About this Constellation ShortList™

The Revenue Platforms sector continues to be a crowded one, even as consolidation starts to enter into the equation. While these solutions started out as tools for improving upon the foundational limitations of legacy sales automation systems, these offerings have advanced to the point of becoming elemental when it comes to managing the bulk of B2B sales engagement cycles. Additionally, the use cases for these tools is extending outside new sales – as more customer success and renewals professionals utilize these tools to help solidify more holistic growth plans across organizations.

Artificial intelligence will continue to play a leading role in the roadmaps of most of these providers - creating more predictive and prescriptive recommendations to sales to optimize when, where and with whom they engage on a daily basis. Additions of more communications channels (such as chat) via acquisitions further extends the value of these solutions as critical tools for sales execution. Also, how these providers continue to provide more complete, accurate and relevant lead and other first-party customer data in the wake of new privacy mandates and degradation of third-party cookies will determine which providers offer the most value to users.

Again, this is still a very active market considering the lower saturation versus more legacy solutions like core sales automation. We estimate the market at about $4 billion in 2024, and continue to expect the market to approach $20 billion by 2030, equating to 28.3% CAGR.

Threshold Criteria

Constellation considers the following criteria for these solutions:

- Automated activity capture of engagement and interactions for revenue activity

- Account-based engagement analysis

- Delivery of next-best actions to sales reps

- Unification of customer interactions across the revenue lifecycle

- Intelligent prioritization of insights

- Revenue and pipeline forecasting and management

- Seamless integration with customer experience (CX) touchpoints

- Conversational intelligence

- Outbound productivity insights

- Pipeline insights

- Deal and opportunity insights

- Lead response insights

- Real-time guidance and notifications

- Performance metric benchmarking on revenue key performance indicators (KPIs)

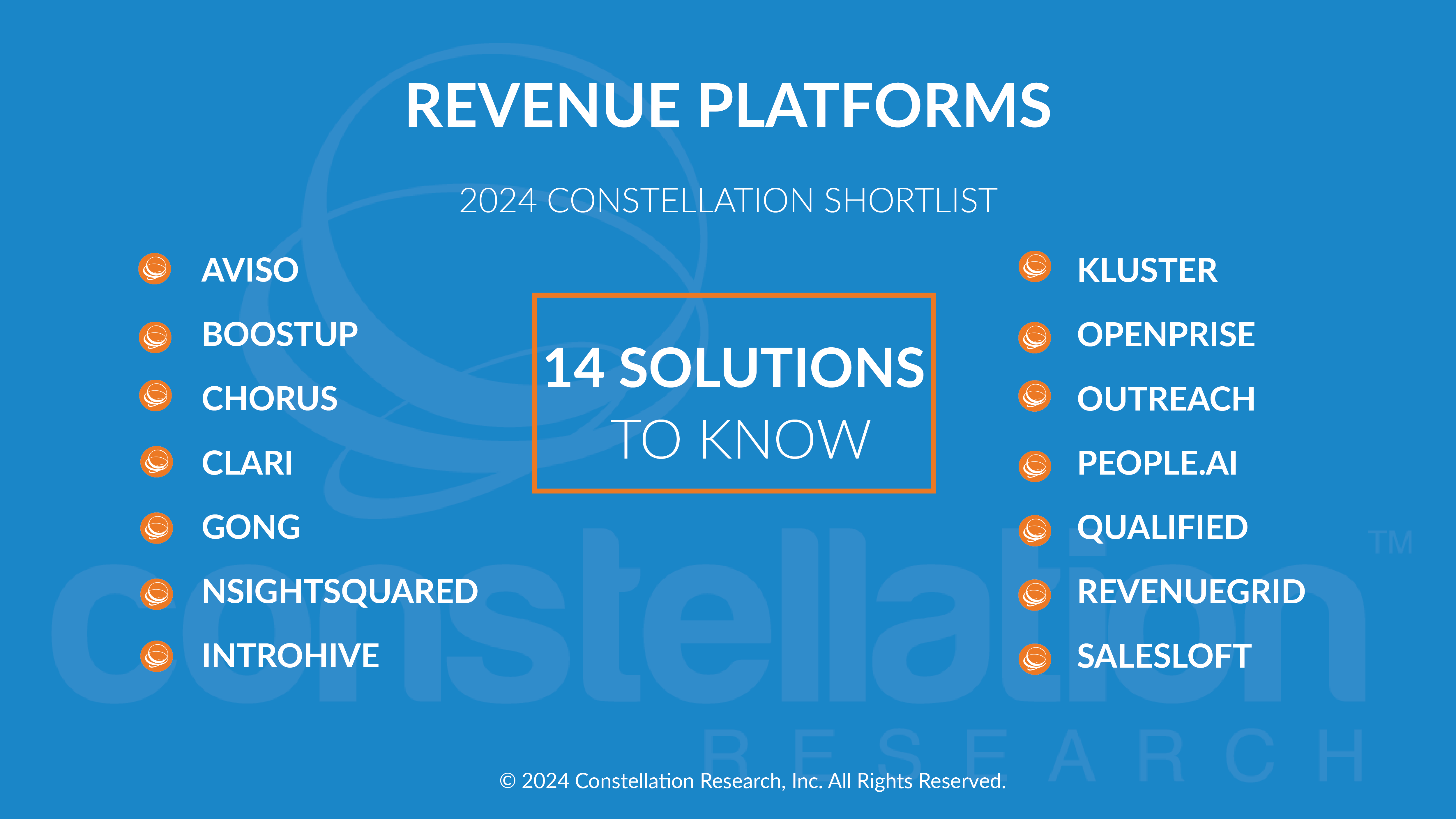

The Constellation ShortList™

Constellation evaluates more than 50 solutions categorized in this market. This Constellation ShortList is determined by client inquiries, partner conversations, customer references, vendor selection projects, market share and internal research.

- AVISO

- BOOSTUP

- CHORUS

- CLARI

- GONG

- INSIGHTSQUARED

- INTROHIVE

- KLUSTER

- OPENPRISE

- OUTREACH

- PEOPLE.AI

- QUALIFIED

- REVENUEGRID

- SALESLOFT

Frequency of Evaluation

Each Constellation ShortList will be updated at least once per year. There could be an update after six months, should the analyst deem it necessary.

Evaluation Services

Constellation clients can work with the analyst and research team to conduct a more thorough discussion of this ShortList. Constellation can also provide guidance in vendor selection and contract negotiation.