V. Nowak, Group Chief Customer Experience Officer at Access Bank PLC, had an interesting problem to solve: How do you maintain and improve customer experience at a bank with multiple touchpoints and employee turnover in an emerging market?

Access Bank is a Nigerian multinational commercial bank that started in corporate banking before expanding into personal and business banking in 2012. The company, which has more than 28,000 employees, features more than 700 branches and service outlets across 21 countries and serves more than 65 million customers. The bank is one of Africa's largest retail banks.

Access Bank is a Nigerian multinational commercial bank that started in corporate banking before expanding into personal and business banking in 2012. The company, which has more than 28,000 employees, features more than 700 branches and service outlets across 21 countries and serves more than 65 million customers. The bank is one of Africa's largest retail banks.

When Nowak (right) joined Access Bank over two years ago, Access Bank's customer satisfaction rate was at 54% with a negative Net Promoter Score. The bank improved its customer satisfaction rate to 64% for fiscal 2023 and moved its Net Promoter Score from the negatives, to 13, to today's 23 across its channels.

The CX improvements and approach to technology by Virginie at Access Bank PLC was recognized by Avaya at its CX Force Awards. The awards recognized CX leaders at Avaya's ENGAGE 2024 conference in May.

"My job is to create a seamless experience and make sure that I remove friction. I don't want to keep a customer on the call 3, 5, or 10 minutes because first I need to authenticate and the customer has to hit one or two buttons," explained Virginie.

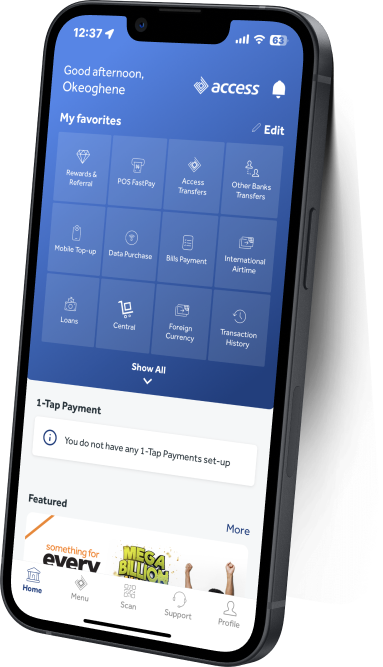

To transform Access Bank's customer experience, Nowak set out to reach customers through multiple touchpoints leveraging Avaya's solutions including video banking, conversational Interactive Voice Response (IVR) systems, and voice biometrics with real-time analytics. Nowak also sprinkled gamification to keep agents motivated to respond to customers.

Here's a look at the key parts of Access Bank's CX transformation:

Technology: Nowak chose to use the Avaya Experience Platform™ (AXP) for digital efforts and Avaya Elite Voice for on-premises. The hybrid plan included  Voice Biometrics, Conversational IVR, Video Banking, Call Back assist, Auto QM, Real time Speech Analytics, Microsoft Dynamics CRM integration with Avaya as Agent Interface, Enhanced Reporting, Dashboards and Gamification. The stack was chosen to revamp IVR to make it easier to use, and to give agents real-time information and speech analytics for context on customer issues.

Voice Biometrics, Conversational IVR, Video Banking, Call Back assist, Auto QM, Real time Speech Analytics, Microsoft Dynamics CRM integration with Avaya as Agent Interface, Enhanced Reporting, Dashboards and Gamification. The stack was chosen to revamp IVR to make it easier to use, and to give agents real-time information and speech analytics for context on customer issues.

As for the roadmap ahead, Access Bank plans to add AXP Connect and build a new chatbot with 14 self-service workflows, with avenues to AXP chat agents to escalate problems. Nowak chose an architecture that allows the addition of new technology and the room to move completely to the cloud when ready, which pairs well with Avaya’s core value proposition ‘Innovation Without Disruption’. Through this strategy, Avaya empowers organizations like Access Bank to choose their own cloud journey, rather than risky and costly ‘rip-and-replace’ cloud migration strategies that many companies eagerly chase.

"When it came to upgrading our technology, I needed to ensure it's sustainable," said Nowak. "By 2027, our ambition is to expand to 125 million customers, so I need to make sure we are prepared to serve this number of customers."

She also is looking to use blockchain, AI and large language models (LLMs) to reduce failed transactions, speed up dispute resolutions, and serve Hausa language speakers, the second largest community in Africa. "We are good at mitigating risk, so we can adjust after we try something with new technology on a small scale," said Nowak.

Metrics that matter. Nowak, who has spoken at multiple conferences about African business, customer experience, and digital banking, has taken a continuous improvement approach to CX at Access Bank. The metrics back up the CX improvement:

- Voice response time in the Access Bank contact center has improved from 2:25 minutes in fiscal 2022 to 38 seconds in fiscal 2023 and 30 seconds in the first quarter.

- Email response time in the contact center has improved from more than 144 hours in fiscal 2022 to just under 7 hours in the first quarter.

- Contact center first contact resolution has improved to 74% in the first quarter from 70% in fiscal 2022.

- Digital channel customer satisfaction perception has improved from 63% in fiscal 2022 to 80% in the first quarter.

Today, voice improvements are critical, but Access Bank will see digital interactions increase over time. "I would say about 80% of our interactions with our customers are still voice," said Nowak.

Industry collaboration. Nowak frequently works within industry groups to improve operations across banking, and to better integrate with Nigeria's Central Bank. She spearheaded an African banking group for quarterly CX reviews. Notable wins include forming a group of card point-of-sale processors to review best practices and speed up dispute reviews.

Employee experience translating to good customer services. One of Access Bank's big challenges with its CX statement was the growth of new staff and turnover. Nowak instituted CX training within a week of employee onboarding at the bank and implemented KPIs that are part of performance reviews.

"There is no CX without EX," she said. "We're trying to really help the business see the potential pain points that a customer would get and that an employee would get, so you can remove friction and make it seamless."

Other CX Force winners include:

- CX for Education: Tara Pasalic, Systems Integration Specialist, McMaster University. Pasalic was an early adopter of cloud contact center as a service and a longtime Avaya customer. McMaster University focused on improving experiences for international students leveraging SMS messaging and call center resources.

- CX for Employees: Jayne Hogle, Director of Unified Communications, American Heart Association. Hogle said customer experience at the American Heart Association is really about being heard. The technology plan has focused on everything from automated responses to call-to-ticket workflows and self-service tools made possible with a migration to the cloud.

- CX for Healthcare: Rafael Sousa, Chief Technology Officer, Hospital Nipo-Brasileiro (HNIPO). Sousa led an effort to link customer experience, hospital operations and patient outcomes. Leveraging Avaya, Sousa has been able to provide faster and more personalized assistance to patients and routing them to appropriate departments.

- CX for Good: Ian Cole, Chief Innovation Officer at Give Kids the World Village. Cole is responsible for creating and delivering experiences for critically ill children and their families. Cole's company is in Florida's Lightning Alley and needed to improve communications reliability during natural disasters. He moved from analog lines to SIP and leveraged Avaya, e911, cloud and AI to bolster reliability.

- CX for Growth: Hugh Carr, Director of Customer Services, Standard Focus. Carr has been able to leverage Avaya customer experience technologies to improve experiences and boost revenue growth. By focusing on customer journeys, Standard Focus is reducing costs per contact by leveraging bots for easy issues and using humans for complex items. The result is customer trust and more revenue.

- Rising CX Superstar: Emily Stubbs, Director of CX, Aerflo. Stubbs has focused on funneling CX data into business intelligence tools to build views that head off customer issues before they happen. The proactive approach is critical to product launches and customer experiences associated with them.