Box reported better-than-expected first quarter results and raised its outlook as its content and unstructured data platform carves out a key role as enterprises move to AI agents.

Speaking on an earnings conference call, Box CEO Aaron Levie said customers are upgrading to the company’s Enterprise Advanced plan to leverage Box AI. Box also released a State of AI in the Enterprise Survey, which found more than half of the 1,300 IT leaders surveyed expect transformation from AI in the next two years. Ninety percent of respondents are using AI agents in some capacity with unstructured data and documents a primary use case.

"Box AI Agents will enable enterprises to streamline a due diligence process on hundreds or thousands of documents in an M&A transaction, correlate customer trends amongst customer surveys and product research data, or analyze life sciences and medical research documents to generate reports on new drug discovery and development," said Levie. "None of this would have been possible even a year ago."

The Box earnings follow the company's rollout of Box AI Agent integration for Microsoft 365 Copilot, IBM watsonx Orchestrate, Google Agentspace, Slack AI, ServiceNow AI Agent Fabric and Zoom AI Companion as well as the Box Model Context Protocol (MCP) server. Box is also officially integrated with OpenAI's ChatGPT's deep research agent. If there's a foundational model such as Meta's Llama or Grok, Box plans to integrate.

- Box's master plan: Be the unstructured data enabler of agentic AI

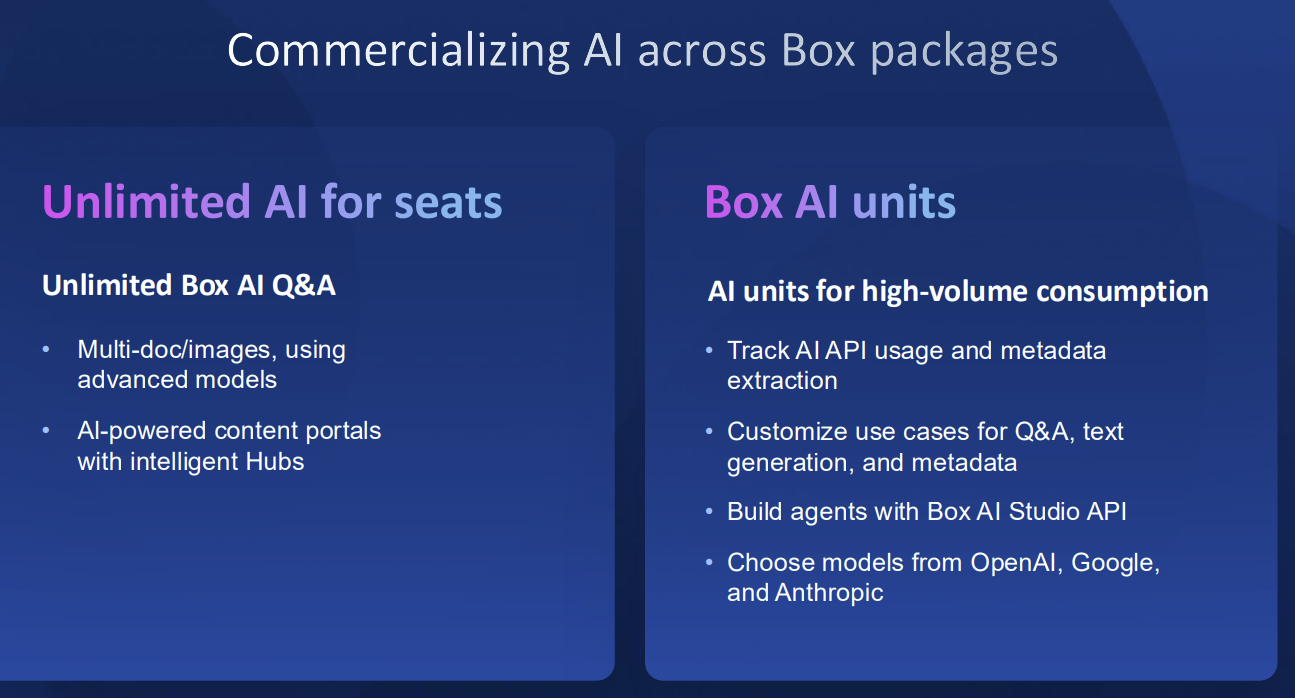

- Box launches new AI features, Box AI Units

Levie added that Box is also benefiting from lower compute costs for AI inference and model improvements.

"On the AI inference side, we've just been very happy about the rate of like-for-like AI model improvements that we're seeing from a cost standpoint. And that can show up in 2 ways. The first is that you can take an existing use case and it might just on a one-to-one basis, be cheaper on a kind of pretty regular basis every kind of 6 to 12 months at a minimum," said Levie. "The alternative is that you get a new capability unlock because you can -- you either get the base model just is getting much better or you can use an existing model and do multiple passes through the model for better accuracy or more complex use cases."

AI use cases will ultimately be margin-neutral, said Levie, who added that Box's pricing is based on seats and credits instead of use case based pricing.

The numbers

Box reported first quarter earnings of $3.51 million, or 2 cents a share, on revenue of $276.27 million, up 4% from a year ago. Non-GAAP earnings were 30 cents a share.

Wall Street was expecting Box to report first quarter adjusted earnings of 26 cents a share on revenue of $274.77 million.

Billings in the first quarter were $242.3 million, up 27% from a year ago. Remaining performance obligations (RPO) of $1.47 billion, up 21%, or 17% on a constant currency basis.

As for the outlook, Box projected second quarter revenue of $290 million to $291 million, up 8% from a year ago. Non-GAAP earnings will be between 30 cents a share and 31 cents a share. Wall Street was looking for second quarter earnings of 28 cents a share on $284.1 million.

CFO Dylan Smith said economic uncertainty hasn't had an impact on Box's business, but it wanted to "remain prudent" with its outlook for fiscal 2026. Box is also navigating currency fluctuations given a big chunk of its business is in Japan.

Box projected annual revenue to be in the range of $1.165 billion to $1.7 billion, up $10 million from its previous guidance, with adjusted earnings of $1.22 a share to $1.26 a share. Wall Street was looking for adjusted earnings of $1.19 a share for fiscal 2026.

Where Box sits in the AI agent ecosystem

Given Box's content platform is a repository and management system for valuable unstructured data, Levie said the company is "sitting very naturally at the center of so much of the innovation happening in AI right now."

Levie added that Box is not competing with any of the AI model providers. Instead, Box is a meeting place where models can add value to customer data. Box also serves as a secure place for content that adds a layer of governance.

"We act as a very natural kind of convening point for these AI models when customers want to be able to use data with any of these leading platforms," said Levie. "You want to ensure that data access controls are actually maintaining the security of your information. And so you don't want to be in a position where you're trying to pack too much of that intelligence into the model layer, you want to pack that into the data plane and the architecture around that, which is what Box provides customers."

By sitting in the data plane, Box has more appeal to regulated customers as well as mission critical AI use cases, he added. Levie said Box will occupy two layers of the AI stack including the software plane for end user interaction and platform via APIs. Monetization will be based on seats and usage for agent queries going into Box.

"We want to execute on both of those as fast as possible and in tandem because no single company is going to decide where all of the user does their work. It's just not possible," said Levie. "We want to make sure that you can manage your content one place and ensure that it works everywhere."

Constellation Research analyst Holger Mueller said:

"Box keeps innovating, doing the right for customers, but cannot lift its revenue back into the teenage growth numbers, which is the least investors expect from an innovative AI company. The current quarter flirted with the inflation rate, meaning that Box was treading water… The promise of AI changing how people will upgrade their future of work with documents is becoming clearer and clearer – and if Box can unleash the acceleration potential in the best practices shift, it may well grow again as it should. On the downside are the commoditization pressures that Box has been fighting since the pandemic."

Bottom line: It's early in AI agent use cases, but Box is seeing billings growth, interest for Enterprise Advanced and high-level CxO conversations. Based on those leading indicators, it's just a matter of time until Box sees accelerating revenue growth.