That AI PC upgrade cycle, touted most of the year by the tech industry, is being delayed by companies and consumers.

Earnings results from Dell Technologies and HP indicate that a long overdue PC refresh cycle is going to be delayed.

Jeff Clarke, Dell's Chief Operating Officer, said during the company's third quarter earnings call:

"Enterprise demand was promising, though less than expected as we saw some demand push into future quarters. Profitability in the Commercial space held up well sequentially as customers continue to purchase more richly configured devices.

Our Consumer business was weaker-than-expected as demand and profitability remain challenged. The PC refresh cycle is pushing into next year, but has significant tailwinds around an aging install base, AI-driven hardware enhancements like battery life and Windows 10 end-of-life."

Dell CFO Yvonne McGill said it's not a case of if the AI PC refresh cycle will happen, but when. Clarke added that enterprises are holding off on PC purchases because they want futureproof laptops. Why be first in the AI PC upgrade cycle when specs will only improve?

- PC industry's big dream: AI enabled PCs spur upgrade cycle

- PC upgrade cycle to be driven by AI, but calling timing has been difficult

Fortunately for Dell, the vendor can offset any AI PC hiccups with booming AI server sales. HP Inc. is clearly more tethered to the slow-motion PC upgrade cycle. Former sibling HPE has all the AI server momentum.

HP CEO Enrique Lores said commercial demand in its fiscal fourth quarter was solid, but consumers held back.

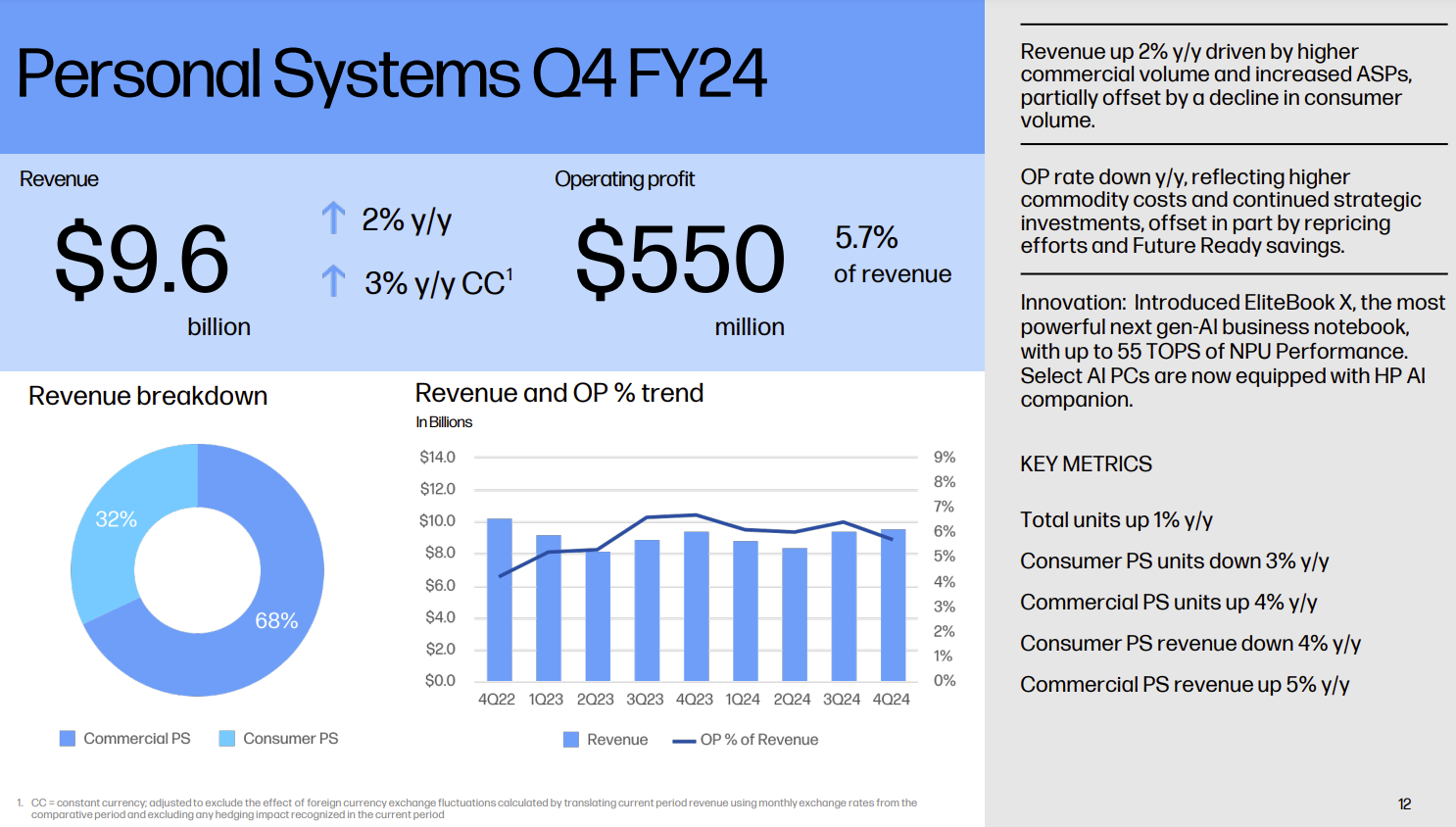

Here's a look at HP's Personal Systems fourth quarter results.

Lores said the company is betting that genAI features can boost PC sales. "Our expanded AI PC portfolio is now equipped with HP AI Companion, a bespoke application. The app uses generative AI to help analyze private files, create content or respond quickly to key tasks," he said.

HP Boost is a feature that allows data scientists to share GPUs remotely. Lores said that 15% of PC sales in the fourth quarter. HP's Personal Systems unit had revenue growth of 2% in the fourth quarter due to enterprise demand. Lores said:

"We saw continued pressure on commodity cost, which impacted operating profit. And we will continue to take actions on pricing and cost to mitigate this over time. We saw gains in worldwide PC market share year-over-year, particularly in high value categories, including commercial and consumer premium. We believe there is more opportunity here and we will continue to prioritize these categories."

HP remains upbeat about the AI PC upgrade cycle and higher average selling prices. Lores added that in three years, HP's personal systems volume will be 40% to 60% of sales.

"We continue to have an aged installed base that needs to be refreshed, which has been driving the growth that we have seen in Q4," said Lores. "The mix of AI PCs will continue to grow, which also is going to create a tailwind for the business."

Constellation Research analyst Holger Mueller said:

"HP Is practically standing still, keeping its position, potentially even going backwards when adjusting for inflation. PC markets have not recovered, and all eyes will now be on the AI PC carrying a strong Q4 with consumers – or not. It certainly has not spurred an upgrade flurry for enterprise PCs."

There are green shoots for the AI PC cycle. Best Buy said laptop sales grew 7% in the third quarter and consumers are showing interest in upgrading and replacing laptops.

Best Buy's Jason Bonfig, senior executive vice president of customer offerings and fulfillment, said:

"We're excited to what's going to happen in the future with AI. We think it's a phased approach. There'll be new features in AI across all the different platforms. And it's not just Microsoft, it's obviously Apple and Google are there as well. But right now, we do think the biggest thing that's driving is really that upgrade and replacement. And that will probably continue into next year as we think about the end of life support of Windows 10 that happens in October of 2025."

Just another year to go.