Lowe's has laid the groundwork and is starting to leverage artificial intelligence throughout its operations including store experiences across multiple channels and backend supply chain processes. The plan is to invest in an uncertain market to reap the awards when the home improvement market improves.

The home improvement retailer's focus on its enterprise architecture, data, artificial intelligence and optimization comes amid a rocky real estate market. With fewer homes being sold and inflation concerns, home improvement projects are being put off. Lowe's CEO Marvin Ellison said that Lowe's is seeing customers put off big-ticket purchases such as appliances and a "greater than expected pullback in DIY discretionary spending."

"At this point, we're expecting a phased recovery, beginning with homeowners re engaging in smaller refresh and repair projects. Then over time, we expect them to engage in more complex remodels," said Ellison, speaking on an investor meeting in December. Ellison added that Lowe's is looking to win share among Millennials with homes and kids and baby boomers. "These two generations make up the largest share of the home improvement market, and by meeting their needs, we're in position to win across all generations," he said.

Lowe's strategy revolves around the following:

- Grow its revenue by appealing to professional contractors.

- Redesign its loyalty program and step up digital marketing efforts.

- Grow its online sales and omnichannel capabilities to target Gen Z.

- Offer more services with design tools and an online marketplace.

- Continue productivity efforts and leverage generative AI.

The modernization effort

All of those initiatives have a heavy dose of data, AI and enterprise technology. Speaking at Lowe's investor meeting Seemantini Godbole, Chief Digital and Information Officer at Lowe's, said:

"We are using technology to improve our operating efficiency, not only in our stores, but across the organization, and we are looking to leverage the exciting capabilities unlocked by generative AI to enhance our customers and associate experience driving traffic and sales."

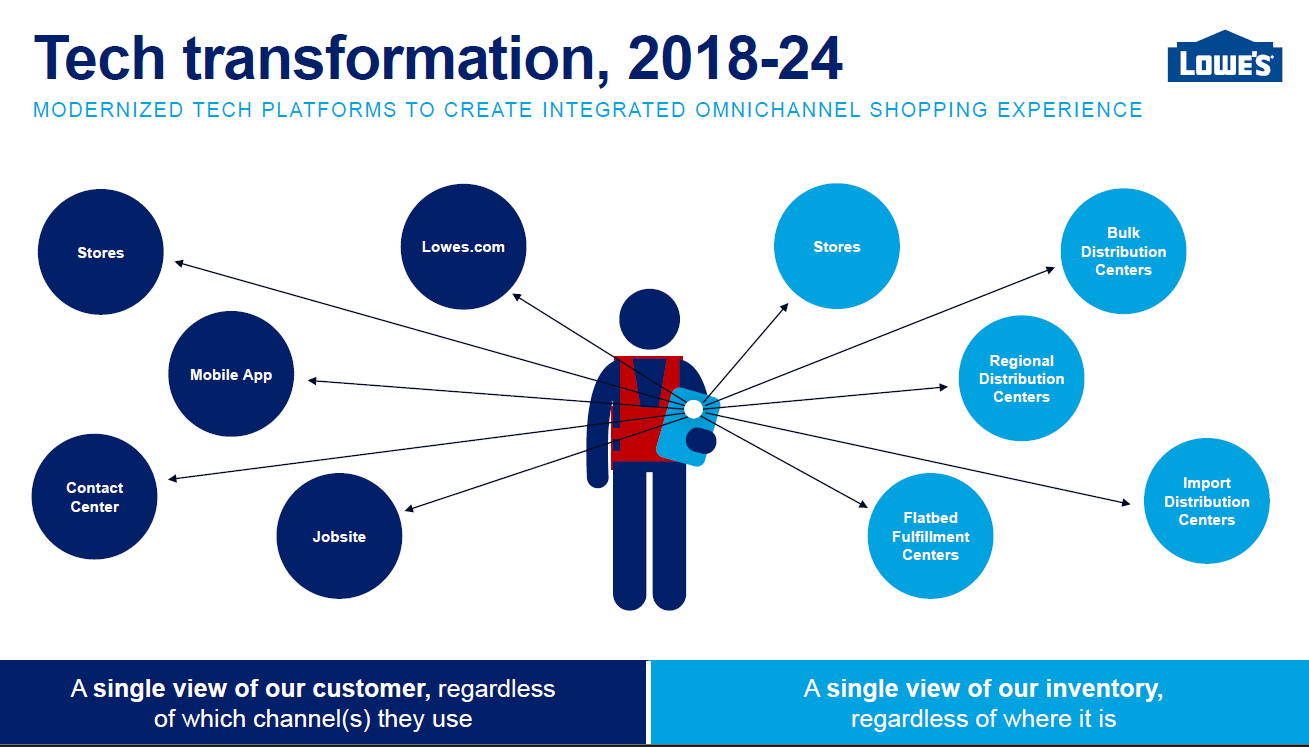

Godbole joined Lowe's in 2018 and started an effort to rebuild the retailer's technology strategy, architecture and processes. Lowe's stores were run by systems designed in the 1990s and had merchandising systems from the early 2000s. The company modernized those systems with a focus on omnichannel customer experiences.

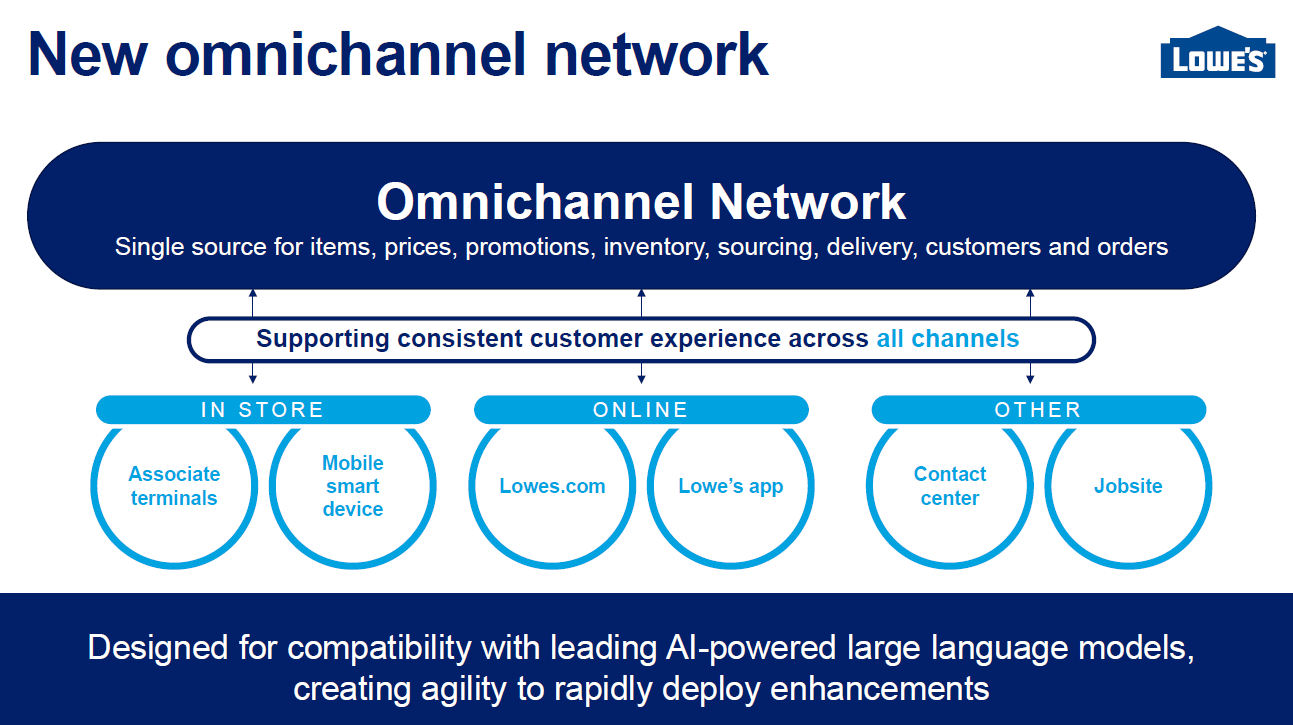

Lowe's then set out to build systems to deliver consistent experiences, said Godbole. Key points about the infrastructure updates:

- The company focused on a unified system that provided one view of the customer across multiple channels.

- Associates can access everything needed to serve a customer across multiple channels instead of navigating green screens. "Associates have one intuitive touch screen they can use for everything, even complex sales," said Godbole. "They can look up inventory across the network and even sell products that just arrived at our distribution centers and are yet to be unloaded."

- The omnichannel system includes "all product information, inventory, locations, pricing and promotions and customer orders across every channel."

- The data architecture at Lowe's was built "with AI in mind" and organized so it can be "easily understood and analyzed by AI," said Godbole. "This allows us to easily work across leading AI, large language models, so we can use the right platform depending on the use case," she said.

Lowe's provides a look at how companies leveraging AI have made transformation investments years in advance. There are no overnight AI hits for enterprises.

Godbole said:

"We are now putting in place a framework to help us harness the new power of generative AI for our business to enhance how we sell, how we shop and how we work. This framework helps us standardize the development process so we are using a consistent set of criteria to establish where we use AI regardless of the project. We have built an AI platform that allows us to reuse components and gives us agility to create innovative solutions alongside many of the leading platforms like Nvidia, OpenAI and Palantir."

Lowe's has been one of Palantir's flagship commercial customers.

Also see: How Home Depot blends art and science of customer experience | Scotts Miracle-Gro and UserTesting: 9 customer experience takeaways

50 AI models in production

According to Godbole, Lowe's has "roughly 50 AI models in place" that are used for search, product recommendations, sourcing, demand and planning tools and pricing.

"Now we are using the experience we gained from these first AI models to help us create leading edge solutions that leverage generative AI," said Godbole.

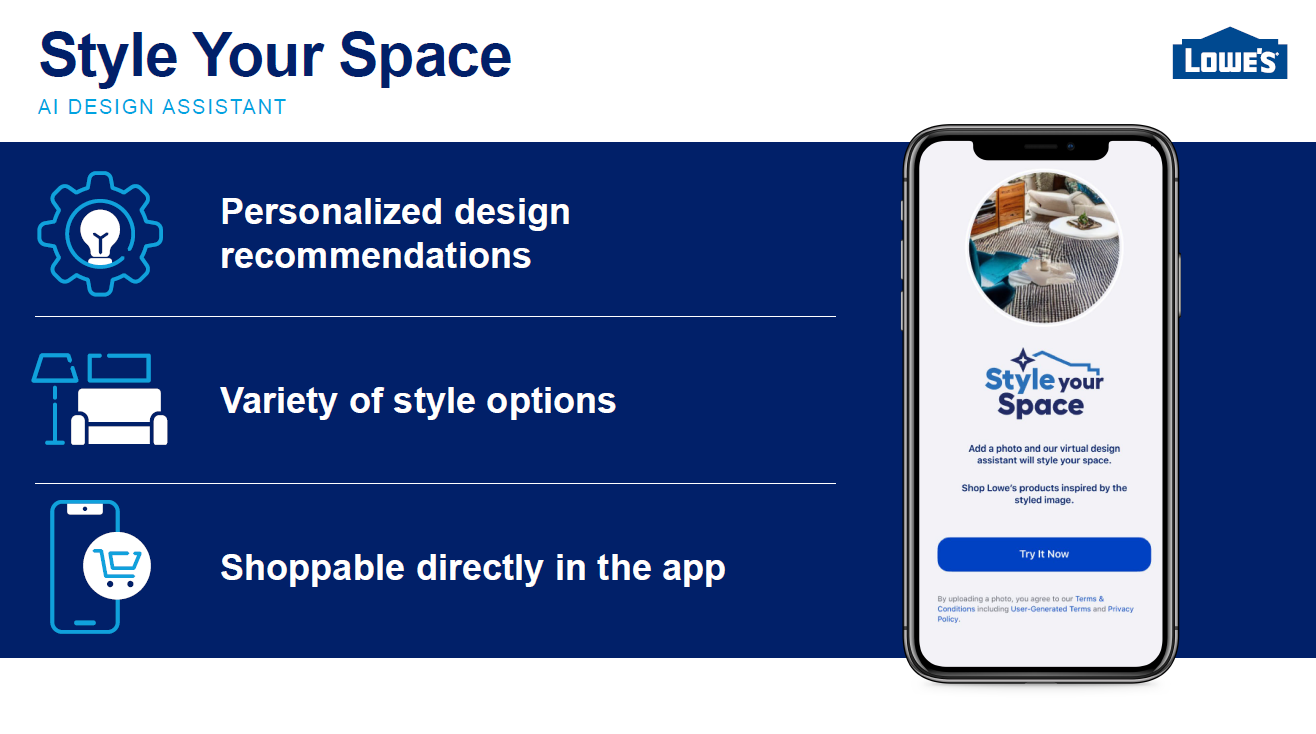

Many of these edge use cases will be used to accelerate online sales with enhanced user experience, customer acquisition and digital commerce. Lowe's app has a style your space feature that is powered by genAI.

Other Lowe's efforts where AI and its data platform are playing a role include:

Localization of assortment. Bill Boltz, executive vice president of merchandising at Lowe's, said the company is expanding private label goods and assortment depending on local market needs. The company is also expanding its efforts in rural areas.

"We're driving space productivity through localization, where we're tailoring our assortments based on demographics, housing sizes, building codes, climate, geography and community preferences, all with the goal of making each Lowe's store feel like your Hometown Store," said Bortz. "We're leveraging AI driven planning tools and insights from our customers and from our field merchants who serve as our boots on the ground to help us understand those local market needs and preferences."

Supply chain optimization. Boltz said the company has been analyzing product components, transportation and raw material costs to verify that supplier charges are warranted. "Leveraging these capabilities, we've worked with our suppliers to claw back some of the costs that we've absorbed due to exceptionally high inflation triggered by the pandemic, and we've worked to then reinvest these savings to drive traffic and sales," said Boltz.

Reducing manual work. Boltz said that Lowe's is focused on reducing manual work, accelerating pricing decisions and optimizing promotions with AI.

Customer data feedback loop. Jen Wilson, chief marketing officer at Lowe's, said the company is using its loyalty program for consumers and contractors to drive a data and consumer insights flywheel. "We built a robust customer data platform, which is transforming our ability to understand our customers and how we market to them," said Wilson. "The more we know about them, the more we can put them at the center of everything that we do, and we can connect with them in more sophisticated ways by offering them a more relevant and personalized experience in anticipating what they need next."

Wilson said the data includes first party data such as purchase behavior and activity on the Lowe's site as well as third party data. "Zero party data," which is information collected through the loyalty program, is also critical because it tells Lowe's whether a customer has a pet, likes to garden and what trades are favored by contractors. Wilson said Lowe's is also adding perks such as digital warranty information attached to appliance purchases.

Efforts to expand professional market share. Lowe's Quonta Vance, executive vice president of pro and home services, said the company has launched a new CRM system to optimize the sales process and personalize offers. Lowe's has also connected directly to suppliers with inventory, pricing and services data. Vance said Lowe's is piloting new fulfillment capabilities for large deliveries.

Services digital payment system. Lowe's is also looking to expand its home services with the ability to make it easy to schedule and pay for installation via smart devices. Customers can now digitally sign a contract and submit payment without a special trip. Typically, customers would have to return to a store to pay for installation for things such as windows, flooring and doors. Associates will also be able to process payments in a customer's home.

"We realized we needed to empower our hard-working front-line associates with better technology and simpler processes so they could be freed from outdated manual tasks and shift their attention to serving our customers and driving sales," said Joe McFarland, executive vice president of Lowe's stores.

Customer experience wins with computer vision

With smart devices, self-checkout terminals and omnichannel improvements mostly in place, Lowe's has set out to leverage AI in ways that can move the needle for customer satisfaction yet operate in the background.

McFarland said the company has been focusing on both associate and customer experiences since it has created "meaningful gains in labor productivity and our operating margin."

According to McFarland, Lowe's proprietary self-checkout registers, improved buy online and pickup in store experiences and optimized front-end selling spaces are just the beginning.

Via a partnership with Nvidia, Lowe's has installed a self-checkout system that uses an AI computer vision tool called Nudge. Nudge detects discrepancies such as a customer that has missed scanning something. Nudge can prod the customer to scan the missing item or alert cashiers to resolve the mismatch.

"Nudge helps us maintain our strong track record managing shrink, and with this assisted self-checkout, we can shift associate time to the sales floor so they can spend more time driving sales and serving customers," said McFarland.

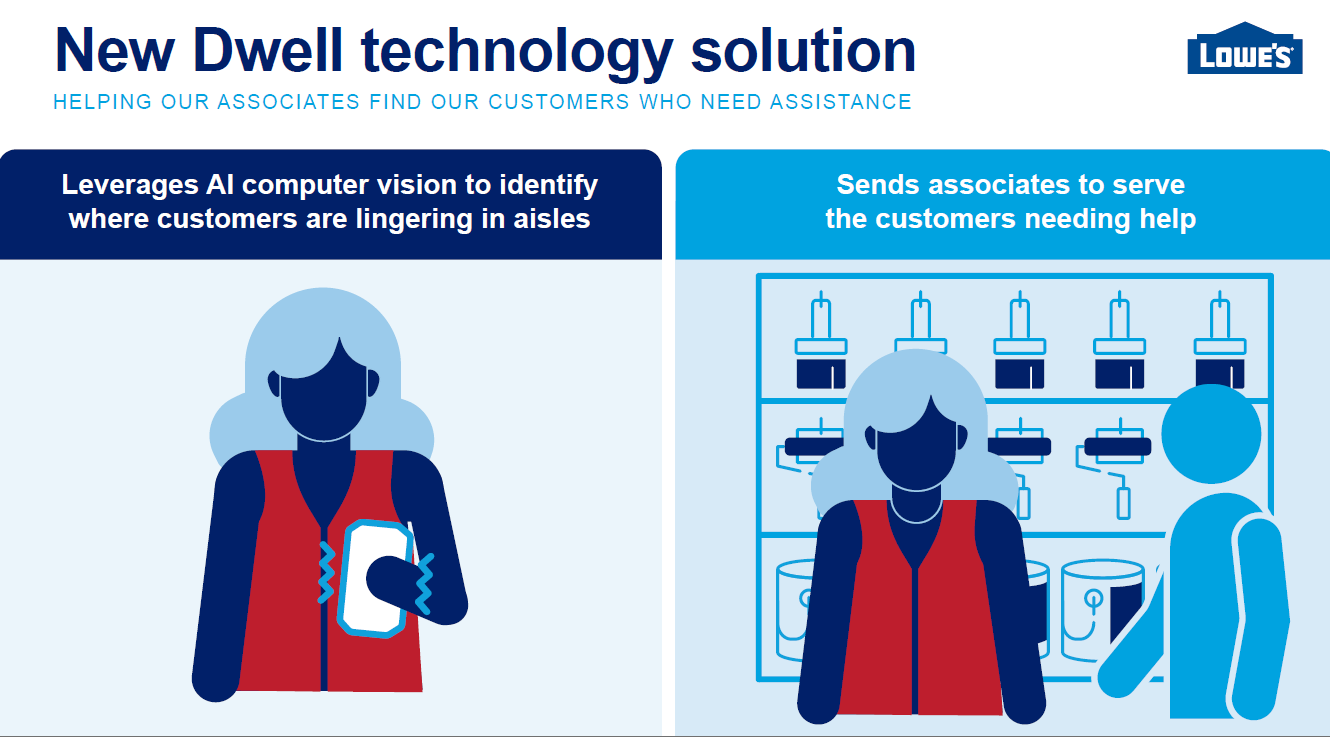

Another interesting customer experience use case is an effort Lowe's calls Dwell. Dwell uses AI vision and algorithms to estimate sales and traffic patterns inside a store. McFarland explained:

"Dwell uses an AI vision algorithm to estimate sales and traffic patterns and see the trends inside of our stores. It uses real time heat maps to see where customers stop in our aisles to look at products and sends associates directly to them to ask if they need help. This new technology will help us staff our stores correctly to maximize sales."

Another use of AI will be embedded into Lowe's companion app for associates. McFarland said the store companion app includes "our very own version of ChatGPT that helps our associates understand what's involved in projects."

The core metrics for these efforts are customer and associate satisfaction scores, operating margin, lower shrink and sales velocity. McFarland said these improvements will also lead to better return on invested capital as Lowe's opens 10 to 15 new stores per year. Lowe's has transformed about a third of its store footprint with new front-end systems and processes.

Supply chain as insights engine

Lowe's has been transforming its supply chain since 2018 to optimize its more than 130 facilities with more than 65 million square feet. The Lowe's supply chain network includes regional, bulk, import and flatbed distribution centers as well as a system of fulfillment facilities.

Margi Vagell, executive vice president of supply chain at Lowe's, said:

"We've transformed our supply chain from a traditional hub and spoke model centered around replenishing stores to one that's more agile, centered around supporting omnichannel fulfillment needs. This multiyear transformation has helped us increase our network capacity, our capabilities to deliver big and bulky items and our flow of product through our distribution centers to our stores. This in turn improves our in stocks and our customer shopping experience and our ability to meet the ever-increasing demand from our DIY and pro customers for fast and flexible delivery options."

Vagell also said Lowe's has deployed a market delivery model for big and bulky products such as appliances. AS a result, bulky products flow from the supply chain to customer homes and job sites instead of stores. Lowe's has been able to double the number of next-day deliveries and improved customer satisfaction by 20 percentage points.

Lowe's said that the company's plan is to further optimize its supply chain and ultimately "make it a proactive sales enabler that drives greater inventory productivity and operational efficiency."

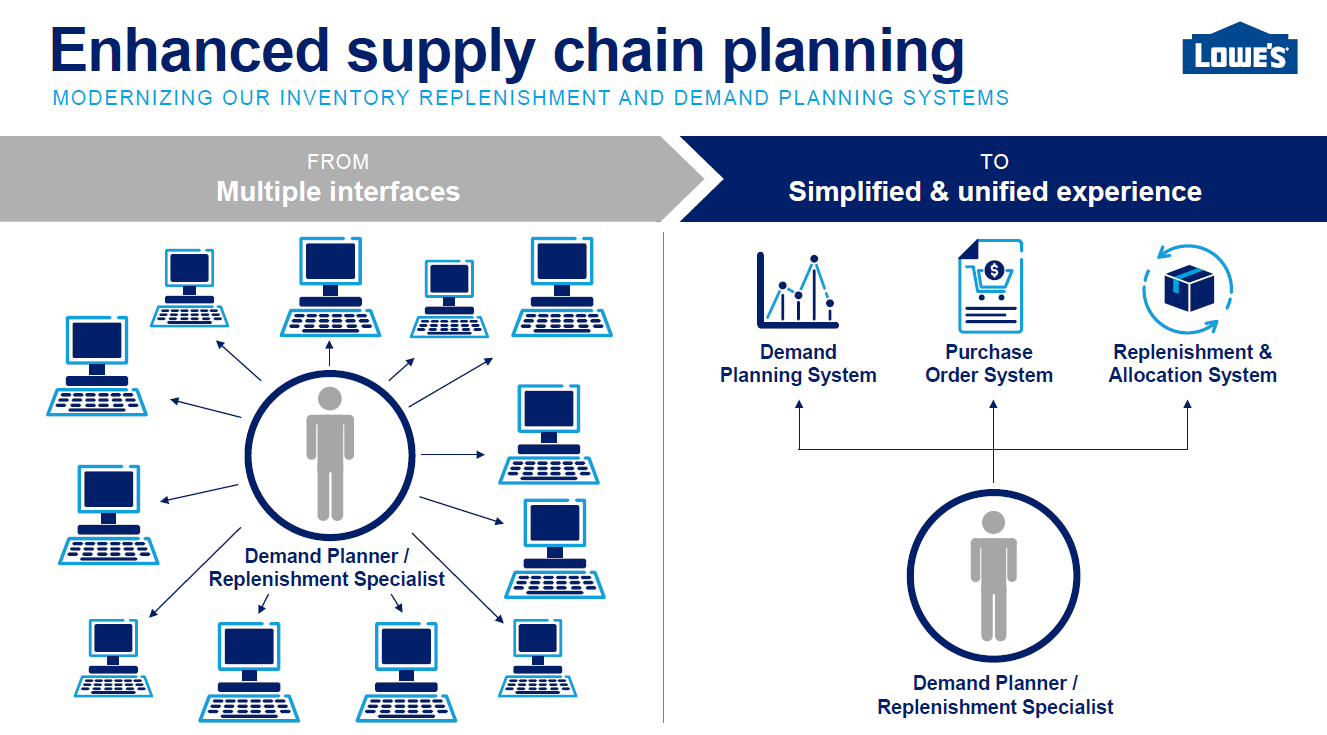

Vagell added that Lowe's has started a three-year project to redesign and modernize its inventory replenishment and demand planning systems. AI will also play a big role in planning for rural locations, rapid store responses and driving insights. Vagell said:

"This new technology ecosystem merges custom and third-party applications that will create a vastly simplified and cohesive experience, resulting in improved forecast accuracy and increased inventory productivity. With these enhancements to our tools and analytics, we will proactively simulate the business and simulate scenarios instead of simply reacting to them."

Lowe's is expecting its merchandising and supply chain efforts to have an impact of $500 million a year in savings and sales and its store operations optimizations to generate another $500 million annually.