Nuclear-powered data centers are on the horizon (and here in some cases), but deployments will take time and likely extend into 2026 or 2027. What's driving the nuclear data center concept? Generative AI workloads and an electricity grid that's currently under strain.

Oracle CTO Larry Ellison dropped this nugget on the company's first quarter earnings call:

"Let me say something that's going to sound really bizarre. Well, I probably -- you'd probably say, well, he says bizarre things all the time. So why is he announcing this one? It must be really bizarre. So, we're in the middle of designing a data center that's north of the gigawatt that has -- but we found the location and the power place. We look at it, they've already got building permits for three nuclear reactors. These are the small modular nuclear reactors to power the data center. This is how crazy it's getting. This is what's going on."

It's not that crazy considering how much attention nuclear power is starting to get its due because of the need for sustainable energy and the reality that so-called AI factories are going to need a lot more power. Is it any wonder that OpenAI founder Sam Altman also happens to be Chairman of Oklo, which specializes in fast fission reactors that can run on fresh fuel and recycled waste?

Oklo is publicly traded, but is pre-revenue. The general idea is that Oklo would build these mini-nuclear power plants attached to data centers handling AI workloads. On a recent second quarter earnings call, CEO Jacob DeWitte said:

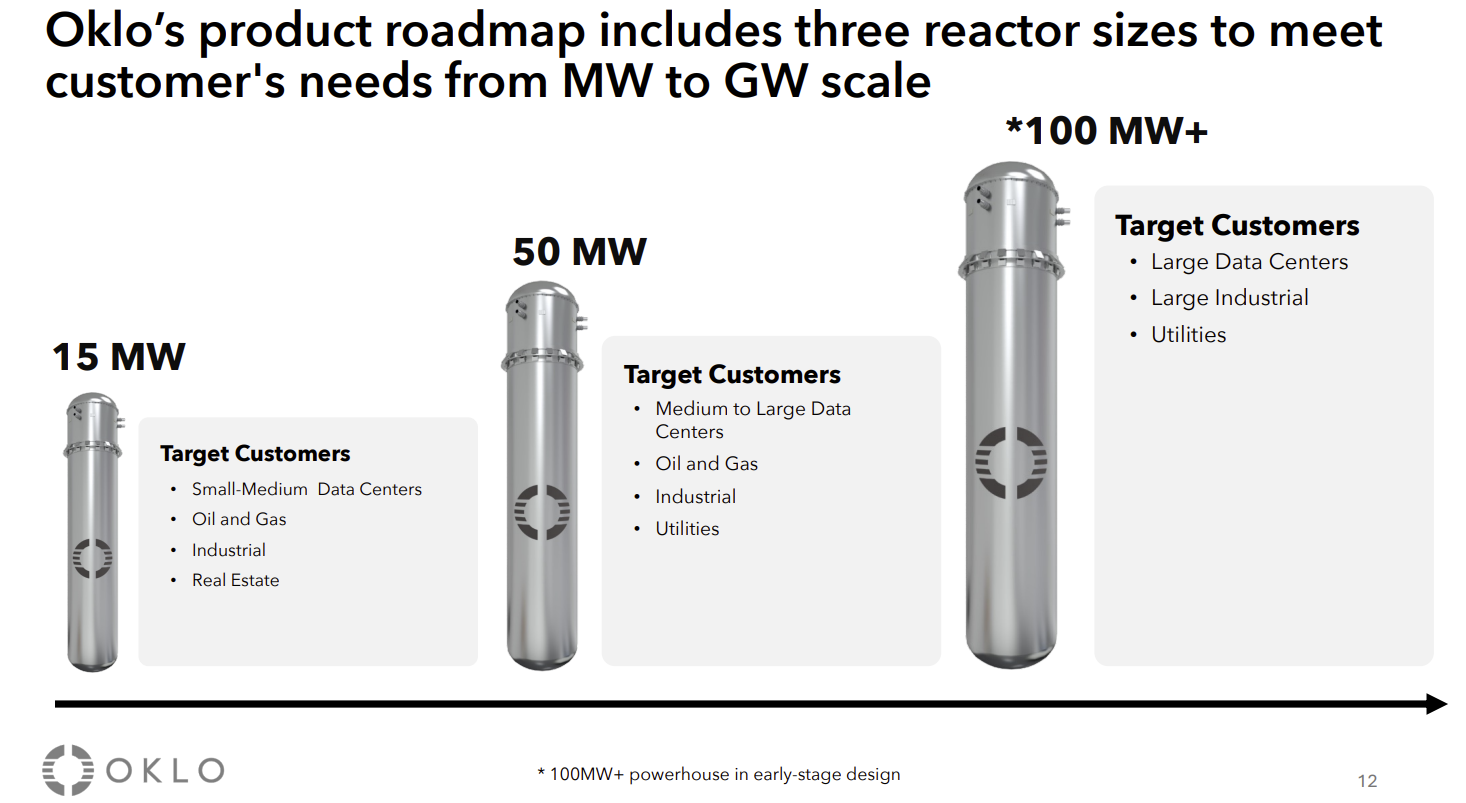

"When we talk about providing power directly to energy users, these sizes offer a good entry point to a number of different markets, and these projects can be quite large when they aggregate together. The reality too is that data centers are making up a vast majority of the market opportunity we see in front of us. While the numbers are very large around those opportunities, especially around the larger scale AI purpose data centers, these projects are not being deployed all at once at a one gigawatt or multi-gigawatt scale. Instead, they're ramping into it. It's phased growth through a development process."

Oklo recently announced deals with Equinix, Wyoming Hyperscale and Diamondback Energy.

- DigitalOcean highlights the rise of boutique AI cloud providers

- Equinix, Digital Realty: AI workloads to pick up cloud baton amid data center boom

- The generative AI buildout, overcapacity and what history tells us

- AI infrastructure is the new innovation hotbed with smartphone-like release cadence

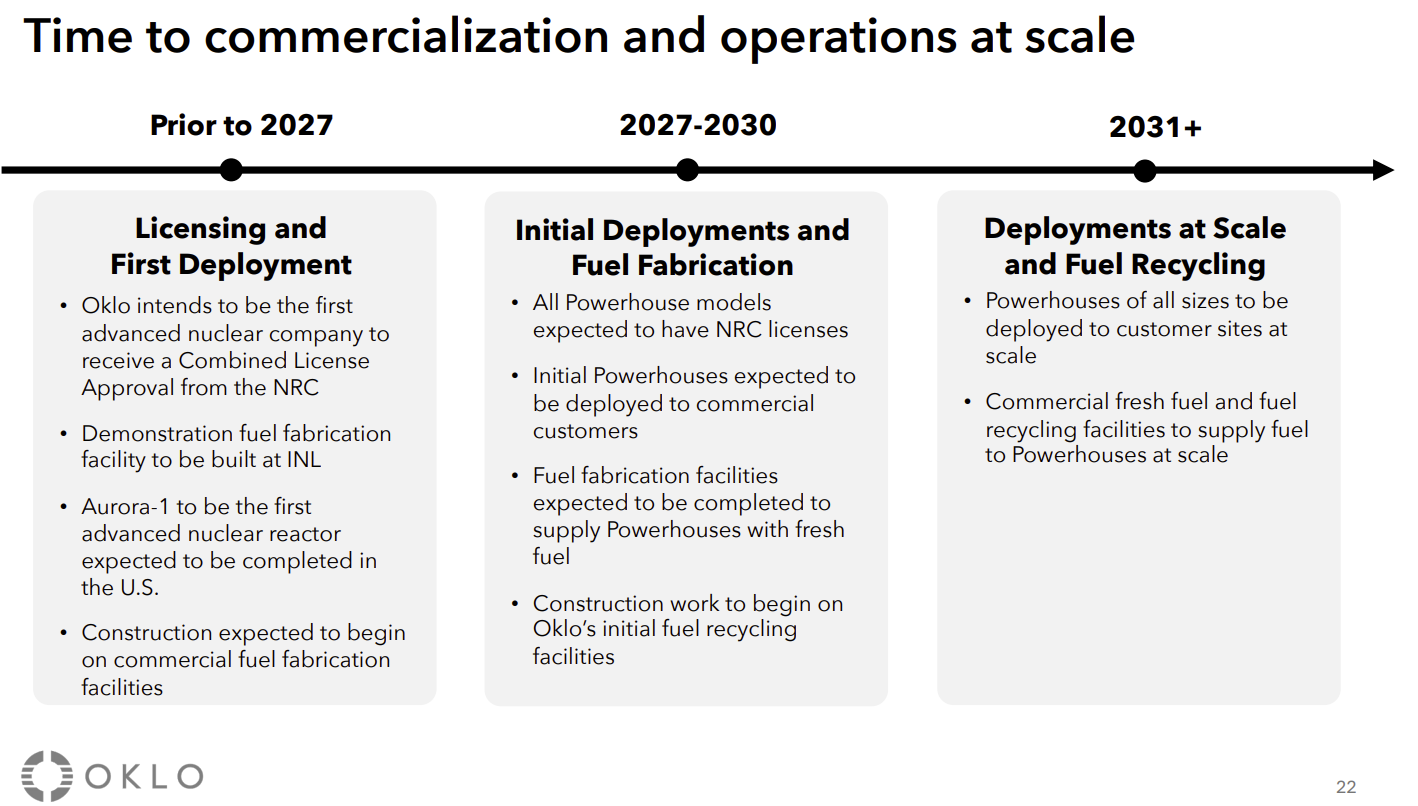

These two slides highlight Oklo's reactors and commercialization plan. Oklo's shareholder letter and deck are worth a read to get up to speed.

Barron's, however, on its cover this week also highlighted Oklo and more established plays on nuclear including Constellation Energy, Duke Energy and Vistra. Bill Gates' TerraPower has also built out nuclear facilities. Amazon founder Jeff Bezos backs General Fusion, a nuclear company in British Columbia. TAE Technologies, a nuclear fusion startup raised $250 million in a venture capital round that included Google in 2022.

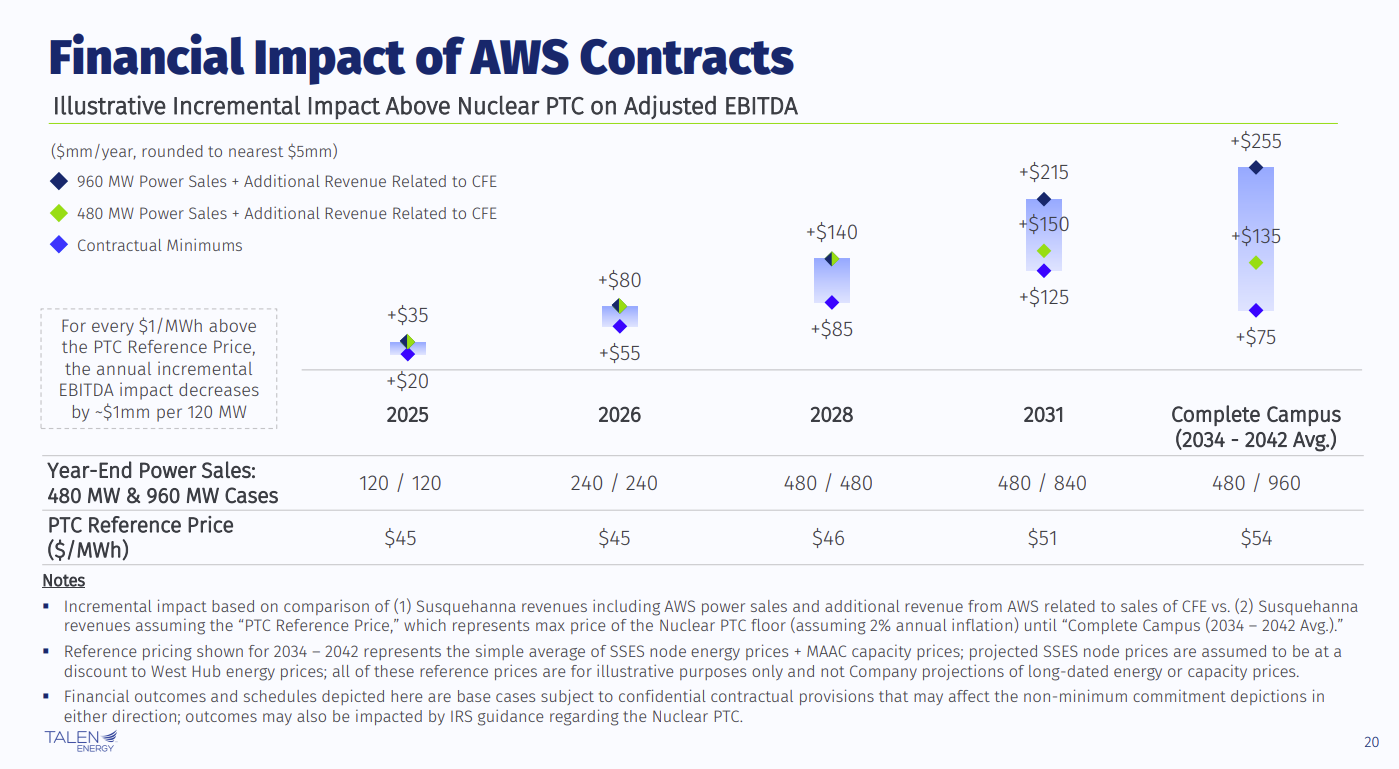

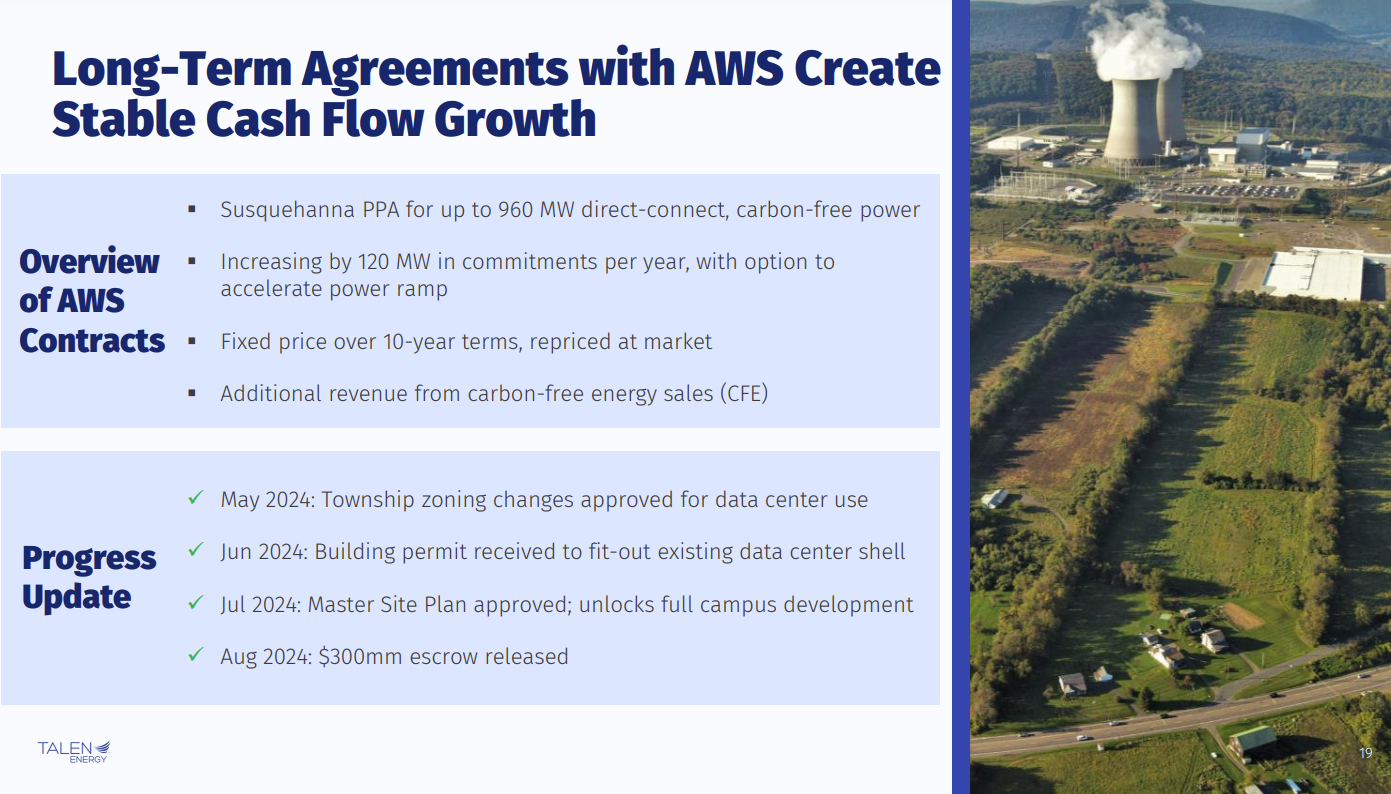

And in January, Amazon Web Services acquired a data center attached to Talen Energy's nuclear plant. Talen Energy will sell power to AWS.

Talen Energy CEO Mac McFarland said:

"At Talen, we have come up with one creative cost-effective solution by co-locating a 1-gigawatt AWS data center campus next to our Susquehanna nuclear plant. Everyone seems interested in our efforts, our colleagues in the IPP space, regulated utilities and RTOs. And the issue now sits at FERC’s doorstep. In the investment community, our deal created excitement about increased demand and incremental value creation across the entire power sector, attracting new investors."

Bottom line: AI is going to tax data center infrastructure and the grid. It increasingly looks like a nuclear power renaissance may occur due to AI workloads.