Alphabet handily topped third-quarter expectations and its Google Cloud saw revenue growth of 35% from a year ago due to generative AI.

The company, which includes Google, Google Cloud and YouTube, reported third quarter net income of $26.3 billion, or $2.12 a share, on revenue of $88.27 billion, up 15% from a year ago.

Wall Street was expecting Alphabet to report third quarter earnings of $1.85 a share on revenue of $86.3 billion.

Google Cloud revenue was $11.4 billion, up 35% from a year ago. Alphabet said Google Cloud saw strength across AI infrastructure, genAI and core services.

CEO Sundar Pichai said the company's "long-term focus and investment in AI" are paying off. Specifically, Google Cloud is driving "deeper product adoption" with existing companies while landing larger deals and new enterprises. How Google Cloud is monetizing AI

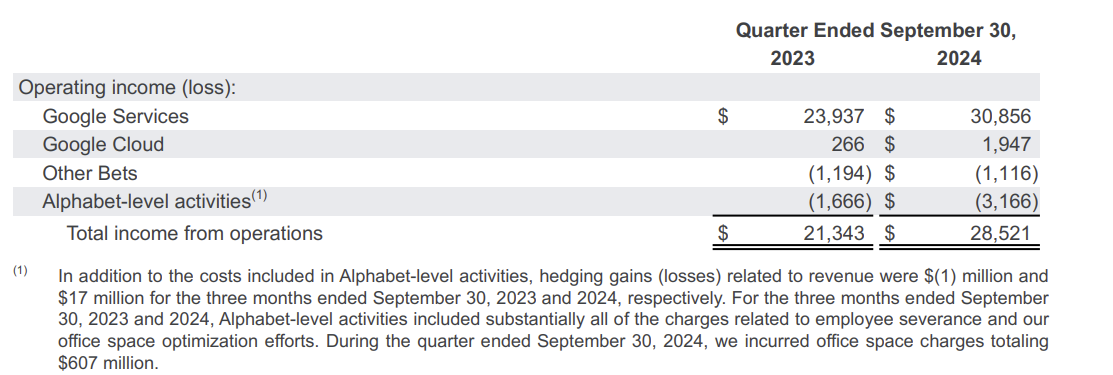

Indeed, Google Cloud's operating income is accelerating. The company's third quarter operating income was $1.947 billion, up from $266 million a year ago.

Google's core services remain the cash cow with operating income of $30.86 billion.

Google Cloud has been picking up traction as it builds out services for the AI layer and also drills down into industries.

- Google Cloud Vertex AI updates focus on the practical with Context Caching, grounding services

- Google Cloud Next 2024: Google Cloud aims to be data, AI platform of choice

- Google Cloud Next: The role of genAI agents, enterprise use cases

And more on industries.

- Honeywell, Google Cloud team up on industrial IoT, genAI use cases

- How Google Public Sector and NASA aim to bring generative AI to aircraft ground traffic control

- Google Public Sector 2024: US Space Force General Saltzman on innovation, scale, leadership

- Google Public Sector Summit: 9 takeaways you need to know

- Google Public Sector lands new clearances for Gemini, authorizations for Air Force Cloud One

- Google Public Sector: A look at the strategy

Speaking on Alphabet's earnings conference call, CEO Sundar Pichai said Google Cloud's stack is paying off as enterprises leverage AI.

Pichai said Alphabet continues to invest in AI infrastructure--including nuclear power for data centers. Google Cloud is also benefiting from workloads powered by new Nvidia GPUs as well as its own processors for AI workloads. CapEx in the fourth quarter will be similar to the third quarter tally of $13 billion. The largest component of that CapEx was servers, data centers and networking equipment.

Takeaways from the conference call:

- Google services are all leveraging Gemini models.

- The company has unified teams in AI and machine learnin to move faster. He said the team behind NotebookLM highlights how smaller teams can move faster. "You'll see a rapid pace of innovation," he said.

- Google is using AI to generate code that is then reviewed by engineers.

- Google is seeing search queries surge due to AI overviews and strong engagement as consumers ask longer and more nuanced questions.

- Circle to Search is available on more than 150 million Android devices.

- Google Cloud's ability to attract generative AI workloads is landing the company larger deals.

- Gemini API calls have grown 14x in the last six months.

On a conference call with analysts, Pichai said the following:

- "Customers use our AI platform together with our data platform, BigQuery, because we analyze multimodal data no matter where it is stored with ultra-low latency access to Gemini."

- "Each week, Waymo is driving more than 1 million fully autonomous miles and serves over 150,000 paid rides. The first time any AV company has reached this kind of mainstream use."

- "On the TPU front, I just spent some time with the teams on the road map ahead. I couldn't be more excited at the forward-looking road map, but all of it allows us to both plan ahead in the future and really drive an optimized architecture for it."

- "We are in much more of a virtuous cycle with a lot of velocity in the underlying models. We've had two generations of Gemini model. We are working on the third generation, which is progressing well. And teams internally are now set up much better to consume the underlying model innovation and translate that into innovation within their products. There is aggressive road map ahead for 2025."