Enterprise procurement departments are already annoyed with software-as-a-service contracts and AI agents--and the consumption-based models that go with them--are likely to make deals even more complicated.

Welcome to the new world of enterprise software--licenses, seats and a heavy dose of credits and consumption charges. Get ready for conversations like the following:

CFO: "Our IT operating expenses are running hot."

Procurement: "Yeah, we were dinged by extra AI packs, power ups and consumption units."

IT: "We need to optimize our AI agent costs. These $2 conversations with AI are adding up."

Within a few weeks you can rest assured that your enterprise software providers will be layering in consumption models. On the bright side, CIOs are used to consumption models from their hyperscale cloud providers including AWS, Microsoft Azure and Google Cloud as well as data platforms such as Snowflake and Databricks. The bad news: CIOs have struggled to manage those cloud consumption costs for years.

In recent weeks, we've seen the following:

- Monday.com will introduce AI Blocks, Product Power-ups and Digital Workforce. These tools are designed to streamline and automate processes with AI. Monday.com will offer a generous free tier and then you can buy AI credits from there.

- ServiceNow outlined its AI agent pricing with a hybrid approach that blends seats, subscriptions and consumption. CEO Bill McDermott said the model is a "Goldilocks scenario" for ServiceNow and customers. "Customers can start with a base subscription, which they like. They want that flag in the ground, so they can predict their spend and their current ROI schemes. But then, they obviously want to take advantage of agentic AI and yet at the same time, the industry is early in its formation," said McDermott.

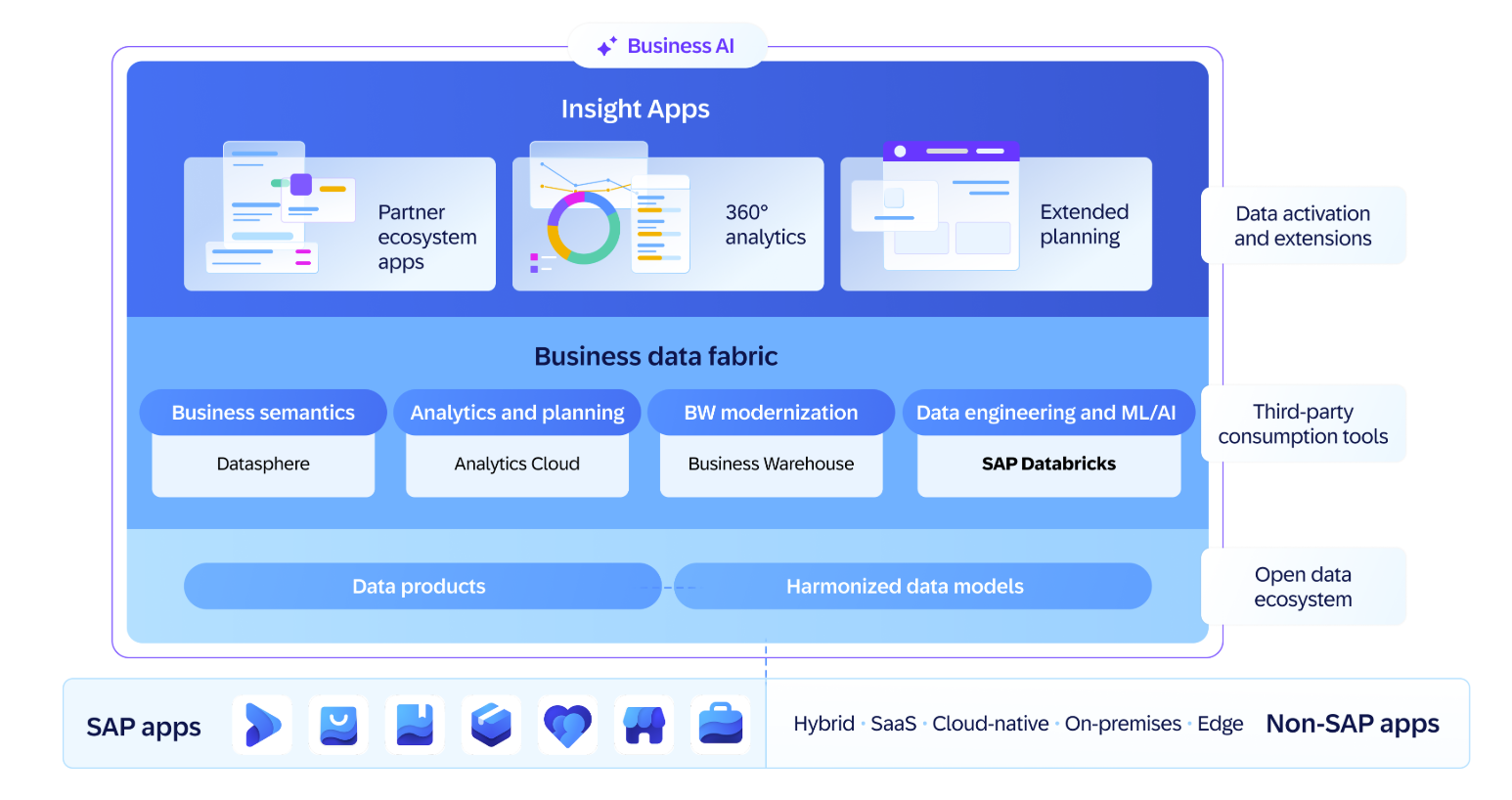

- SAP outlined AI and data strategy as well as a partnership with Databricks that will likely include consumption pricing.

HubSpot CEO Yamini Rangan explained on the company's fourth quarter earnings call that the company's approach has been to create an AI-first product without add-ons for AI. Monetization has come by raising prices for the overall product. Going forward, hybrid models based on seats and usage will be the norm for AI agents.

"I do think that the future of pricing for AI will be hybrid. We'll have both seat based and usage based pricing. Right now, we're focused on delivering value with our agents and as more customers get consistent value with AI, we will introduce usage based pricing," explained Rangan. "The pricing model will be a combination of usage and seats based pricing. But what is really important is that we will consistently focus on delivering value first before adding on to our seat-based models and then monetizing based on usage."

And those are just some recent examples. Salesforce monetizes Agentforce via consumption pricing, Adobe has sold credits for its AI usage and Dynatrace, Confluent and others are going the same route. You can expect a consumption announcement from a SaaS vendor almost weekly going forward.

What does this mean for the enterprise buyer?

Consumption will surge. These consumption models from software vendors often include a healthy free tier because they want more usage. Once enterprises move past free tiers there will be a learning curve to optimize costs and AI agent use cases. Remember how shocked companies were when they thought the cloud cut costs? Get ready for the SaaS-y version. The good news is that DeepSeek and cheaper models will also bring down prices.

Transparency will be at a premium. AI agents are going to require pricing transparency that SaaS vendors aren't used to providing. Enterprise software vendors will need to provide the same dashboards and consumption dashboards that hyperscale cloud players deliver. One customer, who is an early adopter of AI agents, said he expects that same cost transparency from his SaaS vendor as he gets from AWS. If anything, SaaS vendors should have better transparency.

- Agentic AI: Three themes to watch for 2025 | Agentic AI without process optimization, orchestration will flop

Cloud marketplaces will be critical. Efforts like AWS Marketplace that enable enterprises to purchase software and roll up procurement under one dashboard will become popular. Procurement is already coming around to cloud marketplaces and consumption transparency will accelerate that move.

- Big software deals closing on AWS Marketplace, rival efforts | AWS Marketplace adds 'Buy with AWS' as it expands reach, woos procurement departments

It's unclear who will manage the digital labor force. One news item that was notable this week was the Workday Agent System of Record. The big idea is that Workday already manages human capital and it can extend into digital capital, aka AI agents too, and track returns and onboarding.

Attribution of outcomes will be the missing link in AI agent consumption models. Ron Miller, operating partner and head of editorial at boltstart ventures, said on DisrupTV that figuring out what vendor is responsible for an outcome is going to be messy. Miller said: "If you start talking about outcome pricing as another element of consumption-based pricing it's chaotic. Who was responsible for the outcome? Was it the Salesforce piece? Was it the Box piece? Was it the ServiceNow? That's just another piece of all this."

Customers will demand cross-platform AI agent transparency. Miller's take revolves around the harsh reality of AI agents today: Every vendor thinks enterprises only operate on one platform. The reality is that there will be AI agent workflows that may be connected from AWS to Google Cloud to Salesforce to Workday to ServiceNow. How do you optimize that mess when each vendor has different pricing? AI agents will make those per-core pricing schemes look straightforward.

The Goldilocks scenario will be delayed. McDermott obviously thinks that the seat, subscription and consumption hybrid model is a win-win for vendors and customers, but I'll bet that there will be a lot of grumbling on the way to Goldilocks.