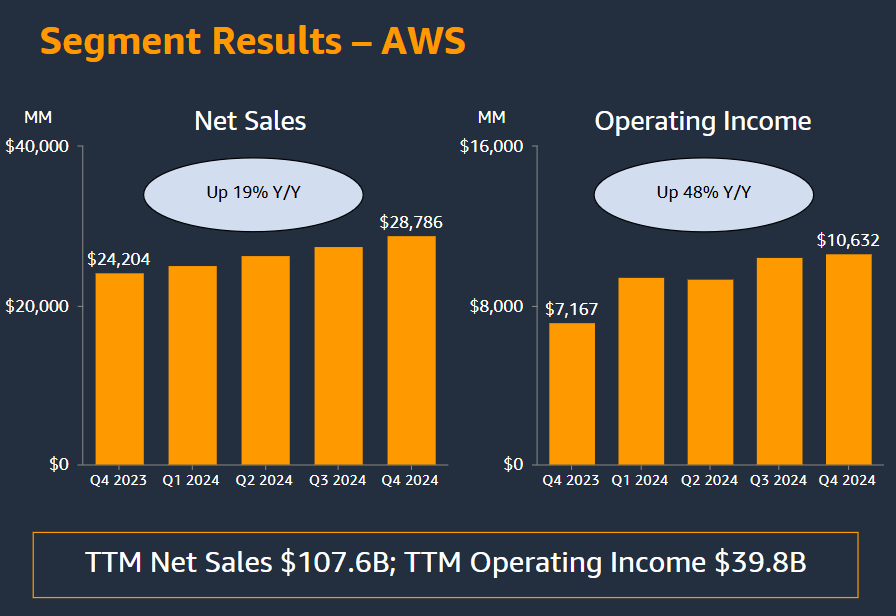

Amazon Web Services revenue growth checked in at 19% in the fourth quarter as parent Amazon handily topped estimates. Amazon's outlook, however, was mixed.

AWS reported operating income of $10.6 billion in the fourth quarter on revenue of $28.8 billion as the annual run rate topped $115 million. AWS in the third quarter also grew at a 19% clip. AWS in the fourth quarter had re:Invent where it outlined its AI strategy.

- AWS re:Invent 2024: 7 takeaways after drinking from the firehose

- AWS CEO Garman Q&A: Model choices, competition and AI's future

- AWS re:Invent 2024: Four AWS customer vignettes with Merck, Capital One, Sprinkr, Goldman Sachs

- Amazon Bedrock vs. DIY approaches benchmarked

Rvals Microsoft Azure and Google Cloud showed revenue growth just above 30% but are working off of a lower base. Microsoft Azure and Google Cloud growth also decelerated sequentially. Amazon CEO Andy Jassy said:

“When we look back on this quarter several years from now, I suspect what we’ll most remember is the remarkable innovation delivered across all of our businesses, none more so than in AWS where we introduced our new Trainium2 AI chip, our own foundation models in Amazon Nova, a plethora of new models and features in Amazon Bedrock that give customers flexibility and cost savings, liberating transformations in Amazon Q to migrate from old platforms, and the next edition of Amazon SageMaker to pull data, analytics, and AI together more concertedly.”

Hyperscale results:

- Google Cloud revenue up 30% in Q4, Alphabet results mixed

- Meta on DeepSeek, custom silicon, AI optimizing engineering and business

- Microsoft Q2: Azure revenue growth of 31%, AI revenue run rate of $13 billion

Amazon reported fourth quarter earnings of $20 billion, or $1.86 a share, on revenue of $187.8 billion, up 10% from a year ago. Wall Street was expecting Amazon to report fourth quarter earnings of $1.48 a share on revenue of $187.23 billion.

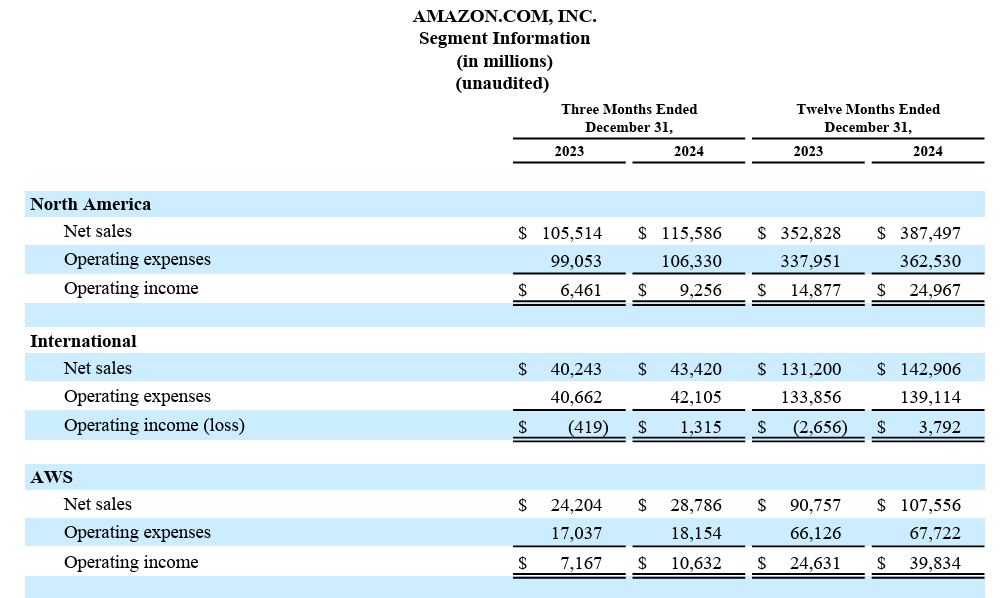

Here's the breakdown by unit:

- Amazon North America operating income in the fourth quarter was $9.3 billion on revenue of $115.6 billion, up 10% from a year ago.

- Amazon international reported operating income of $1.3 billion on revenue of $43.4 billion, up 9%.

- AWS delivered the most operating income for the company.

For 2024, Amazon reported net income of $59.2 billion, or $5.53 a share, on revenue of $638 billion, up 11%. AWS reported operating income of $39.8 billion on revenue of $107.6 billion.

As for the outlook, Amazon projected first quarter revenue of $151 billion and $155.5 billion, up 5% to 9% from a year ago. Amazon said it will take about a $2.1 billion hit from foreign exchange rates. Operating income will be between $14 billion and $18 billion in the first quarter.

One of the big questions was how much AWS would spend on building it AI infrastructure. It’s also worth noting that Amazon’s capital expenditures, which are on a run rate of more than $105 million a year and $26.3 billion in the fourth quarter, also include distribution centers, supply chain improvements and technology. Hyperscale cloud players’ AI buildout was questioned considering DeepSeek, which was a lower cost model from China. Amazon spent $23.6 billion on technology and infrastructure in the fourth quarter.

DeepSeek: What CxOs and enterprises need to know | GenAI prices to tank: Here’s why

Nevertheless, cloud providers said they’ll keep spending heavily on AI infrastructure. Alphabet will spend $75 billion in 2025 on capital expenditures. Microsoft said it will spend $80 billion on AI data centers. Meta is planning to spend $60 billion to $65 billion on AI in 2025 and end the year with 1.3 million GPUs. Project Stargate will spend $500 million on US AI infrastructure.

Here's what Jassy had to say on the call:

- Jassy said the AWS build out needs to continue. "We could be growing faster if not for some of the constraints on capacity," he said. "A lot of that comes from power constraints."

- "We were impressed with what DeepSeek has done with some of the training techniques, primarily in flipping the sequencing of reinforcement training, reinforcement learning being earlier and without the human the loop. We thought that was interesting, ahead of the supervised fine tuning. We also thought some of the inference optimizations they did were also quite interesting."

- "Virtually all the big generative AI apps are going to use multiple model types and different customers going to use different models for different types of workloads. You're going to see us provide as many leading frontier models as possible for customers to choose from."

- "Sometimes people make the assumptions that if you're able to decrease the cost of any type of technology component that it's going to lead to less total spend in technology. In this case, we're really talking about inference. But we've never seen that to be the case."

- "The cost of inference will substantially come down. I think it will make it much easier for companies to be able to infuse all their applications with inference and with generative AI."

- Amazon saw a $700 million headwind from foreign exchange rates, more than anticipated.

- Third party sellers were 61% of items sold in 2024.

- Same day delivery serves 140 metro areas.

- "We also remain squarely focused on costs to serve in our fulfillment network, which has been a meaningful driver of our increased operating income. We talked about the regionalization of our US network. We've also recently rolled out our redesigned us inbound network, while still in its early stages, our inbound efforts have improved our placement of inventory so that even more items are closer to end customers."

- "We've reduced our global cost to serve on a per unit basis for the second year in a row, while at the same time increasing speed, improving safety and adding selection. We see opportunity to reduce costs again, as we further refine inventory placement, grow our same day delivery network, accelerate robotics and automation throughout the network."

- Amazon ad revenue was $17.3 billion in the fourth quarter, up 18% from a year ago.

- AWS will be lumpy over the next few years due to enterprise adoption cycles, capacity and advances, "it's hard to overstate how optimistic we are about what lies ahead for AWS customers and business."

- Enterprises including Databricks, Adobe and Qualcomm are testing Trainium2 now. Trainium3 will be in preview in late 2025.

- Thousands of AWS customers are using Amazon Nova models including Palantir, SAP, Fortinet and Robinhood.

- "While AI continues to be a compelling new driver in the business, we haven't lost our focus on core modernization of companies' technology infrastructure from on-premises to the cloud."