About This Constellation ShortList™

Much hype has been made about the metaverse. However, very few organizations have fully grasped the impact the metaverse will have on experiences and engagement for both the consumer world and the enterprise. More than just gaming worlds or hardware devices, the metaverse economy brings new opportunities for brands and enterprises to bring their physical presence and 3D digital presences together in one unified offering to their stakeholders—customers, employees, partners, and suppliers.

Metaverses are digital worlds that can parallel physical worlds or create fictional worlds that allow people to do anything they desire in a digital life. Today’s metaverse worlds are often walled gardens but future designs will have more interoperability. Constellation estimates the overall metaverse economy to be worth a market cap of $20.7T by 2030.

CxOs who want to get an early start with metaverse use case in order to gather experience, create differentiation and to be an early adpter can use this list to start (and possibly even go live) on metaverse applications in 2024.

To be included in this shortlist, vendors need to support at least two of the use cases for metaverse, base their offering in the public cloud, utilize AI across the whole meta ecosystem they create and operate, have at least 20+ offerings in general availability by end of 2024 and pilots in the remaining use cases mentioned below. Moreover, they have to be in a strong financial position for the massive investments needed to make the metaverse real in the next years, have at least 100 ongoing customer engagements and operate on at least two of the seven continents.

Threshold Criteria

Constellation considers the following criteria for these solutions:

- A cloud-based solution

- At least one operational offering by end of 2022.

- A number of pilots in above use cases in 2022.

- Financial position to operate and launch metaverse offerings in 2023.

- At least 50 ongoing customer engagements

- At least operational on 2 continents

- A cloud-based solution

- At least three operational offering by end of 2023.

- A number of pilots in above use cases in 2023.

- Financial position to operate and launch metaverse offerings in 2023.

- At least 75 ongoing customer engagements

- At least operational on 3 continents

- Functional coverage of at least two metaverse use cases from the following list:

- Collaboration and meetings

- Recruiting

- Onboarding

- Training

- Internal comms

- Digital twins

- Advertising and search

- Marketing

- Sales

- Commerce

- Customer service and support - Live events

- Gaming- A cloud-based solution

- At least five operational offering by end of 2024.

- A number of pilots in above use cases in 2024.

- Financial position to operate and launch metaverse offerings in 2025.

- At least 100 ongoing customer engagements

- At least operational on 3 continents

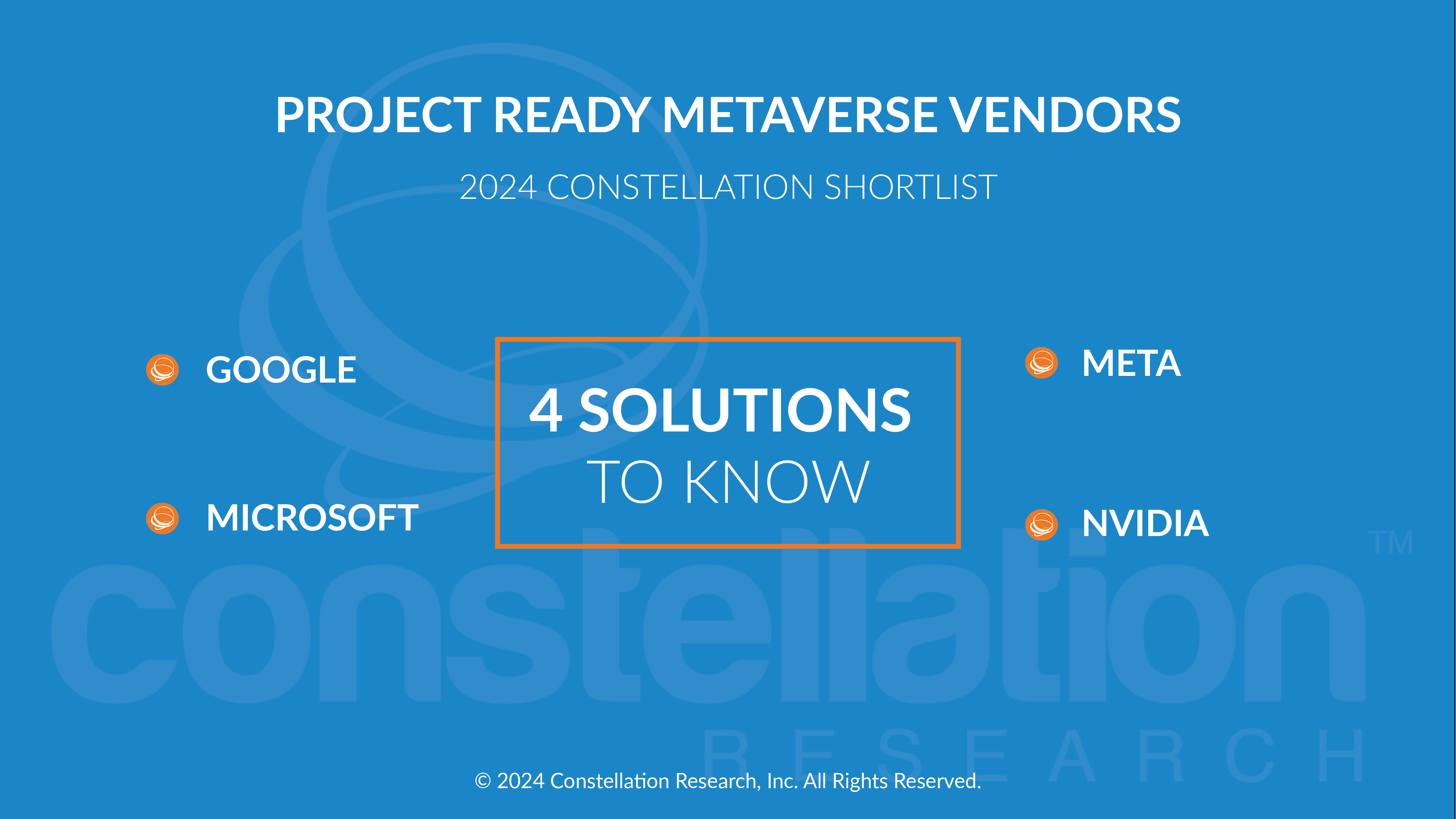

The Constellation ShortList™

Constellation evaluates more than 10 solutions categorized in this market. The Constellation ShortList is determined by client inquiries, partner conversations, customer references, vendor selection projects, market share and internal research.

- MICROSOFT

- META

- NVIDIA

Frequency of Evaluation

Each Constellation ShortList is updated at least once per year. Updates may occur after six months if deemed necessary.

Evaluation Services

Constellation clients can work with the analyst and the research team to conduct a more thorough discussion of this ShortList. Constellation can also provide guidance in vendor selection and contract negotiation.