So, take a look at my musings on the event here: (if the video doesn’t show up, check here)

No time to watch – here is the 1 slide condensation

(if the slide doesn’t show up, check here):

Want to read on? Here you go: As I do with major events – I share my top three positives and top three concerns.

Top 3 Positives

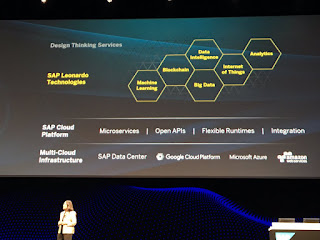

Leonardo – SAP unveiled a new offering, running on top of SAP Cloud platform and bringing together existing products and offerings (Analytics, IoT), nascent offerings (e.g. Machine Learning) and brand new offerings (e.g. Blockchain) as well as pre-natal ones (BigData and Data Intelligence), all with the purpose to enable SAP customers to build solutions in the age of Digital Transformation. But products, offerings and technology aren’t enough, to get the customer requirements, SAP wants to run Design Thinking workshops with customers, starting in Q3. That’s a very different and new approach for a standard application vendor (or SaaS if you will), more of the consulting offering of a system integrator or a consulting company. SAP would not be SAP if it would not plan to enable partners in the near future. Last but not least the Leonardo offerings and products require a different licensing approach: While traditionally enterprises had to buy and license products before they could experiment, SAP plans to provide products during the Design Thinking projects free of charge. So, a very new offering, go to market, implementation and licensing approach. Hopefully SAP doesn’t create confusion around Leonardo now, nobody wants a HANA confusion repeat. |

| McDermott opens SapphireNow |

In the past I have often criticized SAP to bring it’s R/3 code into S/4HANA. Despite all improvements, simplifications, it means 20th century best practices are being baked into a 21st century offering. With technology disruption (most prominently BigData and Deep Learning) a complete new set of business best practices will have to evolve. Plattner nailed half of the equation how he learnt Finance by ICI in the 70ies and created finance software. The problem for all SaaS vendors is – enterprises don’t know the best practices of the 21st century – yet. They need to experiment, risk, fail and win. This phase is a nightmare for SaaS vendors – as they want to sell the same software to 1000s of enterprises. This is why Leukert was right in his keynote to call [PaaS] a life line for enterprises (and SaaS vendors). When enterprises find no fit in SaaS software, they need to build for these new practices. SaaS vendors with no PaaS – or not good enough capabilities will lose these enterprises to PaaS vendors… With this background, SAP’s move with Leonardo is truly honest in the implicit confession that the new best practices need to be fleshed out in … Leonardo projects.

|

| Impressive SAP Stats |

SAP is out of the IaaS business – and more Google. When SAP announced the Azure partnership at Sapphire 2016, I predicted that this was the end of SAP’s IaaS ambitions. At Sapphire 2017 SAP stopped short of saying this explicitly, but with Google’s Greene on stage with Leukert, SAP has now partnerships with Microsoft, AWS and Google (and don’t forget IBM, the first partner in fall 2014). It makes sense for SAP not to focus on IaaS after a few failed inhouse attempts and to focus on PaaS and SaaS (and more DaaS – see below). And AWS, Google and Microsoft are doing all they can for the SAP load, all announced new memory rich instance types (because of HANA’s RAMetite (RAM + Appetite = RAMetite). Good for SAP customers and good for SAP, as a better return of R&D can now be expected from SAP and more CAPEX for R&D (I would hope).

|

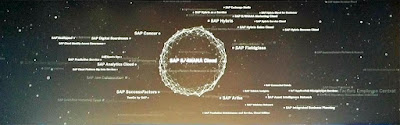

| All SAP SaaS Properties |

Empathy lived – Last year McDermott used empathy as the Leitmotiv of Sapphire. 12 months later SAP has made progress, but the verdict remains open if a technology vendor can be empathetic with its customers. The good news for SAP customers is that the effort remains on going, is genuine and shows some promising data points. No better proof point than McDermott announcing free static reads to data, along the line ‘it’s your data’ – in the overall indirect access turmoil that SAP has gotten itself into. Falling back to the proven engine pricing for order interfaces has worked for SAP in the past. SAP now has to define what ‘static access’ means operationally and bring more clarifications to the indirect access dilemma. The good news is that in conversations with random customers, most have stated tender beginnings of SAP becoming more empathetic with customers. It’s a marathon here, and we have not even reached 5k mark. The direction is good for SAP vis a vis its core competitor Oracle, which has an ultra-marathon ahead (to use the same analogy), should Oracle even decide to run in this race.

Top 3 Concerns

S/4HANA adoption – SAP pulled a key trick from the high-tech vendor bags of tricks: If you don’t have a good story (S/4HANA adoption) tell a new one (Leonardo). The truth is simple, it takes a long time to build a new ERP suite. It took Oracle almost 10 years, why would it be dramatically faster for SAP, at the end it’s the same functionality. And as much as customer love simple, too simple doesn’t run their business, hence the very low S/4HANA cloud adoption numbers. But not addressing the adoption, way forward and roadmap in the keynote leaves the install base empty handed and many SAP customers will travel home with the new Leonardo story – but not much keynote coverage for ECC, Suite on HANA and even S/4HANA customers. If this was an accident or deliberate omission doesn’t matter, and SAP can fix this with Solution Manager and Transformation Navigator. |

| Greene & Leukert |

SAP & Hadoop – it remains rocky – A regular reader knows the concerns I have articulated many times with SAP – the lack of support for ‘spinning rust’ – aka HDD, aka ultra large cheap storage of digital information. Literally every next generation application scenario that creates digital disruption runs on Hadoop and uses MapReduce to understand data. I ask Plattner the question every time I can at Sapphire and got mildly optimistic, when Plattner agreed SAP needs a story here (after, body language doesn’t lie and an audible of then CTO Clark on ‘social networks’) in 2015: SAP mustered Vora as a response, but Vora suffers the same in-memory malaise like HANA being constrained to Spark. On Wednesday Plattner ‘relapsed’ to the ‘HANA can index external data and then bring in data as needed’, but that approach degrades HANA to an (way too expensive cache) on top of PB of Hadoop data. My hope is that SAP will get aware of this gap in its capabilities with the Leonardo workshops. If they are truly transformative, Hadoop support will be flagged in almost every one of them. Today the lack of native Hadoop / MapReduce makes the ‘lifeline’ that Leukert mentioned very thin to not existing for customers looking at SAP Cloud Platforms. SAP IoT capabilities are hamstrung without Hadoop / MapReduce and a warning sign for Leonardo scenarios that risk to be sub par.

|

| Leonardo |

The sprawling SAP portfolio – As important and probably the right move Leonardo is, it’s another offering for SAP to create, maintain and operate. At the same time, SAP operates literally a ‘zoo’ of technology across Ariba, Concur, Fieldglass, Hybris, SuccessFactors and on. And as good as pragmatism in regards of this heterogeneity is in the short term, SAP needs to address it in the long term. The long time it takes for SAP to make Fiori real across this vast portfolio is telling and it is ‘only’ a UX. With conversational interfaces replacing UX as we know it, the rollout of Fiori gets overtaken by UX innovation. A warning sign for any application vendor. Plattner plead for higher development speed maybe be based on the same realization.

And the vast SAP portfolio has repercussions for enterprises, from the ‘fasten your seat belt’ user experience to incompatible extension frameworks and a higher TCO in system administration (doesn’t matter if it’s born by the SAP customer or SAP itself, a $ spend more in admin is a $ missing somewhere else). It would be good (and empathetic!) for SAP to identify the long, long convergence roadmap of the product portfolio.

Tidbits

SAP and Machine Learning – In a presentation of SAP Chief Innovation Officer (is that a CIO or CInO?) Juergen Moeller we learnt that SAP has chosen Google Tensorflow as its neural network framework of choice. Not a hard decision, as Tensorflow is winning the Machine Learning race on what is really working at the moment, neural networks, best self (or deep) learning neural networks. Google’s leadership and the cross-platform portability makes this the right decision for SAP.SAP Cloud Platform – Is getting attention and spotlight it needs and deserves, see the Leukert quote. Good that SAP CP remained out of the Leonardo offerings, it needs to be the platfom for SAP going forward, not part of the family of new technologies that are ingredients for digital transformation. As such it needs to be good enough to host Leonardo offerings and bridge the various runtimes it operates (CloudFoundry, Neo and now even (likely Kubernetes) and somewhere there is an ABAP server that runs S/4HANA). The good news is that freshly minted CTO Goehrke is keenly aware of the challenges, one can only wish him and the team good luck (and resources).

HANA and Vora – are both rolling on towards SP2 for later in the year. Adoption of HANA Express is well, prominently feature in the SAP and Google partnership. With the IaaS vendors racing to provide larger memory instances, HANA gets more viable in regards of a platform for SAP and beyond SAP use cases. Important for the product for the impeding Leonardo projects.

SAP Digital – The unit headed by former CMO Becher always has a good and interesting idea at events. This time it was a SIM card that can be used for IoT. SAP connoisseurs will know that SAP acquired a substantial telco business in the Sybase ‘Goodie bag’ – with Sybase 365. SAP can offer a SIM card based on the relationships with telecom providers worldwide, as Sybase 365 drives almost all SMS and MMS traffic worldwide. An interesting offering to solve the last mile IoT challenge, which depending on the perspective can really also be the first mile.

SAP Data Network – We caught up with former CIO Arnold who is now heading the SAP Data Network, a startup inside of SAP that is chartered with moving SAP in the DaaS age. The group partners with customers in rapid projects to bring more value to their data. The two first projects – benchmarking on SAP Fieldglass data and re-thinking the elevator installation experience with a prominent elevator manufacturer are the two first showcases. It is good to see SAP thinking about DaaS, which has to become a substantial revenue stream for SAP customers (and SAP) going forward

The Build Tool becomes (even) more prominent – One of the best moves in the industry to empower the long tail of usability – the screens only few users use operate have usability challenges with – is the SAP Build tool. I called it UXaaS at the time, as it empowers end users to take their usability destiny in their own hands. No surprise – Build will be a key tool in the Leonardo Design Thinking workshops. We will be watching.

Fiori & Co-Pilot – Fiori is now 4 years old, and with SAP tackling pricing issues 3 years ago – should be widely adopted across the variety of SAP products, but it isn’t. Technology stack challenges and diversity, customer and competitive pressures another reason to not get to a common Fiori look & feel. With the rise of conversational interfaces, SAP us creating the SAP Co-Pilot, but not many details are available. With Google announcing Google Assistant for iOS the other day (and bringing the Google voice recognition to iOS) the answer for the voice recognition part is given. That chairman Plattner wants to work with Apple is interesting on the topic, but reveals some need to catch up on the latest in speech recognition (Google is miles ahead now).

Customer References – SAP did a good job with customers using their new products. We learnt on the IoT uptake from a Latin American agricultural vehicle provider, we learnt how SAP CP helped create a unique customer experience at an automotive manufacturer and how SAP HANA and Vora allow banks to improve their anti-money laundering activities. All good examples what SAP can do, and how early adopters are using its products.

SAP & Apple gains steam – With the joint Fiori SDK now available, SAP customers are building iOS apps. We learnt about a European gas station network that allows to pay via smartphone at the pump. And even more interesting, delivering shop products to customer busy at the car filling up. Innovative, possibly disruptive capabilities that the partnership has enabled. With 2 week training initiatives on the way, the developer community can now learn how to build Apple / SAP Fiori apps. If it will increase device sales, the original hope of Apple, remains to be seen.

IBM Watson to make SAP Ariba more intelligent (and Procurement awesome) – On SAP Ariba’s quest to make procurement awesome, intelligence has never hurt. And IBM Watson can help making purchasing contracts more intelligent. IBM also has a small army of consultants that can help with the effort, as well as help the Emptoris customers to use new Ariba / Warson capabilities. A good example of what is possible when ‘elephants’ like SAP and IBM partner – plenty of synergies all around.

SAP Hybris Innovation Labs – At the Hybris reception, we had the chance to take a look on what is coming from the innovation labs in Munich, conveniently in a windowless room in Orlando. The infinite shopping cart allows shoppers to pick up a NFC device in a store, scan products of interest and store them on a barcode at exit. The same barcode can then later have used to bring the cart ‘alive’ again e.g. in a browser. The other demo was a conversation with the Hybris assistant Charly, about a conversation based shopping experience. Charly knows about location and speech recognition was very good – all the way to power a transaction. Both are interesting showcases what next gen applications can do to disrupt retail.

SuccessFactors keep eliminating Bias – Last year SuccessFactors unveiled its plans to use machine learning to eliminate bias in HR decisions. 12 months later there is progress and encouraging results. Check out the Facebook video on a conversation with Dr. Gabby Burlacu and Patty Fletcher (see here). I also had the chance to catch up with Ludlow on the latest development at SuccessFactors, having missed the analyst summit, and good things are coming later this year (can’t say more).

Developer Outreach – Always good to meet with the developer evangelists Grassl and Cmehil, though force in unusual attire by SAP dress code. But they survived the attire and are always at the forefront of SAP going beyond its traditional ecosystem, with reach out to CloudFoundry, Microsoft, AWS and more recently Google.

Transformation Navigator – What’s the default response of a software company to a problem? More software – and the Transformation Navigator is the answer here. Customers can see what they could achieve if they move from point A to B. B includes S/4HANA as well as existing and future Leonardo offerings. A good approach to empower the customer – but also an effective way to reduce the resilience on sales people to share roadmaps – and replacing them with a consistent tool. We will see how successful the Transformation Navigator will be in a few quarters.

MyPOV

A good Sapphire for SAP customers and SAP, sensibly improved over the 2016 edition, with better keynotes and an exciting as well as necessary new offering with Leonardo. SAP keeps pushing on all fronts, it now needs to make sure that SAP Cloud Platform can run Leonardo, doesn’t get spread too thin across different IaaS infrastructures. And SAP takes a gamble with Leonardo Design Thinking workshops – what if the needed capabilities are not with SAP Leonardo (yet) but the customer needs and wants to transform? And goes elsewhere? But by now there is no way back.Effectively SAP is telling customers, don’t worry too much about S/4HANA, digital disruption will shake and rock your enterprise before you make that decision. Leonard is here to prepare you for the digital storm to come – or even become a digital disruptor. The rest of ERP, no matter if ECC, Suite on HANA or S/4HANA will be a 2nd class of priority problem. A taxi company disrupted by Uber or Lyft is also not worried about its call center solution, but to get a mobile app with superior customer experience out there. And in the meantime, SAP can get S/4HANA in the shape that complex SAP customers can move to it – maybe in a few years. A lot of reading between the lines from yours truly, take it with a grain of salt.

Exciting times ahead.

Want to learn more? Checkout the Storify collection below, it's about the Day #1 keynote, the Day #2 keynote is here and the 10 Questions I had before SapphireNow are here. (if it doesn’t show up – check here).