Enterprises are betting on generative AI and digital transformation at the expense of other IT projects, but scaling AI is difficult and more foundational work is needed, according to Accenture CEO Julie Sweet.

Sweet, speaking on the company's second quarter earnings call, said Accenture saw 39 clients with quarterly bookings topping $100 million. The company also had more than $600 million in generative AI bookings to reach $1.1 billion in generative AI sales for the first half.

That's the good news. The bad news is enterprises are prioritizing large transformation projects that convert to revenue more slowly. Sweet said:

"We see clients continuing to prioritize investing in large-scale transformations which convert to revenue more slowly, while further limiting discretionary spending particularly in smaller projects. We also saw continued delays in decision-making and a slower pace of spending.

Our clients are navigating an uncertain macro-environment due to economic, geopolitical, and industry-specific conditions. And in response, we are seeing them thoughtfully prioritize larger transformations, building out their digital core to partnering, to improve productivity, to free-up more investment capacity to focus on growth and other initiatives with near-term ROI."

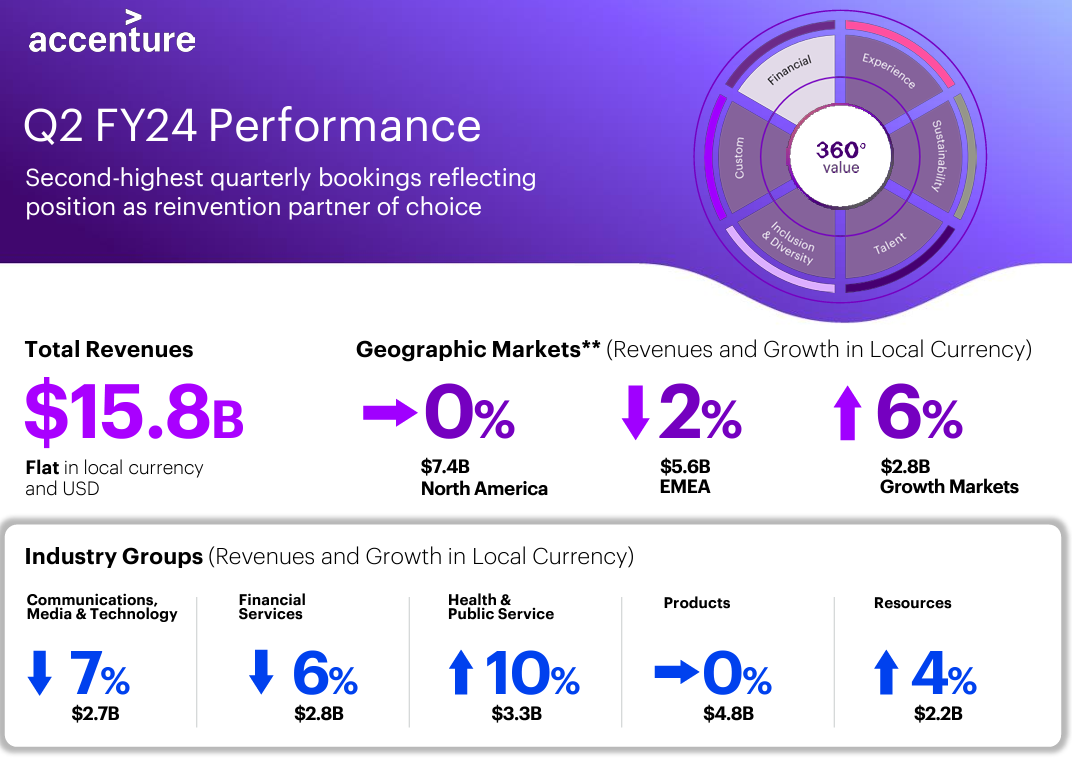

Revenue in the quarter was flat for the second quarter even though Accenture saw mid-single digit growth or higher in six of its 13 industries.

Overall, Accenture reported second-quarter revenue of $15.8 billion, flat from a year ago, with earnings of $1.71 billion, or $2.63 a share.

Accenture's outlook for the third quarter fell short of expectations. The company projected third quarter revenue between $16.25 billion to $16.85 billion, below Wall Street estimates of $17 billion. Full year revenue will be between 1% and 3%. Analysts were looking for growth of 2% to 5%.

Sweet said enterprises are now "near universal recognition of the importance of AI," but "most clients are coming to grips with the investments needed to truly implement AI across the enterprise and nearly all are finding it difficult to scale, because the AI technology is a small part of what is needed."

- Accenture goes big on AI reskilling, acquires Udacity, launches LearnVantage

- Accenture's Paul Daugherty: Generative AI today, but watch what's next

- Accenture sees human-ish AI, spatial computing, body-sensing tech on horizon, but timing is everything

Indeed, Sweet said companies with strong data and digital cores are moving quickly. Laggards are investing in digital core and new processes. "We are working closely with our ecosystem partners to help our clients understand the right data and AI backbone that is needed and how to achieve tangible business value," said Sweet, who noted that 2024 budgets were just recently set and there's caution about the economy.

Here's a look at some of the enterprise technology spending takeaways from Accenture:

- Enterprises pulled back on spending for Accenture services and smaller projects at the beginning of the year.

- Accenture is focused on market share and meeting customers where they are.

- Cloud, data and AI are leading priorities.

- Companies are substituting projects instead of adding to budgets.

- Foundational data projects are necessary, and those transformation projects are heavier lifts.

- Companies are dialing back services because they are more discretionary. Large transformations are happening because the need to replatform is critical.

Sweet said:

"You can't just jump to the great data foundation. You need to be in the cloud. You have to have modern platforms. The clients during these higher bookings rate are making big transformations oftentimes to be ready to put in the data foundation. Only 40% of workloads are in the cloud and 20% of those roughly haven't been modernized. Many of our clients haven't put in the platform--if you don't have the major ERP platforms that are modern, you don't create a data foundation to fuel GenAI. You've got to build the digital core. And there's a lot more to go."