Workday reported better-than-expected fourth quarter earnings as the company saw strong demand for its AI products and more penetration across industries.

The company reported fourth quarter earnings of 35 cents a share on revenue of $2.21 billion, up 15% from a year ago. Non-GAAP earnings for the fourth quarter was $1.92 a share.

Wall Street was expecting Workday to report non-GAAP fourth quarter earnings of $1.78 a share on revenue of $2.18 billion.

For fiscal 2025, Workday reported earnings of $1.95 a share on revenue of $8.45 billion, up 16.4% from fiscal 2024. Non-GAAP earnings for fiscal 2025 was $7.30 a share.

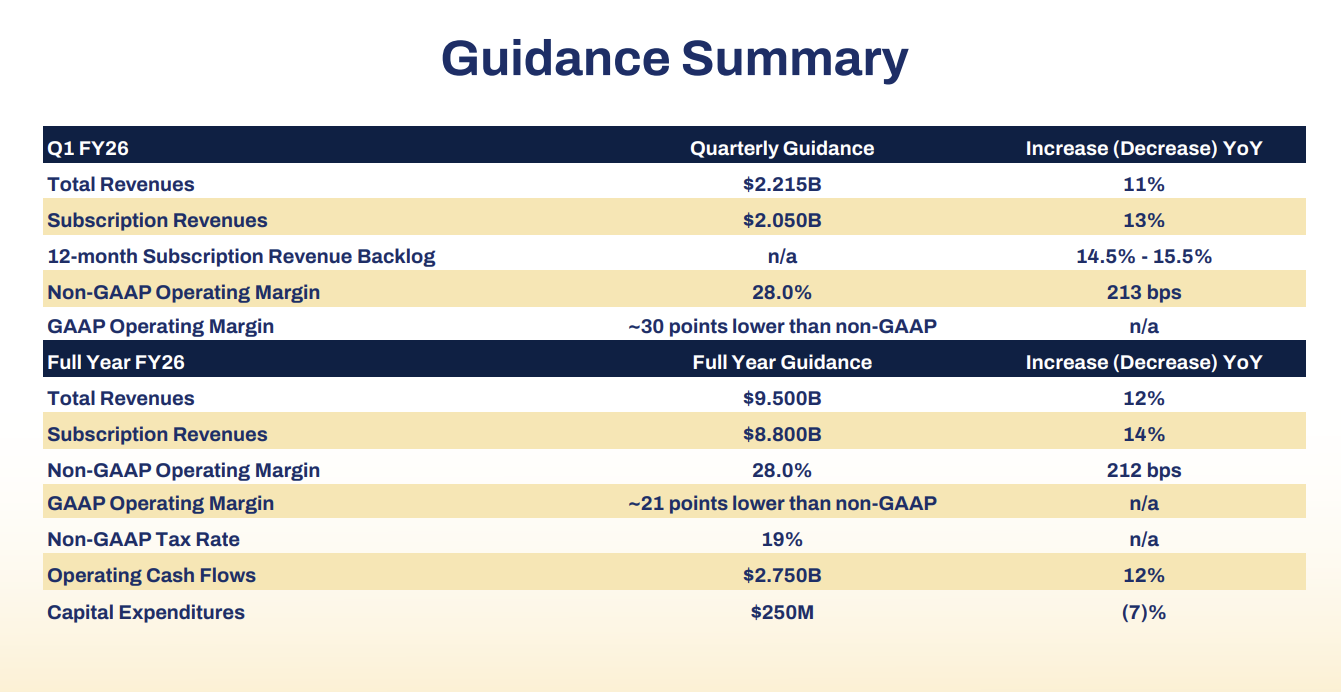

As for the outlook, Workday projected first quarter subscription revenue of $2.05 billion, up 13% from a year ago. Workday projected subscription revenue of $8.8 billion, up 14% for fiscal 2026.

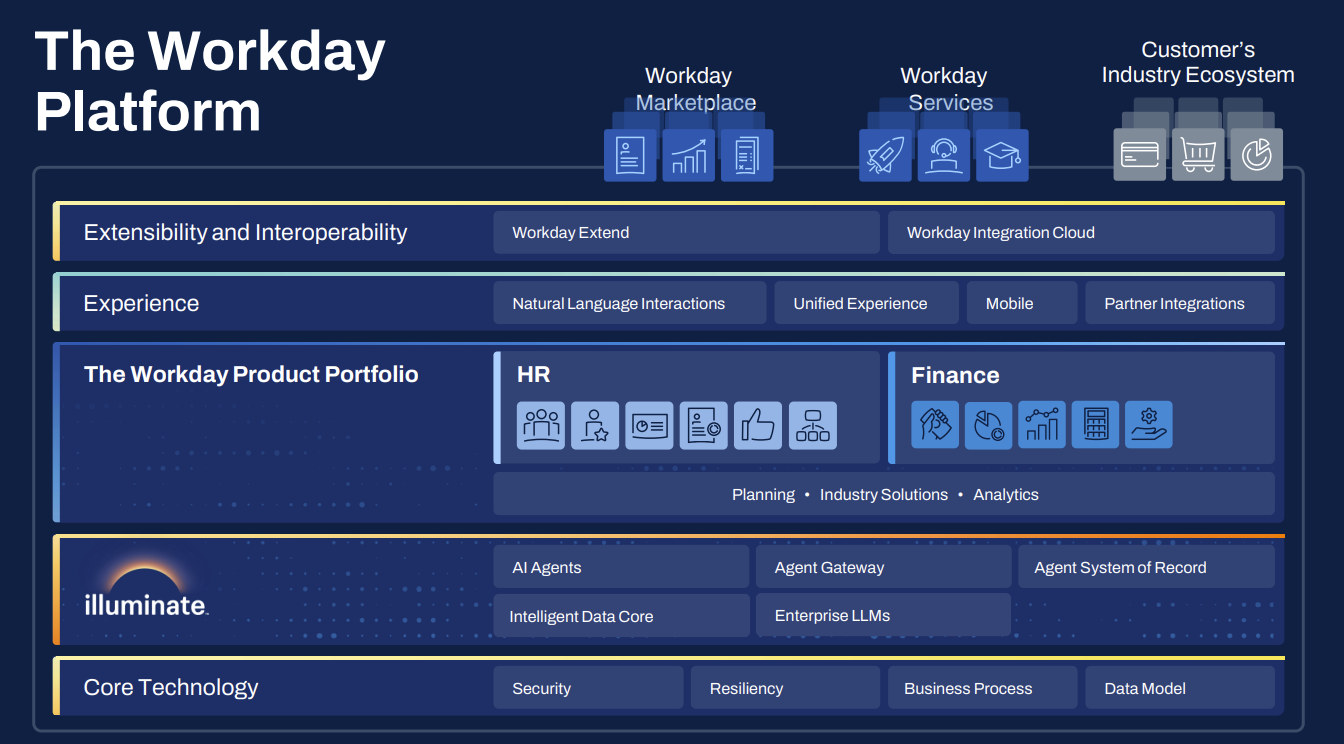

Workday CEO Carl Eschenbach said the company was benefiting from its platform approach as well as demand for its AI products.

CFO Zane Rowe said Workday saw good traction in industry verticals.

"With our unified platform, our customers can unlock value faster, reduce their total cost of ownership and harness the power of AI across our best in class HR and Finance solutions," said Eschenbach.

Eschenbach touted AI efforts such as its Agent System of Record. "We continue to see increasing demand for AI solutions. In fact, AI is front and center in every conversation I have with customers, prospects, and partners. They want to move beyond incremental productivity gains—they’re looking for ROI that will help drive growth back into their business," he said.

Workday also said that product and technology chief Sayan Chakraborty has retired. He will be replaced by Gerrit Kazmaier, who will be President of Product and Technology March 10. Kazmaier joints Workday from Google Cloud where he led data analytics and business intelligence. He was at SAP before Google.

By the numbers:

- Workday has more than 11,000 customers.

- Workday Student has more than 135 customers and half will be live by the Spring.

- The company has more than 6,100 core HCM and financial customers.

- 30% of the customer expansion deals involve one or more AI SKUs.

- 15% of Workday's net new annual contract value is through partners.