Lloyds Banking Group is building its next-generation machine learning platform on Google Cloud's Vertex AI in a move that will replace legacy systems.

Ranil Boteju, Chief Data and Analytics Officer at Lloyds Banking Group, said the company's previous machine learning and data science platform was on-premise and pushing a decade of use. "We realized we needed to modernize and wanted to move to the public cloud and Vertex AI," said Boteju. Lloyds completed the migration a year ago.

Boteju said the bank's hundreds of data scientists are building models at scale. According to Boteju, the move to Vertex AI is "quite a significant step up in capability," but is also enabling Lloyds to "pursue our agentic AI aspirations as well."

More from Google Cloud Next 2025

- Google Cloud Next 2025: Agentic AI, Ironwood, customers and everything you need to know

- Healthcare leaders eye agentic AI as next frontier for clinicians, patients

- Google Cloud, UWM partner as mortgage battle revolves around automation, data, AI

- Lowe's eyes AI agents as home improvement companion for customers

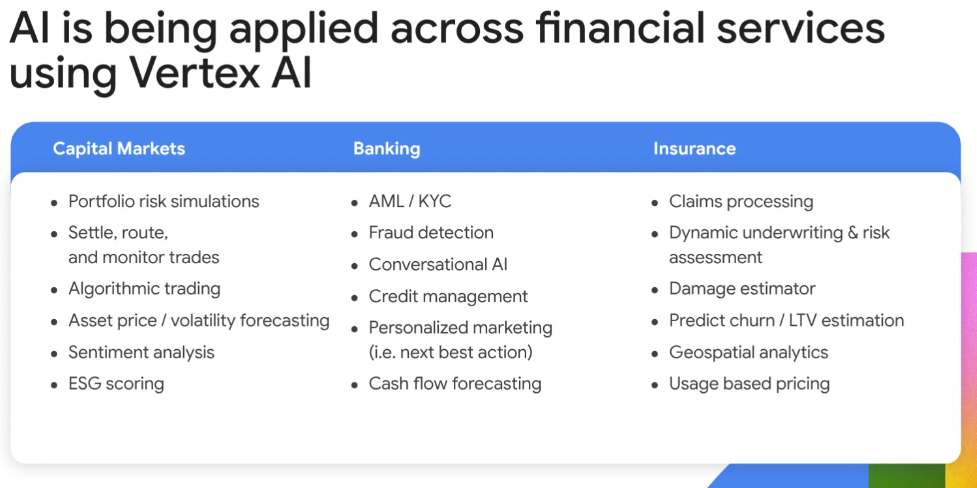

According to Boteju, Lloyds is leveraging Vertex AI to accomplish the following:

- "Enable the whole bank with AI," he said.

- Build the bank's GenAI Workbench on Vertex AI.

- Use multiple models via Google Cloud's Model Garden including Gemini and open source models based on ability to handle use cases. "We can select the right LLM for the right task," he said.

Ultimately, Boteju said the plan is to leverage agentic AI. "For the last nine months, we've had a heavy focus on agentic AI capabilities," said Boteju. "There are many use cases in financial services and we think there are at least 50. What we're trying to build is a robust agentic AI architecture that we can deploy against multiple use cases from customer advice to software engineering to claims or underwriting."

Lloyds AI plans part of broader transformation

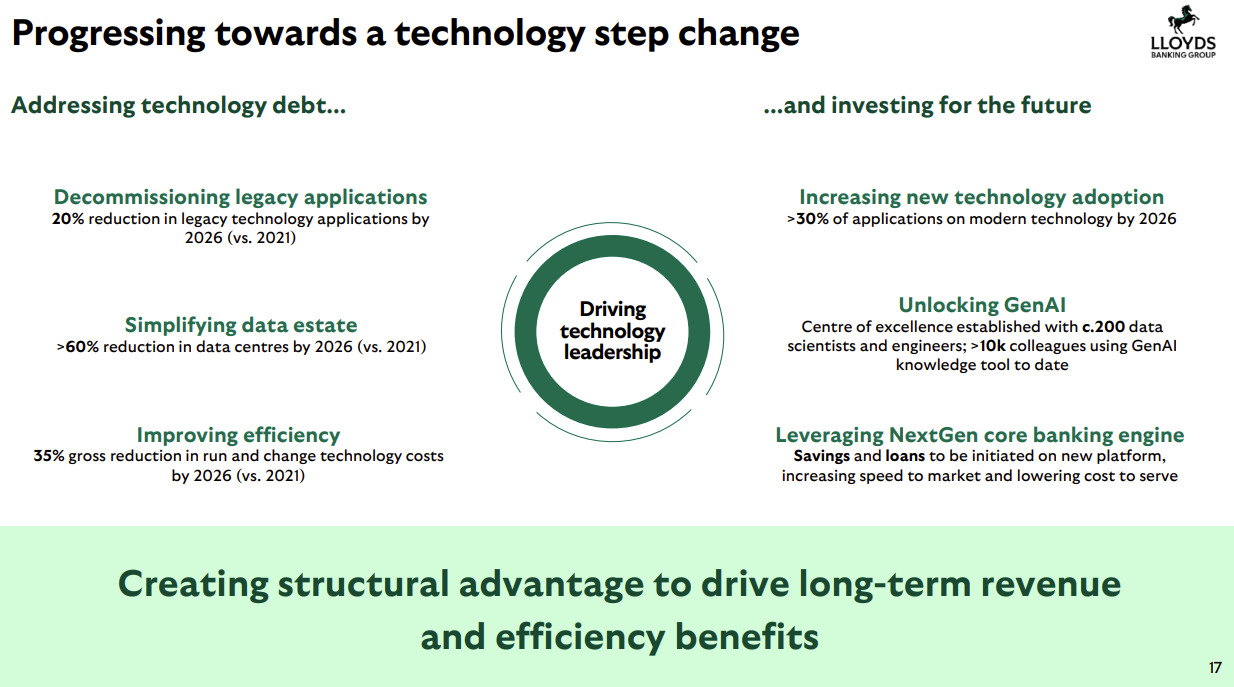

Lloyds's use of Vertex AI is part of a broader transformation that's focused on driving efficiencies and experiences throughout the company.

Speaking at a Morgan Stanley conference, Lloyds CEO Charlie Nunn said the company hit its targets and was feeling good about its position in the UK. Nunn said the company committed to driving market share and growth, operating leverage and change via technology.

"The most important part is what we call change, so grow-focus-change. And the change is really about building new capabilities, bringing in new technologies, and then driving underlying business and market share growth. We did that across every single part of the bank, and that's the stuff that gets me excited," said Nunn.

Lloyds said it started the first phase of its strategic transformation in 2022 with the aim of returning to growth and adding capabilities. Nunn said the bank focused on people, technology and data and specifically hired engineering talent.

"Our technology strategy over the next two years will have two distinct elements. Ongoing modernization and rationalization of our estate will continue to deliver savings and improve efficiency, providing the capacity for investment in new technologies," said Nunn, who added that the bank had more than 800 AI models live at the end of 2024 and "already launched a significant number of genAI use cases across the group."

From concept to production

Boteju said Lloyds Bank was viewing agentic AI as a concept that was just emerging as recently as last summer. "We went through a process with the Google team on a 12 week sprint to have an MVP (minimum viable product)," he said. "We started with a first step toward exposing an intelligent agent directly to customers to provide financial tips and guidance."

That use case was chosen due to less risk. Lloyds Bank refined the agent with more advice elements that can be used for other use cases, added Boteju.

Boteju said the advice assistant MVP was complete at the end of 2024 and the plan is to have a production agent in place by August or September.

Now that Lloyds Bank engineers have seen what's possible agentic AI capabilities are being used elsewhere.

"For example, we have automated our process to build data products. There's a lot of automation and our engineers have started building on top of that with an agentic approach to make the process more intuitive and easy to use," said Boteju. "Agentic AI has gone from literally PowerPoint slides 12 months ago to MVPs to engineers building agent systems."

Consistency matters

Lloyds Bank's experience with developing agent systems highlights how consistency matters.

Boteju said "it's really important that people use and deploy agents in a consistent way." He laid out the strategy to ensure consistency:

- Lloyds Bank built a workbench that is consistent across the bank.

- Give everyone the same set of capabilities and leverage Google Cloud advances to accelerate processes.

- Deploy and operate guardrails centrally across the enterprise.

- Create a center of excellence.

- Invest in skilled users and AI literacy. "We've invested very heavily in AI literacy and data culture targeted at both technicians and business leaders," said Boteju. "On the technician side there's a lot of upskilling about how to use these capabilities. On the business side, the whole point is to reimagine your business."

The workbench needs to facilitate multiple models that are exposed to teams across the bank.

"We focused everyone on building things that scale to ensure reuse and that we focus on the highest value use cases," said Boteju. "We're excited about the next 12- to 18-months as these technologies really start to mature and add value across our bank."