Enterprise customers are miffed about software-as-a-service vendors trying to double and sometimes triple prices, layering AI-services that may not deliver returns and prioritizing revenue quotas over value.

That's one of the big takeaways from our June BT150 meetup with CxOs.

A few nuggets:

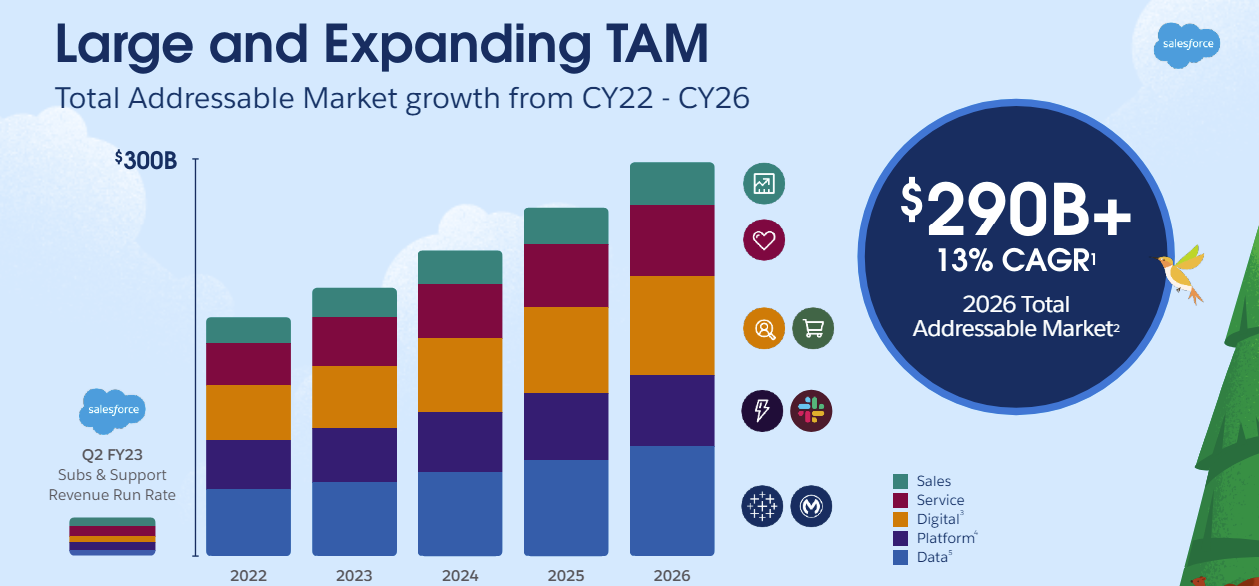

Salesforce has been particularly aggressive about upselling AI and running that cross-selling playbook to the hilt. "We're getting a lot of pressure from Salesforce to buy AI," said one CXO. "Salesforce loves to pitch Data Cloud and anything with data also requires MuleSoft. They're trying to tie it all together which is what I would do if I were them too, but it's very apparent they see AI as a threat and want to lock their customer base in." This sales practice shouldn't be that surprising given Salesforce's goal is to cross-sell you clouds to continue to grow.

OutSystems was another vendor that was dinged by our CxOs. When the OutSystems contract was up, one CxO was told by sales rep his price would triple. After some back and forth, the solution was apparent to the enterprise customer. Get a new vendor. "These vendors are just coming up with insane things when the contracts expire," he said.

Workday, Adobe and a bevy of others were also called out for similar tactics. Some vendors will play ball and see the win in a long-term relationship and others won't. And we've previously documented the VMware and SAP angst.

BT150 2024:

- BT15O CXO zeitgeist: Vendor procurement, cool projects and margin compression

- BT150 CXO zeitgeist: Data lakehouses, large models vs. small, genAI hype vs. reality

- BT150 CXO zeitgeist: Low marks for SAP RISE, process automation, change management, AI risk

- BT150 CXO zeitgeist: AI trust, AI pilots to projects, VMware angst, projects ahead

- BT150 nominations | 2024-2025 class

What is going on here? A few thoughts on why CxOs are increasingly annoyed with their software vendors, which appear to be aggressive.

- The value provided by the software is mostly horizontal and not necessarily differentiating to the customer's industry. The copilot use cases beyond coding and haven't delivered scalable value just yet. Nevertheless, SaaS vendors are under pressure to show they are monetizing generative AI.

- Software vendors are playing the annual contract value (ACV) game, but customers want to cut budget. Vendors are happy to sell you more stuff (even if it won't be used) so they can show growth. Customers are looking to hold the line on enterprise IT spending or cut to fund more interesting projects.

- The margin compression is just starting for software vendors and they can smell the upheaval. My hunch is that terms like "elongated sales cycles"

- Enterprise buyers want to consolidate vendors and standardize contracts, but not at the expense of lock-in.

- AI is more of a threat to software vendors than a turbocharger. When you buy SaaS you're getting easier upgrade cycles, more innovation and a consumption model. In many cases, you're also getting a UI. What happens when the UI becomes a natural language generative AI bot? Suddenly the enterprise vendors that grew by relegating rivals to plumbing suffer the same fate.

- There's little competition right now. Enterprise software is the land of giants and smaller startups that aren't ready to scale. As a result, the bench looks thin, and vendors are looking to press their advantage.

- It's unclear how this plays out, but some CxOs are leaning toward build over buy. Others are plotting their escapes from overzealous vendors. The real game may not play out for 2 years or so when a) generative UI upends the SaaS market; b) new entrants smell the opportunity to disrupt incumbents.

One thing is clear: No software vendor is going to see ACV going up without delivering value and lowering customer costs. A vendor's ACV chart in an earnings report isn't the enterprise buyer's problem.