Earnings season for the December quarter and the January conference calls that follow are great for setting the scene for enterprise technology buying cycles for the year ahead.

Many of the major enterprises with multi-billion dollar technology budgets have reported earnings and with those calls come a pretty good read on the state of IT buying. Here’s a look at some choice quotes from the buy side of enterprise technology and how they’re thinking about AI, technology and transformation. These comments were taken from dozens of earnings calls in January.

The comments from CxOs highlight an optimistic view of AI and technology transformation as well as the benefits of automation. However, CxOs are focused on efficiency as well as financial prudence.

Get Constellation Insights newsletter

RTX (formerly Raytheon) CEO Chris Calio:

“We're innovating how we do our work as we continue to implement AI applications across RTX. Last year, we saw benefits in areas including product testing, first article inspections and RFP responses. For example, using Generative AI, Collins' avionics business has seen software testing cycle times improve by 3x, while maintaining our same quality standards. We have a plan this year to deploy another 40 use cases. Through our continued initiatives to leverage machine learning and generative technologies, we expect to improve operational speed, cycle times and capital utilization, while decreasing our dependency on external labor.”

T-Mobile President, Technology Ulf Ewaldsson:

"The whole network team has industrialized a process over the last years that gives the opportunity for us to dedicate towers, build up, upgrades, everything we do to exactly where customers need it. We're using AI to analyze thousands and millions of data points across the network on a daily basis to understand sentiments and movements in our customer base and correlate that with business outcomes, which is giving us the ability to allocate capital. I think what is really good with the network team now is that we are able to platformize the network using AI capabilities for an autonomous network model."

Starbucks CEO Brian Niccol:

"We're beginning to pilot a new in-store prioritization algorithm and are exploring other technology investments to improve order sequencing and our efficiency behind the counter. We're also progressing efforts that build on the strength and popularity of the Starbucks app. This includes development of a capacity-based time slot model that allows customers to schedule mobile orders and a midyear update that will simplify customization options, improve upfront pricing, and provide real-time price changes as customers customize beverages.”

Also: Starbucks aims for 4 minute barista to customer handoff process to boost CX

AT&T CEO John Stankey:

“In December, we established a new $3 billion plus run rate cost savings target that runs through the end of 2027. In 2025, we'll make progress on this goal by further integrating AI throughout our operations. We also expect to realize cost savings as we evolve our technology stacks and work to exit our legacy copper network operations across most of our wireline footprint by the end of 2029.

If you kind of look at our cost of service dynamics, a lot of that has been driven by AI tool application. And it's not that we're necessarily exclusively replacing individuals with the technology, but we're making them a lot more effective and efficient in how they handle customer needs and then complementing that with customer supported AI.

We’re also seeing demonstrative improvements in our code effectiveness. We're spending less right now to develop new code internally and getting more through the application generative AI.”

Capital One CEO Richard Fairbank:

“We’re investing more in technology and at the same time, getting all the benefits on the efficiency side, both in terms of growth and in terms of costs. Hopefully our investors share our excitement that this 700 basis point improvement that has happened since we began our tech transformation in 2013 has certainly been good. There are multiple things behind that, but the biggest driver is the technology transformation. Even as we invest a lot, there are also ways to create savings through reduced vendor costs, legacy technology and the benefits of the cloud to rebuild the company and how it operates.”

Also: CxOs upbeat on economy, plan to invest heavily on genAI, AI agents

- Why your IT strategy will be easier (in theory): There's only one path

- BT150 Spotlight: Karen Higgins-Carter on practical AI approaches

- BT150 zeitgeist: AI, efficiency, vendor angst and finding the right IT structure

Travelers CEO Alan Schnitzer:

“In 2024, our strategic tech investment approached nearly half of our overall tech spend of more than $1.5 billion. At the same time, our efforts to improve operating leverage also enable us to lower our expense ratio by more than 3 points, or about 10%. Broadly speaking, we're digitizing the value chain. That’s digitizing the customer journey. It's modernizing the foundation. It's advanced analytics. It's automation. It's faster speed to market, getting the right price on the risk, those sorts of things. At the enterprise level, we're also investing in talent and AI and third-party data, product development.”

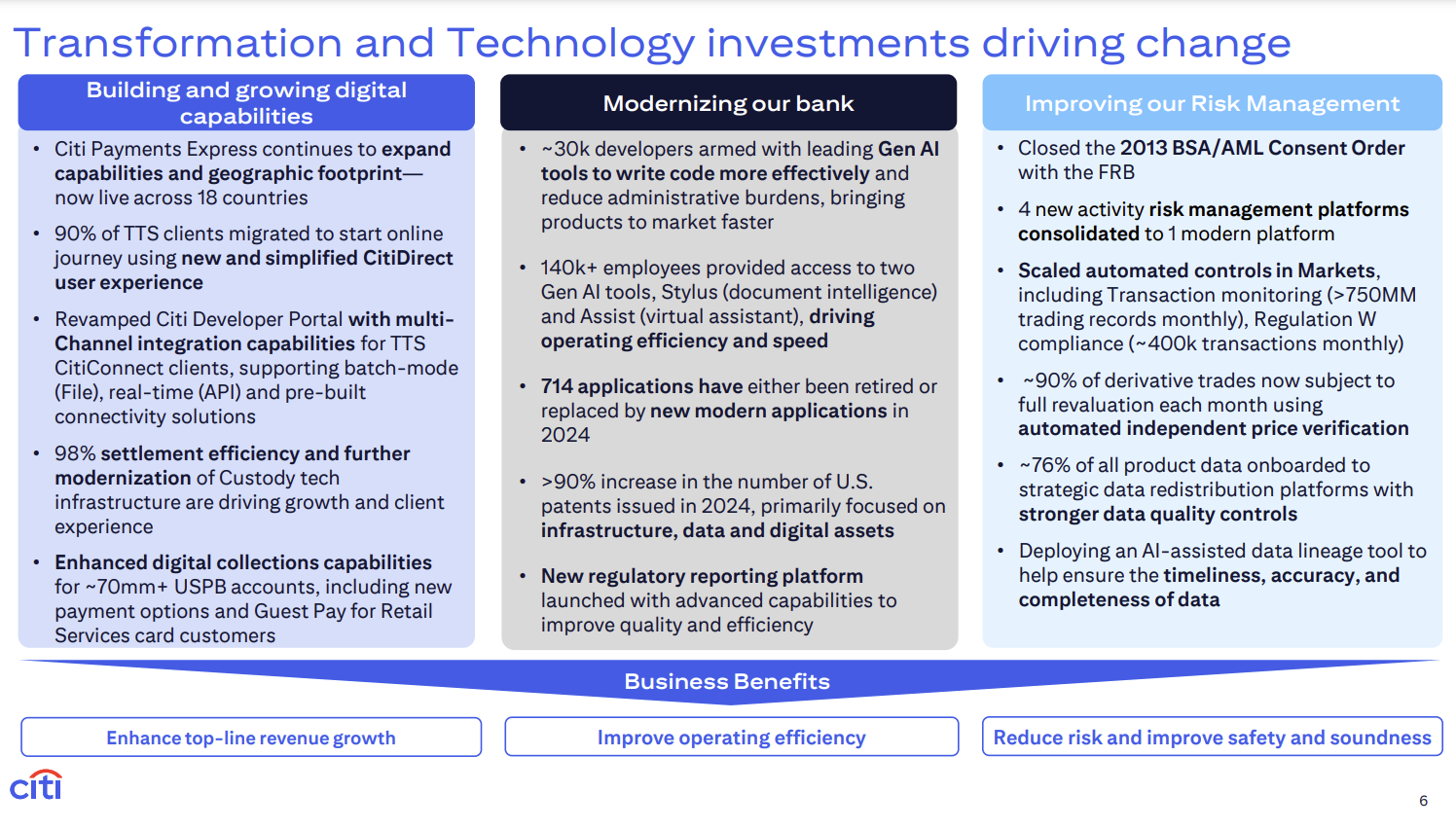

Jane Fraser, CEO Citigroup:

“We accelerated our use of AI arming 30,000 developers with tools to write code and launched two AI platforms to make our 143,000 colleagues more efficient. The investments we're making to modernize our infrastructure, streamline processes and automate controls are changing how we run the bank.

We consolidated our balance sheet reporting to one unified ledger. We implemented a cloud-based solution for risk analytics to better value trading assets. We have closed out three longstanding consent orders.

We're all very focused on improving our operating expense base. Consolidating technology, the simplification work, automation, getting different utilities put in place rather than fragmented around the firm using AI tools.”

Mark Mason, CFO Citigroup:

“We spent $11.8 billion on technology, focused on digital innovation, new product development, client experience and other areas such as cybersecurity. We continue to reduce stranded costs, drive efficiencies across the businesses, and as benefits from investments in transformation and technology allow us to eliminate manual processes.”

United CEO Scott Kirby:

“We do have the leading digital team in the business. You can see in the app; you see in all kinds of places. And we have been, I think, done a Yeoman's effort, but really using genAI in all types of ways to be impactful for the airline and operations. One of the things that I'm most proud of is how much better we communicate with customers when there are delays to choice and explaining it in terms of they understand.

Another one of the interesting applications of genAI is that we have these old labor contracts that go back decades. And they've got all these provisions that have built up over decades. And you have people that have 25, 30 years of experience trying to interpret what the labor contracts mean in unusual situations. There’s literally a team of people that try to interpret and get those right, and they don’t always know. Amazingly, genAI can read the contract and give you a really good answer of what the output is.”

Also: Delta Air Lines completes cloud migration with focus on AI and data-driven customer experience

Rick Wurster, CEO Charles Schwab:

“In 2024, we invested in new technologies and capabilities that help our employees do their jobs more efficiently. We increased usage of Schwab Knowledge Assistant by 90% in 2024, which is our AI technology supporting the efficiency of our service professionals.

Through these efforts and others, we're able to drive down our cost per client account, which has decreased more than 25% in the last decade. On an inflation-adjusted basis, cost per account has decreased nearly 50%. This focus helps us keep costs low for our clients while also enabling us to invest in our highest priority growth opportunities.

In 2025, these critical efforts will continue. We'll invest in continued process transformation and systems modernization. We'll continue to invest in AI and other technology to help employees across the firm do their jobs more efficiently and free up expense capacity to fund our growth.”

Brian Moynihan, CEO Bank of America:

“Our digitalization and engagement expanded across all our businesses. We saw more than 14 billion logins to our digital platforms in 2024. Our Erica capability surpassed 2.5 billion interactions from its inception. And our CashPro app surpassed $1 trillion in payments made through the app in 2024. It's also worth noting that digital sales in our consumer product areas crossed 60% in the fourth quarter again.”

Morgan Stanley CFO Sharon Yeshaya:

"Self-funding investments remains a priority. In the short run, additional modernization efforts focused on decommissioning legacy technologies. This alongside business enabled innovation and process optimization with AI should support the firm's future efficiency path.

We've been investing in all of our processes and our systems in order to engage and make sure that we have a robust infrastructure in order to meet all of our growth objectives. And that has to do with everything across technology side, better understanding of our data, better, servicing our clients and the underlying infrastructure.”

UnitedHealth CTO Sandeep Dadlani:

“Our AI, digital, automation and modernization agenda has focused largely on removing administrative menial tasks in the system and improving consumer experiences. Some examples have been around our call center efforts. We received 10% less calls for the same consumer base compared to last year. And we haven't even scaled this fully. By the end of 2025, we will be scaling this fully, and that's one of hundreds of use cases that we are scaling.

As we focus in 2025, we are excited about more compelling consumer experiences, helping providers and clinicians with documentations and summaries, and digitizing all the paperwork in the entire healthcare experience--benefits documents, facilities, provider contracts and frictionless claims processing.”

Goldman CEO David Solomon:

“We are leveraging AI solutions to scale and transform our engineering capabilities, simplify and modernize our technology stack, drive productivity. These efficiencies will allow us to further invest for growth and improve client experience. This firm is zealously focused on its expense base and creating efficiencies that give us the capacity to invest in our franchise and grow our client franchise. We're going to continue to use technology to make the firm more productive. We're going to continue to scale and create automation of platforms.”

JPMorgan Chase CFO Jeremy Barnum:

“We're putting a lot of effort into improving the sort of ability of our software engineers to be productive as they do development and there's been a lot of focus on the development environment to enable them to be more productive. We also have a lot of focus on the efficiency of our hardware utilization.

We have probably reached peak modernization spend. Inside the tech teams, there's a little bit of capacity that gets freed up to focus on features and new product development.”