Infosys CEO Salil Parekh said his company is seeing "good traction" with enterprises moving to SAP S/4HANA as well as the use of generative AI as enterprises look for efficiencies.

The comments from Parekh landed after Infosys reported its third quarter earnings, which fell short of expectations.

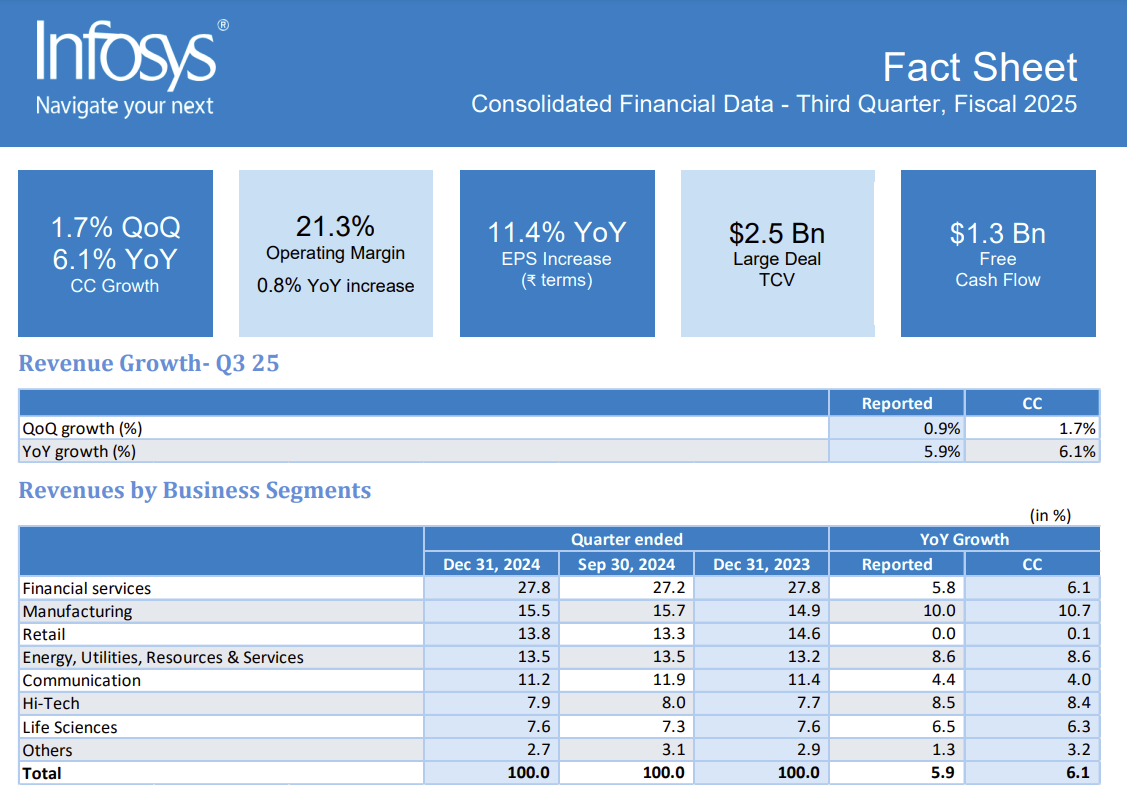

Infosys reported third quarter revenue of $4.94 billion with earnings of 19 cents a share. The company projected revenue growth of 4.5% to 5% for fiscal 2025.

Infosys research: AI Global Services: Infosys Topaz | Constellation ShortList™ AI-Driven Cognitive Applications | Constellation ShortList™ AI Services: Global | Constellation ShortList™ Innovation Services and Engineering

"We are seeing good traction on areas like SAP S/4HANA," said Parekh. "We are seeing good traction on cost takeout."

Parekh added that Infosys was seeing strong demand on SAP cloud migrations under the Rise with SAP program. "That work is more implementation of migration," said Parekh.

CFO Jayesh Sanghrajka added that "the S/4HANA migration deadline is driving budget allocation to make enterprise workloads compliant."

- DSAG: SAP's innovation focus on cloud, discriminates against on-premise users

- SAP ups 2024 outlook as Q3 better than expected

- SAP gives ABAP code a genAI boost, adds data lake capabilities to Datasphere

- BT150 CXO zeitgeist February edition: Low marks for SAP RISE, process automation, change management, AI risk

- Amazon Bedrock integrated into SAP AI Core, SAP to use AWS chips

The SAP comments from Infosys follow a talk by UiPath at the Needham Growth Conference this week. UiPath CFO Ashim Gupta said the company's partnership with SAP has been a win-win due to the automation capabilities that help migrate to S4/HANA. SAP reports earnings Jan. 28.

Gupta said:

"The value proposition is two-fold. When you move to S/4HANA you want to customize it less. SAP calls it a clean core. To maintain a clean core, you can really do a lot of your customization through the automation that surrounds the ERP. You can automate upon delivery of the ERP or as a part of that implementation. That value proposition is felt by our customers. We've already seen some traction and some wins for it."

Infosys is also adding genAI agents to some of the financial processes that touch finance processes. Parekh said that invoicing is a key area.

According to Infosys, enterprises are showing interest in the company's small language models designed for specific tasks and process. Parekh added that Infosys is also using generative AI to deliver its own services.

Here's a look at some of the notable takeaways from Infosys' third quarter earnings:

- "We are seeing an improvement in retail and consumer product industry in the U.S. with discretionary pressures easing," said Parekh. "Demand trends remain stable in other industries with clients continuing to prioritize cost takeout over discretionary initiatives."

- "We have built four small language models for banking, for IT operations, for cyber and for enterprises broadly. These small language models have 2.5 billion parameters. These models are built using some of our proprietary datasets," said Parekh.

- Infosys is developing more than 100 new genAI agents for clients. Parekh noted that Infosys has created a research agent for a product support team at a large technology company as well as three audit agents for a services firm.

- Parekh said small language models are being used for software development, customer service and knowledge transfer in clients. Infosys is betting that it can deploy these models and then gain share by helping enterprises build their own models. "It's like having the model as a service," said Parekh.

- AI budgets are broad-based and separate initiatives relative to the IT budget, said Parekh.

- IT spending has picked up and enterprises are focused on cost optimization, AI, cloud adoption, cybersecurity and analytics.

More:

- GenAI's 2025 disconnect: The buildout, business value, user adoption and CxOs

- Agentic AI: Three themes to watch for 2025

- 2025 in preview: 10 themes in enterprise technology to watch

- Enterprise software 2025: Three big shifts to watch