM for value PCs and 32GB to 64GB for higher priced PCs. The same memory buildout is expected for the smartphone market too.

- For fiscal 2024, Micron reported net income of $778 million, or 70 cents a share, on revenue of $25.11 billion, up from $15.54 billion a year ago.