Zoom Video reported better-than-expected fourth quarter earnings as its enterprise revenue picked up. However, fourth quarter sales were below estimates and the outlook for the fiscal year was underwhelming.

The company reported fourth quarter earnings of $367.9 million, or $1.16 a share, on revenue of $1.18 billion, up 3.3% from a year ago. Non-GAAP earnings in the fourth quarter were $1.41 a share.

Wall Street was looking for Zoom to report non-GAAP fourth quarter earnings of $1.35 a share on revenue of $1.19 billion.

Zoom said its fourth quarter enterprise revenue was $706.8 billion, up 5.9% from a year ago. For fiscal 2025, Zoom's enterprise revenue was $2.75 billion, up 5.2%.

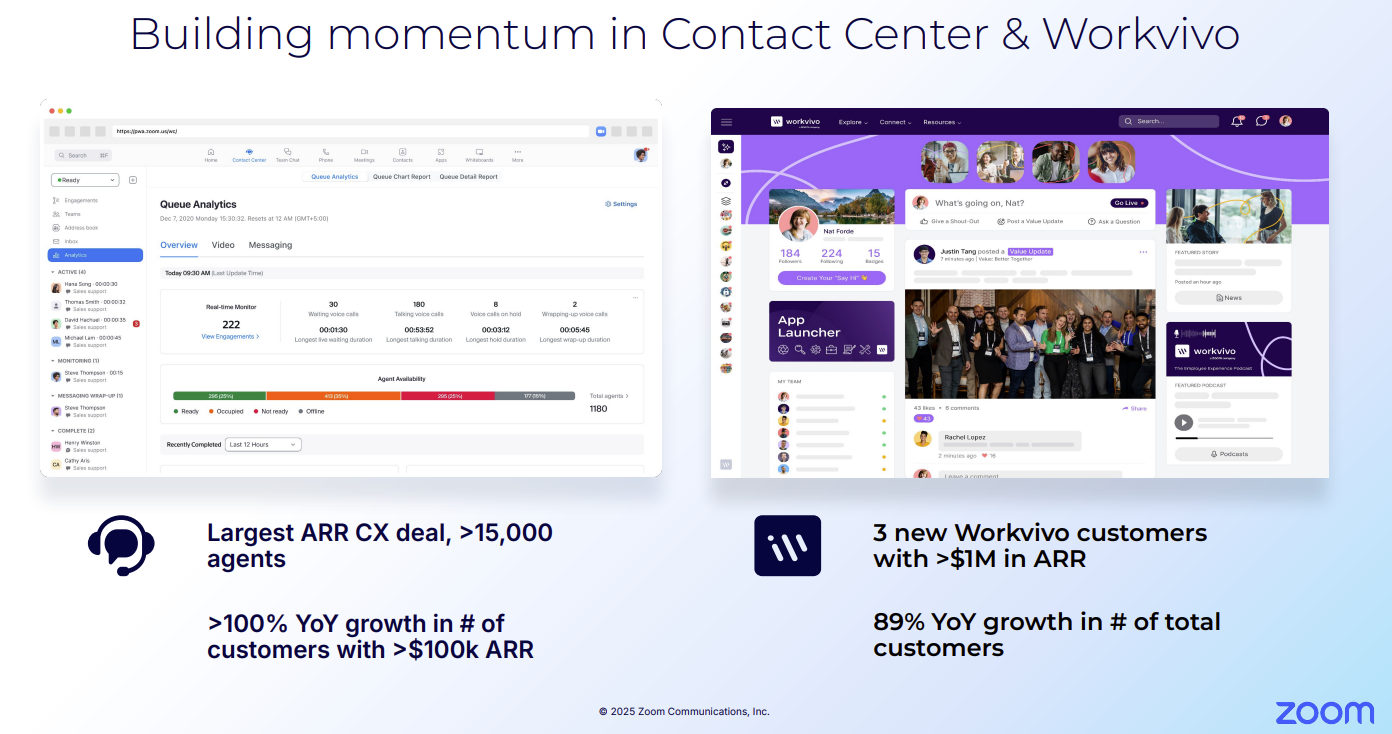

CEO Eric Yuan said Zoom was benefiting from Zoom AI Companion adoption and contact center and Workvivo demand.

In prepared remarks, Yuan said Zoom is uniquely positioned for agentic AI. He said:

"Zoom is a system of engagement for our users with recent information in ongoing conversations. This exceptional context along with user engagement allows us to drive greater value for customers. Our federated AI approach lets us combine the best models for each task.

We can use specialized small language models where appropriate, while leveraging larger models for more complex reasoning - driving both quality and cost efficiency."

Zoom launches AI Companion 2.0, eyes enterprise, industry expansion

Yuan also touted a big customer win with Amazon for Zoom Workspace. Amazon shuttered its Chime platform. "Our AI-first work platform continues to gain momentum, driven by our core strengths in meetings and expanding portfolio of integrated solutions such as Phone, Team Chat, Events, Zoom Docs, Whiteboard, and Zoom Rooms," said Yuan.

"We are excited to offer Zoom to Amazon employees and further strengthen our longstanding relationship with AWS as our preferred cloud provider. This builds on the success we’ve achieved helping customers easily procure and deploy Zoom through AWS Marketplace," said Yuan.

For contact center, Zoom said it signed its largest ARR deal in its history with a Fortune 100 company with more than 15,000 customers. Workvivo landed three deals worth more than $1 million in ARR.

For fiscal 2025, Zoom reported earnings of $1.01 billion, or $3.21 a share, on revenue of $4.66 billion, up 3.1%.

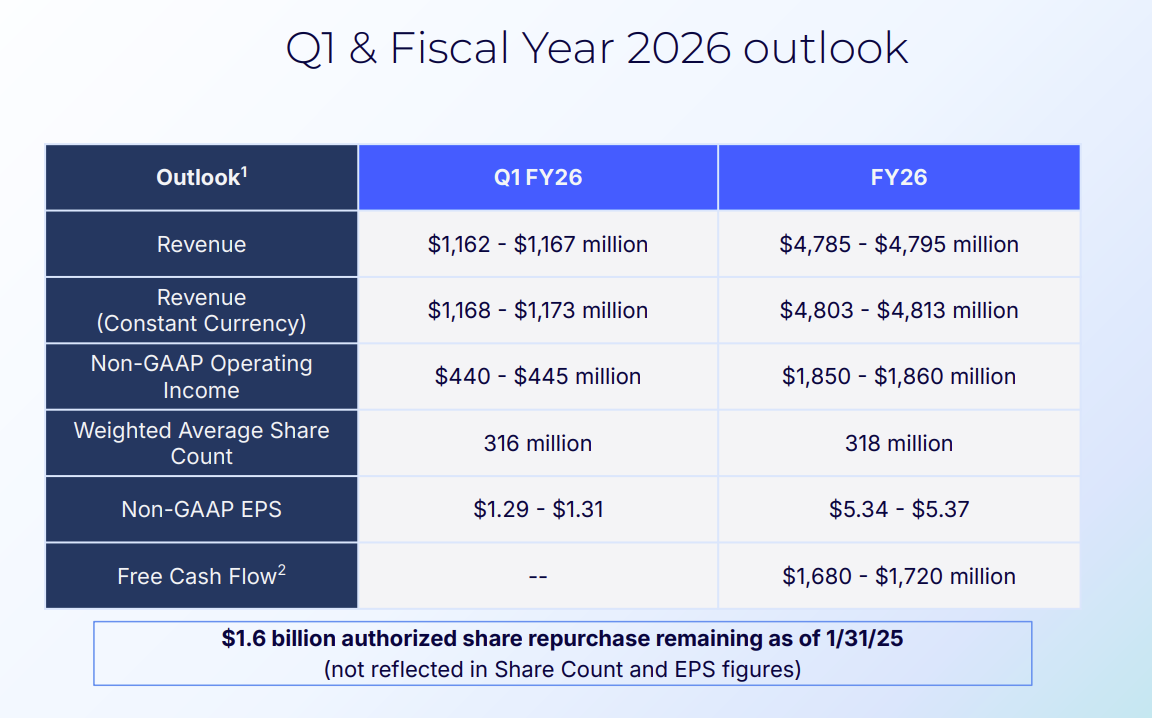

As for the first quarter outlook, Zoom projected revenue between $1.162 billion and $1.167 billion. Non-GAAP earnings are expected to be between $1.29 a share and $1.31 a share. Wall Street was expecting revenue of $1.18 billion in the first quarter and non-GAAP earnings of $1.34 a share.

Zoom projected fiscal 2026 revenue between $4.785 billion and $4.795 billion. Non-GAAP earnings will be between $5.34 a share to $5.37 a share. Zoom said that revenue in constant currency will be higher.

At the end of the fourth quarter, Zoom had 192,600 enterprise customers, 4,088 customers contributing more than $100,000 in revenue for the trailing 12 months and an online churn rate of 2.8%.