Salesforce said it has closed 5,000 Agentforce deals since October with 3,000 of them paid, but the company's fourth quarter results were mixed relative to estimates.

The company reported fourth quarter earnings of $1.71 billion, or $1.75 a share, on revenue of $9.99 billion. Non-GAAP earnings in the fourth quarter were $2.78 a share. Wall Street was expecting Salesforce to report fourth quarter non-GAAP earnings of $2.61 a share on revenue of $10.04 billion.

Salesforce, Google Cloud expand partnership: Here's what it means

See: Behind the Scenes: The Force Behind Agentforce | Salesforce launches Agentforce 2.0 as it ramps its release cadence | Salesforce Dreamforce 2024: Takeaways on agentic AI, platform, end of copilot era

For fiscal 2025, Salesforce reported earnings of $6.2 billion, or $6.36 a share, on revenue of $37.9 billion.

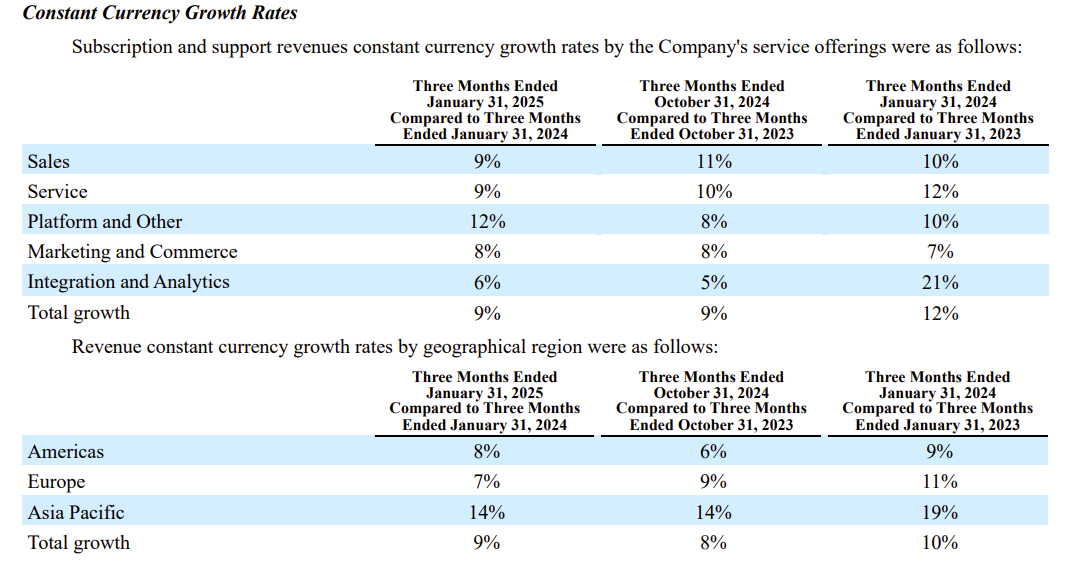

As for the outlook, Salesforce projected revenue growth, which remains in the single digit range.

For the first quarter, the company projected first quarter revenue of $9.71 billion to $9.76 billion, up about 7% in constant currency. Salesforce projected fiscal 2026 revenue of $40.5 billion to $40.9 billion up 7% to 8% in constant currency.

CEO Marc Benioff said Salesforce is well positioned for "the digital labor revolution" and "deeply unified platform." CFO Amy Weaver, however, noted that it's early in the Agentforce adoption cycle. "The adoption cycle is still early as we focus on deployment with our customers. As a result, we are assuming a modest contribution to revenue in fiscal '26. We expect the momentum to build throughout the year, driving a more meaningful contribution in fiscal '27," she said.

In the second quarter, platform and other had revenue growth of 12%, but other clouds such as sales, service and marketing all had single digit revenue growth.

Speaking on an earnings conference call, Benioff hit on themes of a unified platform as well as Agentforce and Data Cloud traction. He said:

"We have this incredible Data Cloud, and this incredible agentic platform. These are the three layers, but it's this that it is a deeply unified platform. It's a deeply unified platform. It's just one piece of code. That's what makes it so unique in this market and that is why customers are having so great success with it.

It's not a collection of disjointed parts. You're going to have to kind of self-assemble, DIY it, all kinds of how do you get the security running, how do you do this, how do you do that. It's this idea that it's a deeply unified platform with one piece of code all wrapped in a beautiful layer of trust. And that's what gives Agentforce this incredible accuracy that we're seeing."

Constellation Research analyst Holger Mueller said:

"Salesforce has a great quarter and year, missing the $10 billion revenue mark for the first time, by just a hair. Agentforce is front and central to growth, but now we will see in 2025 whether AI is adding to Salesforce related spend, or if it cannibalizes other Salesforce expenses. The question is, how much budget will CFOs 'rob' from somewhere else to fund AI from a SaaS vendor, or stick to the same apps budget. We know extra budget was found for custom AI, but the verdict for packaged AI is still out and Q1 / Q2 will tell.

The negotiation question for enterprises will be: What has the SaaS vendor delivered in maintenance improvement in it's core, non AI offering? If that is of substance, things are hard for a CFO / CPO. The argument can be made that the vendor poured all resources into AI and neglected the core business automation maintenance and natural functional automation progression. What wound you have done if there was no AI is the question?"