Accenture said it may start seeing the effects of a US government funding pause and enterprises growing cautious amid geopolitical and economic volatility.

Speaking on Accenture's second quarter earnings conference call, CEO Julie Sweet laid out the current conditions for the consulting giant. Accenture Federal Services accounted for 8% of the company's global revenue and 16% of Americas revenue in fiscal 2024.

She said:

"As you know, the new administration has a clear goal to run the Federal government more efficiently. During this process, many new procurement actions have slowed, which is negatively impacting our sales and revenue. In addition, recently, the General Service Administration has instructed all federal agencies to review their contracts with the top 10 highest paid consulting firms contracting with the U.S. government, which includes Accenture Federal Services.

The GSA's guidance would determinate contracts that are not deemed mission critical by the federal -- by the relevant federal agencies. While we continue to believe our work for federal clients is mission critical, we anticipate ongoing uncertainty as the government's priorities evolve and these assessments unfold."

That caution has spilled over to enterprises, which have gone from bullish at the end of 2024 to uncertain. Other vendors have also noted that enterprises have turned cautious in recent weeks.

Sweet said enterprises have only recently turned cautious and haven't paused spending just yet. See: AI? Whatever. It's all about the first party data

"We are seeing an elevated level of what was already significant uncertainty in the global economic and geopolitical environment, marking a shift from our first quarter FY ‘25 earnings report in December," said Sweet. "Businesses are trying to process what this (volatility) might mean."

The forecast from Accenture lands as its results for the second quarter were solid excluding new bookings growth.

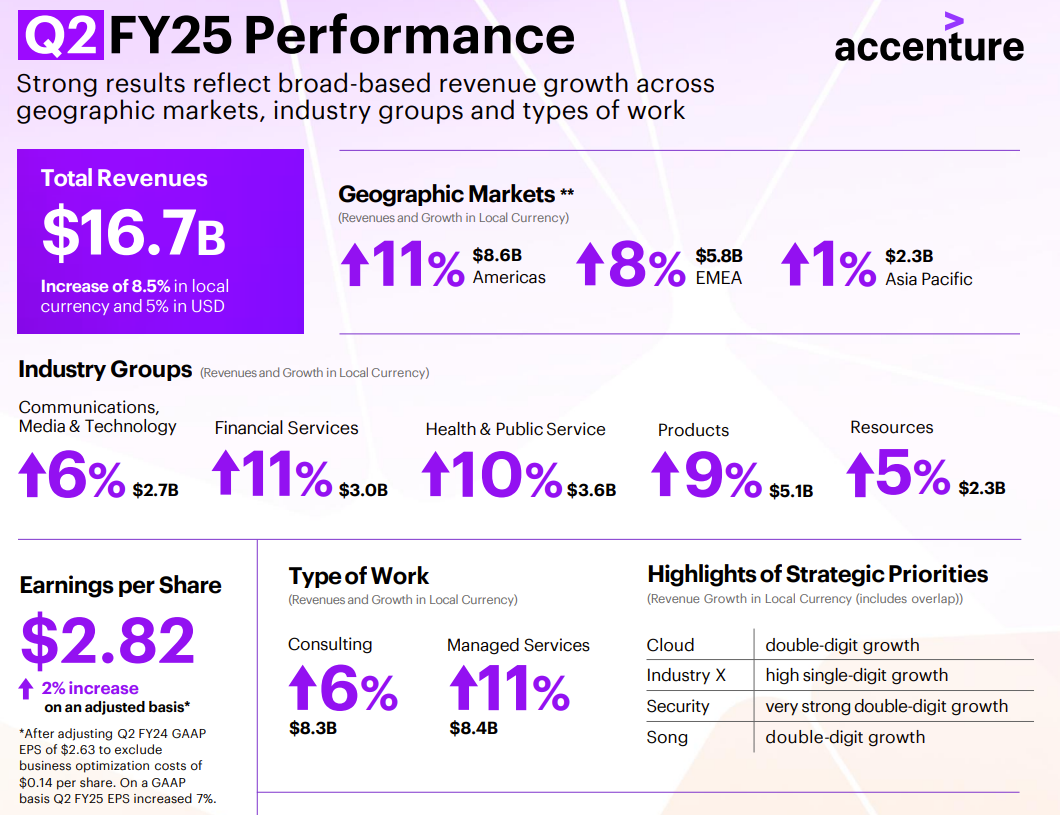

For the second quarter, Accenture reported earnings of $2.82 a share on revenue of $16.7 billion, up 5%. Both top and bottom lines beat estimates. Accenture saw $1.4 billion in generative AI bookings in the quarter.

The issue for Accenture is that new bookings for the second quarter were $20.91 billion, down 3% from a year ago. New bookings growth in the first quarter was only 1%. That slowdown in new bookings may indicate a great pause amid uncertain economic conditions.

As for the outlook, Accenture said its third quarter revenue will be between $16.9 billion and $17.5 billion compared to estimates of $17.22 billion. For fiscal 2025, Accenture projected revenue growth of 55 to 7% compared to 4% to 7% last quarter.

AI projects to save the day?

Sweet said Accenture is still seeing strong demand for AI services. Enterprises are focused on their "digital core with more AI being built-in."

"For our clients, the twin themes of achieving both cost efficiency and growth continue. The number of clients embracing Gen AI is increasing significantly and we are starting to see some tangible examples of scale in data and AI," said Sweet.

Accenture is also scaling its AI Refinery platform that focuses on business processes and agentic AI. Sweet cited customer wins in manufacturing, automotive, food and telecom via a partnership with Telstra, a leading telecom in Australia.

Sweet added that Accenture is using its AI Refinery platform and automation to cut costs with AI.

In the end, Accenture may be seeing a tale of two businesses. AI and data projects will get funding and everything else is downgraded. Sweet said the US geopolitical and economic picture is uncertain and it's unclear how customers will react, but spending in Europe could pick up. Sweet said:

"Everyone is well aware that in the last few weeks, there's been an elevated level of what was already significant uncertainty and there's a couple of big themes around that, obviously tariffs, and that's a global discussion that is not just an Americas discussion.

And there’s consumer sentiment, which is a little bit more of an Americas discussion. We're already in the heart of the discussions of clients globally who are talking about it."