Elastic upped its outlook for the third quarter following better-than-expected second quarter results as its plan to extend from search into generative AI paid off.

The second quarter results were a reversal of the first quarter. In the first quarter, Elastic made sales changes that hurt revenue growth and the company cut guidance.

When Elastic reported its second quarter, however, it appears that the worries about customer commitments was overblown. The company reported a second quarter net loss of $25.45 million, or 25 cents a share, on revenue of $365.36 million, up 18% from a year ago. Non-GAAP earnings from Elastic in the second quarter were 59 cents a share, 21 cents a share better than estimates.

As for the outlook, Elastic projected third quarter non-GAAP earnings of 46 cents a share to 48 cents a share compared to estimates of 40 cents a share.

Fiscal 2025 earnings will be between $1.68 a share and $1.72 a share. Full year revenue is projected to be $1.45 billion to $1.46 billion compared to $1.44 billion.

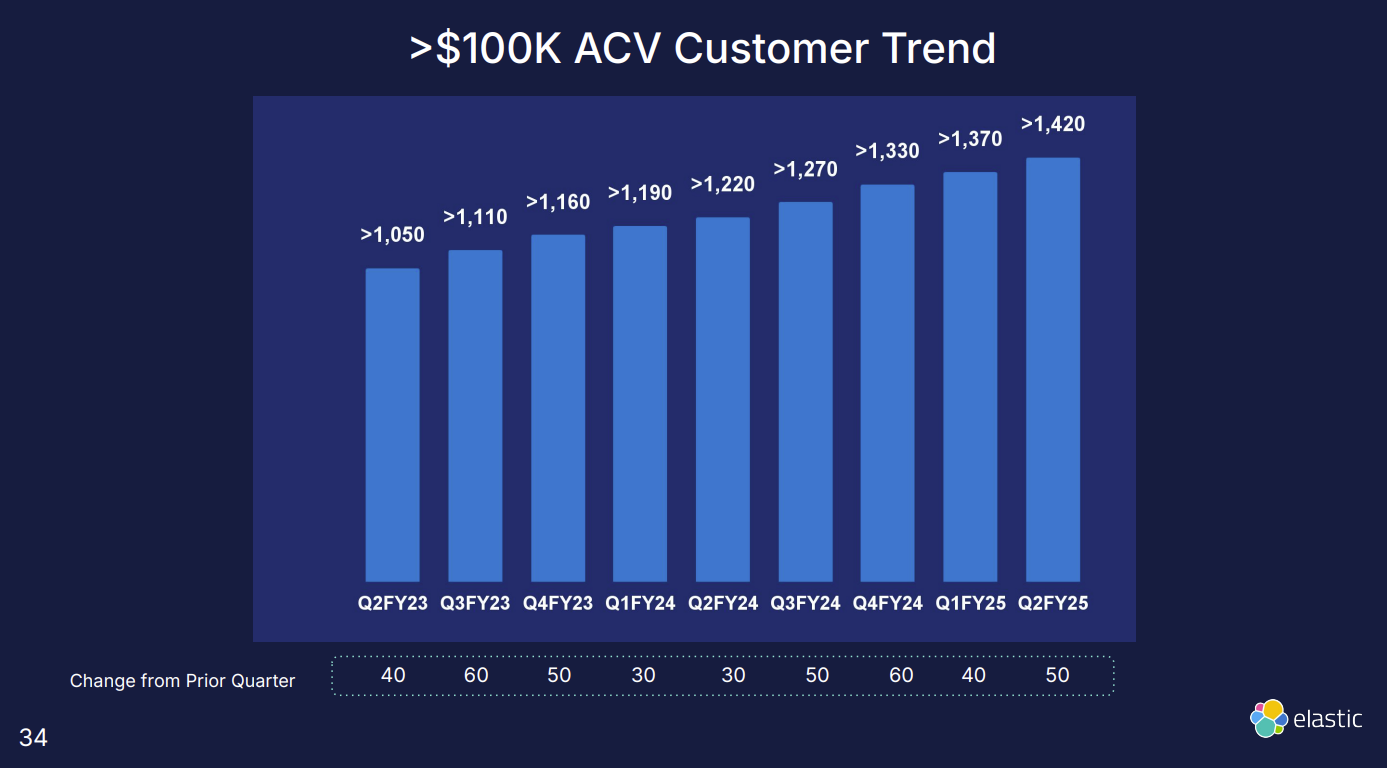

CEO Ash Kulkarni said the company saw wins across Elastic Cloud, which saw second quarter sales growth of 25%. "In Q2 we saw strong customer commitments with key wins across all our solution areas, with continued momentum in GenAI and platform consolidation," said Kulkarni.

- Constellation ShortList™ Security Information and Event Management (SIEM)

- Constellation ShortList™ Observability

Elastic ended the quarter with 21,300 subscribed customers.

The lumpy progression of Elastic--first quarter miss and plunge and second quarter beat and raise--highlights how the company doesn't fit well into any one category. Elastic also said CFO Janesh Moorjani is leaving to pursue another opportunity. Eric Prengel, group vice president of finance, will become interim CFO Dec. 14.

Speaking on the earnings conference call, Kulkarni said the company saw solid sales execution and customer interest. He said:

"After some unexpected disruption in sales performance in Q1, we are now starting to see the benefits of the changes. Our performance in Q2 reaffirms our confidence in our strategy and shows that we are well on our way to returning to the strong pace of sales execution that we have demonstrated in the past."

Kulkarni said customers were consolidating security and observability products and migrating onto the Elastic's SearchAI platform. "We also saw strong demand for our vector database as customers increasingly adopted Elastic as a natural choice for building genAI applications across many different industries and use cases."

Key points from the conference call:

- Kulkarni said one big win in the company was a multi-year seven figure deal where a company standardized on Elastic's vector database to power more than 30 chatbot clusters.

- Another customer was a retailer using Elastic for its omnichannel experience.

- Elastic Express, a migration program for its AI platform, is seeing strong traction and helped the company win in more than 40 deals in the second quarter.

- The company will weight its investments in genAI features.

- Elastic saw strength across multiple geographies and the largest enterprises accelerated consumption.

Elastic isn't easily defined

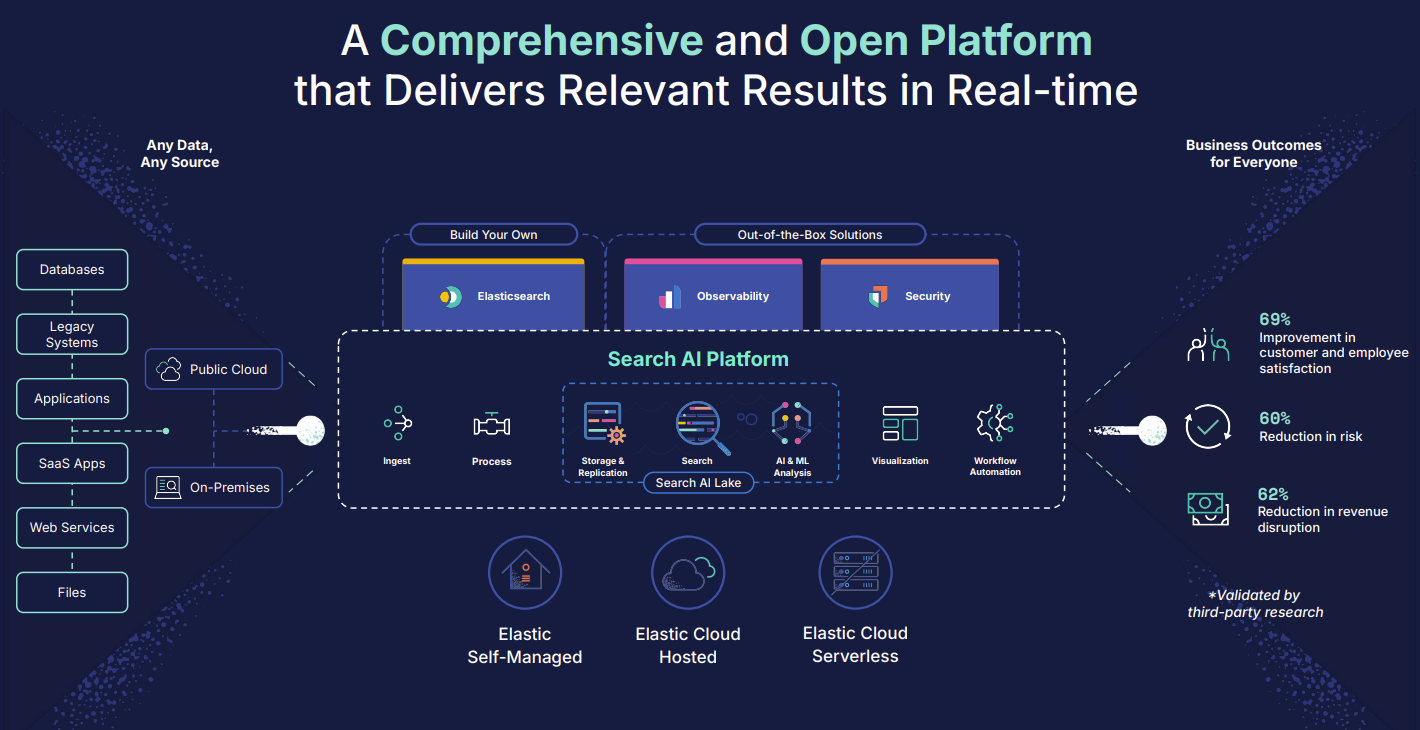

The company's search business is a mainstay, but it also has a monitoring and management business dubbed AutoOps, a security business and is a retrieval augmented generation (RAG) play.

In a September briefing, Elastic executives noted the following about the company's strategy.

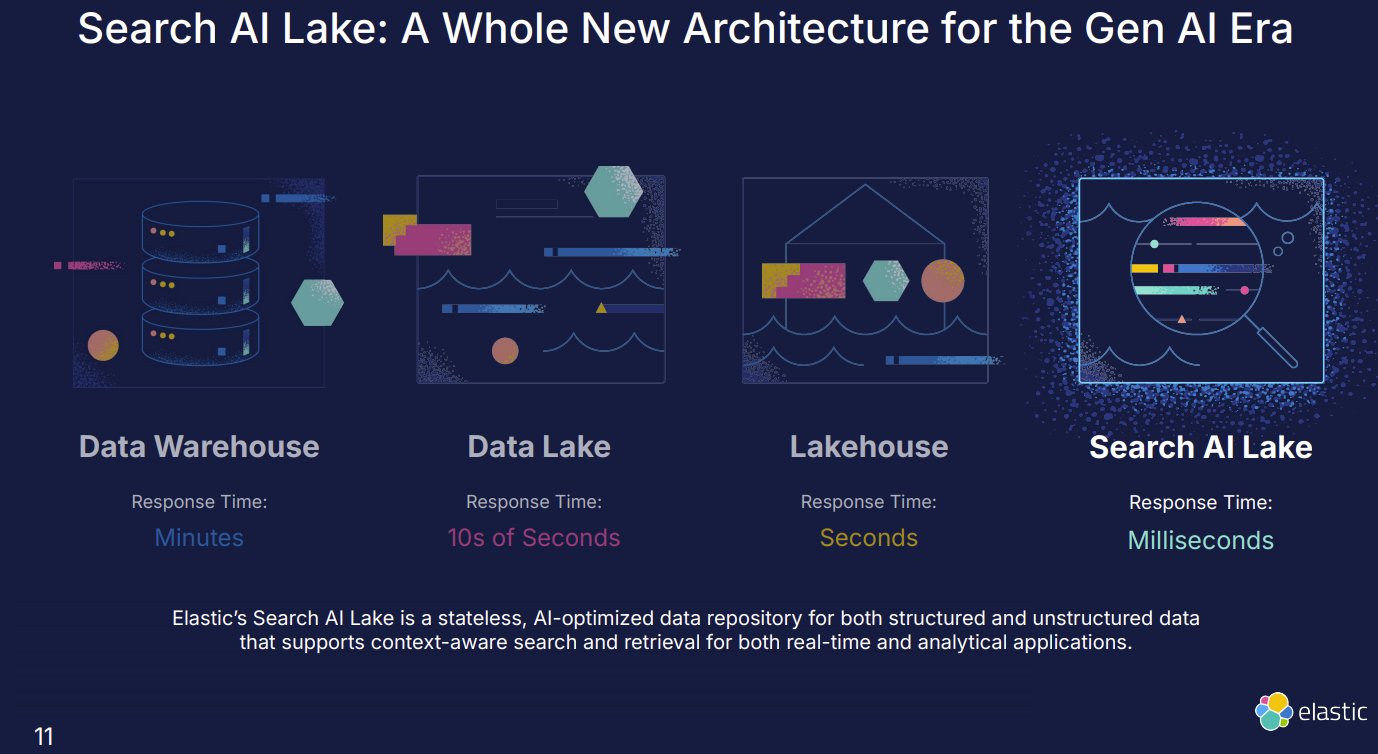

- Elastic's search AI architecture integrates vector embeddings, enabling generative AI use cases like semantic search and RAG.

- The company positions itself as a leader in AI search with its vector database for applications in security, observability and analytics.

- Generative AI is seen as a way to redefine Elastic's brand.

- Elastic is building managed serverless offerings to simplify deployment and scale for customers.

- And Elastic is betting on cross-cluster and federated search capabilities to handle distributed data environments.

Constellation Research's take

Constellation Research analyst Andy Thurai said:

"Elastic is well positioned in the areas of observability, security, and enterprise search with mature offerings. Especially with 480EB data expected to be produced in 2025 alone, search is a major issue for a lot of enterprises. Elastic has flexible offerings and is very appealing to enterprises that want to keep things local, combined with cloud hosted and serverless offerings.

The new addition of "Search AI Lake," with its millisecond response times, allows searching unstructured data which was almost impossible to search before. The addition of generative AI-powered security playbooks, runbooks, and AI assistants is also appealing to customers. Elastic has finally seemed to have figured out their licensing model, and the tighter relationships with all three hyper scalers - AWS, GCP, Azure - Elastic seem to be poised for growth."