Microsoft’s latest study shows enterprises’ pace of cloud computing adoption continues to accelerate. Nearly half of the respondents (45%) report they have cloud-based applications running in production environments. 58% report that they selectively target new applications and projects for cloud computing.

Microsoft’s latest study shows enterprises’ pace of cloud computing adoption continues to accelerate. Nearly half of the respondents (45%) report they have cloud-based applications running in production environments. 58% report that they selectively target new applications and projects for cloud computing.

Microsoft commissioned 451 Research to complete one of the most comprehensive global surveys to date of hosting and cloud computing, titled Hosting and Cloud Go Mainstream releasing the results earlier this month. The 74 page slide deck of results provides a wealth of insights into the current and future state of hosting and cloud computing. 451 Research constructed the methodology to include interviews with 2,000 companies and organizations of all sizes from 11 countries, with more than a third of respondents coming from the United States. Microsoft and 451 Research provided the slides showing the result of screener questions, which provides a useful context for analyzing the survey results.

Here are the key take-aways from the study:

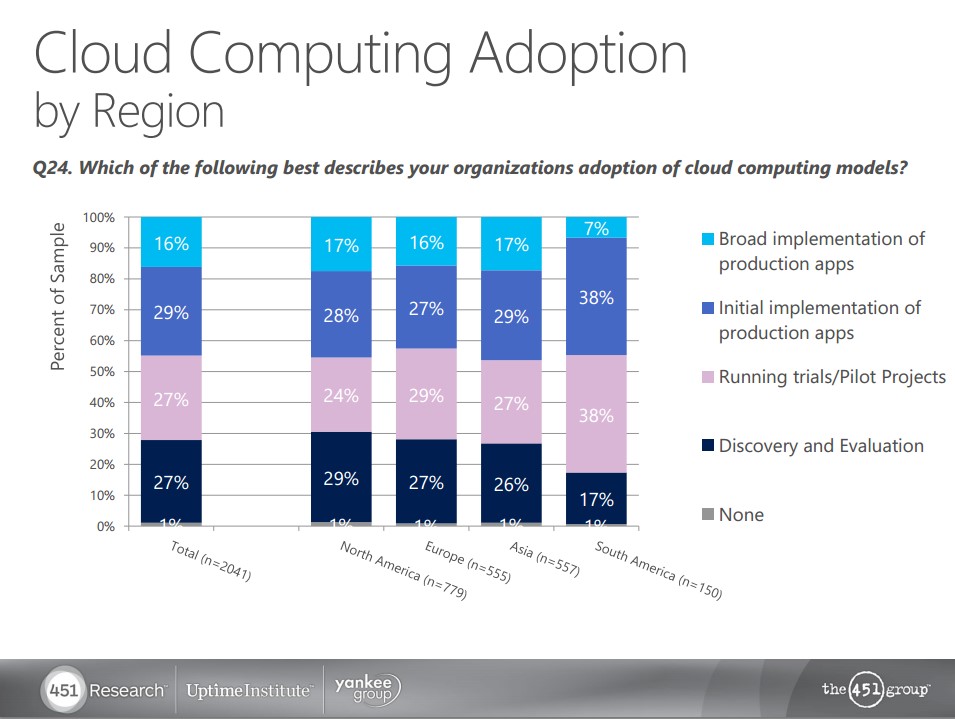

- 45% of enterprises globally are running production-level cloud computing applications today. North America and Asia have the greatest percentage of enterprises reporting broad implementation of production cloud-based applications (17% each). North America has the greatest percentage of enterprises in the discovery and evaluation phase of cloud computing adoption at 29%.

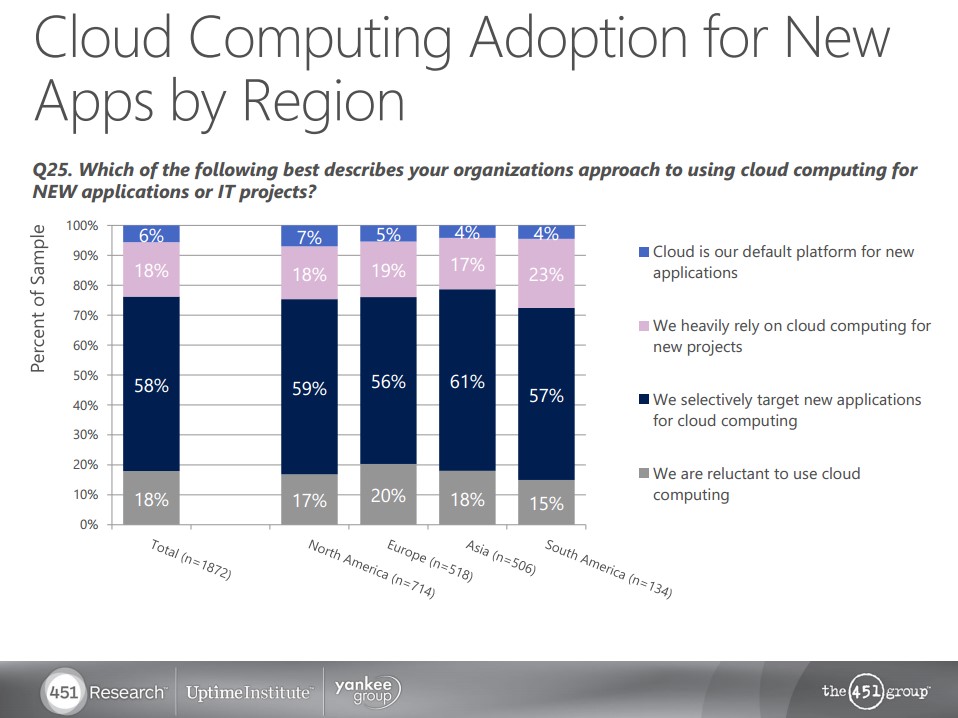

- 58% of global enterprises are selectively target new applications for cloud computing, with 18% heavily relying on cloud computing for new projects. The following graphic shows the distribution of organizations’’ approaches to using cloud computing for new applications or IT projects.

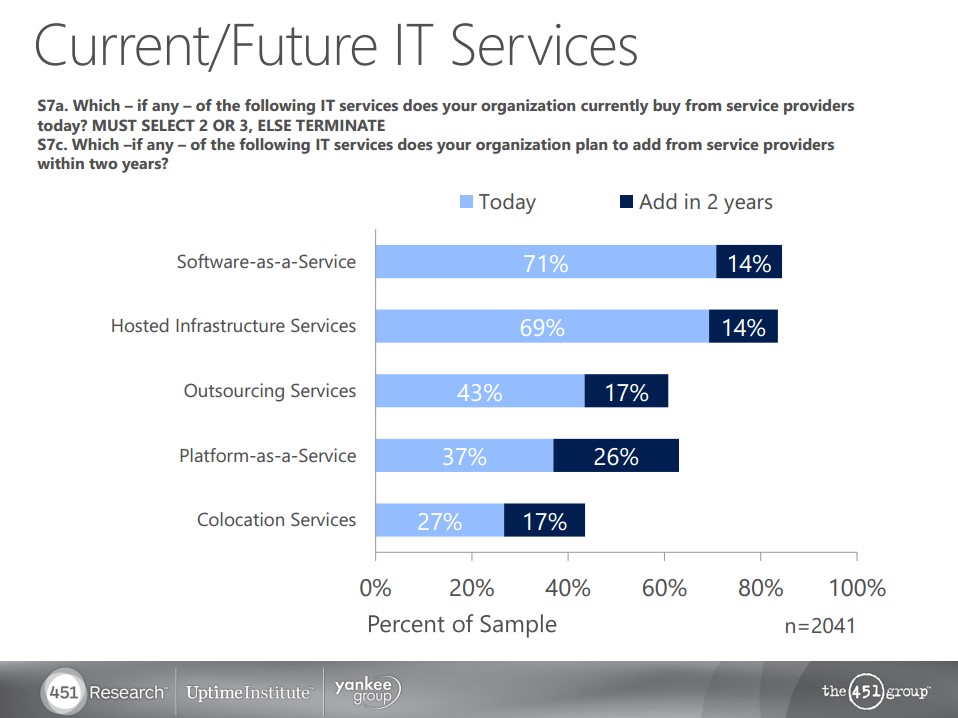

- SaaS (71%) and Hosted Infrastructure Services (69%) are the two most common IT services currently purchased today, with 14% growth forecasted in each by 2016. The fastest growing category is Platform-as-a-Service (PaaS), with 37% purchasing these services today projected to grow another 26% in two years.

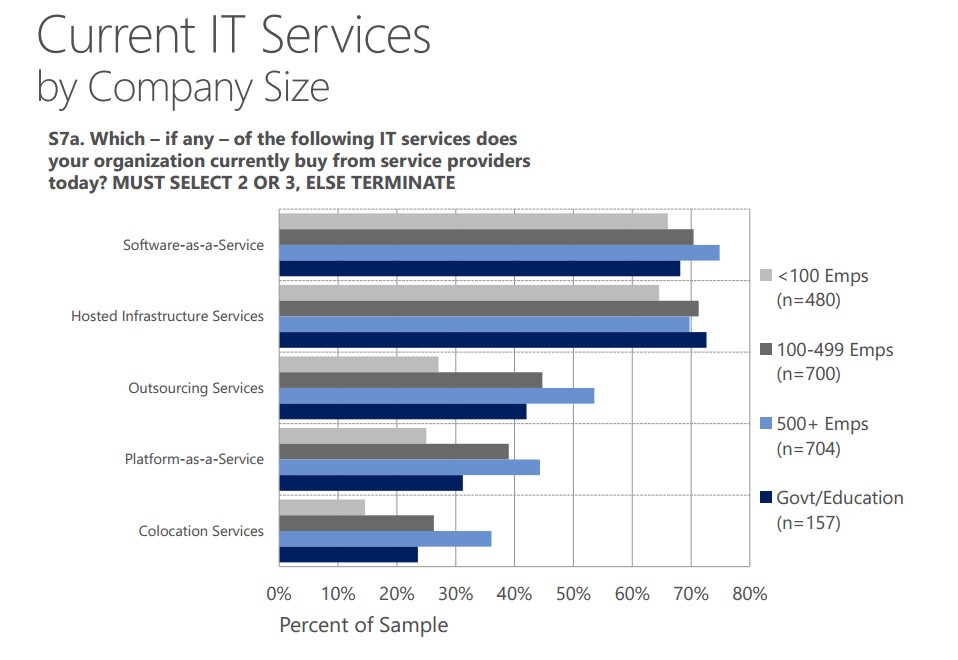

- SaaS is most prevalent in enterprises with over 500 employees, and Hosted Infrastructure Services, in government and education. Please see the graphic below for the distribution of responses by IT service and organization type.

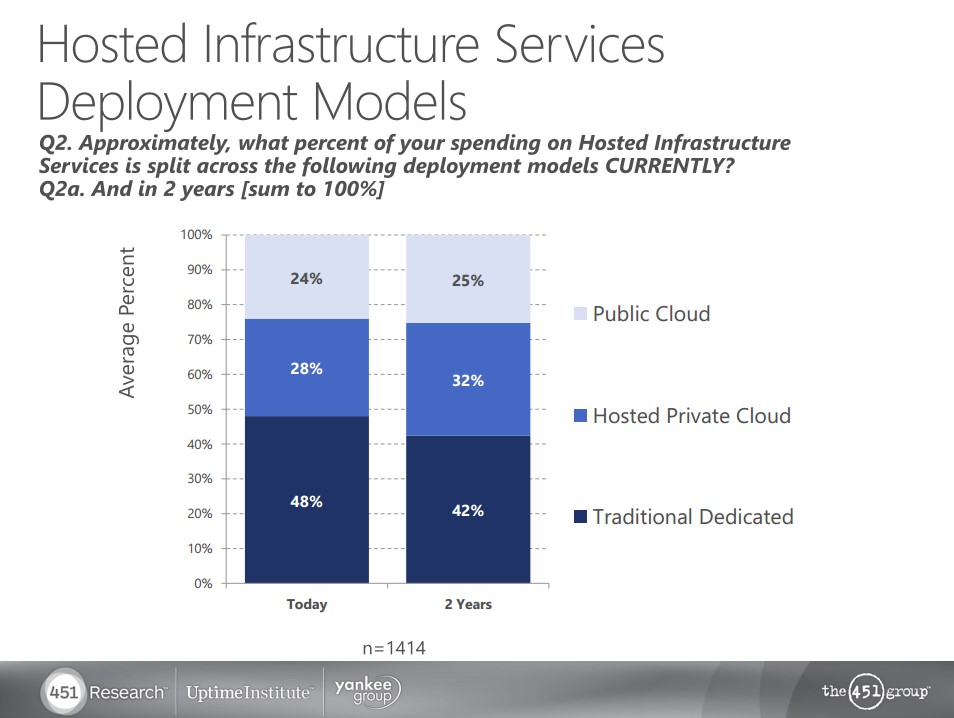

- Spending on hosted private clouds will increase from 28% of spending today to 32% in 2016, with traditional dedicated infrastructure services dropping from 48% to 42%.

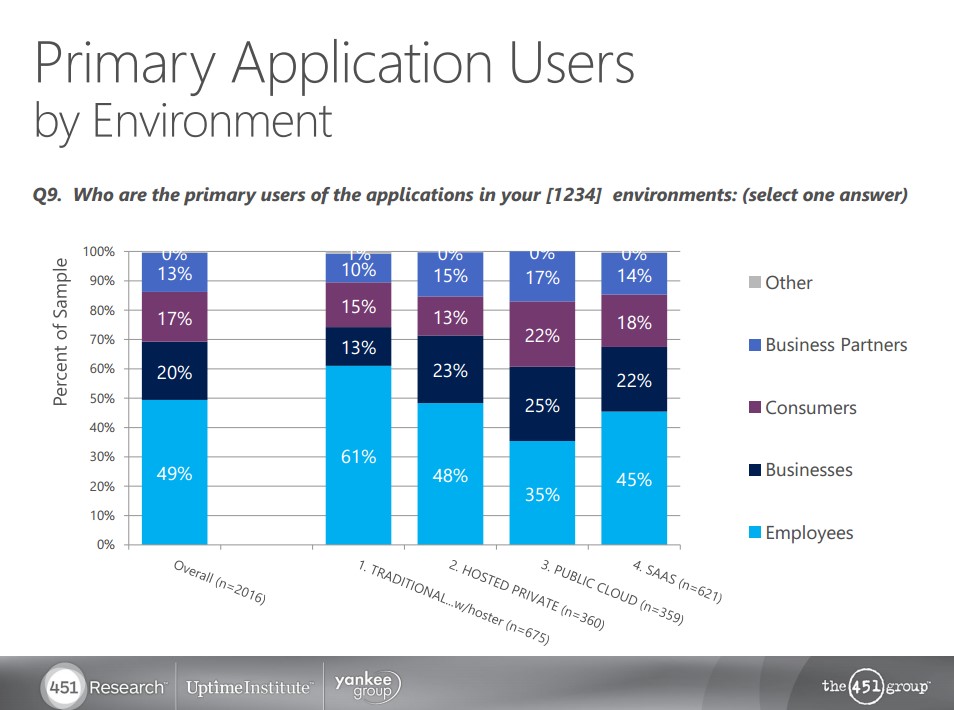

- The majority of SaaS users are employees (45%) followed by businesses (which could be interpreted as suppliers and the broader supply chain) (22%), consumers (18%) and business partners (including distribution channels (14%).

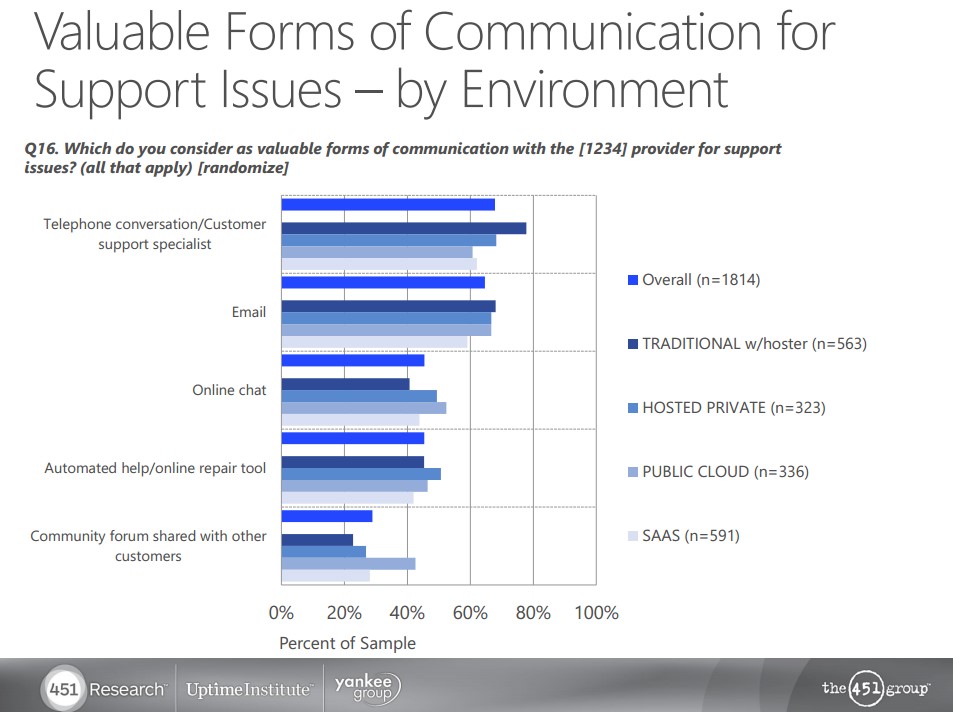

- Telephone conversations with customer support specialists is the most valuable form of communication (just over 60%) across all support channels. It is also the most preferred channel for SaaS support.

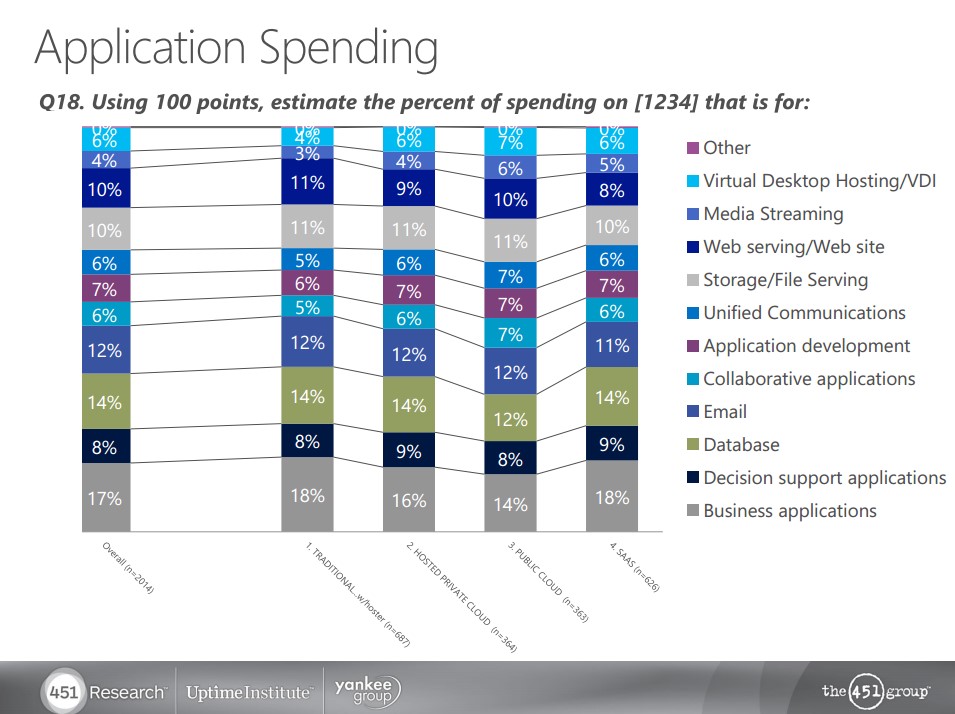

- Business applications (17%), databases (14%) and e-mail 12%) are the top three application spending categories today in hosted and cloud applications. The following graphic breaks out spending by hosting and cloud configuration.

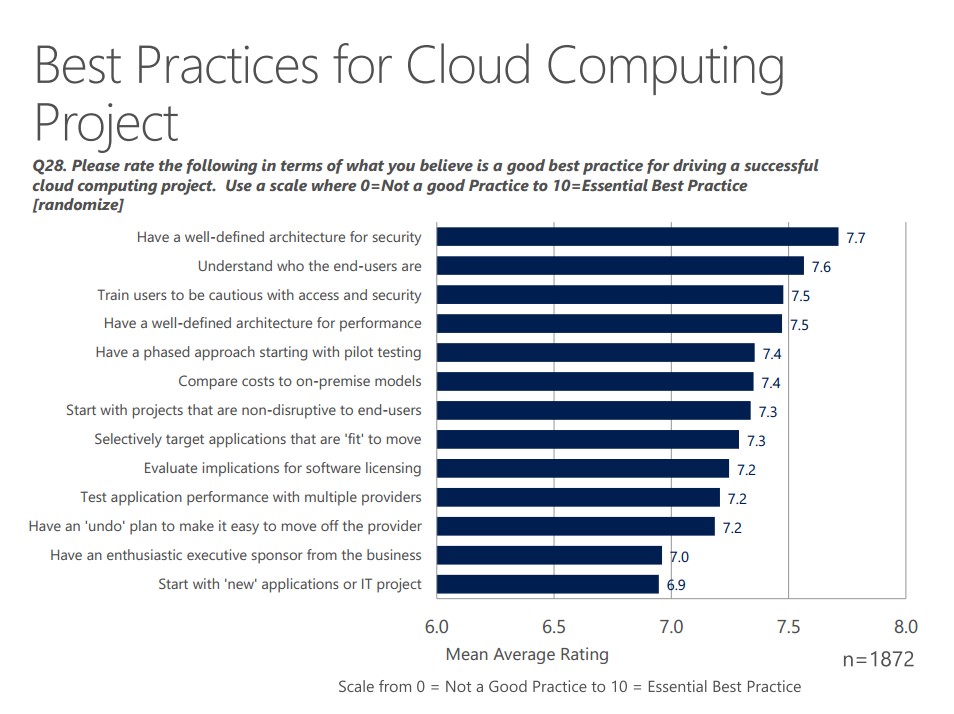

- Having a well-defined architecture for security (7.7 out of 8.0), understanding who the end-users are (7.6) and train users to be cautious with access & security (7.5) in addition to having a well-defined architecture for performance (7.5) are the three top best practices for cloud computing projects.

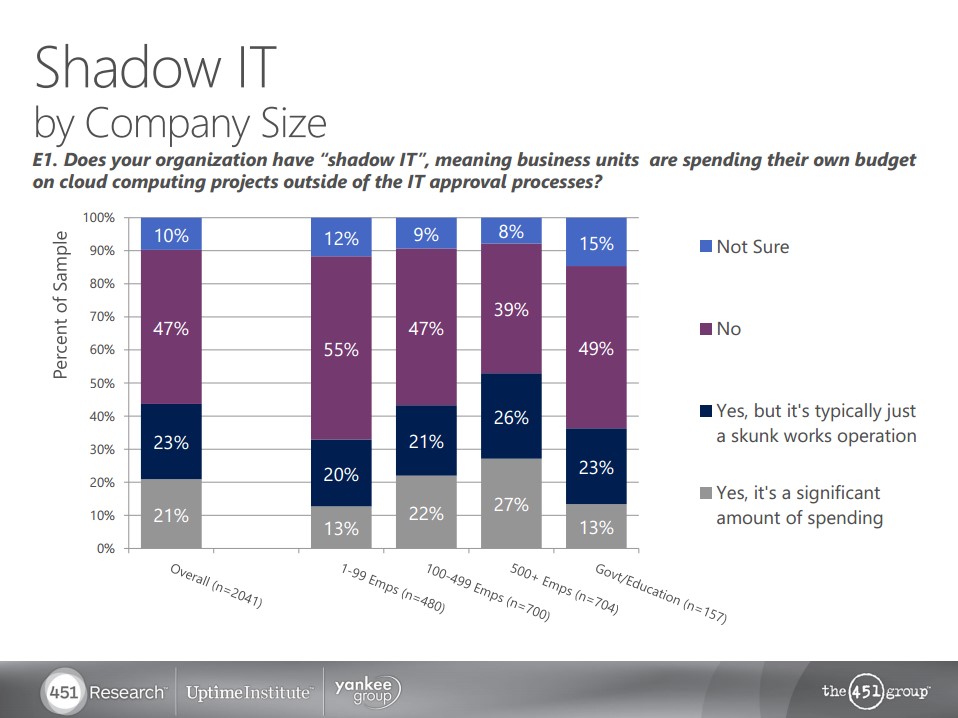

- 44% of enterprises globally have “shadow IT”, meaning business units are spending their own budget on cloud computing projects outside of the IT approval processes. The following graphic provides the breakdown by type of organization included in the survey.

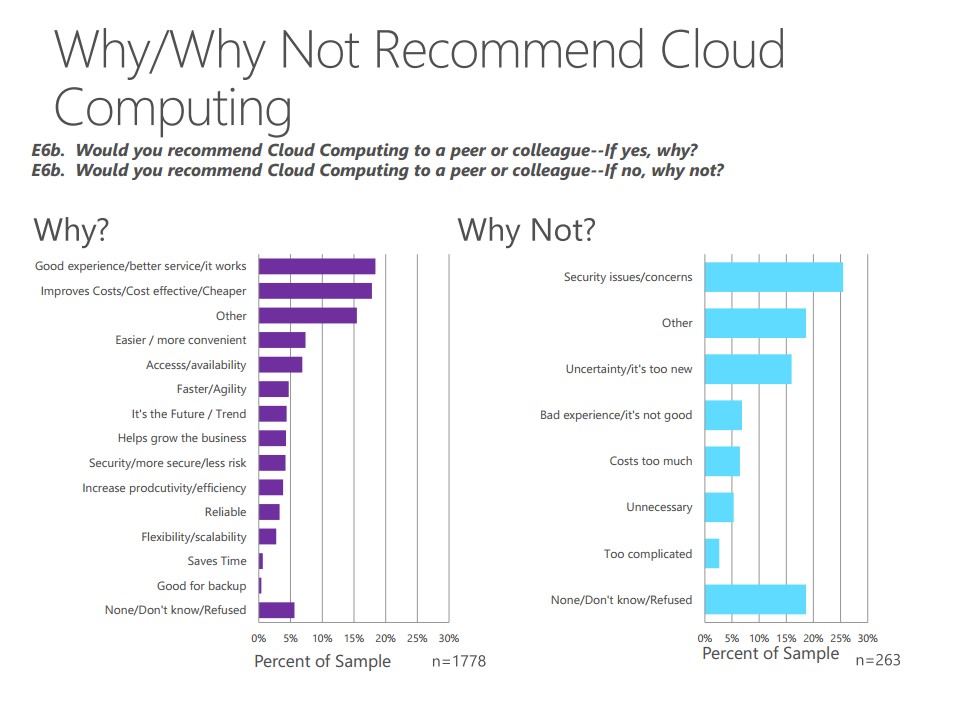

- 87% of respondents globally would recommend cloud computing to a peer or colleague and 13% would not. When asked why or why not, respondents most often mentioned a good experience and better service/it works (approximately 17%), followed by improving costs/cost effective/cheaper (approximately 16%). Security issues and concerns (25%) and uncertainty/it’s too new (approximately 16%) are the reasons for not recommending cloud computing.